AML(Anti-Money Laundering)

Transaction Monitoring

Enhancing Supporting Service

AML(Anti-Money Laundering)

Transaction Monitoring

Enhancing Supporting Service

Strengthen continuous transaction monitoring to combat increasingly complex financial crimes. Simultaneously address the two conflicting challenges of improving operational effciency without compromising quality.

Measures to combat Money Laundering (AML), including counter-terrorist financing and Counter-Proliferation Financing, have grown more complex and critical. This is due to tighter regulations in various countries in response to changes in the global situation and the acceleration of cross-industry integration. Financial institutions (FIs) are now required to establish robust AML internal controls, streamline their operations, and continuously enhance their practices.

On the other hand, FI must achieve this without excessive investment, as effcient operations are also a priority. With its deep expertise and extensive experience in AML, ABeam Consulting will enable effcient AML operations by supporting to establish an enhanced transaction monitoring and structure to upgrade the analytical infrastructure for monitoring.

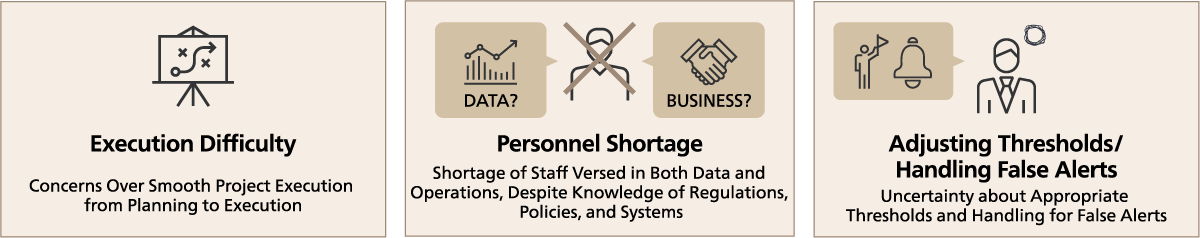

Why is it difficult to handle the enhancement of transaction monitoring solely in-house?

FIs are highly required by authorities to conduct stricter transaction monitoring for against the backdrop of increasingly complex and sophisticated financing methods. However, many face challenges in accomplishing the entire process, from planning to execution, due to their specific characteristics. One of the reasons is the lack of personnel who possess both a comprehensive understanding of data and business operation in rigorous transaction monitoring. Additionally, many FIs confront diffcult issues involving regulations, policies, business operations, data, and systems. For example, inappropriate threshold setting can trigger numerous unnecessary alerts, and many false alerts cause excessive investigation. To smoothly enhance transaction monitoring smoothly, it is crucial to assign personnel with expertise not only in regulations but also in monitoring operations, data, and systems, along with experience in handling similar cases.

