As society and the economy as a whole progress toward a digital economy, there are high expectations for efforts to radically improve customer value and productivity by linking commercial distribution and financial functions with the power of digital technology and reforming the value chain.

For example, there is embedded finance that embeds banking functions as Bank as a Service in the commercial flow of companies that have contact with customers and provides services to customers by linking the financial functions with the commercial flow.

Movements to reform these value chains are also beginning to be seen in trade transactions and trade finance, which have traditionally relied on paper and manual work.

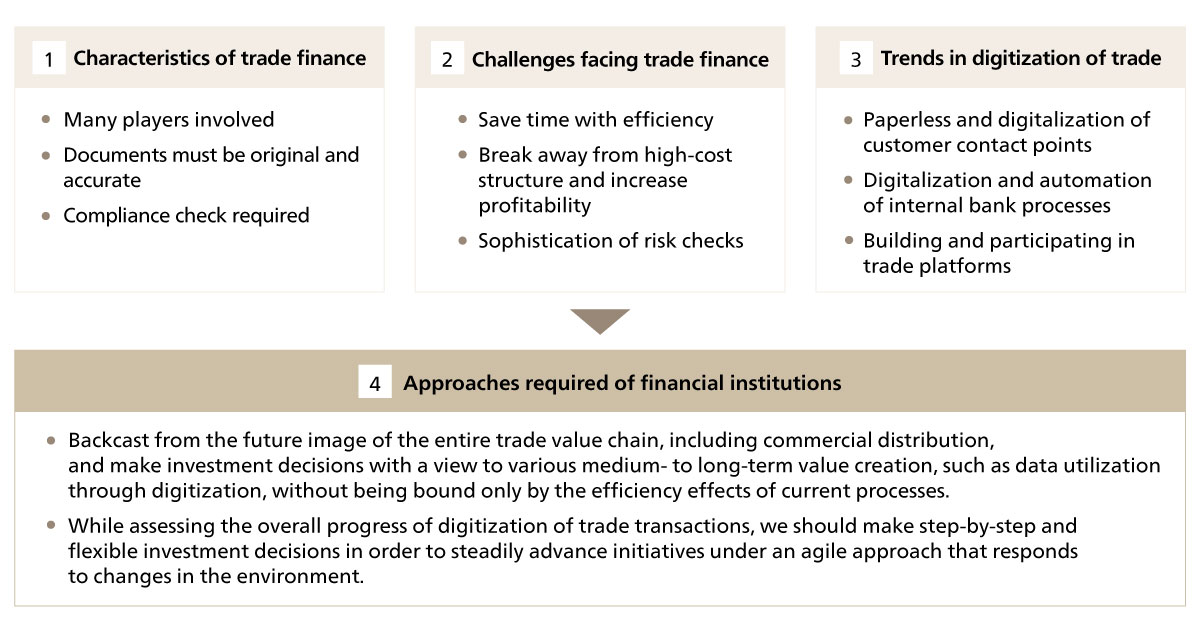

Based on the characteristics of trade transactions, including finance, this insight provides an overview of current efforts and challenges in trade finance DX, and considers the approach that banks should take (Figure 1).

