InsureTech Connect Asia 2023, Southeast Asia's largest insurance-related event, was held in Singapore from May 30th to June 1st, and ABeam Consulting participated as an official sponsor.

This insight introduces some of the advanced insurance-related themes discussed at the event, and also presents ABeam Consulting's support areas in major categories.

InsureTech Connect Asia 2023 Summary Report

- Insurance

1. InsureTech Connect Asia Overview

In 2023, ABeam Consulting became an official sponsor of InsureTech Connect Asia

InsureTech Connect Asia is the largest insurance-related event in Southeast Asia held annually in Singapore. In 2023, a total of 350 companies and 1,400 people participated in the event, including insurance companies, reinsurance companies, insurance brokers, InsureTechs, Venture Capitals, and consulting firms. This time, ABeam Consulting became an official sponsor and set up a joint booth with Denodo Technologies Inc., a global leading company in data management. .

The event also featured around 80 sessions on advanced insurance-related topics, and ABeam Consulting hosted and moderated one of the main plenary sessions on the SME ecosystems, along with insurance companies, leading InsureTech, and a leading bank corporate venture. .

2. Keynote Session by MAS Fintech Officer

At the beginning of the event, Monetary Authority of Singapore (MAS) / Chief Fintech Officer, Singapore gave a lecture on the challenges faced by InsureTech (insurance x technology) and their growth areas.

Photo: Sopnendu Mohanty / Monetary Authority of Singapore (MAS) / Chief Fintech Officer, Singapore

Photo: Sopnendu Mohanty / Monetary Authority of Singapore (MAS) / Chief Fintech Officer, Singapore

First, regarding challenges, he mentioned that the InsureTech field is in decline, based on data such as the recent decline in investment amount, market size, and number of new entrants. As specific problems behind this, reference was made to 1. Access to data, 2. Lack of appeal to the target groups, 3. Existence of legacy systems at insurance companies, and 4. Shift from ‘compensation’ to ‘prevention’ of risks (Figure 1).

横にスクロールしてご確認ください

| 1 | Access to data | Due to regulatory constraints and other factors, the necessary data is still held by the traditional insurance sector, with limited access right |

|---|---|---|

| 2 | Lack of appeal to the target groups | Insurance remains unfamiliar to people in 20-30s whom InsureTech targets |

| 3 | Legacy systems | Traditional insurance companies have many legacy systems, which are difficult to integrate with new technologies |

| 4 | Shift from ‘compensation’ to ‘prevention’ of risks | While many insurance companies focus on risk compensation, technology can play a major role in risk prevention |

Figure 1: Challenges for InsureTech

Meanwhile, as for growth areas, 1) utilizing generative AI to fundamentally review the points of contact with customers and creating insurance that is truly needed, 2) Lifestyle insurance, which embeds insurance as a part of customers' lives and responds in a timely and appropriate manner to the various risks they face every day, and 3) realization of prompt and seamless claims handling (Figure 2).

横にスクロールしてご確認ください

| 1 | Generative Insurance | Utilizing generative AI to fundamentally review the interactions with customers and creating insurance that is truly needed |

|---|---|---|

| 2 | Lifestyle Insurance | Embedding insurance as a part of customers' lives and responding in a timely and appropriate manner to the various risks they face every day |

| 3 | Instant Gratification | Realization of prompt and seamless claims handling |

Figure 2: InsureTech growth areas

Finally, the public digital infrastructure "SGFinDex" was introduced as an initiative by the Singapore government. This is a system that integrates all financial data held by customers, allows them to view it on a single interface and share the data on the platform with the consent of customers and companies, whether in insurance, banking, or any other industries. He also emphasized that the Singapore government will steadily promote initiatives to support innovation in the insurance industry in terms of data utilization.

