Materials chemical manufacturers are making its way into the CMO (Contract Manufacturing Organization) and CDMO (Contract Development and Manufacturing Organization) service industry, and thus enhancing its investment in facilities in aim to expand their business. In response to the supply-demand balance and intensification of competition that are expected to occur, not only will investment in facilities be important, but enhanced service levels that accommodate the needs and resolve the pain points of pharmaceutical companies will also become a significant differentiation factor. The key to achieve this is data utilization. In the insight we will share below, we will explain the ecosystem that many materials chemical manufacturers are currently in, the challenges they face, the effectiveness of data utilization, and how to actually utilize data.

Growth strategies for CMO/CDMO services provided by materials chemical manufacturers: The key to a sustainable growth

- Process

- Health Care

-

Shingo Nakamura

Principal -

Hiromu Yoshiura

Manager

Contents

- Chapter 1 Overview of the CMO/CDMO service market and the environment that Japanese materials chemical manufacturers are in

- Chapter 2 Challenges of CMO/CDMO observed from the outsourcers’ point of view and conditions for growth

- Chapter 3 Concrete measures for growth in the CMO/CDMO services

- Chapter 4 ABeam’s prospective vision on CMO/CDMO services

Chapter 1 Overview of the CMO/CDMO service market and the environment that Japanese materials chemical manufacturers are in

With new modalities being drastically developed over recent years, it has become difficult for pharmaceutical companies to maintain their market competitiveness while engaging in all business phases, from research and development to manufacture and sales, by themselves. In 1997, the Federal Food, Drug, and Cosmetic Act enacted by the U.S. Food and Drug Administration (FDA) was amended. In 2005, the Pharmaceutical Affairs Act in Japan was also amended. Such law modifications have significantly alleviated regulations on the outsourcing of pharmaceutical goods production, and thus accelerated the movement of pharmaceutical companies to partially outsource corporate functions such as research and development. This has led to the drastic development of the CMO/CDMO service market.