Trade Finance DX ~Approach for new value creation~

- Banking/Capital Markets

Figure 1 Points of this insight

Figure 1 Points of this insight

1. Characteristics of trade finance

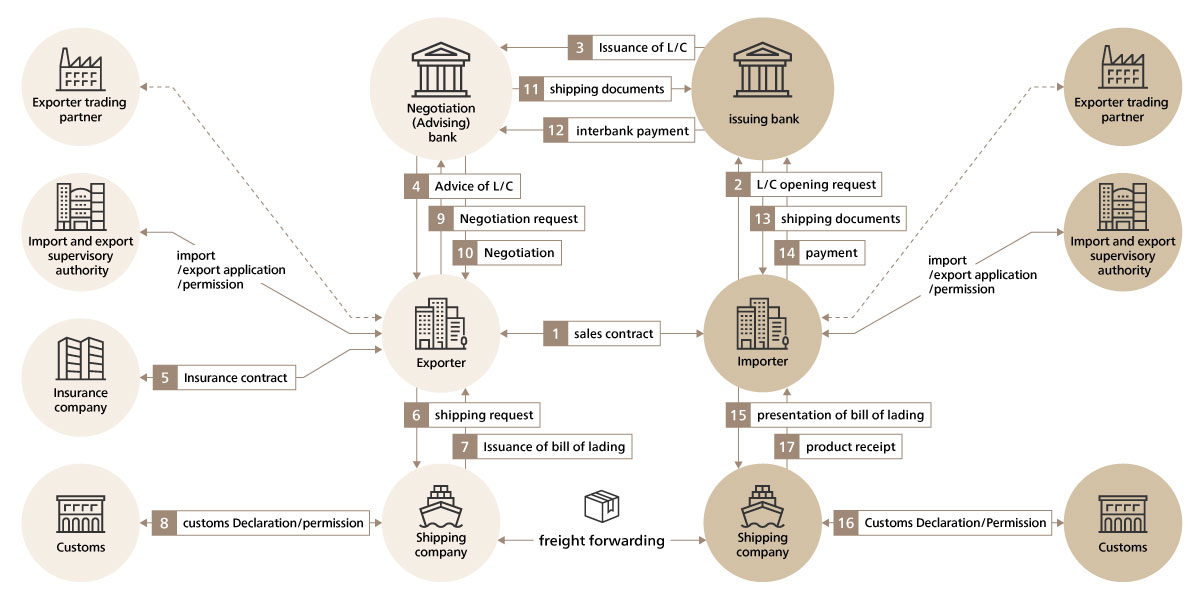

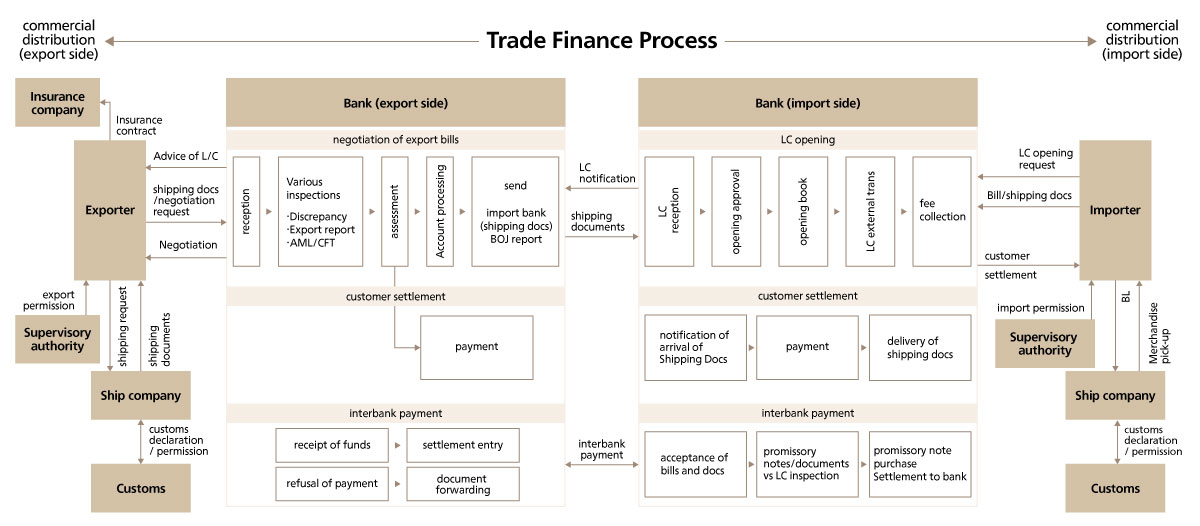

Figure 2 shows the flow of a trade transaction, taking letter of credit (L/C) negotiation as an example. As you can see from this, in order to complete trade transactions including trade finance, not only exporters and importers but also insurance companies, shipping companies, banks, and many other players need to be involved. In addition, since it is a transaction with partners that crosses the border, after confirming and processing the documents received by each player, it is necessary to pass it on to the next player who is reliable for himself. This situation can be described as "an epic relay game with a large number of players".

Figure 2 Flow of trade transactions that can be said to be a grand relay game

Figure 2 Flow of trade transactions that can be said to be a grand relay game

In addition, trade transactions are characterized by the presence of documents that require originality, such as bills of lading (hereinafter referred to as BL), which are securities embodying goods to be imported and exported. Furthermore, since trade involves transactions with parties across national borders, financial institutions bear the credit risk as an intermediary. Therefore, it takes a lot of effort to check the content of the documents received and the consistency between multiple documents, and if there is a discrepancy, it will be amended with many players and much adjustment is required. Another feature is that the bank is responsible for compliance checks, such as whether the countries and parties involved in the trade are subject to economic sanctions or whether the goods are prohibited from export.

2. Challenges facing trade finance

Since trade finance has the above characteristics, shortening processing time through efficiency and breaking away from the high-cost structure due to dependence on various paper and manual work will lead to the digitalization of the entire society and economy. This has been a long-standing issue on a global basis, even as globalization progresses.

