Going beyond addressing revisions to laws and process transformations (calculating debts, credits, and cost accounting etc.) to support sustainability management in accounting with ESG and data-driven management

Financial Accounting and Business Management

Service

The environment surrounding businesses has undergone rapid changes due to the advancement of digital technology. As DX accelerates, accounting and finance departments at the core of CFO functions are being pushed to transform themselves. They need to shift from organizations that quickly and accurately settle accounts into organizations that can leverage digital technology to drive corporate value. Those departments must now gather and analyze massive amounts of data to implement data-driven management.

ABeam Consulting supports CFOs in addressing their management challenges by taking advantage of cutting-edge technology and leveraging our extensive experience and diverse range of services.

-

Information

Winner of the APJ Regional Consulting Alliance Award at the BlackLine Partner Awards 2024

-

Case Study

Ajinomoto Co., Inc.:Integrating data through a use-case-driven approach Fostering data utilization across the Group to accelerate business value creation

-

Press Release

The Top 30 ESG Indicators for Enhancing Corporate Value (FY2024 ver.)

-

Case Study

Nikko Co., Ltd.:Side-by-side support on a “business transformation journey” aiming to generate new growth and transform corporate culture in line with transformation themes

-

Press Release

Japan Association for Chief Financial Officers Director Koji Nitto Appointed Executive Advisor for ABeam Consulting

Trends/Challenges

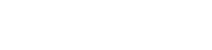

Achieving ESG management - Enhancing management decision-making and driving corporate value by gathering, storing, analyzing, and surfacing non-financial data

“Corporate value” is undergoing dramatic change. What KPIs should companies use against which challenges for management control purposes, and to advance disclosures with external parties?

ABeam Consulting focuses on the role of “non-financial capital” in contributing to driving corporate value. Non-financial capital will be an important source of future corporate value. It is at the core of the stakeholders’ “growth expectations” for companies. Companies must form close connections between non-financial capital and their vision, corporate strategy and business plans, and execute on management controls. They must also advance disclosures and dialogues with external parties to convey the appeal of those items.

There are also cases of companies where it would be difficult to claim there is a “close connection” between their qualitative disclosures and their corporate vision or business strategy. This results in setting KPIs that are only slightly related. One major challenge is that companies are aware of the difficulties in “quantitatively” understanding the products of increased non-financial capital. They struggle to integrate cost-benefit measurements, KPI setting, accomplishment indicators, and management targets.

To address these issues, companies must create frameworks that enhance management decision-making and drive corporate value by taking advantage of the latest digital technology to gather, store, and analyze relevant non-financial information.

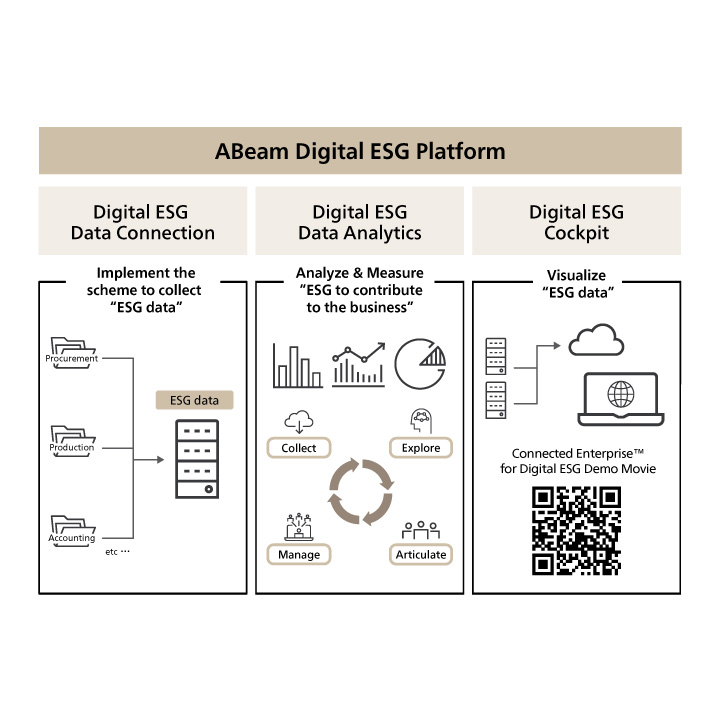

Rooting data-driven and ROIC management - Connecting management and on-the-ground KPIs and building a data-driven management/business decision-making cycle

Companies focus on their ROIC (return on invested capital) as an indicator of their capital performance.ROIC is an indicator that makes it easier to determine returns on capital per business, and is useful for measuring investment portfolios. Thus, companies are required to establish a data-driven management platform that bases management and business decision-making on data.

When companies attempt to improve ROIC, they encounter challenges such as barriers between corporate business divisions. They also face issues in failing to perform analysis as a result of siloing between business units, and lacking personnel capable of involving stakeholders.

To achieve an ROIC-focused management transformation, companies must set KPIs that connect management to work on the ground. They must also establish data-based management and business decision-making cycles.

Transforming planning operations - Transforming budgeting and anticipated decision-making operations, analysis, and action planning to enhance planning and assessment (xP&A)

The demands of markets and people’s work styles are changing at an accelerating pace, and companies that want to remain industry leaders must make rapid management decisions while keeping an eye on competitors.

CFOs must perform future action planning (xP&A achievement) that focuses on discrepancy analyses of budgets and future developments (forecasting) incorporating coherence across all operational domains, and on discrepancy analyses of budgets and projections (figures adjusted by incorporating future development of measures). They should avoid the old model of budget management based on separate operations (comparison of budget vs. actual costs). In action planning, companies must run multiple simulations and make feasible decisions, however, frequent and high-level execution of such operations in a typical spreadsheet program is impractical in terms of operational burdens, adjustability, and management.