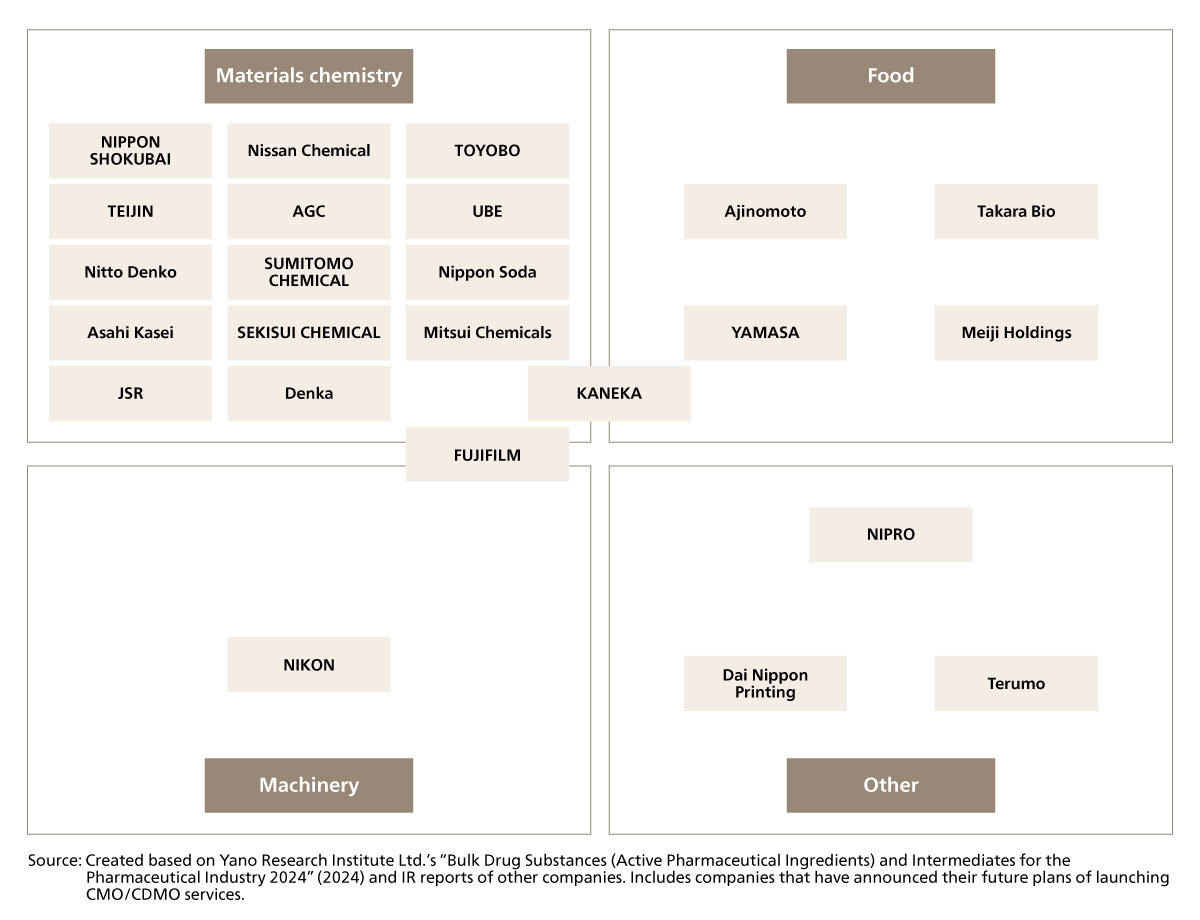

We have seen many manufacturers in Japan advance into the CMO/CDMO service industry (Figure 1-1). One can say that this is a result of making use of the high manufacturing capabilities and elemental technologies already owned by Japanese manufacturers. In particular, materials chemical manufacturers are vigorously making its way into the market. Some of the leading materials chemical manufacturers are also announcing that they will soon be entering the CMO/CDMO service industry. As for the materials chemistry industry, many companies are struggling to enhance their profit margin as their primary source of revenue (conventional business) has become the core target of an intensifying price war. Many are starting to shift their primary business to CMO/CDMO services which seem to promise a higher operating profit margin.

Figure 1-1 Examples of Japanese manufacturers engaged in CMO/CDMO services

Figure 1-1 Examples of Japanese manufacturers engaged in CMO/CDMO services

Most of the growth strategies for CMO/CDMO services set forth by materials chemical manufacturers are based on aggressive facility investment. The aim is to increase sales by enhancing their manufacturing capabilities to accommodate the rapid market growth. In addition, many are vigorously enhancing facilities that will enable the company to seamlessly handle all manufacturing phases, from production of drug substances, drug formulation, to packaging. In this way, pharmaceutical companies would be able to outsource the entire manufacturing process to one manufacturer. However, over recent years, we have started to observe many cases where materials chemical manufacturers are not receiving enough outsourcing orders to reap profit from the excessive investments made to their facilities. They need to take into consideration that the market growth will soon start to dwindle, explore ways to differentiate themselves from their competitors in terms other than their manufacturing capacities, and increase their market competitiveness.

Chapter 2 Challenges of CMO/CDMO observed from the outsourcers’ point of view and conditions for growth

The royal road for CMO/CDMO to differentiate themselves from their competitors is to understand the needs and pains of their client and roll out services that accommodate to such needs and pains. In a research conducted by ABeam Consulting to pharmaceutical companies, the greatest causes of dissatisfaction and issues that the outsourcers felt when using CMO/CDMO services were “deviations from the manufacturing processes and delays in the manufacturing schedule” and “miscommunication and issues regarding information sharing.”

