Since the March 2023 reporting of financial results, listed companies, among others, have been required to disclose human capital data, as per the official notification. However, we have seen many cases of companies struggling because they do not know specifically what sorts of details they should be disclosing, and thus do not know how to gather data for disclosure or how to set indicators. Escaping such a predicament comes down to whether companies can make a strong appeal through their disclosures as by formulating a story that contributes to improving its unique corporate value, rather than just making disclosure an end in itself.

This Insight will thus begin by going over the background to and reasons for human capital disclosures being mandated, before presenting some disclosure items and key points in performing disclosure, and our approach to genuine human capital management disclosure.

What is human capital management disclosure? We go over the 19 items across 7 areas requiring disclosure and why they are mandatory, and explain key points in performing disclosure

- Management Strategy/Reformation

- Human Capital Management

Contents

- What is human capital management disclosure?

- Why companies are required to disclose human capital information

- Movements in Japan in the disclosure of human capital information

- When did disclosure of human capital information become mandatory?

- The 19 items across 7 areas requiring disclosure of human capital information

- What companies should do when disclosing human capital information

- Key points when performing disclosure of human capital information

- Case study in putting into practice company-specific human capital disclosures: Resonac Holdings

- Summary: Making disclosure of human capital more than just mandatory

What is human capital management disclosure?

Firstly, to lay the groundwork, we will think about the human capital philosophy and go over what human capital disclosure is.

What is human capital?

The term “human resources,” which has been conventionally used, refers generally to the management resources and general resources of a company in the form of the “people, things, money and information” that we have now. For that reason, personnel are viewed in terms of “quantity and cost.” This is why there are many cases where companies make undifferentiated investments in this area, and do not have clear coordination between HR strategy and business.

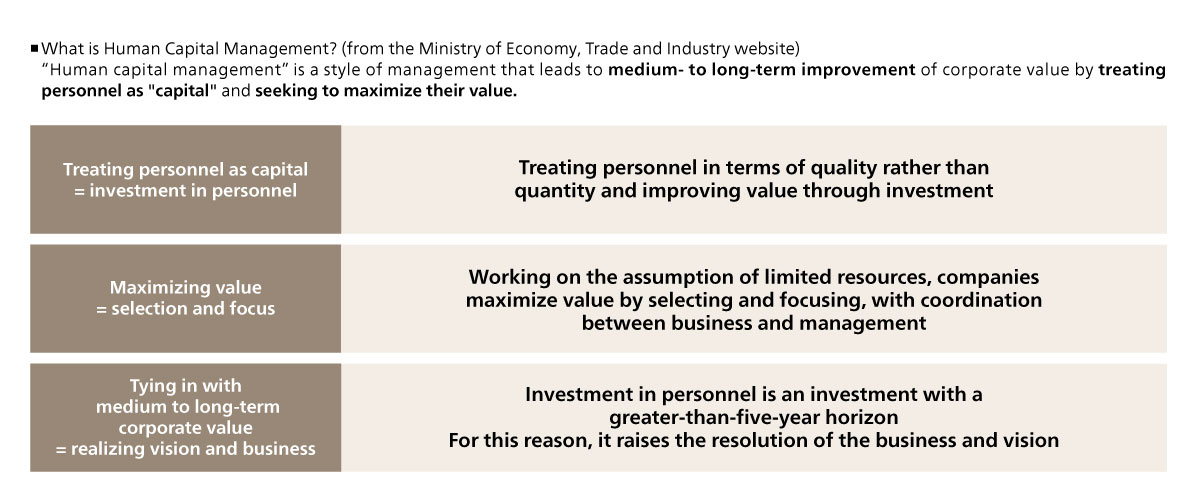

The “human capital” approach, however, is a philosophy that views personnel as a form of “capital,” and thus includes not just quantity but also the idea of “quality” (see Figure 1). In other words, along the time axis, it is possible to both improve and lower the value of that capital. The approach thus implies the need to change the qualities held by people in order to maximize the company’s human capital and so improve corporate value, rather than just treating them as a resource as we do now.

A management approach that seeks to draw out the maximum capabilities of its personnel based on a such an approach and thus improve corporate value sustainably is termed “human capital management.”

Reference Insight: What is Human Capital Management? An easy-to-understand explanation of the background to and advantages of an approach that is in the spotlight, and how to put it into practice and make relevant disclosures

While there is no other way to make the most out of human capital other than to increase the capabilities and skills of each individual, at ABeam Consulting, we believe it is important to clarify “what personnel contribute to creating value at your company,” and to invest in human capital with an awareness of the time axis.

Japanese companies have long faced calls to improve labor productivity, which lags behind that of foreign companies, in order to take back the “lost three decades.” Surveys have shown that investment in personnel development is five times as high in Western countries as it is in Japan, showing the exceptional importance of human capital.

*Japan Productivity Center, Integrated Research Center for Productivity, “The State of Investment in Personnel Development at Japanese Firms and Its Future Direction: Report on the Findings of a Survey and Hearings Targeted at Japanese Firms on Personnel Development”

To achieve this, we believe that companies need to perform “selection and focus” while focusing on the coordination of business and management, and to carry out human capital investment from a medium to long-term point of view, over a five or ten-year horizon, having raised the resolution of their vision and business strategy.

Figure 1. Defining human capital management

Figure 1. Defining human capital management

What is human capital management disclosure?

“Human capital disclosure” is disclosure of information to the market to prove the value of a company’s personnel, which is one of the intangible assets that make up the company’s value.

For example, it can refer to clarifying the status of a company’s current human capital through various indicators beginning with the number of employees, and including things like amount invested in personnel and diversity of skills.

Corporate disclosures that show a company’s value, including the financial statements that express the outcomes of corporate activities, the medium-term management plans that show a company’s strategy, as well as securities reports and integrated reports, have long since been published by companies. However, investors have only gotten partial glimpses of the state of a company’s personnel, who are the main actors in performing corporate activities.

The biggest advantage of human capital disclosures is potentially that, by quantitatively showing stakeholders where the company is at in terms of personnel, companies can reinforce the feasibility and future prospects of their corporate activities, and thus appeal the value of their companies to investors based on solid data. To achieve this, rather than treating disclosure as something being mandated, companies should treat it as an opportunity to establish a “human value creation story” unique to their company, perform disclosure that combines initiatives rooted in that story and meeting stakeholder expectations, and improve their corporate value.

Why companies are required to disclose human capital information

Here we will review the reasons and background to why companies are required to disclose human capital information.

ESG investment and sustainability perspective

In recent times, ESG investment has been entering the mainstream, with how companies take on ESG treated as one criteria by which to evaluate companies, as a standard for measuring corporate management and investment decisions along the axis of the company’s sustainability. ESG stands for “environmental, social and governance,” and efforts to evaluate companies from this perspective are spreading.