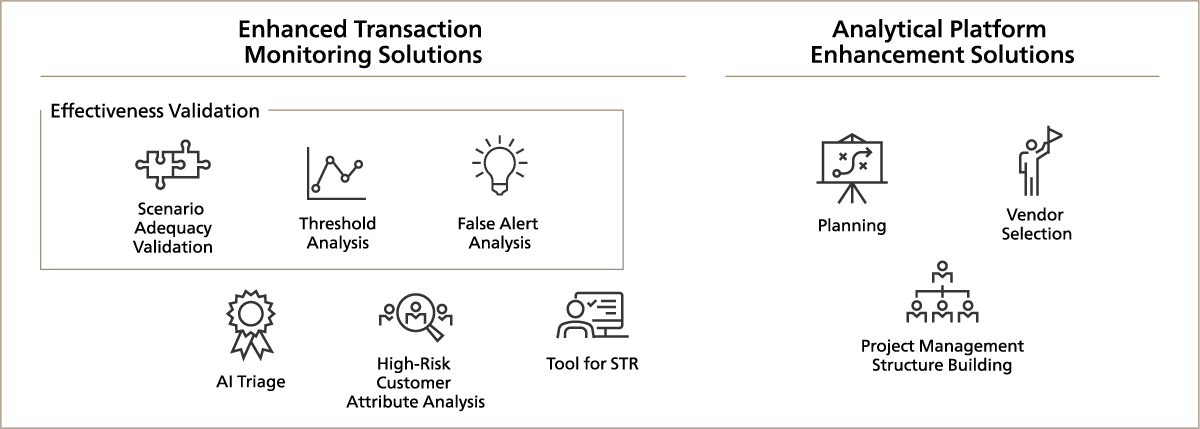

Transaction monitoring enhancing supporting Service provided by ABeam Consulting

ABeam Consulting leverages its extensive experience to enhance transaction monitoring and renew analytical infrastructure for monitoring. Specifically, transaction monitoring is bolstered through validation, AI triage, high-risk customer attribute analysis, and tools for Suspicious Transaction Reporting (STR). In terms of analytical infrastructure renewal, consistent support is provided—from planning and vendor selection to project management and structure building. Assistance is also provided with authority-related tasks, such as drafting report materials for regulatory bodies.

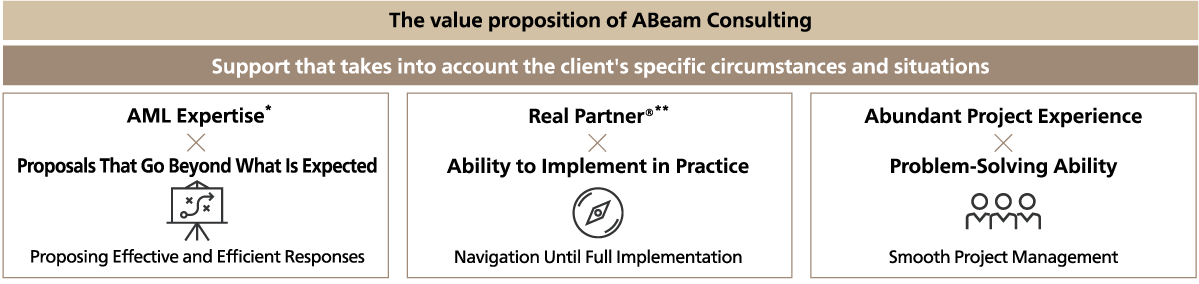

The value proposition of ABeam Consulting

ABeam Consulting assembles specialized teams that include Certified Anti-Money Laundering Specialists (CAMS) possessing international professional AML qualifications. By leveraging expertise in AML regulations, data analysis, and systems, ABeam Consulting provides end-to-end support from planning to execution. The strengths of ABeam Consulting lie in three key areas: 1) providing practical and effective solutions tailored to specific client situations and needs, rather than adhering to mere theoretical ideals, 2) guiding clients through various issues and aiding in the implementation of solutions, with the ultimate aim of fostering self-driven operations, and 3) solving problems based on extensive project experience and robust organizational skills. ABeam Consulting's proven track record in effective project management bolsters the enhancement and effcient operation of AML practices.

-

*The specialized team is composed of members who have Certified AML Specialist (CAMS) qualifications, an international certification for experts in the anti-money laundering field.

**”Real Partner” is the management philosophy of ABeam Consulting. A Real Partner, maintains a strong commitment to leading clients towards successful project delivery and transformation.

