Business portfolio management is an approach to management in which corporate leaders seek to combine growth, improvement and withdrawal stories across individual businesses, and make and execute on decisions about redistributing management resources and investing with a view to transforming the management structure into a combination of high-profitability businesses.

Leadership at many companies have aspirations of “transforming the business portfolio” with the aim of raising corporate value as part of their long-term visions or medium-term business plans. The reality is, however, that they often fail to achieve this, as they fail to prioritize investment because they spend too much time on quantitative analysis and forecasting, or communicate the roles expected of each business in their portfolio in ways that are understood and accepted internally and externally, along with other factors.

It is common practice for companies to visualize their “portfolios” along the axes of growth and efficiency. It is not enough, however, for leadership to merely describe their visions and ideas for their companies in their communications with internal and external stakeholders.

ABeam Consulting helps companies structurally reinterpret the “mechanisms” by which they increase corporate value so that they can establish frameworks for not only “describing” their portfolios, but also for systematizing the “thinking” and “applications” behind their portfolios, and materially incorporating paths towards achieving their desired transformation.

Portfolio Management Support Services That Increase Corporate Value

Driving increases to corporate value by combining “management” ability and frameworks for transforming business portfolios

Background

Companies need more than just current profitability and management efficiency. They need portfolio management that raises expectations for the future and increases corporate value

Compared to global firms across North America and Europe, Japanese companies have long been viewed as having issues with capital efficiency, profitability and low share prices. It is against this backdrop that the Tokyo Stock Exchange has asked listed companies with low PBR (price-to-book ratios) to disclose and implement measures to improve these metrics. As digitalization and globalization proceed, corporate management is growing more complex, leading companies to also be faced with a greater need than ever before to improve their whole-of-company “earning capacity” and foster “expectations for growth” among stakeholders.

Business portfolios are effective tools for clarifying the statuses and expected roles of each business, with the involvement not only of corporate departments, but also of managers across business departments, beginning with the CSO (Chief Strategy Officer). They are even useful for helping CFOs (Chief Financial Officer) make investment decisions and in communicating with investors and stock analysts.

It is important for companies to accurately and strategically make use of portfolio management so that management can better and more quickly steer the direction of the firm.

Challenges

“Portfolios” are about focusing on and improving competitiveness, not selling off businesses

Pitfalls

- It is difficult for companies to drill down to or redefine the source of their competitive edge, and it is easy to put the focus on each individual business that makes up a portfolio. This creates a tendency to seek short-term profits from each business. While it is necessary to take a long-term perspective on the portfolio as a whole, it is often the case that there is a lack of “leadership endurance” during the investment period, which means structural transformation is not achieved.

- It is critical for companies to raise the level of the capabilities that form a shared platform across businesses, rather than just prioritizing investment in growth businesses.

- Management can be prone to falling to the law of inertia in its steering of the company, leading it to fail to transform mindsets in a way that leads to structural transformation, either from an “inward-looking” attitude that is satisfied as long as the company’s scale of revenue is growing, even if it is failing to keep up with market growth and losing out in relative terms, or from a lack of management experience that leads to falling into a “PL bias” in which management deems any investment to have value if it generates a profit, regardless of the scale of the investment.