The background to this is the move away from so-called “shareholder supremacy,” which treats the interests of shareholders as the highest priority of corporate management, towards “stakeholder capitalism,” which aims to return profits over the long term, by focusing on relationships with all stakeholders involved in corporate activities, thus leading to companies being called on to combine the pursuit of profit with sustainability.

Human capital forms part of the “social” aspect of ESG. Human capital disclosure is thus called for in consideration of whether companies can develop personnel over the long term and thus provide value sustainably.

Increasing the ratio of intangible assets

The backdrop to calls for human capital information disclosure is, in addition to questions of sustainability, the broad trend towards intangible assets forming a greater proportion of the value of companies.

Previously, methods for valuing companies using measures centered on their accumulation of tangible assets have been in general use. However, so-called intangible assets, which cannot be expressed using direct financial value, underpin corporate value, so it is important to understand the situation of such intangible assets, leading to the rise of this new trend. Intangible assets are the things that serve as the sources of a company’s competitive edge, such as its intellectual capital (personnel, technology, organizational capacity, customer networks, brand and other assets that are not immediately visible), and include human capital.

This trend has stood out particularly in the US, with the ratio of intangible assets in companies rising across recent decades. Japan, too, is seeing a growing focus on intangible assets.

For this reason, disclosure of information related to human capital, which forms a large part of the asset value of said intangible assets, has been called for by stakeholders including shareholders and workers.

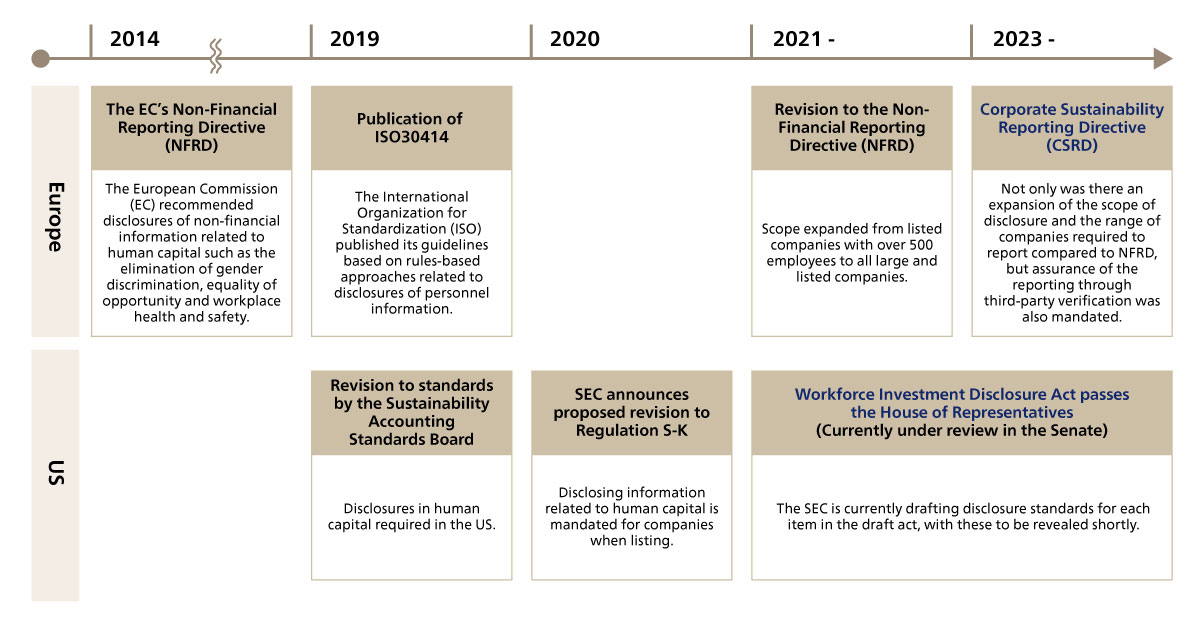

Trend towards mandating disclosure in the West

The West is leading the way in moves to mandate the disclosure of information related to human capital (see Figure 2). In 2014, the European Commission (EC) issued the “Non-Financial Reporting Directive” (NFRD), requiring companies to disclose non-financial information related to their human capital. This was an unprecedented attempt that came from an intention to manage whether companies in the region were taking into account “the elimination of gender discrimination,” “equality of opportunity” and “workplace health and safety.”

This directive was revised in 2023, with its name changed to the “Corporate Sustainability Reporting Directive” (CSRD). At this time, not only was there an expansion of the matters to be disclosed and the range of companies required to report, but assurance of the reporting through third-party verification was also mandated.

In the US, 2019 saw a revision to the Sustainability Accounting Standards Board (SASB) standards, incorporating disclosures of information related to the human capital of companies. A bill influenced by this passed the House of Representatives in 2021, and the Securities and Exchange Commission (SEC) is currently at the stage of drawing up disclosure guidelines (as of late November 2024).

Figure 2. Overseas movements around human capital disclosure

Figure 2. Overseas movements around human capital disclosure

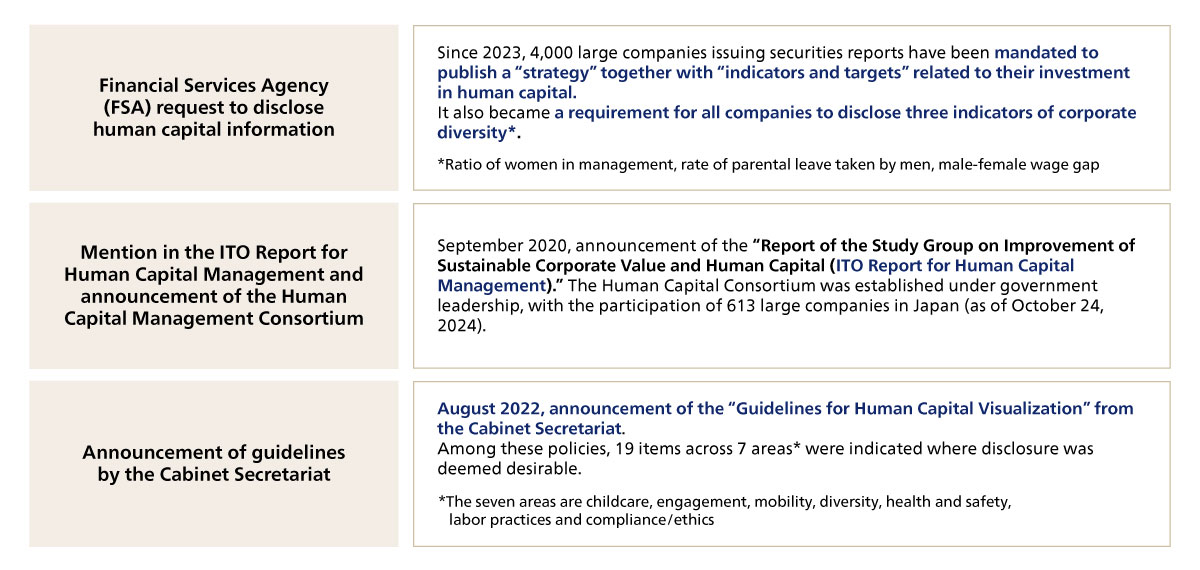

Movements in Japan in the disclosure of human capital information

In response to such developments in the West, moves to disclose human capital information have gathered pace in Japan too under the leadership of the Tokyo Stock Exchange and government institutions. Here, we will go over the major trends in Japan around the disclosure of human capital information (see Figure 3).