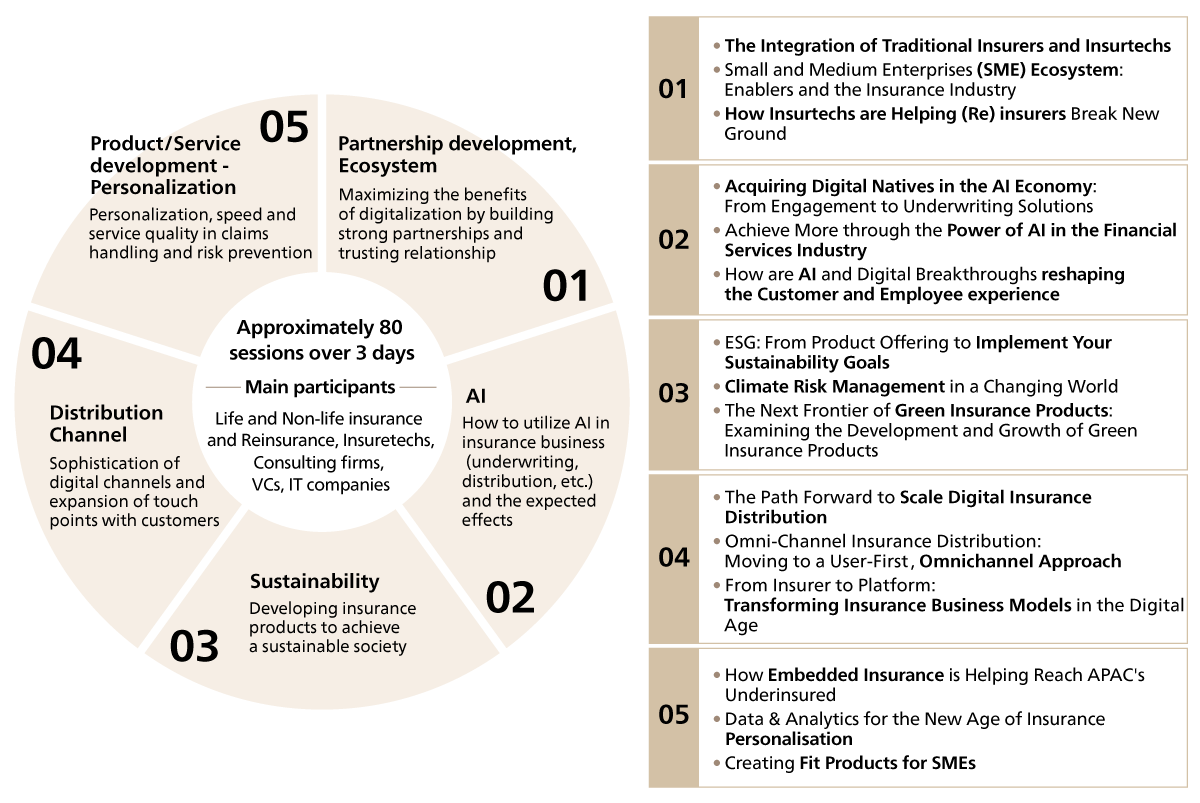

3. Five major categories in 2023

Within the event in 2023, the following five themes were mainly discussed (Figure 3). The first is “Partnership development, Ecosystem”, maximizing the benefits of digitalization by building strong partnerships and trusting relationship between insurance companies and InsureTech. The second is “AI”, how to utilize AI in insurance business (underwriting, distribution, etc.), including the rise of Chat GPTs, and the expected effects. The third is “Sustainability”, developing insurance products to achieve a sustainable society from an ESG perspective. The fourth is “Distribution Channel”, sales and distribution areas such as the sophistication of digital channels and the expansion of touch points with customers. The fifth is “Product/Service development – Personalization”, products and services areas, such as personalization, speed and service quality in claims handling and risk prevention.

Figure 3: Five major categories of InsureTech Connect Asia 2023

Figure 3: Five major categories of InsureTech Connect Asia 2023

Source: Created by ABeam Consulting based on the session contents from InsureTech Connect Asia 2023

From next, one session per category will be discussed in detail.