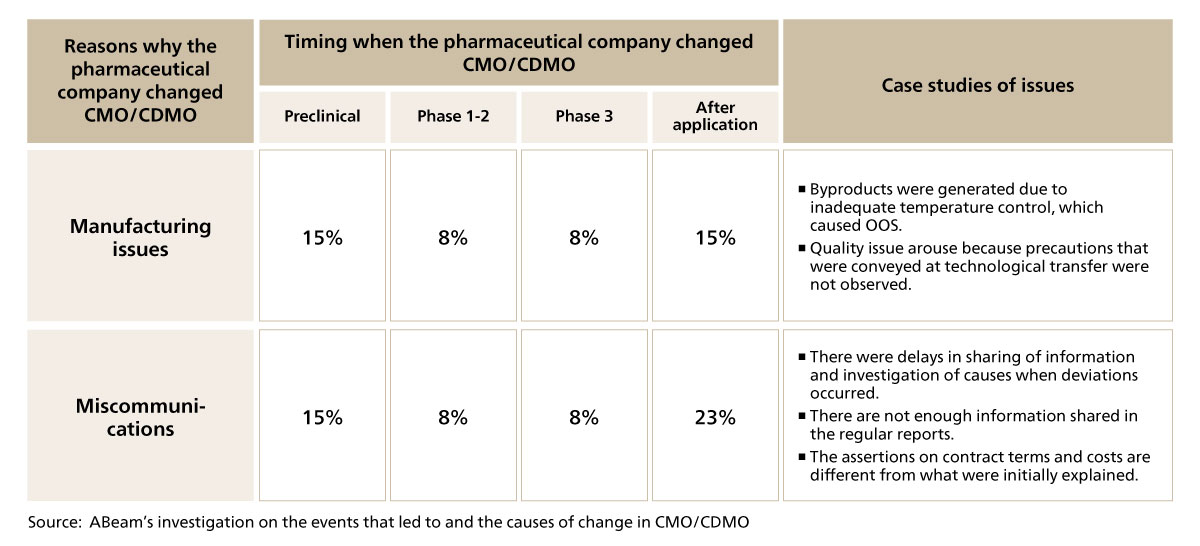

One significant result from this research was that the number of cases in which the outsourcer decides to change CMO/CDMO due to manufacturing issues and miscommunication from the latter phases of development (during or after Phase 3) may be nearly equivalent to the number of cases in which the outsourcer decides to change CMO/CDMO during Phases 1 and 2, which are the preclinical phase and early stages of development (see Figure 2-1). In general, the number of manufacturing volume increases and the unit cost becomes higher as the development phase progresses in CMO/CDMO services. Hence, the loss of orders in the latter phases of development has a great impact on the provider’s business. Even from the outsourcer (pharmaceutical company)’s perspective, changing production location which are high in both cost and risks during the latter phases of development indicate how much their reliability towards the CMO/CDMO has decreased. As of today, the CMO/CDMO service market is still growing at an alarming rate and the demands are higher than what can be supplied. So, even if the CMO/CDMO’s reputation drops, they may still be able to receive orders from elsewhere. However, as the balance between supply and demand approaches an equilibrium, the risks of such CMO/CDMO losing their share in the market will rapidly increase.