Figure 3. Movements in Japan Around Human Capital Management

Figure 3. Movements in Japan Around Human Capital Management

Announcement of the “ITO Report for Human Capital Management”

The idea of human capital management first came to prominence in Japanese industry with the publication by the Ministry of Economy, Trade and Industry’s publication in September 2020 of the “Report of the Study Group on Improvement of Sustainable Corporate Value and Human Capital l (ITO Report for Human Capital Management).” This report spurred a change in attitudes away from the previous approach of “human resources and management” to one of “human capital and value creation.”

Through events such as the “Study Group toward Achieving Human Capital Management,” which serve as a space to deepen discussion among interested companies, the government advanced understanding of human capital management and debate around how to put it into practice. In May 2022, the government released the “Report of the Study Group on Improvement of Sustainable Corporate Value and Human Capital (Ito Report 2.0).”

The Human Capital Management Consortium was announced under government leadership in August 2022, with the number of participating companies rising to 613 (as of October 24, 2024).

Revisions to corporate governance

Another impetus behind disclosure of human capital information is the June 2021 announcement by the Tokyo Stock Exchange of the revised version of the “Corporate Governance Code.”

The Corporate Governance Code is a document that stipulates that companies should perform decision making in ways that are transparent and fair, as well as prompt and decisive, based on the perspectives of stakeholders beginning with shareholders and including customers, employees and regional society. With this revision, the details of the Code show a strong awareness of “human capital investment and disclosure.”

Release of “Guidelines for Human Capital Visualization”

In August 2022, the Cabinet Secretariat’s Study Group on Disclosure Policies for Non-financial Information also put together and released the “Guidelines for Human Capital Visualization.”

This document is a set of guidelines on disclosure of information related to human capital, and recommends companies proactively apply it in line with their industry, business model and strategy. In this document, the government also unveiled its “19 Items Across 7 Areas Where Disclosure Is Desirable For Human Capital Management” (see below for a detailed look).

This guidelines also presented the following visualization methods and steps for implementing human capital management (partial excerpt).

- Links between human capital investment and improving corporate value

- Closing the gap between the value your company wants to emphasize and the expectations of investors

- Disclosure in line with the four elements (governance, strategy, risk management and targets and indicators)

- Company-specific initiatives, indicators and targets (and their disclosure) in line with company-specific strategy and business models

The guidelines’ “Establishing Platforms and Structures” section and the subsequent “Building Visualization Strategies” section, which serve as a standards for visualizations, also included content such as “considering integrated stories for investment in human capital and HR strategies in line with value co-creation guidance.”

2023 was the year when, all of a sudden, companies across the board suddenly intensified their efforts to disclose human capital information. Since that year, disclosure of human capital information has been mandated for target companies by the Financial Services Agency (FSA). We will go into more detail on this in subsequent sections.

When did disclosure of human capital information become mandatory?

Let’s briefly review what matters are mandatory for which companies to disclose in relation to human capital, as well as items that are commonly covered in many guidelines.

Timing of disclosure mandates

As stated earlier, disclosure of human capital information is already mandatory for Japanese companies. In January 2023, the Cabinet Office Order on Disclosure of Corporate Affairs and the Points to Note Regarding Disclosure of Corporate Affairs were revised, with disclosure of human capital information becoming mandatory in integrated securities reports from the March 2023 quarter reporting period.

Companies required to perform disclosure and details mandated to be disclosed

In Japan, since the March 2023 quarter reporting period, 4,000 large companies issuing securities reports have been mandated to publish a “strategy” together with “indicators and targets” related to human capital.

A section for recording sustainability data in securities reports was newly created. It became necessary for companies to disclose personnel development policies and internal environment development policies in relation to human capital “strategy,” as well as details of indicators and targets and achievements associated with said indicators around personnel development policies and internal environment development policies, in relation to “indicators and targets.”

It also became a requirement for companies to disclose three indicators of corporate diversity (ratio of women in management, rate of parental leave taken by men, male-female wage gap) at all consolidated subsidiaries related to them.

Going forward, it is expected that the matters to be disclosed and the scope of which companies are required to perform disclosure will expand. We thus believe starting early on this will help them secure a competitive advantage.