(1) Partnership development, Ecosystem

Regarding partnerships and ecosystems, Cyrus Cruz of ABeam Consulting Singapore, Corporate Innovation Lead, Insurance Sector Southeast Asia served as the moderator and discussed the theme of "SME Ecosystem: Enablers and the Insurance Industry" focusing on the ecosystem of small and medium-sized enterprises (SMEs), which has been recognized as an important theme in the insurance industry in recent years with insurance companies QBE Asia and Muang Thai Life, InsureTech ZA Tech, and corporate venture arm SC Ventures of Standard Chartered Bank.

First, SC Ventures at Standard Chartered Bank explained that SMEs have an overwhelming presence in all emerging markets and as an example, information was shared that in India, SMEs account for 40% of GDP and have 100 million employees. He expressed the view that the blue ocean for SMEs is the BtoB field, but their insurance literacy is insufficient, as it is difficult for them to thoroughly understand insurance because their time is taken up by growing their own business. The company’s BtoB EC marketplace and lending platform for SMEs in India and Kenya, “SOLV” was also introduced. The platform has 350,000 SMEs participating, forming a highly trusted virtual circle which embeds microfinance into an organized supply chains and provides easy access to financing.

ZA Tech shares the view that current insurance products are not cost-effective or attractive enough for SMEs to make purchase decisions indicating the need for a more comprehensive and flexible service offering for SMEs, including pre- and post-insurance services.

Muang Thai Life, a leading life insurance company in Thailand, also shared that when working with SMEs, it is essential to have a risk management perspective, including regulatory compliance, and that a clear and concrete business plan is necessary. Furthermore, QBE Asia believes that it is important to put ourselves in the shoes of SMEs, accurately understand their needs, and focus on solutions, and also that it is necessary to work on creating an ecosystem utilizing InsureTech as the needs of sales partners such as agents are becoming more complex.

Photo (from left):

Cyrus Cruz / ABeam Consulting / Corporate Innovation Lead, Insurance Sector Southeast Asia, Singapore

Young Yang / ZA Tech / CEO SEA, Singapore

Jiten Arora / SC Ventures at Standard Chartered Bank / Member, Singapore

Ronak Shah / QBE Asia / CEO, Singapore

Sara Lamsam / Muang Thai Life Assurance Co / CEO, Thailand

Summary: To successfully do business with SMEs, it is necessary to accurately understand their needs and business plans and provide more comprehensive and flexible solutions, including pre- and post-insurance services

(2) AI

Microsoft Asia introduced trends and case studies of AI utilization in the financial services industry under the title "Achieve More through the Power of AI in the Financial Services Industry".

He stated that while technological advances have driven GDP growth in the past, it has tended to accelerate more in recent years, with ChatGPT reaching 100M users in just three months. Next, as an example of the use of AI for insurance companies, he introduced a case in which Progressive, an American company, achieved a cost cut of US$10 million by improving productivity with an AI chatbot.

He stressed that Chat GPT-3.5, which is currently in widespread use, has a neural function equivalent of a single person learning over 500,000 lifetimes, and that it is important how smartly a system can be built using it, and that AI can be used for all kinds of actions in the insurance industry, including call centers and claims handling.

He also suggested that in the case of insurance claims, by using AI to analyze calls with customers and determining the processing method, the customer would only need to explain once, minimizing the burden on the customer. He emphasized that AI should be appropriately managed by governments and institutions, and Microsoft has established the “Responsible AI Principles'' which consist of six points such as reliability, safety and accountability.

Summary: AI, including ChatGPT, is at the forefront and center of innovation, and it was suggested that companies from all industries, including the insurance industry, should join this evolution with a focus on speed

(3) Sustainability

Sustainability-related topics included insurance company Zurich, insurance broker Marsh, and InsureTech's Aktivolabs, who discussed the current state and future direction of green insurance under the theme "The Next Frontier of Green Insurance Products: Examining the Development and Growth of Green Insurance Products".