Figure 2-1 Timing when the pharmaceutical company changed CMO/CDMO

Figure 2-1 Timing when the pharmaceutical company changed CMO/CDMO

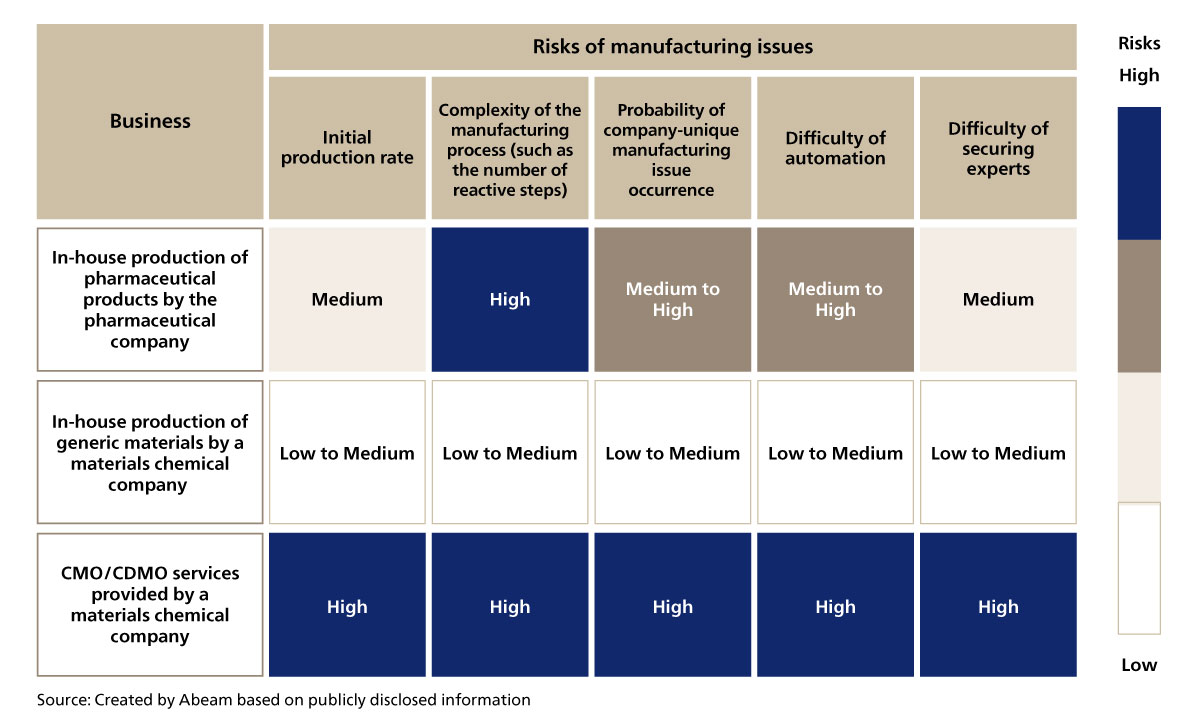

The reasons why “deviations from the manufacturing process” occur frequently, causing dissatisfaction among the outsourcing pharmaceutical companies, are the low proficiency of the manufacturing operators and their lack of knowledge regarding regulations on pharmaceutical goods. It seems the insufficiency in skills has a great affect on the manufacturing process. It can be said that this issue is unique to the CMO/CDMO services. CMO/CDMO are often entrusted with first-time production. In most cases, the manufacturing process of low molecular drug substances are particularly complex. Moreover, the type, size, and specifications of the facilities that each manufacturer owns slightly vary. Even if the target pharmaceutical goods to manufacture is the same, the types of issues that may occur differ from one manufacturer to the next. In other words, the types of issues that a CMO/CDMO needs to address increases proportionally with the number of orders it receives. Overall, the likeliness of an issue to occur becomes higher, making it necessary for CMO/CDMO to allocate resources who have the proficiency, knowledge, and skill to foresee such issues.

Furthermore, for a materials chemical company to provide CMO/CDMO services, it would need to secure personnel who are well versed in pharmaceutical goods manufacture. However, this is not easy, because in general, the average wage of employees at a pharmaceutical company is higher than those at a materials chemical company, making it hard to scout personnel from the pharmaceutical industry. While other industries can supplement their lack of resources with measures such as process automation, there is not much CMO/CDMO can do as they must respect GMP (Good Manufacturing Practice).

Figure 2-2 Background on why manufacturing issues are likely to occur in CMO/CDMO services provided by materials chemical companies

Figure 2-2 Background on why manufacturing issues are likely to occur in CMO/CDMO services provided by materials chemical companies