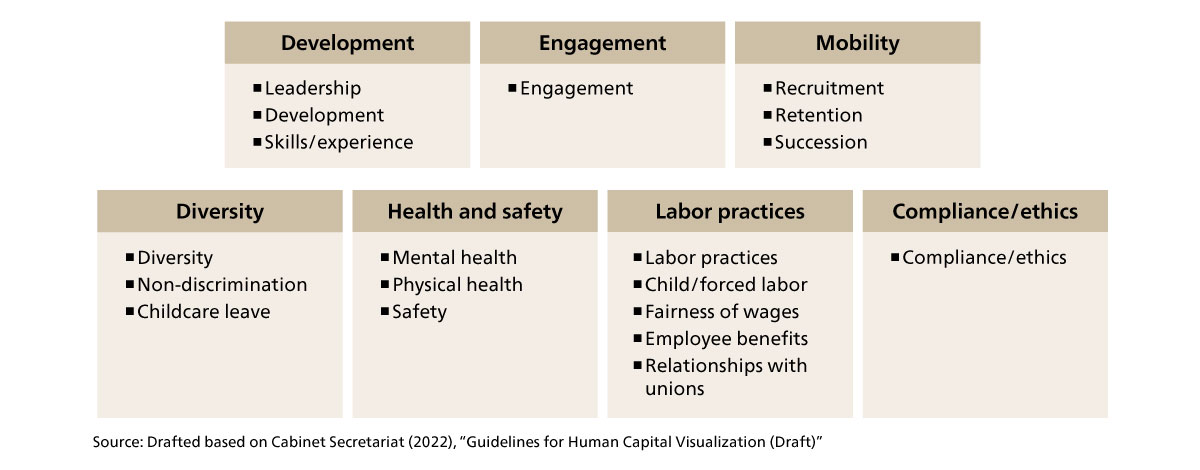

The 19 items across 7 areas requiring disclosure of human capital information

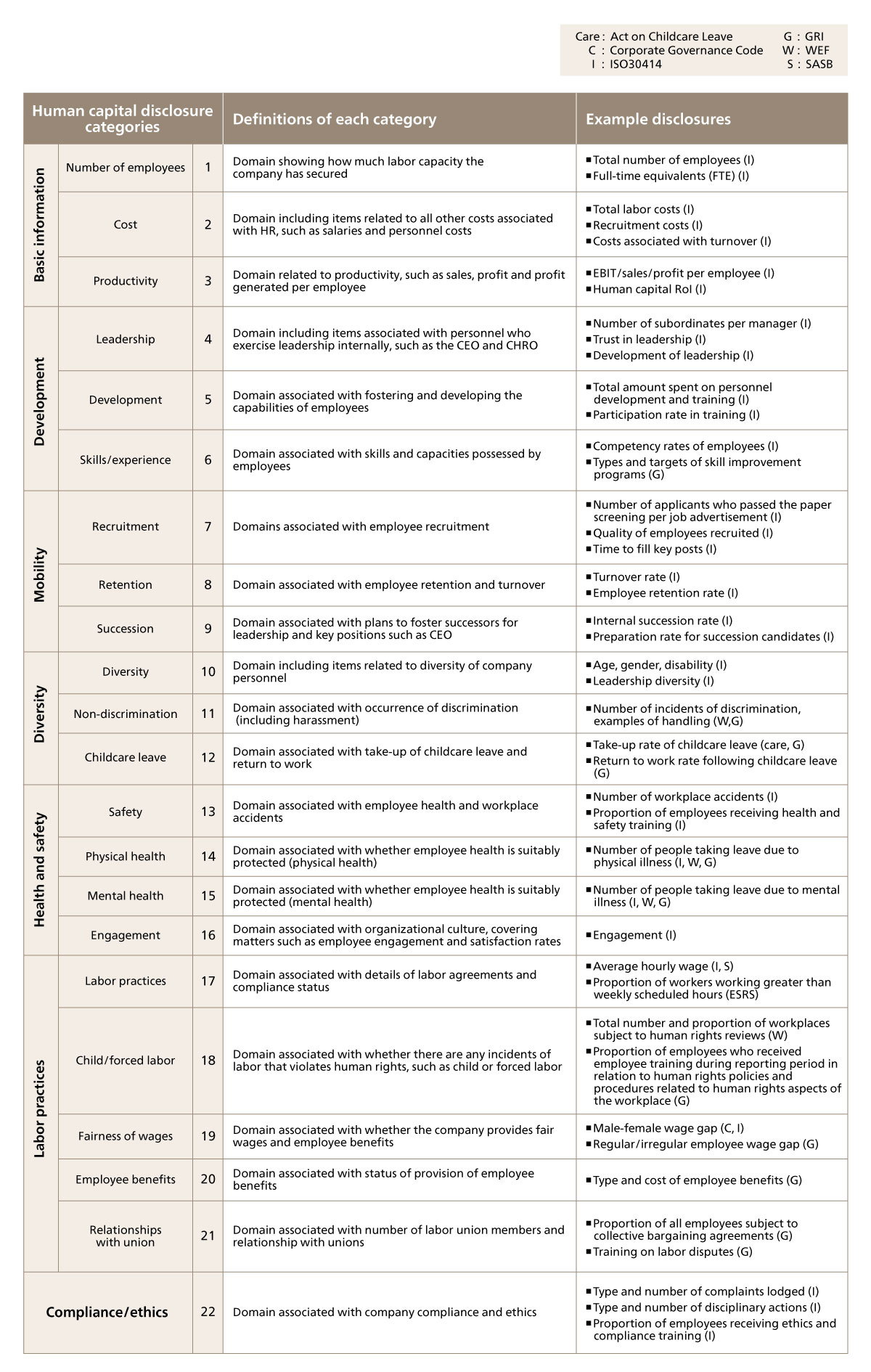

The Cabinet Secretariat’s “Guidelines for Human Capital Visualization” put forward “19 items across 7 areas” where disclosure is deemed desirable (see Figure 4). We will also present a summary of the disclosure items related to human capital based on various laws and regulations and other guidelines. These disclosure items are strictly recommendations and are not mandatory, so please take them into account when considering your approach.

Figure 4. The 19 Items Across 7 Areas Where Disclosure Is Desirable For Human Capital Management

Figure 4. The 19 Items Across 7 Areas Where Disclosure Is Desirable For Human Capital Management

Development (3 items)

- Leadership: Personnel who exercise leadership internally, such as the CEO and CHRO

- Development: Fostering and development of the capabilities of employees

- Skills/experience: Skills and experience possessed by employees

Example disclosures

Number of subordinates per manager/total amount spent on personnel development and training/competency rates of employees etc.

Engagement (1 item)

- Engagement: Organizational culture, covering matters such as employee engagement and satisfaction rates

Example disclosures

Employee engagement

Mobility (3 items)

- Recruitment: Employee recruitment

- Retention: Employee settling and turnover

- Succession: Plans to foster successors for leadership and key positions such as CEO

Example disclosures

Number of applicants who passed the paper screening per job advertisement/turnover rate/internal succession rate

Diversity (3 items)

- Diversity: Diversity of company personnel

- Non-discrimination: Occurrence of discrimination (including harassment)

- Childcare leave: Take-up of childcare leave and return to work

Example disclosures

Age, gender, disability/number of incidents of discrimination, examples of handling, examples of how they were handled/take-up rate of childcare leave etc.

Health and safety (3 items)

- Mental health: Whether employee health is suitably protected (mental health)

- Physical health: Whether employee health is suitably protected (physical health)

- Safety: Employee health and workplace accidents

Example disclosures

Number of workplace accidents/number of people taking leave due to physical illness/number of people taking leave due to mental illness

Labor practices (5 items)

- Labor practices: Details of labor agreements and compliance status

- Child/forced labor: Whether there are any incidents of labor that violates human rights, such as child or forced labor

- Fairness of wages: Whether the company provides fair wages and employee benefits

- Employee benefits: Status of provision of employee benefits

- Relations with labor unions: Number of labor union members and relationship with unions

Example disclosures

Average hourly wage/total number and proportion of work sites subject to human rights reviews and other reports/gender wage gap/type and cost of employee benefits/ proportion of employees subject to collective bargaining agreements etc.

Compliance/ethics (1 item)

- Compliance/ethics: Company compliance and ethics

Example disclosures

Type and number of complaints lodged/type and number of disciplinary actions/proportion of employees receiving ethics and compliance training

At ABeam Consulting, we organize disclosure items related to human capital taking into account multiple laws, regulations and guidelines, including the Corporate Governance Code, ISO 30414, the Guidelines for Human Capital Visualization, the Act on the Promotion of Women's Active Engagement in Professional Life, and the Act on Childcare Leave (see Figure 5). The content of this, beginning with basic information of employee numbers, costs (salaries and other personnel costs, all other costs associated with HR) and productivity, is divided into the seven areas of “development,” “mobility,” “diversity,” “health and safety,” “labor practices,” and “compliance/ethics.”

