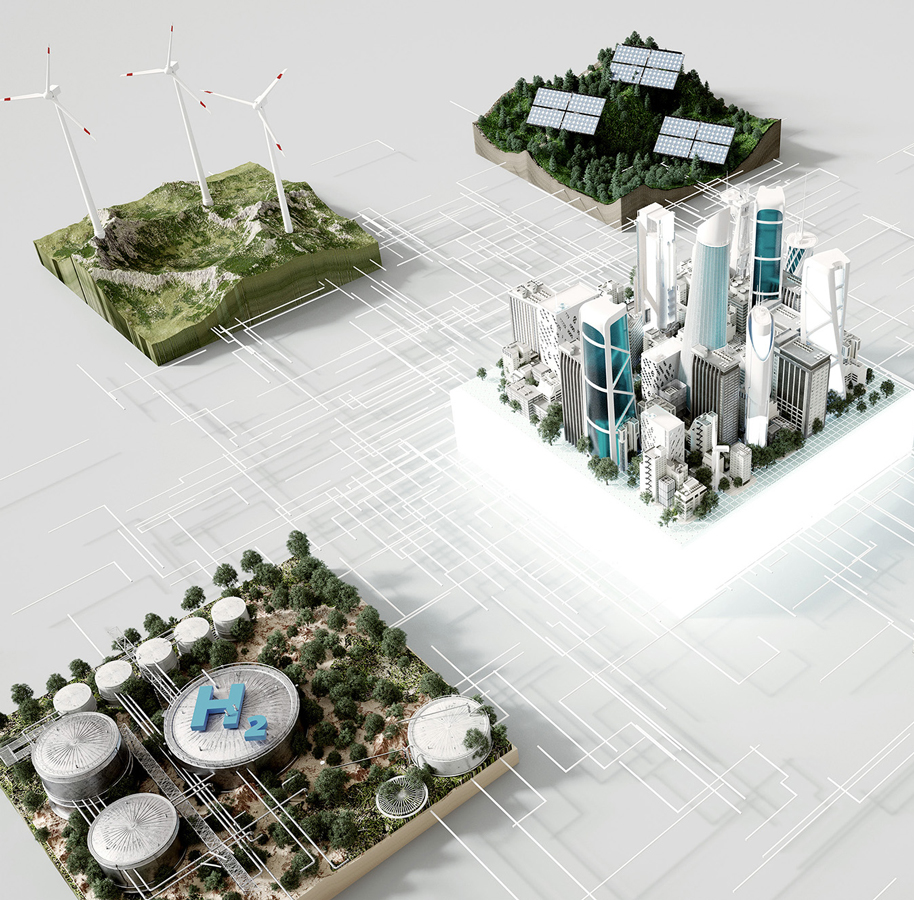

Achieving Green Transformation (GX) through business risk reduction and new business generation aimed at carbon neutrality

Which Next-Generation Business Infrastructure Will Support Decarbonized Management?

Achieving Green Transformation (GX) through business risk reduction and new business generation aimed at carbon neutrality

Carbon neutrality is accelerating on a global scale. Companies are facing calls to carry out GX to minimize business risks by effectively cutting their GHG emissions, including in their supply chains, and monetizing businesses through models adapted to the new market environment.

ABeam Consulting supports clients in building a complete PDCA cycle covering strategy formulation for corporate GX, GHG reduction measures, managing progress towards targets, and strategy revisions. We are also ready to support clients in constructing business models adapted to the new opportunities of a post-carbon society. ABeam helps clients achieve their company-wide GHG reduction targets and management targets.

In March 2024, ABeam Consulting established GX Concierge Inc. in partnership with Sumitomo Corporation to support clients in pursuing post-carbon management. Through our global network, cutting-edge technology, and business creation and transformation capacity that combines economic, social, and environmental value, ABeam will assist clients in achieving a carbon neutral society.

Driving a GX that views the transition to carbon neutrality as both a “business risk” and a “business opportunity”

Policies and regulations for net-zero are accelerating globally. This has made reducing greenhouse gases (GHG) a major challenge for management in carbon-intensive industries (energy, steel, chemical etc.) and in all other industries (automotive, machines, retail, real estate etc.).

To achieve company-wide GHG reduction, companies must take initiatives not only within their group but across their supply chains in partnership with external stakeholders such as suppliers and customers. Companies are also facing requirements to calculate and disclose their GHG emissions on a per product (product CFP) and per organization basis. We also anticipate growing opportunities to generate revenue by building new business models and services. This is due to the changes to market environments and energy value chains resulting from the transition to carbon neutrality.

