Jibun Bank Corporation has been steadily expanding its business as a "smartphone-based bank."

In order to achieve further expansion, the bank planned to develop and implement a new CRM strategy. The bank needed its new partner to provide outstanding insights into not only marketing and CRM but also finance and FinTech. After diligent examination, the bank selected ABeam Consulting, which presented a proposal displaying its abundant experience. Using the smartphone as the main channel of communications, Jibun Bank provided every customer with high value-added user experience (UX), deploying One-to-One marketing campaigns and succeeded in acquiring new customers.

Jibun Bank Corporation

- Banking/Capital Markets

- Marketing, Sales, and Customer Service

Challenge

- Needed to improve the customer structure producing a limited number of highly profitable customers

- Needed to optimize resource allocation to the customers

- Needed to build and reinforce customer relationships through personalization

ABeam Solution

- To Support Every Step from the Development of the Concept Designs to Its Implementation to Upgrade CRM(Requirement Definitions, Business Process Designs, UAT Support)

- Creation of New Values Added in Customer Experience by Utilizing the Smartphones

- Establishment of the One-to-One Marketing Implementation Platform

Success Factors

- Drastic reinforcement of the CRM activities using the smartphones as the main communication channel

- Establishment of long-lasting customer relationships by totally renewing the smartphone applications and introducing the EBM (Event Based Marketing) capability

- Increase in the number of smartphone application users and improvement in the user convenience and satisfaction

Overview

The bank added new viewpoint from customer-centric as a driver for growing top line.

Jibun Bank Corporation (hereafter, Jibun Bank) is an internet-only bank established through a joint investment by the Bank of Tokyo-Mitsubishi UFJ and KDDI in 2008. With the motto of delivering nice smiles to its customers by providing smart financial services and the fun that could be specifically brought about by using mobile communications, the bank began dubbing itself "the Smartphone Bank" in 2011, and has since focused on providing banking service via smartphones.

With the steady increase of the total balance of customers’ deposits and the number of customer accounts, Jibun Bank is now stepping into the growth period from the founding period, boasting the customer base of approximately 40 million subscribers to KDDI and au and 18 million auWALLET users. While undergoing such a transitional stage as this, the bank, in order to achieve further business expansion, has examined the necessity to add customer-centric viewpoint to its conventional marketing activities based upon product-centric viewpoint Mr. Daisuke Inoue, Jibun Bank Executive has asserted the following. "In the past, when running the campaigns to increase foreign-currency deposits, we used to halve the handling fees uniformly for all foreign-currency account holders. We could not yet initiate One-toone marketing since we had not completed processing the customer data. We also applied the same approach to other services including the number of free withdrawals from ATMs. Now, thanks to the recent advancement of data warehousing etc, we have become able to capture each customer's activities distinctively. After reviewing the distribution of our management resources, which had been too uniformly conducted, we decided to engage in more precise sales and marketing activities based on the newly added customer-centric viewpoints" Therefore, the bank has selected ABeam Consulting (hereafter, ABeam) as its new partner to embark on reinforcing the marketing activities.

When it comes to internal documents, the contents will be totally different when they are prepared for the management, for the discussions among the staff, and for the explanation used in the call center.

ABeam prepared these documents in a short time, satisfying those different needs.

Their repeated contributions like this enabled the project to develop very rapidly.

Jibun Bank Corporation

Executive Officer

Chief Executive,

Corporate Planning & Marketing

Mr. Toru Yoshikawa

Why ABeam

The decisive factors were their ability to make down-to-earth proposals, and their experience and speed in developing the CRM strategy and measures.

Jibun Bank selected ABeam as the partner to develop and implement the CRM strategy because ABeam had displayed deep insight in marketing and CRM in general, sufficient understanding of Jibun Bank's business challenges, and rich experience in providing consulting services to banking and financial businesses. "Several proposals presented by other companies deviated from the issues we were facing," reflects Mr. Toru Yoshikawa, Jibun Bank Executive Officer.