For example, looking at the “development” items, we could suggest as indicators for this area “number of subordinates per manager,” “trust in leadership” and “leadership development.” Other examples of potential indicators could be “total amount spent on personnel development and training” and “participation rate in training.”

While none of these are currently mandatory, going forward, gathering information across these areas will be necessary. For companies developing overseas, we also recommend taking into account local guidelines.

Figure 5. Definitions of human capital disclosure categories

Figure 5. Definitions of human capital disclosure categories

What companies should do when disclosing human capital information

So far, we have gone over the need for disclosure, and what disclosure items have been mandated and recommended. So, how, specifically, should companies select indicators and use these to tell a compelling story that reflects their “identity”? Here, we will go over some specific ways of going about disclosure.

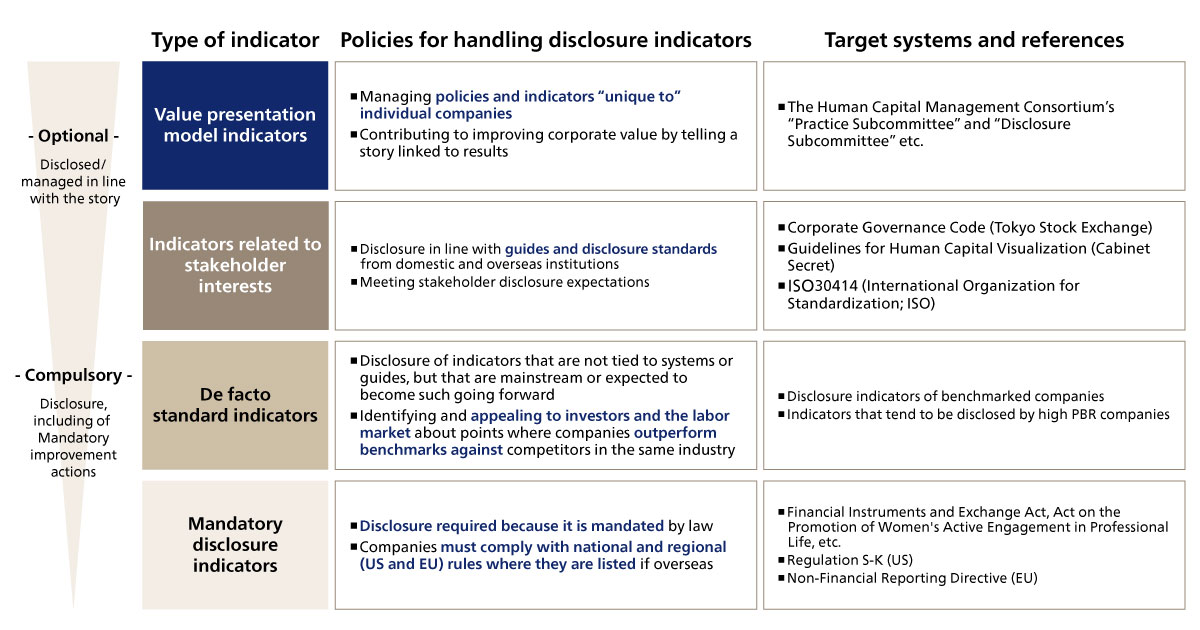

Organizing and discerning disclosure indicators

As stated above, a variety of guidelines have been put forward in relation to the disclosure of human capital. However, this does not mean that just fully going along with the guidelines is the right answer. We believe that we can categorize disclosure indicators broadly into four categories as follows (see Figure 6). In our view, it is important to decide on a policy for dealing with each type of indicator, with these four categories in mind.

At present, companies performing disclosures of “mandatory disclosure indicators,” disclosure of which is mandated by law or regulation, likely make up a majority. However, going forward, looking into “de facto standard indicators” and “indicators related to stakeholder interests,” as well as “indicators for value presentation” unique to individual companies are things that will help companies differentiate themselves from their competitors. We believe that by investigating, setting up and managing indicators unique to themselves, rather than just doing pro forma disclosures, companies can improve their genuine human capital value, and, by extension, their corporate value.

Figure 6. Categorization of disclosure indicators according to ABeam Consulting

Figure 6. Categorization of disclosure indicators according to ABeam Consulting

1. Addressing mandatory disclosure indicators:

Organizing required disclosure items and preparing a data gathering environment

The first category of disclosure indicators are the mandatory disclosure indicators established by law or regulation. For example, indicators established by law or regulation such as the aforementioned three indicators of corporate diversity (ratio of women in management, rate of parental leave taken by men, male-female wage gap) must always be disclosed. An overview of these is available in the FSA’s “Explanation of Revisions to the Cabinet Order on Disclosure of Corporate Activities.”

As disclosures must be made annually, it is necessary for companies to prepare internal data aggregation environments to facilitate frictionless disclosure.

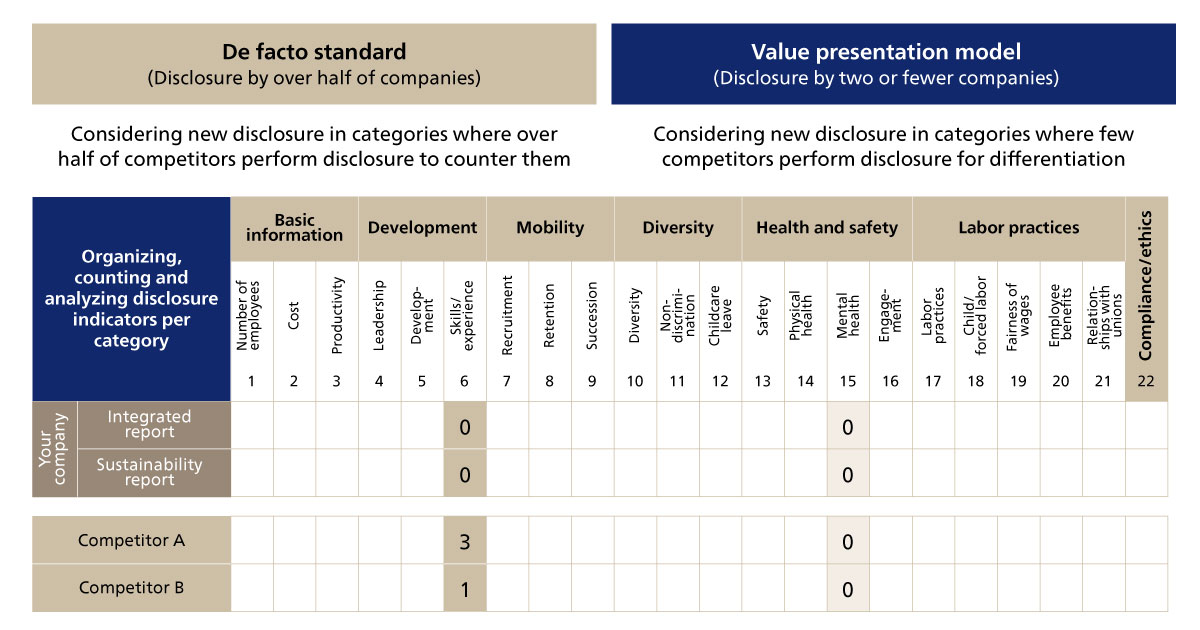

2. Addressing de facto standards:

Analyzing disclosure items against competitors by category and deciding on disclosure items that differentiate your company