Companies need to change how they view the transition to carbon neutrality away from just being one of many “management risks” to being a “business opportunity” and move forward with GX.

Combining GHG emission reductions with corporate financial optimization

In the future, companies will need to calculate and disclose their GHG emissions on a supply-chain level to investors. They must also calculate and visualize GHG emissions levels on a per-product basis for business partners. Another key management challenge will be responding to the risk of variances in energy prices caused by renewable energy and dealing with increases to material and transportation costs due to carbon taxes.

Achieving GX on a company-wide level will be a challenge for the sustainability departments charged with handling GHG emissions disclosures to external parties. It will also be a shared challenge for all departments involved in corporate planning, procurement, and production. Companies must understand these issues, build integrated management processes across related departments, and reduce GHG emissions. Management must optimize their finances, such as by maximizing ROI and minimizing risks from energy price fluctuations.

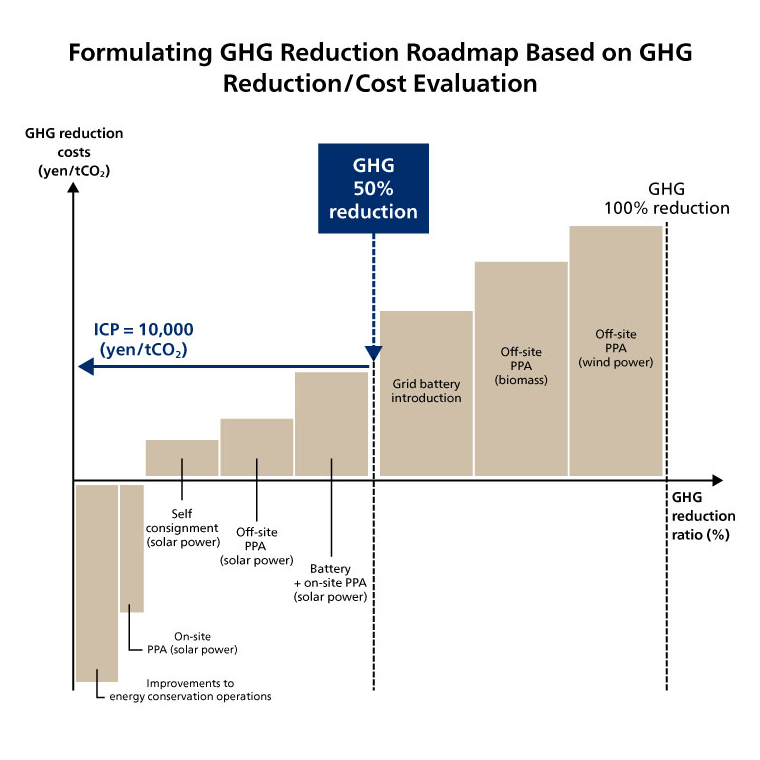

Formulating GX strategy roadmaps based on the costs of cutting GHG

There are three possible approaches to reducing GHG emissions across companies: “saving energy” through energy efficiency measures, switching to “renewable energy,” and “procuring carbon credits.” However, there are different assumptions behind each measure in terms of initial investment cost, operating costs, and the effective period of reduction measures.

It is important to evaluate the GHG reduction cost (yen/CO2) of each measure with a single standard. Companies must also assign an order of preference to GHG reduction measures when formulating GX strategy roadmaps. This allows them to formulate GX strategy roadmaps that account for impacts on corporate finances. But the GHG reduction costs (yen/t-CO2) of each measure are expected to vary in accordance with external market environment changes such as increases to the cost of fossil fuels, electricity market prices, carbon taxes, and changes to the CO2 emission levels of energy companies. These items will have an impact on corporate finances. Companies are required to continuously and systematically analyze the market environment and adjust course on their GX strategy roadmaps.

Improving supplier engagement and building GHG reduction schemes with partner businesses

To reduce GHG, companies must implement measures internal to their own groups (Scope 1 and 2) and in partnership with companies throughout their supply chain (Scope 3). Improving supply chain engagement around GHG emissions reduction is one key to success for companies. This particularly applies to industries (manufacturing, retail etc.) with high levels of emissions (Scope 3 Category 1) coming from their own suppliers within the supply chain. It is important to move forward on strong partnerships with supply chains businesses. This will provide necessary support for GHG emissions reduction according to each supplier, and to build circular economies around renewable energy procurement schemes and waste product recycling.

It is imperative for companies to secure long-term renewable power storage in partnership with supply chain companies, as it is expected to be in limited supply. Domestic business demand for power storage procurement will expand up to 2030 as part of “power saving” GHG emissions reduction measures.