"On the other hand, ABeam’s proposals showed that they were sharing the same viewpoints with their client. Their proposals were firmly down to earth and precisely grasped the problems the bank was facing, regarding how to improve the business results to the profitable level. They proposed the step-by-step plans to solve the problems without making an unrealistic leap." Before the project kicked off, the personnel of Jibun Bank had reached consensus on the direction of the CRM strategy that they were to improve the profitability by establishing and reinforcing customer relationships. The most urgent issue to tackle to achieve that goal was the shortage of the staff who would propel the project. What the venture company stepping into the growing phase needed was human resources who would develop and implement the new CRM measures and the solutions they would produce. ABeam's proposals contained the contents that were just suitable to solve the challenges the bank was facing, including how to concretize the vision of the CRM strategy and how to prepare the abundant staff lineup.

Challenge

ABeam developed and implemented measures as speedily as Jibun Bank staffs were advancing.

In April 2014, Jibun Bank kicked off the CRM Project, and ABeam participated in it to assist the bank to establish the user experience (UX) mainly focusing on the smartphones and expand the bank's information systems. ABeam started to assist the bank in reviewing the customer preferential treatment system in June. In July, it also started to help the bank integrate relevant measures and upgrade the entire CRM measures, which included developing the concept designs and setting up the requirement definitions and work plans in the Management Strategy Department and the Marketing Department. "As soon as the project started, we found that our evaluation on ABeam during the competition was right,” says Mr. Daisuke Inoue. "ABeam’s performance satisfied all our expectations. They gave us the progress reports at the major project milestones as a matter of course. What impressed us most was their response to the questions issued by the management. They never gave us stock answers. Instead, they would run around the premises, collect the relevant information in detail, and then present us with solution that would not affect our business practice. What was also helpful was their thorough documentation. Usually, we need to explain 70 to 80% of the whole picture before obtaining a proposal that would truly meet our expectations, but in the case of ABeam, with only 20 to 30% of information, they would provide us with highly accurate materials. While we were on a tight schedule, that assisted us greatly, especially when we had to explain to our management about the direction we should choose and persuade them to take it."

Having the typical characteristics of internet-only banks, Jibun Bank deploys business and implements programs extremely fast, maybe approximately 30 to 50% faster than conventional banks. Needless to say, speedy implementation is indispensable for this project. "Even in the situation that would require an ample amount of time to make a serious judgement, ABeam, taking the hint, would prepare the framework before our request and plainly present us with the milestones," says Mr. Naoki Inoue, Jibun Bank Director for Marketing Department and Web Planning Department. "Due to the shortage of the assigned staff,we occasionally had to handle multiple assignments simultaneously. In such situations, ABeam facilitated the discussions by flexibly assigning the right staff for the right posts, satisfying the needs of the scopes of work and those in the various hierarchical positions. That made us feel extremely reassured. In the beginning, we dealt with each other as consultants and bank staffs. However, we gradually became able to frankly discuss with each other as if we were both staffs of the bank."