Regarding the definition of green insurance, Zurich explained that it is a product that contributes not only to general damage compensation but also to environmental protection, and that it has a major theme from an ESG perspective. Environment was organized as climate change and asset protection against it, Social was mainly correcting compensation disparities in the health field, and Governance was data governance.

Next, Marsh believes that green insurance is not limited to climate and environment, but contributes to the SDGs of “eliminating global poverty and hunger and achieving health and well-being for all,'' and its scope explained that insurance can play an important role in helping consumers understand the SDGs broadly.

In order to provide better green insurance, Zurich believes that from the perspective of underwriting, insurance companies are not good at utilizing data from new fields or predicting the future. He emphasized the need to be more open to data sources in the field.

In addition, based on the experience of pricing risks based on human life and death data over the past 200 years, insurance companies continue to update pricing to be appropriate in response to the recent increase in longevity. they proposed the idea that incorporating new data and supplementing existing models could be a key to solving current climate change risks.

Regarding the most recent example of green insurance, Zurich believes that auto insurance that reflects the amount of risk of individual customers in insurance premiums can change customer behavior toward savings and encourage them to switch to EVs in the event of a total loss, introduced ways to encourage people to switch to sustainable materials and install solar panels in the event of a total home insurance loss.

Marsh also offers parametric insurance, which pays a predetermined amount of insurance when indicators (parameters) that have a causal relationship with damage meet the conditions set at the time of contract, and provides customers with numerical targets. This study suggested the possibility of leading to behavioral changes. In addition, Aktivolabs believes that products related to parametric insurance, where customers are incentivized to share data with insurance companies, are the right direction for insurance products.

Photo (from left):

Roopa Malhotra / Zurich / Head of Customer & Digital, Asia Pacific

Debra Burford / Zurich / Chief Underwriting Officer, APAC

Marshall Lee / Marsh / Managing Director, Head of Climate & Sustainability Strategy, Asia -

Gourab Mukherjee / Aktivolabs / CEO & Co-Founder

Summary: Green insurance plays an important role from the perspective of ESG and SDGs, and is expected to lead to changes in customer behavior through the use of data in new fields and the expansion of sales of parametric insurance.

(4) Distribution Channel

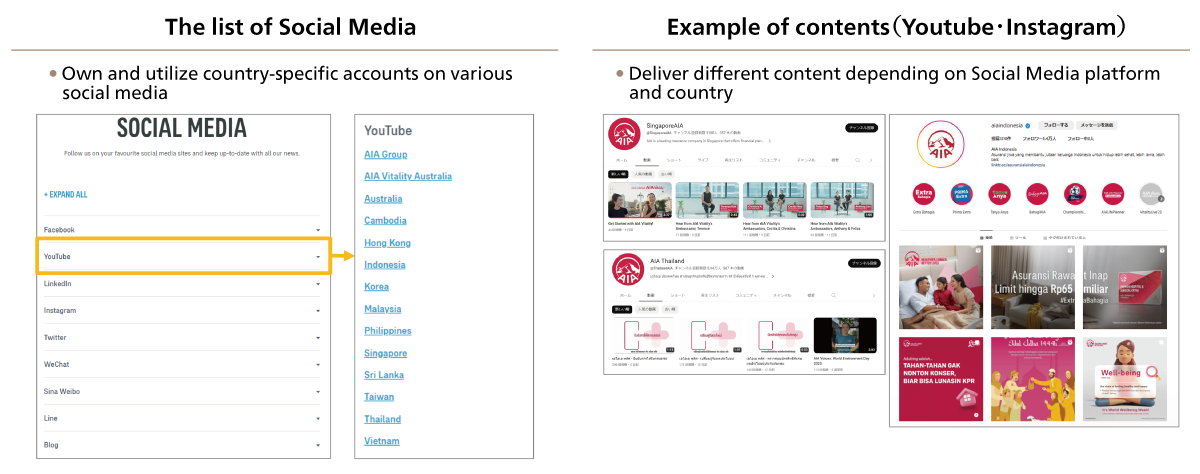

Regarding the Distribution Channel category, we would like to take up the theme of “Social Media: The New Key Player in the Customer Acquisition Game,'' which discussed how to utilize social media for customer touch points.