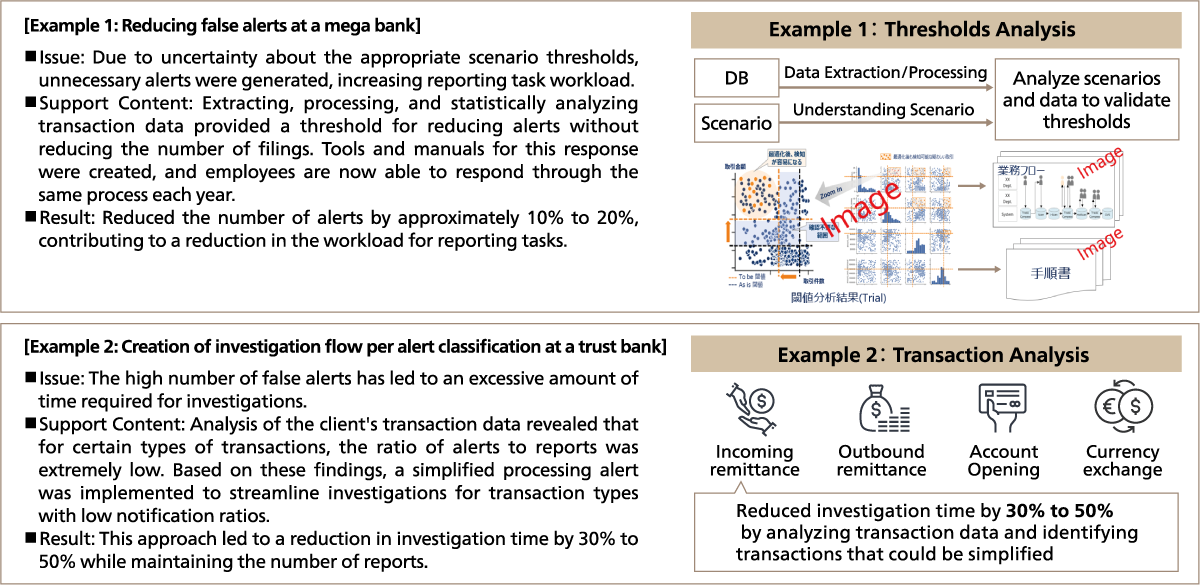

Examples of transaction monitoring operations support

Examples of client challenges and solutions supported by ABeam Consulting.

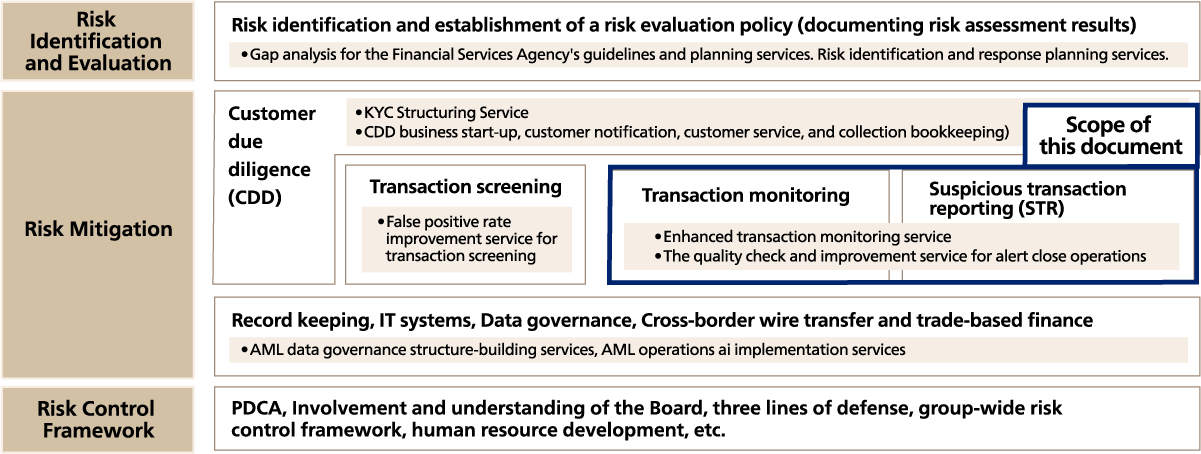

Overall picture of AML and the scope of this document

ABeam Consulting offers comprehensive support for Anti-Money Laundering (AML) initiatives, ranging from risk identification and evaluation to risk control framework. This leaflet introduces our Enhanced Transaction Monitoring Service for risk mitigation.