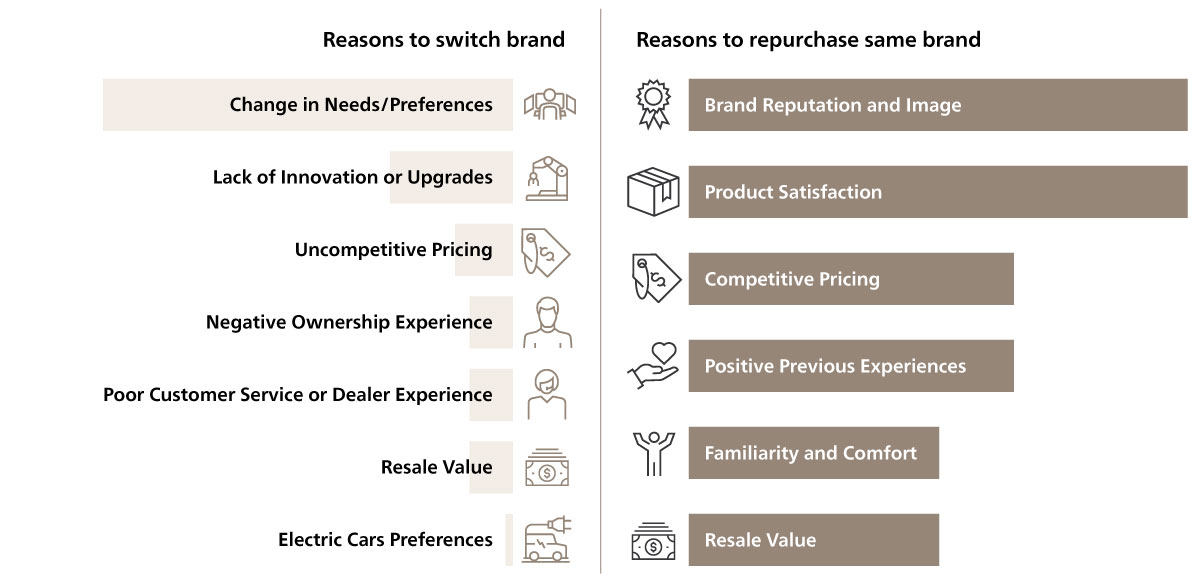

Automotive consumer journey unfolds across five key stages, each revealing distinct characteristics in consumer behavior, including (1) research and consideration, (2) dealer visit, (3) test drive, (4) purchase and delivery, (5) post-sales service, and end with (6) car replacement.

The Consumer Survey conducted by ABeam Consulting Vietnam sheds light on noteworthy aspects of consumer behavior at each stage. The entire lead time from research to actual purchase typically spans 2-3 months, with an additional 2-4 weeks for delivery.

During the research phase, consumers predominantly seek information from dealers as the primary offline source and Google as the primary online channel. Safety, fuel economy, and driving experience emerge as the top three factors influencing car purchase decisions. Moving on to the dealer visit stage, reputation, price, and car availability take precedence, selected by over 65% of respondents. This stage is also the preferred time for contact exchange among respondents.

While most buyers visit a single dealer per brand 2-3 times, the majority conduct a test drive only once for their chosen model. In the purchase and delivery stage, cash proves to be the most common payment method, with 67.8% of respondents opting for this approach.

Post-sales services are typically initiated through phone or SMS communication, with phone communication being the preferred method for almost 100% of respondents. As the journey concludes, car replacement tends to occur when the vehicle reaches 3-5 years of use or surpasses 150,000 km in mileage. Car replacements often involve passing the vehicle to relatives or non-dealers.