When asked whether insurance companies should engage with customers through social media, AIA said that while social media can be used to connect with customers, they must be careful not to push the company's message. Roojai, a Thai InsureTech, said that Thai and Indonesian people spend a lot of time on social media, and that insurance companies should focus on using social media not only for fear-mongering insurance advertisements but also for educational purposes.

Indonesia has the second largest number of users in the world on TikTok, a major social media platform. Therefore, marketing methods through social media influencers are effective, but since social media itself does not have a license to sell insurance, it is important for insurance companies to utilize it.

PT. Central Asia Financial, an Indonesian insurance company, shared that they are researching how to streamline the insurance purchasing process, for example, how to create an insurance sales channel starting from a TikTok shop.

Next, regarding the appropriate approach for insurance companies to use social media, Roojai stated that each social media has a different format and customer base, and that insurance companies need to customize their messages to specific markets.

In addition, AIA assumes that consumers will research online and purchase insurance from an agent offline, and aims to stimulate consumers' subconscious minds and develop a favorable impression of insurance companies and products. AIA shared examples of how they sent out content in a more entertaining format in order to receive more feedback. (Figure 4)

Figure 4 : AIA social media usage examples

Figure 4 : AIA social media usage examples

Summary: As insurance is a consumer-facing business, the use of social media cannot be avoided, and it is necessary to send messages customized to each country, market, and social media.

(5) Product/Service development – Personalization

In the product-related category, we take up the theme of “How Embedded Insurance is Helping Reach APAC's Underinsured,'' which discussed APAC's Embedded Insurance. Embedded Insurance allows companies to reach customers digitally without going through traditional channels such as agents and brokers, and is expected to be a solution to bridging the coverage gap, especially in geographically wide emerging markets.

A collaboration example from Income was introduced. Automotive marketplace Carro, along with insurance company Income, sells Singapore's first AI-driven mileage-linked insurance, “Covered” and the coverage rate for this product on cars sold by Carro reaches approximately 90%.

Carro has expressed the view that one of the success factors is that it offers instant comparisons of multiple quotes and insurance plans, giving policyholders the opportunity to make their own choices.

