Genuine sustainability management that sustains growth by understanding the mechanisms driving corporate value

The Search for Drivers to Improve Enterprise Value - How to Drive Up Earning Power and the Growth Expectations -

Genuine sustainability management that sustains growth by understanding the mechanisms driving corporate value

To achieve sustained growth and generate value, it is important for companies to develop their future “growth prospects” while delivering near-term results that raise their “earning power.” Companies require management that views financial and non-financial capital as two sides of the same coin, makes strategic capital investments, and measures the outcomes.

Non-financial information can become critical to future finances. This approach adopts measures by grasping near-term results from financial information, manages non-financial capital in line with future business scenarios and improves the company’s valuation through dialogue with stakeholders. Management that drives sustained value follows this kind of story.

Financial and non-financial capital are two sides of the same coin. Understanding the drivers of genuine value creation

A medium to long-term focus and stakeholder perspectives are essential elements to understanding financial and non-financial capital as two sides of the same coin. These are crucial in achieving sustained corporate growth. Companies must understand what stakeholders prioritize in the medium to long-term and the factors that require their genuine attention. This process isn’t about implementing surface-level qualitative value creation processes and managing them with KPIs and KGIs that cannot be quantitatively measured.

Instead, it is about a mutual understanding with stakeholders about their business models and strategies. Quantitative factors must be established that serve as the “value creation drivers” to maximize value, drive those factors, and report the results. It is critical for companies to incorporate this cycle into their corporate management.

Business transformation and capabilities that accelerate social transformation

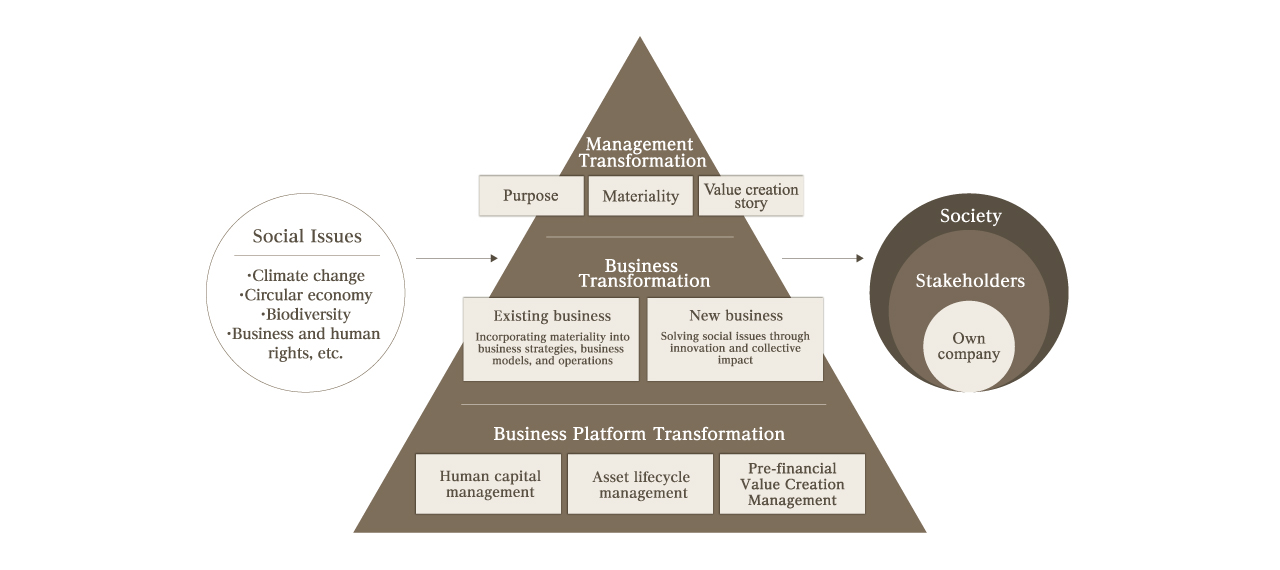

Sustainability management is achieved through business transformation. That is why all-around materialities disconnected from the business will degrade the quality of management.