De facto standard indicators are those indicators, from among the indicators proposed generally in guidelines, that it has become mainstream for many competitors to disclose, and which are likely to become mainstream in future. However, this does not mean that your company must address all of the indicators enumerated here. To the contrary, you may find that if you indiscriminately address all items, you may make it harder to discern the areas where your company is particularly attractive, rendering your appeal more generic. For that reason, companies need to analyze disclosure items against competitors in each category and decide on which ones to disclose to best differentiate their own strengths, rather than simply disclosing every indicator that could be used for comparison. By performing disclosure that focuses on indicators where your company has a stand-out advantage compared to competitors or where other companies have limited disclosures, you can push your company’s strengths in human capital and your unique appeal (see Figure 7). Companies may also need to refine or promote measures to address sections where they may come up weaker compared to competitors.

Figure 7. Example competitor analysis

Figure 7. Example competitor analysis

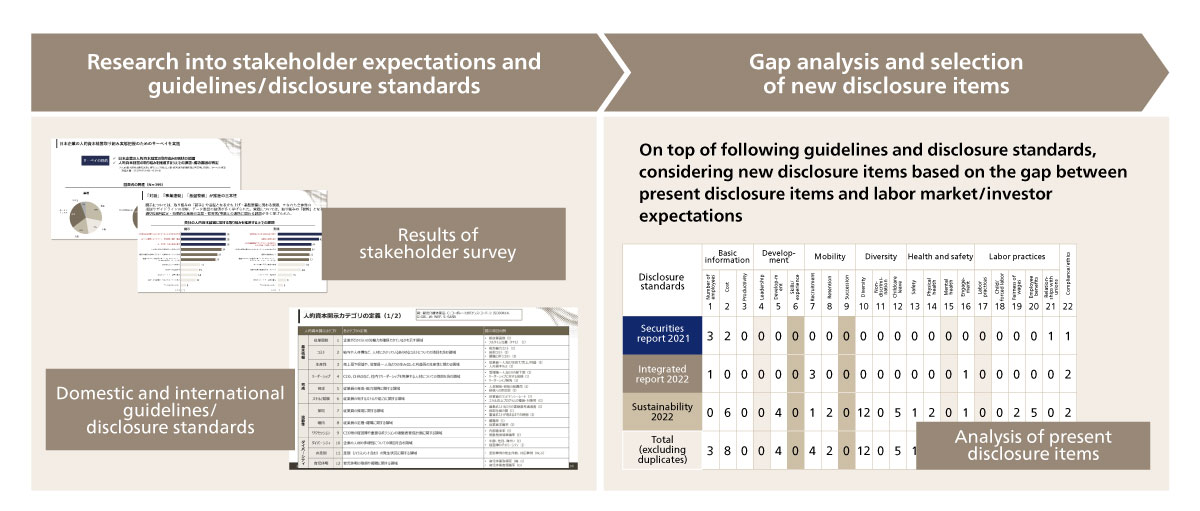

3. Addressing indicators related to stakeholder interests:

Researching stakeholder interests, guidelines and disclosure standards, and analyzing any gaps with those

The third category is disclosure indicators of the type that address stakeholder expectations. Where your company’s human capital-related initiatives and achievements are likely to be appreciated or welcomed in the market, this is a big plus for your company’s future growth. What is necessary when dealing with indicators of this type is to hold hearings with investors and research areas of interest to potential employees entering your company from the labor market in advance, then select and disclose indicators likely to resonate with those stakeholders, such as your investments in employee development.

For example, the “Guidelines for Human Capital Visualization” present the results of a survey performed to discover investor expectations. This offered “policies for ensuring diversity among leadership and key people,” “indicators related to diversity among key personnel” and “personnel development policies and internal environment development policies” as items that investors expected disclosure over.

Companies also need identify any gaps between their present disclosure items and the expectations of the labor market and stakeholders, and then consider what disclosures to make (see Figure 8).