Solution

To Develop the CRM Upgrading Programsand thoroughly renew the smartphone apps

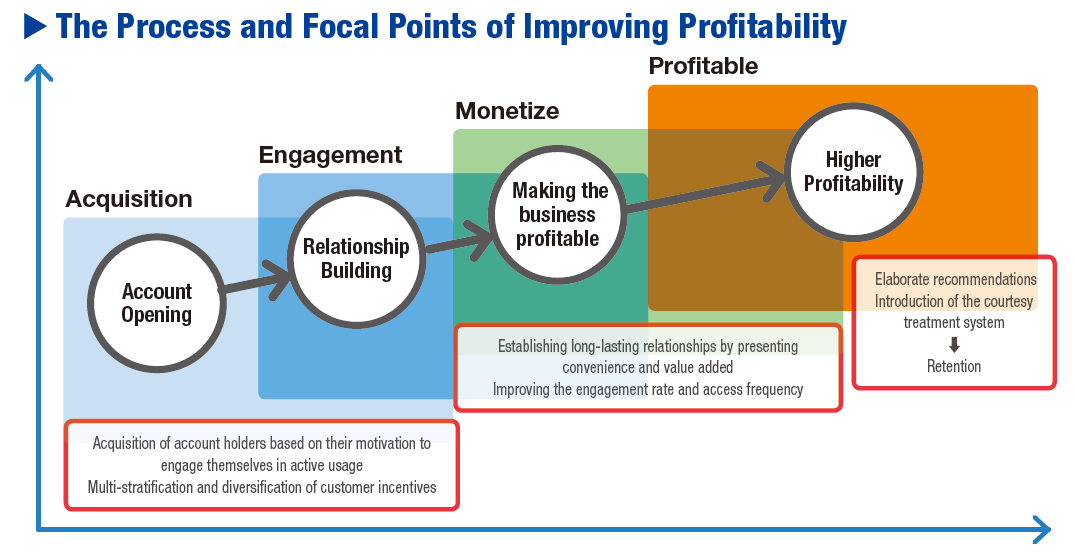

The keys for the retail banking businesses to expand the profit are: 1) control the operational cost, 2) improve the products and services, and 3) convert ordinary customers into profitable customers by utilizing cross-sell, up-sell and customer-attracting incentive programs. As the basic policy to realize the above, Jibun Bank defined their relationships with the customers as a major pipeline. Under this definition, they placed all customers at respective points of the stream in the pipeline, and stimulated them to move en masse from the starting point to the goal, maintaining a good balance. They intended to raise the levels of the customers as a whole.(Fig. 1).

Concretely speaking, they set up the four stages: 1) acquisition of customers by opening new accounts, 2) engagement by establishing the firm relationships with customers, 3) monetization by making the business profitable, and 4) the higher profitability produced by the accelerated monetization. Among them, they placed the utmost importance upon establishing the engagement stage. They decided to provide the excellent user experience and service (UX) as value added, excluding financial transactions, as well as adjust the resource allocations.

Regarding the customers whose transactions have exceeded a certain level, they decided to take One-to-One approach, provide incentives, maintain their relationships, and thus, improve profitability.

As the strategy of the entire bank, they narrowed the measures indispensable for expanding profit down to three aspects. First, increase the number of customers. Second, reinforce and elaborate the products in the fields of deposits, loans, and closings. Third, expand the relationships with customers by promoting CRM, including cross-sell, retention etc. With access via smartphones occupying approximately 80 percent, they, placing the first priority on the access via smartphones in examining CRM, planned to renew the entire smartphone app UX in order to provide the CRM promotion platform.

“While examining CRM,” Mr. Toru Yoshikawa explains, "we implemented interactive features in order to raise the customer's awareness of the convenience of our services and increase the frequency of their usage. We provided incentives according to their transaction levels in order to deepen our relationships with them and nurture the feeling of them receiving courteous treatment. In addition to establishing the relationships of mutual trust with our customers in this way, we decided to make timely and appropriate proposals by using EBM (Event Based Marketing) to provide financial products accompanied by fluctuant interests and fees based upon the analysis of changes of the customers’ usage situations. Thus, we planned to bring about higher profitability." Regarding the smartphone app UX, which would play the key role as the main channel, they decided to build the communication platform that would provide customers with the advanced and high value-added functions, and help them conduct relevant actions, intuitively considering the money-related events as their own business.

I felt that ABeam had abundant human resources.

They were able to anticipate our intention before our requests and always supplied the most appropriate staff.

When they had to replace the staff at major project milestones, they supplied new staff as capable as their predecessors.

Jibun Bank Corporation

Executive Officer

Unit Leader, Marketing Unit Deputy Unit Leader,

Retail Banking Promotion Unit General Manager,

Corporate Strategy Division

Mr. Daisuke Inoue

Result

New smartphone application functions and services provided in three stages from June 2016 to March 2017.