Approach

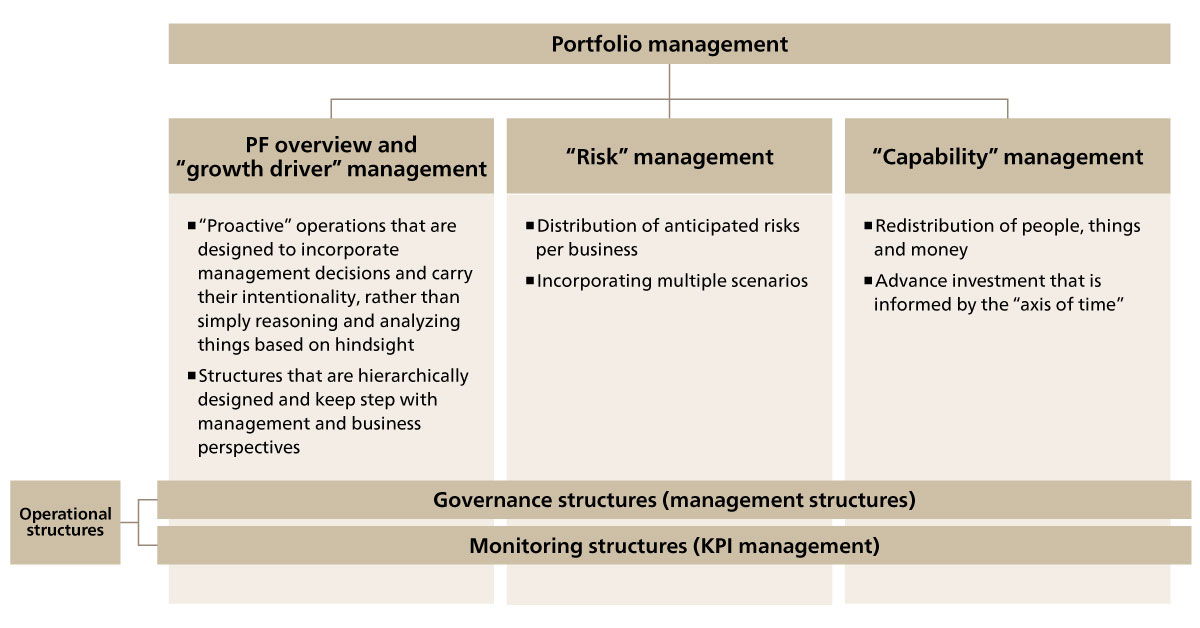

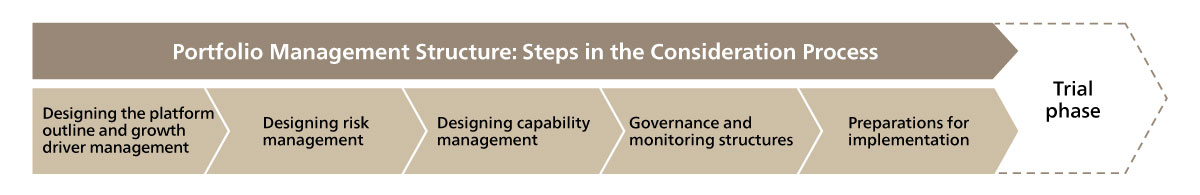

ABeam Consulting supports clients in establishing the three forms of management - “growth driver management,” “risk management,” and “capability management” - and the two structures - “governance structures” and “monitoring structures” - that comprise portfolio management.

Key features

-

Identifying growth drivers and optimizing risk-return

This means adopting a “business focus” and planning for drilling down to and refining the source of a company’s competitive edge, rather than combining financial indicators. Companies pursue a balance of incorporating business risk and return, using methods such as scenario planning.

-

Designing HR and investment portfolios that link in with business

To realize a good business portfolio, companies need to systematically design and operate a redistribution of people, things and money. They should seek to connect multiple portfolios along an axis of business transformation, and avoid division into management, business, finance and HR silos.

-

Building governance and monitoring structures

Companies should seek to formulate communications plans that pervade every aspect of their strategy, policies and how they associate with committee structures such as the board of directors or the external directors, who discuss the portfolios the company should aim for. Companies should also establish structures to evaluate and analyze the degree to which they are managing to realize their portfolios.

Details

Designing and Refining KPIs for Growth Drivers

Rather than over-focusing on organizing neat numerical structures or analyzing totals, as with ROIC trees, companies should outline their business environment changes, business characteristics and challenges, and capture change in KSF. This should allow them to redefine key actions needed for business growth, and drill down to and refine their KPIs.

They should also identify the risks that could potentially damage their corporate value and profitability, based on anticipated trends and changes to the business environment.

Based on these actions, companies can parameterize the business plans, results forecasts and KPIs that underpin those things for the KGIs such as PBR and ROIC that measure corporate value, and draw up multiple scenarios that visualize how they will achieve their anticipated portfolios.

This allows companies to put together logic that can explain the story of how they will realize their desired portfolios in both qualitative and quantitative terms to internal and external stakeholders, rather than simply targeting a specific portfolio or reasoning based on hindsight.

Capturing the Capabilities Needed to Realize a Good Business Portfolio

Companies should design portfolios taking into account how they will capture the necessary human resources, in combination with the growth speed of their businesses. They should devise a series of stories for changes in personnel requirements and rearrangements of HR portfolios. Companies should test the feasibility of their business portfolios informed by an understanding of the key points of human capital management, such as the design of systems for developing talent or improving engagement as their businesses grow, in addition to capturing talent from the labor market as needed.

It is particularly important in investment portfolios for management to incorporate a period and sense of scale of “leadership endurance” informed by an awareness of delayed penetration effects, and to thus design revenue structures that are linked to capital structures and business growth.

Creating Operating Structures Based on Your Company’s Business Characteristics and Culture

Companies should design their approach to have a balance between the “centripetal forces” that permeate the holding company or corporate side’s policies throughout businesses, and the “centrifugal forces” of each business that grow and transform them in line with their expected roles.

They should also implement structures that evaluate the degree of implementation of portfolios as part of their management operations by establishing frameworks for monitoring said portfolios, taking into account the point when a switch occurs from the investment period to the pay-back period, so that these efforts can do more than just exist on paper.

Click here for inquiries and consultations