Figure 8. Selecting indicators related to stakeholder interests

Figure 8. Selecting indicators related to stakeholder interests

4. Addressing indicators for value presentation:

Analyzing factors for addressing HR materialities and setting KPIs

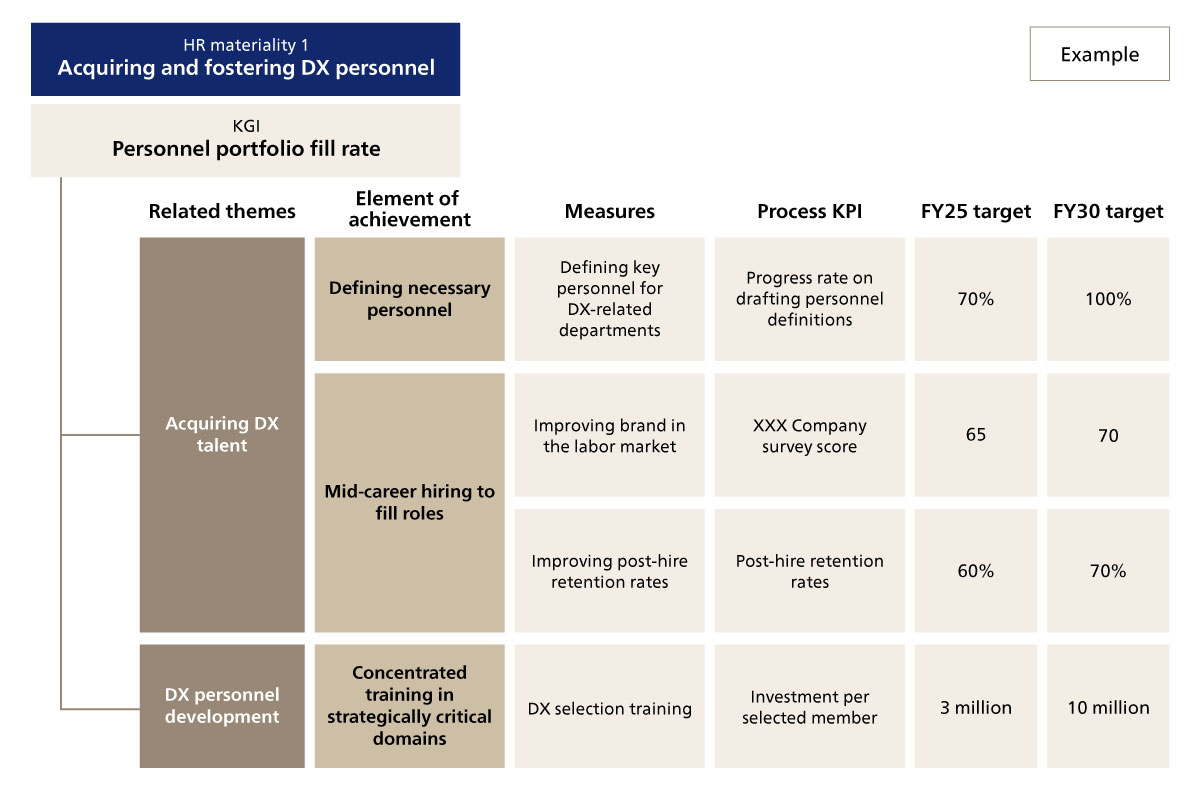

The fourth category are “indicators for value presentation,” which let companies present a value creation story unique to themselves. We believe this makes these among the most important indicators. In setting these indicators, it is necessary to identify the HR materialities for your company. Having done so, companies should go on to set KGIs that concisely show where they are at in addressing those HR materialities, analyze elements necessary for achieving that, consider measures to implement and set KPIs that drive the fulfilment of those measures (see Figure 9).

Initially, if the timing of disclosure and the progress of measures currently under way do not line up, the details of disclosures may end up being limited, but, in taking on human capital management, we definitely recommend companies look into indicators that convey what goes into their “identity.”

Figure 9. Examples of setting indicators for value presentation based on HR materialities

Figure 9. Examples of setting indicators for value presentation based on HR materialities

Key points when performing disclosure of human capital information

So far, we have gone over how to move forward with human capital-related disclosure and indicators for use in such disclosures. Now we would like to turn some key points to be aware of when performing such disclosures and points to be cautious of.

Developing a human capital value creation story

To make human capital-related disclosures a truly meaningful endeavor, it is important for companies to put forward a human capital value creation story that is unique to themselves.

Companies must firstly consider how to manage their HR portfolio in terms of what kind and how many personnel they will need to achieve their medium-term management strategies, business strategies, and long-term sustainability targets. They must attain their vision, ensuring business viability and general competitiveness. On that basis, companies identify HR materialities, set KGIs that serve as numerical targets, formulate HR strategies and measures to achieve these targets, and set KPIs to measure progress. This coalesces into a total, consistent story for how to promote those measures externally while accounting for the particular interests of external stakeholders. Such a story forms the human capital value creation story unique to that company.

Reference Insight:

What Is Human Capital Management? An easy-to-understand explanation of the background to and advantages of an approach that is in the spotlight, and how to put it into practice and make relevant disclosures

What is HR strategy? How is it different to strategic HR and the HR strategy formulation process?

For this reason, setting indicators that highlight the important points in the company’s value creation story is a key part of the role of disclosure. If companies fail to set clear indicators that tie in with the positive features they want to promote, they may fail to gather the data they need to collect in line with those indicators. As the impact of the disclosures itself can end up being brought into question, it is important to form internal consensus.

Disclosing current progress on a long value creation story

While the timing of disclosure is set every year, it may be difficult to put everything together in just one year. As you consider, discuss and put into practice your company’s value creation story, you will gradually make progress and organize the challenges involved, and subsequent steps will come into view. For this reason, disclosing this process this year, next year and thereafter is precisely what serves as proof of the continuing progress of human capital management. This will also help you convince stakeholders that your company has the right attitude to notice challenges and the frameworks in place to address them.

When doing so, it is important to set and disclose indicators for disclosure as a means of showing the objective situation. Companies thus need to have proper internal discussions about how much to disclose, and to formulate strategy and get alignment throughout the whole company over not just that year’s disclosures, but also medium to long-term disclosures, in order to also appeal to stakeholders about the longer term prospects in line with the value creation story. Companies do not need to seek perfect disclosures in a single year. Instead, it is better to think of it as something to tackle over a certain period of time.

Companies should thus approach the task with the attitude of seeking to backcast where they should be this year on their journey to achieving the vision they have set for the medium to long-term, and to incorporate into each year’s integrated report their current progress within that longer story. By thus conveying that these disclosures are not just some transitory endeavor, companies can improve their estimation in the eyes of stakeholders.

Case study in putting into practice company-specific human capital disclosures: Resonac Holdings

Finally, we would like to present a specific case study into human capital disclosures based in a human capital management story unique to individual companies, which ABeam Consulting provided support for.