In June 2016, Jibun Bank launched the CRM Project and disclosed the special website in order to notify their customers of the programs to improve their service and convenience. As the first stage for deploying CRM regarding the smartphones as its key element, the bank completely renewed its smartphone app and started to provide Timeline, Summary, My Menu, 3D Touch, and Touch ID. The Timeline function, in particular, was the first introduction of its kind among domestic banks. It chronologically displays information on the campaigns linked to the deposit/withdrawal details of the accounts and the customer transactions and enables customers to enjoy the intuitive service to acquire their past deposit/withdrawal details simply by swiping the smartphone screen. Summary displays the monthly income and outgoing and the changing balance of the yen ordinary savings accounts. It also displays in easy-to-read graphs the realtime financial status of the yen/foreign-currency savings accounts. My Menu displays the applications in order of higher use frequency.

In November 2016, as the second stage of the project, the bank started the service to enable the customers to compare and analyze the status of their financial assets by using their own specific angles based upon their life stages and financial information on average financial assets etc.

In March 2017, as the third stage of the project, the bank reinforced its EBM and introduced the service to offer financial products with premium interest rates according to the results of analysis of the customers’ deposit balance, their website engagement, and the data of foreign exchange fluctuations. "As the starting point of CRM, we have been struggling to achieve the goal of ‘how to enable our customers to enjoy using this bank more conveniently," says Mr. Naoki Inoue. "In March 2017, we successfully completed the project as we had planned While renewing the applications and adding new services in three stages, the usage of our application continued to steadily increase, which, we believe, was a sign that our customers had actually felt the “convenience” we aimed at."

They kept pace with us, which made us feel very reassured.

When we had to handle multiple assignments simultaneously due to the shortage of the assigned staff, they organized the flows of discussions according to the respective needs, and took the role of helping us reach consensus.

Jibun Bank Corporation

General Manager, Marketing Division,

Web Communication & Promotion Division Marketing Unit

Mr. Naoki Inoue

Aiming to expand the customer base and strengthen the customer relationships through extensive utilization of the smartphones and further promotion of CRM.

Jibun Bank, as the smartphone-based bank, is planning to implement additional new services aggressively. Specifically, the bank will focus on the following six areas: 1) to extensively utilize smartphones, 2) settlements, 3) to advance UX, convenience and robotics, 4) to reinforce strong interfaces with KDDI/au via API, 5) to make more sophisticated the relationships with the customers by further utilizing CRM, Big Data, Data Management Platform (DMP) and AI, and 6) to strong security. Using the smartphones as the main channel, the bank is intending to enhance the service lineup and functions, and, by refining the quality, aims at advancing the smartphone apps, which will function as the traffic node to the real world and as the communication channel.

Regarding strengthening the customer relationships by further promoting CRM, the bank will pursue the ultimate UX that will exceed the level of “usability and convenience,” realize the higher “delight, fun,” and innovation, and promote One-to-One services based on its understanding of customers by utilizing the Big Data. In this endeavor, the bank will strengthen its digital marketing, deploy state-of-the-art measures, increase the frequency of contacting its customers, strengthen the establishment of the enduring relationships with customers, and improve its efficiency.

(From the left of the photo) Jibun Bank Corporation Mr. Daisuke Inoue, Mr. Toru Yoshikawa, Mr. Naoki Inoue, ABeam Consulting Ltd. Kenta Tanabe

(From the left of the photo) Jibun Bank Corporation Mr. Daisuke Inoue, Mr. Toru Yoshikawa, Mr. Naoki Inoue, ABeam Consulting Ltd. Kenta Tanabe

Customer Profile

- Company Name

- Jibun Bank Corporation

- Location

- Nihonbashi Dia Bldg. 14F, 1-19-1 Nihonbashi, Chuo-ku, Tokyo, 103-0027

- Established

- June 17, 2008

- Capital

- 50 billion yen

- Business Activities

- Banking (Internet-only bank)

Jan 1, 2017

- Corporate data and titles are those in use at the time of writing.

Click here for inquiries and consultations