Advanced Anti-Money Laundering (AML) Service

Towards the Establishment of AML Control Systems in Response to Increasing International Demands

Anti-money laundering, counter-terrorism financing, and counter-proliferation financing (AML/CFT/CPF, referred to here as “AML”) have become more complex and critical due to the tightening of regulations in various countries in response to changing global situations, technological innovation, and the diversification of businesses.

It is one of the areas where advanced measures are continuously sought not only in Japan, but also globally, in order to effectively utilize limited resources through thorough risk-based approaches and the promotion of new technologies.

ABeam Consulting offers a wide range of services to assist in the identification and evaluation of AML compliance risks, comprehensive problem analysis of various business processes, and the development and efficiency of both business and system aspects, contributing to the improvement of clients' AML control systems.

Features of ABeam Consulting Services

One-stop support

As a comprehensive consulting company, ABeam Consulting can provide one-stop support for the improvement and efficiency of the client's AML control system, depending on the situation and needs, from policy planning and formulation to implementation of measures and post-implementation.

In-house collaborative structure and extensive support track record

Since the problems to be solved in realizing the client’s ideal are complex and wide-ranging, as are the methods by which to solve them, ABeam Consulting gathers personnel from various departments with different specialties, such as financial regulations and data analysis, to form the most appropriate team to support the client. ABeam Consulting has more than 50 consultants supporting various AML projects at any given time.

Pursuing high-level expertise

In order to maintain AML expertise, which is becoming more sophisticated and complex with changes in social conditions, ABeam Consulting works to promote the acquisition of qualifications and the visualization of skills, especially for members involved in AML projects. Professional consultants are encouraged to obtain and maintain the Certified Anti-Money Laundering Specialist (CAMS) qualification, which is the global standard for AML certification. In addition, by making in-house training (e-learning) available to all employees, the population of AML consultants will be expanded and maintained.

Scope of Services

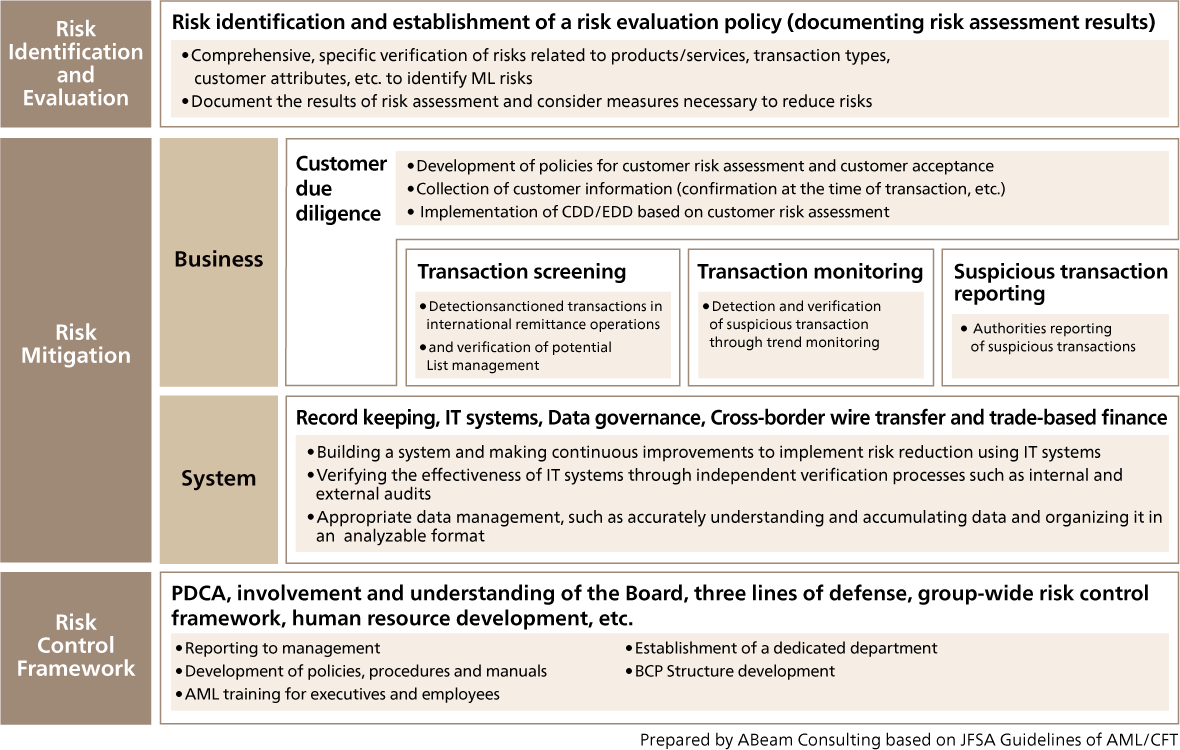

ABeam Consulting's Anti-Money Laundering Upgrading Service can assist the client in all areas necessary to manage the client's AML risk control framework, from risk identification and risk evaluation policy development to key AML operations, system development and analysis.

Required actions for AML/CFT/CPF measures

Support experience

- Support to improve risk identification and assessment

- KYC system implementation support, Transaction monitoring analysis and enhancement support

- Transaction screening enhancement support

- Data Governance Enhancement Support

- New solution evaluation support

- Comprehensive consulting support for AML risk control framework, etc.

Strategic Business Alliance with BearingPoint

ABeam Consulting has a business alliance in the consulting field with BearingPoint Holding B.V. (headquartered in Amsterdam, The Netherlands), a consulting firm based in Europe. The two parties collaborate on global anti-money laundering measures.