-

*

For example, in transactions that do not take many days to transport, such as trade between Japan and other Asian countries, sometimes the importer cannot receive the cargo because the documents have not arrived even though the cargo has already been unloaded.

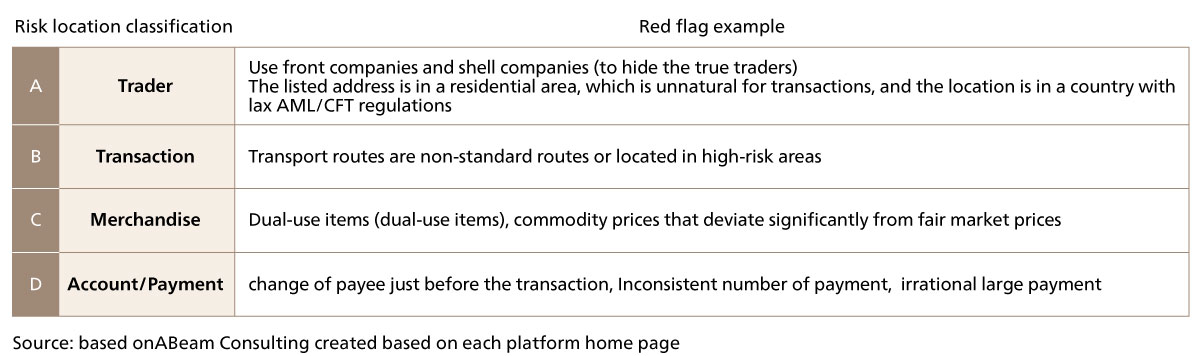

In addition, against the backdrop of the increasing importance of economic security, anti-money laundering (AML), and combating the financing of terrorism (CFT) as well as the increasing sophistication of criminal methods accompanying the rise in global geopolitical risks, risk checks from the perspective of compliance, so-called Further strengthening of Trade Based Money Laundering checks (hereinafter referred to as TBML) is required. For example, it is possible to see through the use of circumvention transactions and shell companies that are difficult to detect, and to check whether or not they are subject to economic sanctions, including those indirectly involved. In addition, while L/C negotiations are credit activities for banks, discrepancies and counterfeit checks rely on visual inspection, so it is important for banks not only to improve efficiency but also to reduce the risk of omissions in checks.

-

*

For example, in 2014 Standard Chartered Plc lost US$175 million due to counterfeit securities at Qingdao port, and in 2017 Australian bank ANZ suffered US$300 million loss due to counterfeit BL in Singapore and South Korea.