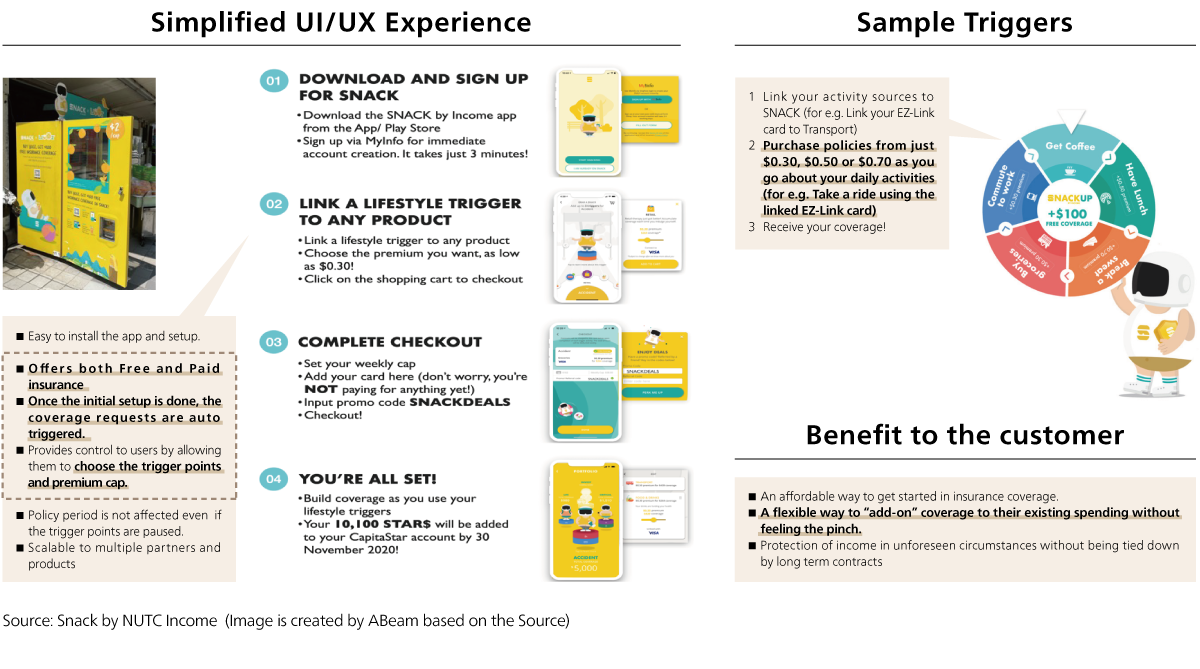

Next, Income introduced the details of “SNACK by Income,'' a system that supports all consumer activities as an insurance portfolio based on the concept of “Lifestyle embedded insurance'' (Figure 5).

SNACK was launched in 2020 via a mobile application and is an insurance product with a new concept that automatically accumulates a small amount of compensation by linking the trigger for paying insurance premiums to daily activities. The company said it is working with around 100 partners to make this happen, including public transportation companies, food delivery companies and retailers.

QBE, Tokio Marine, and Sompo said that in order to avoid price competition and make Embedded Insurance a success, it is essential to strengthen collaboration with IT platforms and provide added value by improving the quality of claim services. One of the challenges when considering a new sales model is that there is insufficient information and experience required for underwriting. In particular, regarding Embedded Insurance, it was stated that seamless support is important for customers not only when purchasing insurance, but also when an accident occurs and during normal times. Finally, regarding Embedded Insurance, they emphasized that the ideal would be for customers to have one-stop access to all the coverage they need, and that the barriers between life insurance and non-life insurance should be removed.

Figure 5 : Simple UI/UX of SNACK by income

Figure 5 : Simple UI/UX of SNACK by income

Source: “Microinsurance Trend in Southeast Asia” by ABeam Consulting

Summary: Building and providing seamless support that is more closely connected to the lives and actions of customers will lead to further growth for Embedded Insurance.

4. Five category summary and ABeam Consulting support areas

Finally, based on the premise that the five categories are recent major trends in the insurance industry, we will present ABeam Consulting's support areas for each theme. (Figure 6)

| 1. Partnership development, Ecosystem |

|

|---|---|

| 2. AI |

|

| 3. Sustainability |

|

| 4. Distribution Channel |

|

| 5. Product/Service development - Personalization |

|

Figure 6 : ABeam Consulting’s support experience for the insurance industry

-

Partnership development and ecosystems, we can explore appropriate partnerships, conduct business due diligence, and support the consideration of new business models, taking into account our industry knowledge and business scale in Asia.

-

AI-related themes, we have a track record of supporting insurance companies' business transformation using Chat GPT and can support PoC and implementation.

-

Themes in the sustainability area, we have a wide range of achievements including the introduction of platforms for "visualizing invisible corporate value" through digital x ESG.

-

Distribution Channel, we can support the search for new global target investment in the insurance and guarantee business, and support in planning, selecting, and implementing IT solutions for bancassurance.

-

Product/Service development - Personalization, various consultations, and discussions with ABeam Consulting's Embedded Insurance experts are possible.

ABeam Consulting is providing various types of support to advance insurance business models based on its track record in the insurance industry in Japan and Asia in accordance with the five categories. If you are interested in holding a discussion or exchanging opinions, please contact us.

-

*

This insight is disseminated with permission from the InsureTech Connect Asia.

Click here for inquiries and consultations