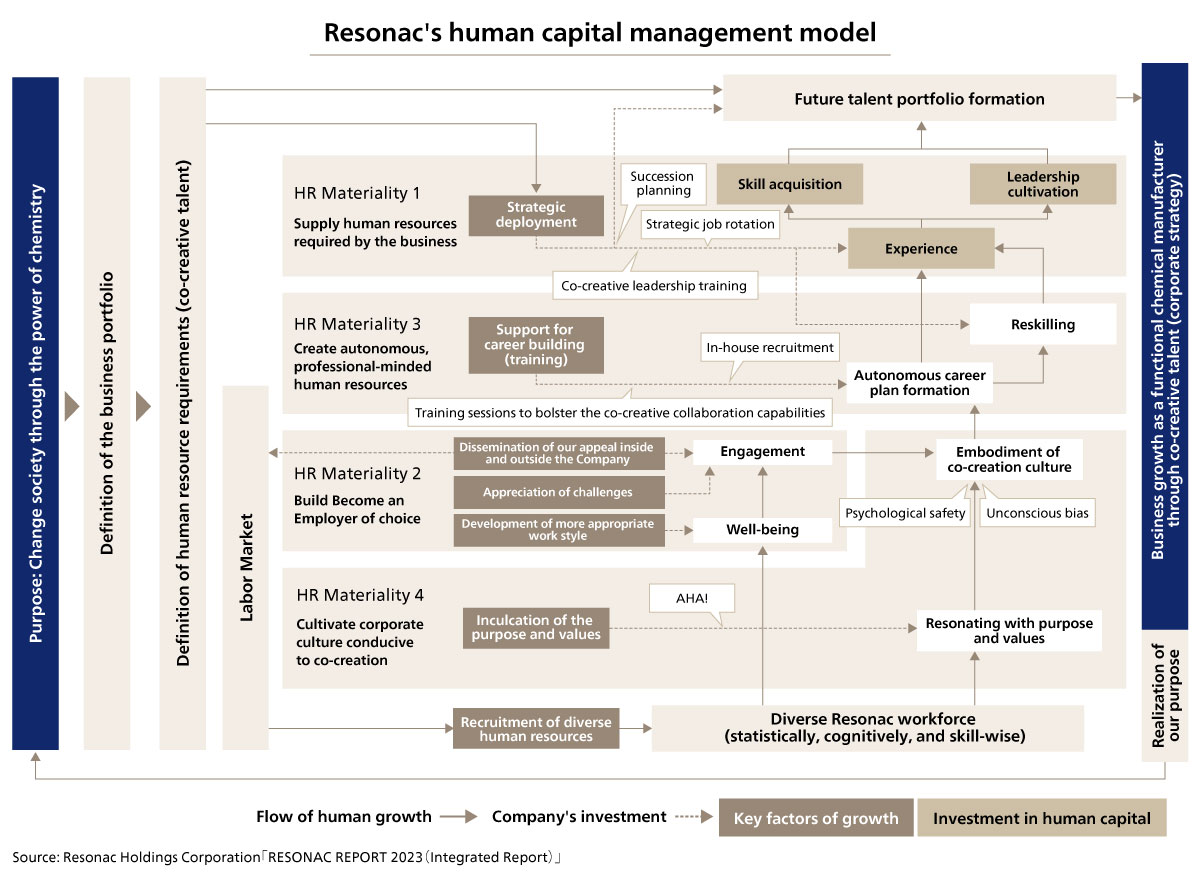

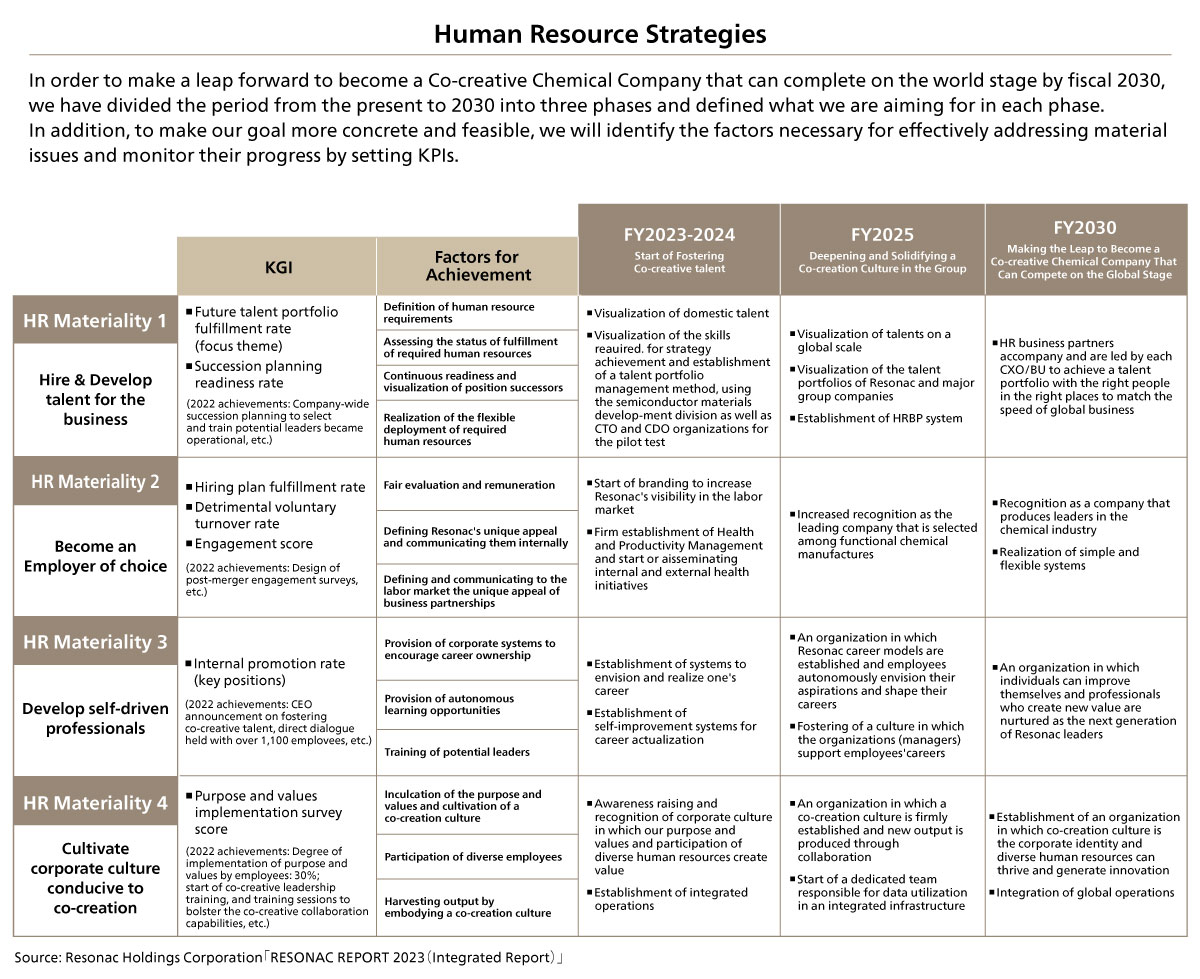

Resonac Holdings, born of a merger of Showa Denko and Showa Denko Materials in January 2023, clearly put forward the goal of realizing human capital management in the first integrated report it published as a new company (see Figures 10 and 11). For details, please take a look at our case studies page.

Figure 10. Resonac Holdings’ human capital management model

Figure 10. Resonac Holdings’ human capital management model

Figure 11. A HR strategy roadmap centered on HR materialities

Figure 11. A HR strategy roadmap centered on HR materialities

Summary:

Making disclosure of human capital more than just mandatory

Thus far, we have gone over the background to and reasons why human capital disclosure is required, the matters where disclosure has been made mandatory and some approaches to tackling disclosure. At the heart of disclosure that improves the value of your company, what is required is ascertaining what materialities your company should focus on, setting indicators that monitor those materialities, and fostering a culture where not just HR, but leadership as a whole, commits to making progress, without over-focusing on the degree of achievement in any given year.

For further details, please see our publication, “HR Materialities: Human Capital Management Through Selection and Focus,” or all five articles and attached videos in our Insight Series covering the key points in putting human capital management into practice.

ABeam Consulting provides side-by-side support to clients seeking a human capital management approach. Our support begins with a process of “selection and focus” on the most important HR materialities for achieving business portfolio transformation, and extends to formulating a transformation vision and proposing and executing specific measures. Going forward, we seek to contribute to the realization of genuine human capital management as a transformation partner for business.

Click here for inquiries and consultations