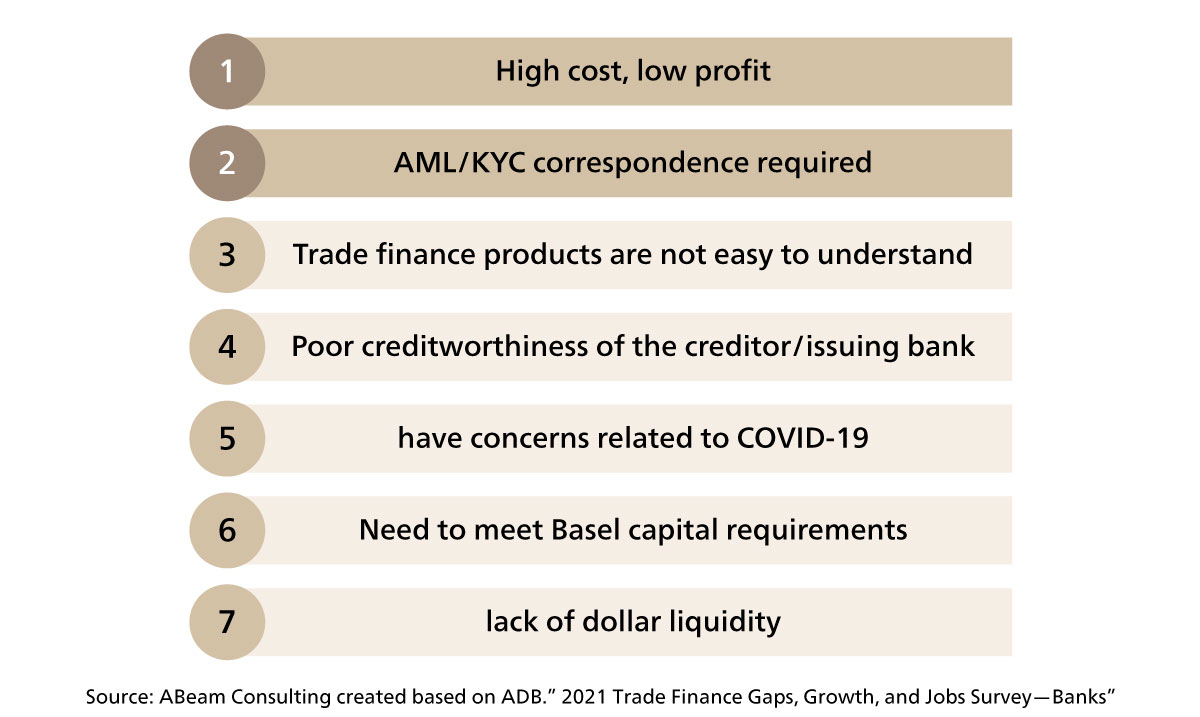

Incidentally, in a survey of financial institutions conducted by ADB (Asian Development Bank) in 2021, as shown in Figure 3, high costs and AML/KYC were listed as top issues.

Figure 3 Challenges in promoting trade finance

Figure 3 Challenges in promoting trade finance

3. Trends in digitization of trade

(1) Digitization of trade finance processes accompanying advances in information technology

Since trade transactions have the above characteristics and issues, digitization attempts to improve efficiency, improve convenience, and reduce the risk of clerical errors have been made along with the spread of the Internet for the past 20 to 30 years. Specifically, EDI (Electronic Data Interchange), which electronically exchanges business transaction data between companies via communication lines under standard rules, was applied to trade. Typical examples include Bolero (Bill Of Lading Electronic Registry Organization), which was launched in 1998 by SWIFT, the de facto standard for international interbank payments, and TT Club, an insurance company for container transport. Bolero has digitized shipping documents such as BL and has realized data sharing on a digital basis between trading parties.

However, although EDI has been promoted for many years in this way, its use was limited to part of the processes of large companies, and it did not reach full-scale spread. This is partly because there were technical issues. For example, if each trading partner has its own EDI, it will be time-consuming and costly to integrate data in different formats, and the concentration of transactions on the central server may not be enough to handle the load and data tampering resistance.

However, in recent years, information technology such as web technology, OCR (optical character recognition), and blockchain has made dramatic progress, and as a result, various initiatives have sprung up, leading to the digitization of processes including trade finance. We would like to introduce some of these trends.

Trend 1: Paperless and digital data conversion of contact points with customers (importers and exporters)

While the digitization of shipping documents across industries is in progress, there is a movement toward paperless and digitized processes at the point of contact between banks and customers.

One of them is an effort to digitize the paper-based documents received by the bank using OCR. In other words, it is intended to digitize shipping documents received on paper and connect them to automatic checks for discrepancies by the system and system processing of subsequent in-house processes. However, this approach has the problem that the format of shipping documents is not uniform for each company, and the display position of each item such as the name of the exporter differs depending on the company even if the document type is the same. Improvements in reading accuracy is expected.

At the same time, mainly major banks have introduced trade portals for electronic communication between bank customers and banks. In addition to being able to obtain shipping document information as data, the trade portal can provide customer benefits, such as the ability to quickly notify customers of L/Cs received from correspondent banks. However, there is a problem that the incentive to use trade portals is limited due to the fact that paper-based exchanges remain due to the lack of legislation regarding the transfer of rights to BL, which is securities.

Trend 2: Digitization and automation of trade finance processes within banks

In parallel with the above-mentioned movement to digitize customer contact points, there is also a movement to digitize processes within banks using RPA, BPM (Business Process Management) tools, and trade finance packages. For example, it is a reduction of manual processing such as automatically inputting transaction data obtained via the previous trade portal into the bookkeeping system using RPA, and furthermore, automatically inputting them into the TBML screening system. There are also solutions that link multiple departments and systems using trade finance packages, BPM tools, APIs, etc., and are being introduced mainly in Western banks. However, if there are many systems to connect, it is necessary to pay attention to the fact that it will be a large-scale development including the system cooperation cost.