Companies must pursue operational transformations to enhance xP&A, and they must take advantage of cutting-edge technologies such as AI predictive features to meet such challenges.

Where ABeam Stands Out

-

Driving projects with industry and operational insights and a strong track record

Using its wealth of experience cultivated across a range of industries, ABeam Consulting is ready to use digital technology to assist clients in addressing the challenges of sustainability management. We will analyze and surface high-precision value-related analysis and ROIC-tree considerations.

-

A proposal-based approach

ABeam Consulting uses a proposal-based model that uses interviews and discussions as an accounting, finance and IT specialist organization.

-

Formulating plans

ABeam Consulting formulates plans that remember downstream processes and the execution phase, from both a top-down and bottom-up perspective, allowing us to work with clients to achieve projects.

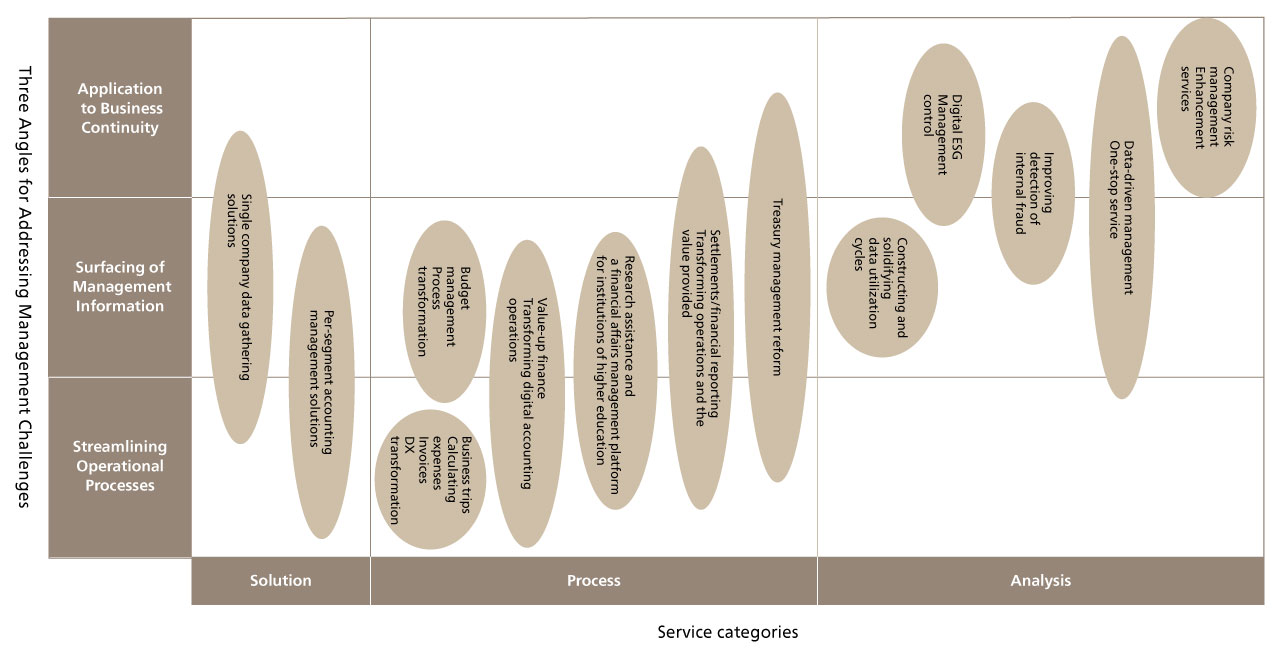

Services Provided

ABeam Consulting supports the accounting and corporate planning departments at the core of CFO functions. We provide assistance with data-driven management in solutions, processes, and analysis. Our focus is on streamlining operational processes, surfacing management information, and advancing business sustainability.

Process

-

Portfolio Management Support Services That Increase Corporate Value

-

Budget Management Process Reform (Japanese)

-

DX for Business Trip and Expense Settlement and Invoices (Japanese)

-

Value Up Finance: Digital Accounting Reform (Japanese)

-

Research Assistance and Financial Affairs Management Platform for Higher Education Institutions (Japanese)

-

Financial Results/Accounting Reports: Reform of Operations and Value Delivered (Japanese)

-

Treasury Management Reform (Japanese)

Analysis

-

REX (ROIC Enterprise Transformation) support service to achieve management reforms while improving ROIC

-

Building/Establishing Data Utilization Cycle (Japanese)

-

Digital ESG Business Management (Japanese)

-

Enhanced Internal Fraud Detection Services (Japanese)

-

Advanced Corporate Risk Management Service (Japanese)

Case Studies

-

Ajinomoto Co., Inc.

Integrating data through a use-case-driven approach Fostering data utilization across the Group to accelerate business value creation

-

Nikko Co., Ltd.

Side-by-side support on a “business transformation journey” aiming to generate new growth and transform corporate culture in line with transformation themes

-

Yokogawa Electric Corporation

Standardization of Expense Management Processes Worldwide using SAP Concur Apply Know-how Gained from Pilot Case to Future DX Promotion

-

Yokogawa Electric Corporation

Enterprise System Deployed in Global Five Regions in Two Years, Accelerated the Global Expansion of Management Foundation

-

Kao Corporation

Kao Corporation, a leading global manufacturer of consumer and industrial chemical products headquartered in Tokyo.

Click here for inquiries and consultations