Regulations and oversight are becoming more stringent. The environment surrounding banks and securities firms is changing, with intensifying competition from outside the industry, the need to upgrade legacy IT architecture, declining and aging domestic populations, and a low interest rate environment. Banks and securities firms must address a variety of challenges, such as new laws and regulations, and must also update their operating and business models to use digital analytics, improve sustainability, and raise the level of their international businesses.

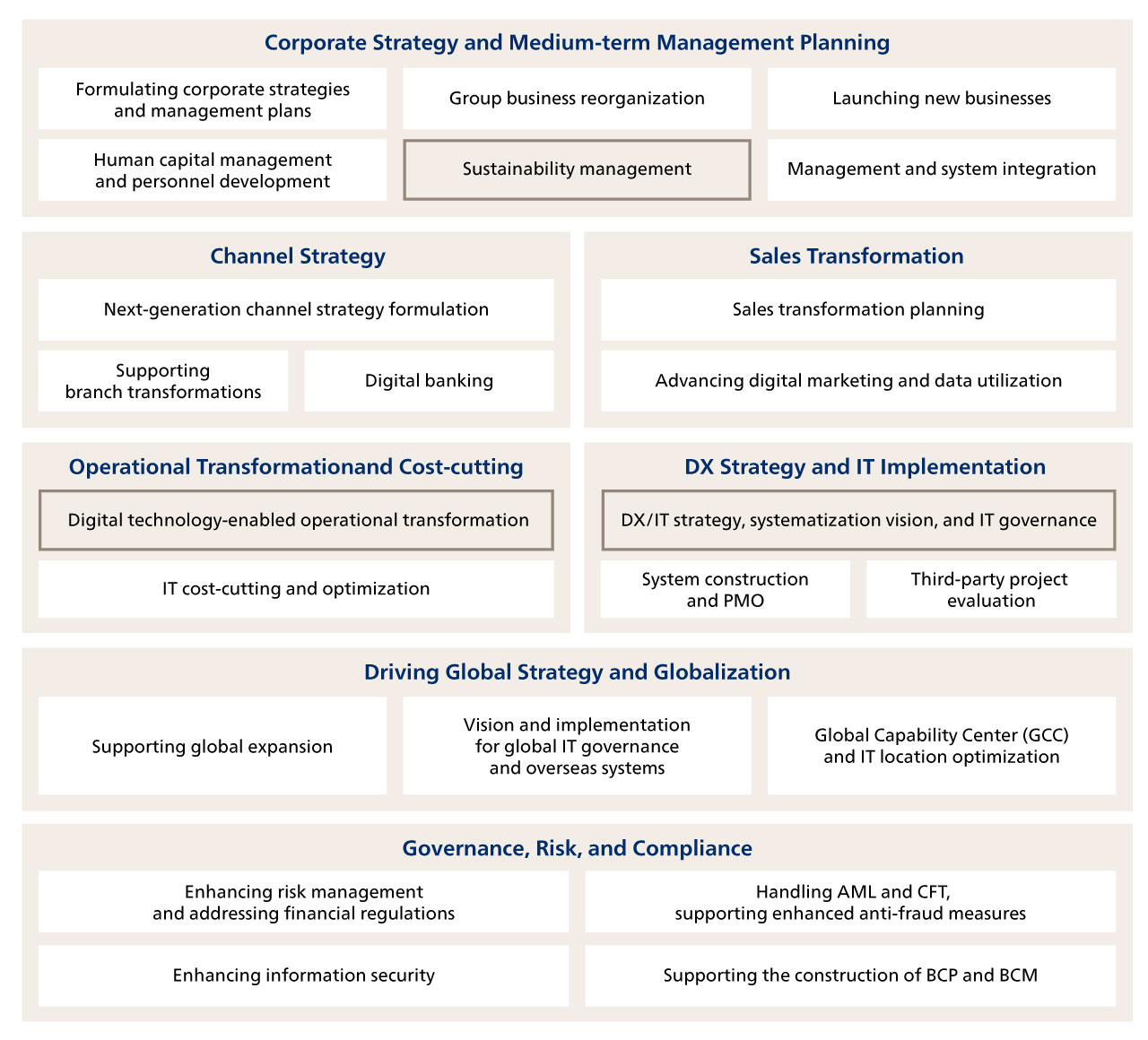

ABeam Consulting is ready to provide ongoing support to banks and securities firms in a complex competitive environment.