Chapter 3 Concrete measures for growth in the CMO/CDMO services

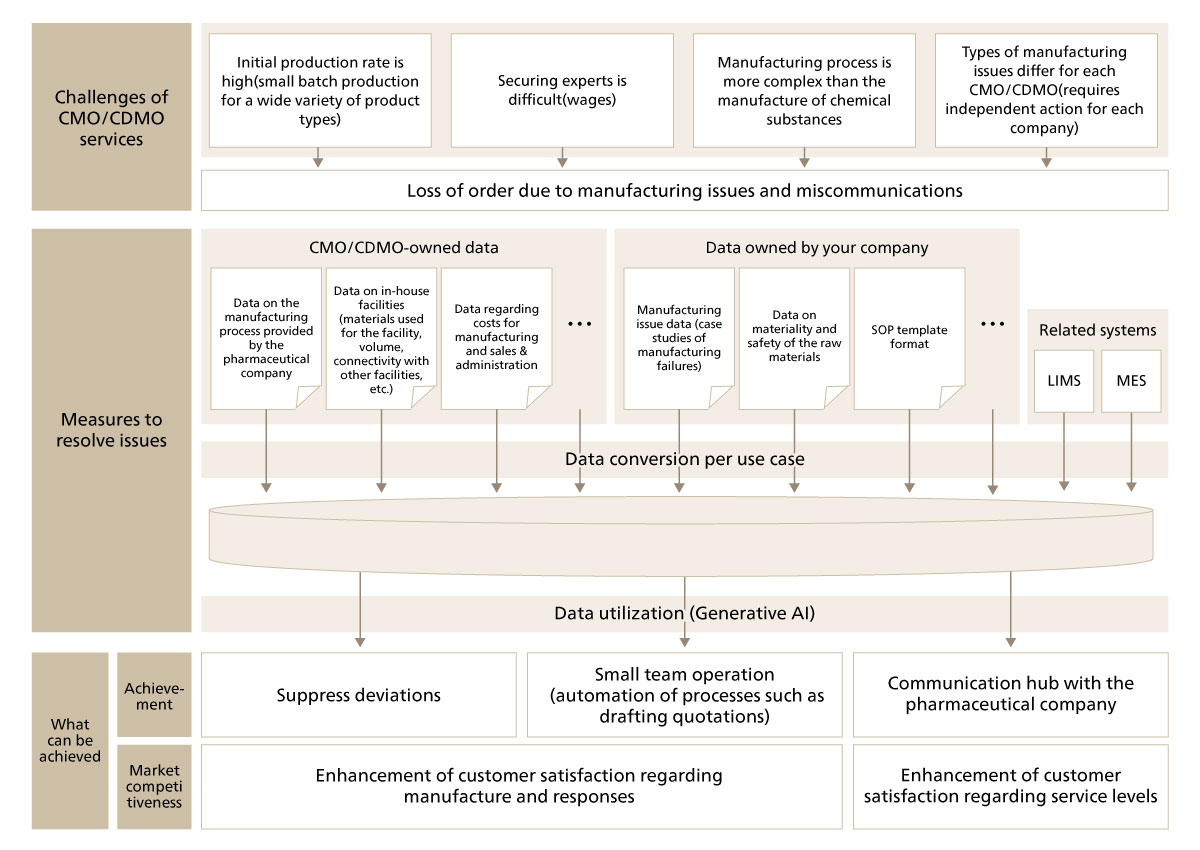

To be able to foresee issues before actual manufacturing begins and reduce risks of manufacturing issues, it is important that there are resources that “has the knowledge of a seasoned personnel and can foresee dangers that may occur in manufacturing.” The key to secure such resource is data utilization. For example, combining manufacturing-related data received from pharmaceutical companies with data of facilities that the CMO/CDMO own, along with case examples of failures in general chemical reactions and issues that had occurred at the CMO/CDMO may draft a proposal on which facilities could be used as well as what other facilities they can be used with. Such assumptions may help list up the manufacturing issues that may occur. (Figure 3-1)

Figure 3-1 Visual example of accumulation of data to build a system specializing in the company’s CMO/DCMO services and outputs that such system can yield

Figure 3-1 Visual example of accumulation of data to build a system specializing in the company’s CMO/DCMO services and outputs that such system can yield

Furthermore, data utilization is not only effective to prevent manufacturing issues but also expected to improve communication. In CMO/CDMO services, tasks such as regular progress reports to the outsourcing pharmaceutical companies and head offices as well as drafting quotations for pharmaceutical companies are regarded as hassle work that manufacturing sites need to provide. Let us take a look at how much of a hassle it is to draft a quotation. Based on the information that the CMO/CDMO receives from the pharmaceutical company, the CMO/CDMO must determine which tanks are best to use, selecting tanks made from the most appropriate material, taking into consideration of factors such as the time it takes to clean the tanks and pH of the reaction solution. The CMO/CDMO needs to allocate resource who are well versed in the facilities that it owns as well as synthetic chemistry. However, as aforementioned, it is not easy for CMO/CDMO services to hire experienced personnel in abundance. Hence, in many cases, it is inevitable for CMO/CDMO to prioritize quotation requests.

If the CMO/CDMO could build a system that supports creation of tank combination plans, using limited information as input, it would be able to standardize the process to draft quotations and promptly create quotations without depending on the availability of experienced personnel. Not only will the customer’s satisfaction towards quotation requests increase, but experienced staff members will also be able to focus on other tasks, enabling the organization to create leisure to improve service quality. These are all effects that could be achieved in the process of accumulating data to reduce risks of manufacturing issues as shown in Figure 3-1.

In addition, data accumulation would make it feasible to create a system to draft SOP and support the creation of a CAPA (Corrective Action & Preventative Action) plan to implement at times of deviation. Although the ultimate goal is to accumulate data that will put forward suggestions to reduce risks of manufacturing issues and eliminate miscommunications, we think it is effective for CMO/CDMO to take into account of the effects that can be expected along this journey and envisage a strategy to gradually differentiate itself from its competitors.

Chapter 4 ABeam’s prospective vision on CMO/CDMO services

CMO/CDMO do not own their own products. Their primary business is to provide advanced manufacturing services which utilize their facilities and human resources. However, not much is yet revealed on initiatives taken to transform its service business. Of course, the improvement of QCD is an issue they need to address as a manufacturer. However, if they do not take measures which focus on improvement of values they can provide as service providers, particularly actions to improve customer satisfaction, we think their business will hit the ceiling in terms of business continuity and portfolio transformation.

In this insight, we have introduced an example of transformation that can be implemented to CMO/CDMO services. To build the data utilization system that we have shared above, we think it is critical to use not only data owned by the CMO/CDMO itself, but also to combine that with other data such as manufacturing issues provided by a third party and assume all possible issues. At ABeam Consulting, we own many intellectual assets such as use cases and know-hows on manufacturing processes and data utilization for the manufacture of chemical and pharmaceutical goods, based on the support we have provided in such projects. Furthermore, we are capable of providing support from developing measures to improve QCD to accompanying companies to envisage, create roadmaps, and implement actions to transform their service business. It would be great if materials chemical manufacturers reach out to us to leverage our experience and knowledge and seek our support in transformation of their CMO/CDMO service business to make it their next primary source of revenue. We look forward to helping materials chemical manufacturers to achieve sustainable growth.

Click here for inquiries and consultations