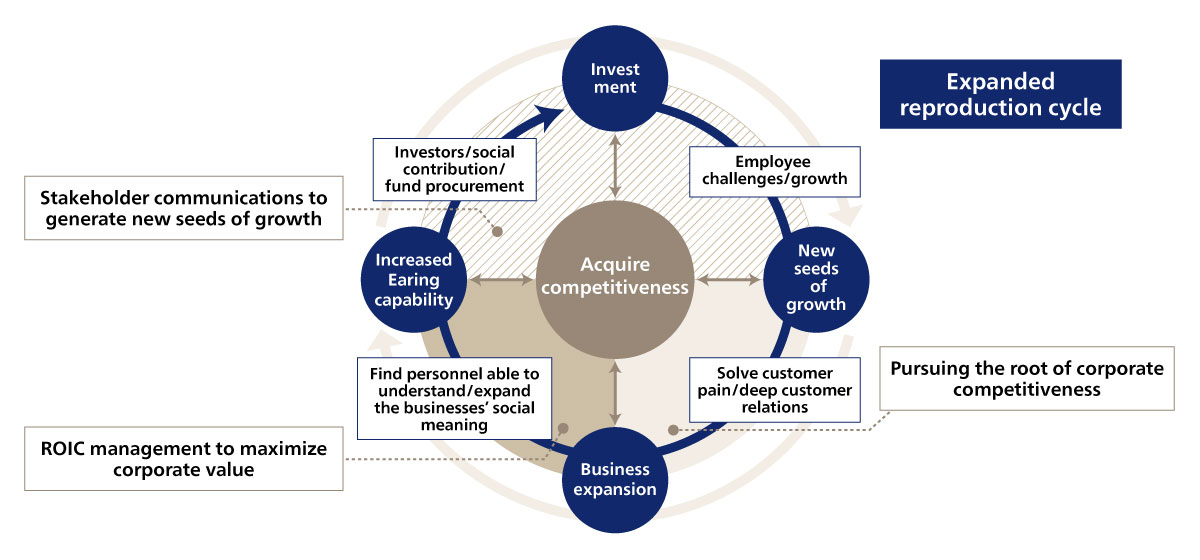

Given today’s rapidly changing environment, Japanese companies are being called on to transform toward improving their enterprise value, and generating earning power and cultivating growth expectations have become an important part of the management agenda. Furthermore, the number of companies using and disclosing return on invested capital (ROIC). ROIC, which shows the company’s capital efficiency and business profitability by business segment, as a management indicator or indicator of capital profitability, is on the rise, causing ROIC based management to garner attention. The notice of request sent out to companies by the Tokyo Stock Exchange entitled, "Action to Implement Management that is Conscious of Cost of Capital and Stock Price", is serving as a trigger to encourage companies to consider their state of management.

ABeam Consulting hosted a seminar entitled, “The Search for Drivers to Improve Enterprise Value - How to Drive Up Earning Power and the Growth Expectations -”. The seminar focused on improving the enterprise value of Japanese companies and featured Ryohei Yanagi, Executive Advisor at ABeam Consulting and Visiting Professor at Graduate School of Accountancy, Waseda University. Yanagi is renowned for establishing the “Yanagi Model” connecting non-financial capital with enterprise value. The event also featured Koji Nitto, an ABeam Executive Advisor and Director of the Japan Association for Chief Financial Officers (JACFO) who advocates for improving ROIC at the operational level through the implementation of the “Reverse ROIC Tree”. Here we explain the content of the panel discussion between Yanagi, Nitto, and Gaku Saito, Unit Leader of Enterprise Value Strategy Unit at ABeam Consulting, on how to move forward with the initiatives required to improve ROIC, as an indicator of corporate earning power, and improve enterprise value in a fundamental way.

(This article has been re-edited based on the seminar, “The Search for Drivers to Improve EnterpriseValue - How to Drive Up Earning Power and the Growth Expectations -,” held on September 24, 2024.)