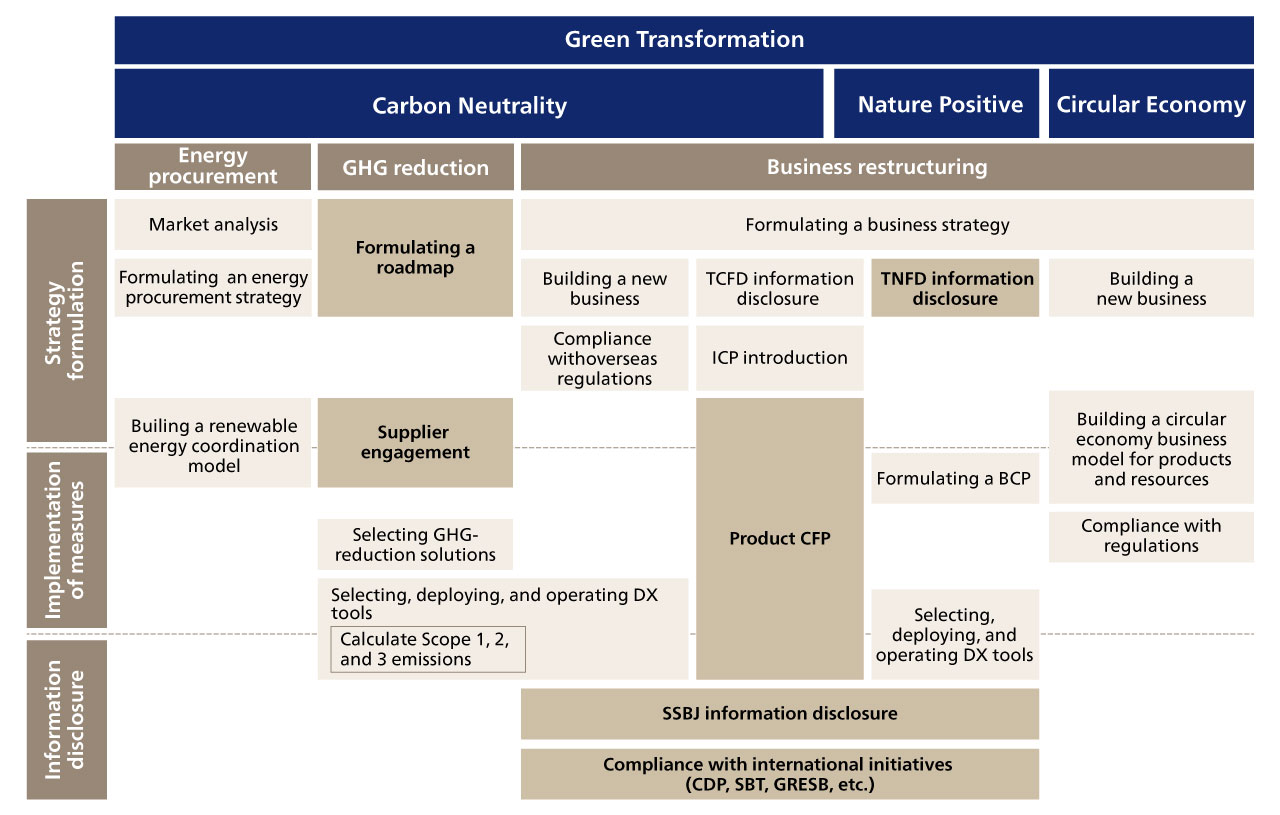

ABeam Consulting supports clients in facilitating corporate GX and supply chain transformation to deliver both economic and social value.

• Strategy formulation: We conduct an as-is assessment (including data collection and analysis of challenges) and help formulate a medium- to long-term GX roadmap and business strategy, as well as an action plan to comply with international initiatives

• Implementation of measures: We help implement emission reduction measures using various solutions that cover both group companies and the broader supply chain. We also help build business models that are tailored to business opportunities

• Information disclosure: We help appropriately disclose information to stakeholders based on the details of GX initiatives, including the Sustainability Standards Board of Japan (SSBJ), Task Force on Climate-related Financial Disclosures (TCFD), Taskforce on Nature-related Financial Disclosures (TNFD), and Carbon Footprint of Products (CFP). We also help comply with international initiatives such as Carbon Disclosure Project (CDP), Science Based Targets (SBT), and Global Real Estate Sustainability Benchmark (GRESB)

Support services for the development and implementation of supplier engagement policies

Establish a system for calculating the carbon footprint of products and support the automation of the calculation

Support for the Sustainability Information Disclosure Standards (SSBJ)

Click here for inquiries and consultations