The first step towards value-generating management for companies is to rediscover their purpose in society, redesign their business portfolio around social transformations in line with that purpose, and transform their business models. Companies must then enhance their capabilities and drive business transformation. The key is to put in place organizations, personnel, and intellectual property portfolios that contribute to the business strategy.

It is important that these approaches are produced as a complete value-generation management story, rather than as discrete actions. Companies must convince stakeholders of their story, get their buy-in, and work to increase value.

Ascertaining non-financial value and the future financial value indicated by non-financials

What financial values are directly generated through capital investment in non-financials in a business portfolio that aligns with a company’s business model? How much of that value can be generated? Or, what kind of indirect value chain ultimately generates financial value? Will this foster growth expectations? To what degree will this generate future financials in the long-term?

Does your company have quantitative and logical answers to these questions? Are you exercising proper management controls and deepening your dialogue with stakeholders with those answers?

ABeam Consulting has a broad array of methodologies for executing appropriate management controls. We have a strong track record of putting these controls into practice, including contributing to the corporate value of non-financial capital investment (PBR), testing the strengths and weaknesses of a company’s value chain, measuring the social impact of capital investments, estimating future financial impacts, and identifying value-creation drivers.

It is important for companies to gradually expand value creation and include that in their management control processes. They must also select the best methodologies based on industry particularities and market trends, their own business model and strategy, and their relationship with stakeholders.

A “well-grounded” appeal for future-oriented corporate “change”

Introducing new management controls alone cannot improve corporate value. New management controls will create “changes” by highlighting new issues, measures, outcomes to those measures, and the resulting updates to future scenarios. Companies must communicate this information properly to all stakeholders.

Companies must avoid communicating in all-around and qualitative terms. They can gain buy-in from stakeholders by providing reasons that include quantitative data, ensuring unity and coherence between financials and non-financials, and creating growth expectations by showing the feasibility of what the company is doing.

This means focusing on deepening and driving an array of initiatives such as developing GX, the circular economy, human and intellectual capital, and creating new businesses from social issues. It also involves understanding the outcomes of these initiatives and disclosing their impact on future finances and capital profitability. This is the best path forward for sharing with stakeholders and understanding the mechanisms that drive corporate value.

ABeam Consulting supports clients in achieving collective impact with stakeholders and sustainability management through management transformation. We contribute to society as a whole.

(1) Clarify the purpose, define materialities, and get buy-in from stakeholders through a value-creation story

(2) Drive existing businesses and generate new businesses with an awareness of materialities

(3) Establish sound business foundations that support management and business transformation

GX

GX Monitoring Support and GRESB Report Support Service for Real Estate Industry (Japanese)

Future Factory Design - Manufacturing DX Journey -

Supply Chain Redesign and Process Transformation Support Service using Digital (Japanese)

Supply and Demand Operation BPR (Japanese)

Digital Transformation Support Service in Transportation and Delivery (Japanese)

Circular Economy Promotion Support Service (Japanese)

Social Impact Generation-Oriented Business Promotion Service (Japanese)

Digital Well-Being: Employee Well-Being × Company Performance – Next-Generation Sound Business Management Inspired by Neuroscience (Japanese)

RPA Operation Reform Service (Japanese)

Human Rights Risk Management-Driven Corporate Culture Reform Support Service (Japanese)

Infrastructure Development Service to Support Human Capital Management (Japanese)

Service to Formulate Strategy for Dialog with Stakeholders to Promote Human Capital Management (Japanese)

Employee Engagement Improvement Service through Analysis and Action Cycle (Japanese)

Connected Enterprise® for Digital ESG

Corporate Governance Reform Service (Japanese)

Digital ESG Data Analytics to Achieve Integrated ESG Business Management (Japanese)

ESG Support Service for Chinese Market (Japanese)

Building/Establishing Data Utilization Cycle (Japanese)

Click here for inquiries and consultations