Trend 3: Building and Participating in Consortium-type Trade Platforms

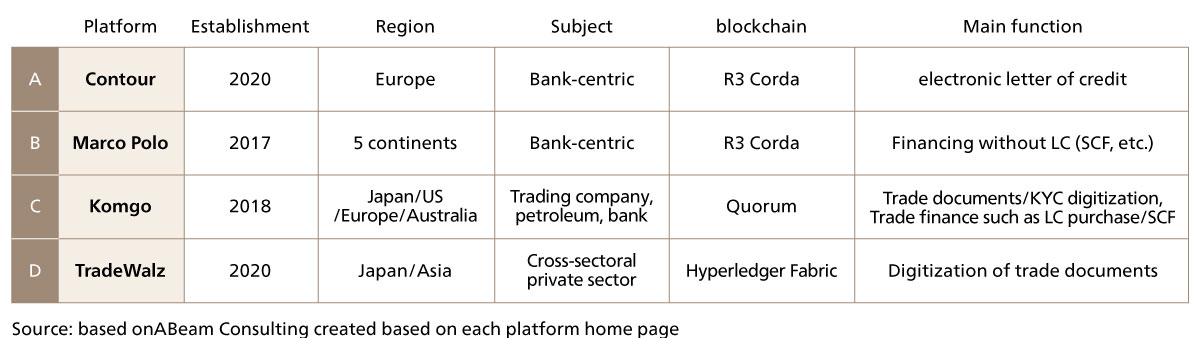

The consortium-type trading platform, which is expected to overcome the technical challenges of EDI mentioned above, is expected to meet great expectations with the advent of blockchain. Trade transactions require the originality of securities and contracts, and while exchanging contracts and documents on a paper basis, many involved parties visually check and process in turn. Blockchain has the following characteristics: (1) it is extremely difficult to falsify, (2) once recorded transaction history cannot be deleted, and (3) it is possible to share information with necessary participants in real time. In addition to meeting the essential requirements of trade transactions, such as ensuring traceability, it enables the enjoyment of benefits such as speeding up the process that used to take time by mail. Recognizing the affinity between the characteristics of blockchain and trade, platforms with various functions have been launched in various regions of the world, as shown in Figure 4.

Figure 4 Examples of trading platforms

Figure 4 Examples of trading platforms

Despite the high expectations of such a trading platform, there is still a long way to go before it becomes popular and profitable, as seen in the announcement that TradeLens, which was launched in 2018 by IBM and Maersk, one of the world's leading shipping and logistics companies, will withdraw in November 2022. In reality, there are the following issues.

- There is no legislation in place regarding the digitization of shipping documents. In particular, BL is a securities and physical transfer is a requirement for rights transfer, but since legal development of electronic BL has not been completed in many countries, paper-based transfer will remain even if it is digitized.

- The required information differs depending on the business customs of each country and the agreements of each industry. In addition, unique public-private platforms such as customs clearance systems have been partially built. Therefore, if you try to digitize in the current state of non-standardization, it will be necessary to respond to the specifications of each country and industry.

- From the user's point of view, there are many cases of trade transactions with various countries, and in terms of functions, it is necessary from logistics to finance. In order to meet the needs of digitalization, it is necessary to connect to various platforms. As a result, costs such as office system support are required.

On the other hand, in response to the above issues, the International Chamber of Commerce and the World Trade Organization have issued the "Standards Toolkit for Cross-border Paperless Trade" to standardize trade transaction data. Attempts to solve the problem are underway, such as TradeWaltz, which was established in 2020 with investment from logistics and non-life insurance, aiming to build an ecosystem that links the platform "TradeWaltz" with platforms in Asian countries.

(2) Utilization of trade digital data

Trend 4: Advancement of TBML

Regarding trade transactions, we described that checking from the perspective of discrepancies and compliance, so-called TBML, are important, and that their importance is increasing against the backdrop of increasing geopolitical risks. On the other hand, TBML is under pressure for its sophistication. Figure 5 is a typical example of TBML risk, but with the increasing sophistication of crimes such as circumvention transactions and the use of shell companies, emphasis is placed on CDD (Customer Due Diligence), which checks for problems with trade transaction parties. The conventional TBML with data analysis including machine learning that digitizes shipping documents and combines them with data provided by third parties is useful in deterring these increasingly sophisticated crimes. However, although some banks are making such efforts, most of them are still limited to simple screening from the perspective of digitalization.

Figure 5 TBML red flag example

Figure 5 TBML red flag example

Trend 5: Expansion of supply chain finance

From the perspective of data utilization related to trade finance, supply chain finance (SCF), which provides funds based on order placement data on the supply chain, is becoming widespread. According to the World Supply Chain Finance Report by BCR, an accounts receivable finance research firm, the market size of SCF is US$1.31 trillion, growing at a CAGR of 17.1%.

On the other hand, SCF brings benefits such as improved cash flow for suppliers and buyers, but manual operations place a heavy administrative burden on customers and banks. Major banks, mainly in Europe and the United States, are advancing digitization by sending and receiving order data between suppliers and buyers via web portals or by directly connecting customer systems and bank systems, and automatically linking with internal bank processes. However, in order to further expand the base of SCF, it is expected that the suppliers and buyers who provide order information as data and financial institutions other than major financial institutions will expand their efforts to digitize.

4. Approaches required of financial institutions

(1) Possible future image

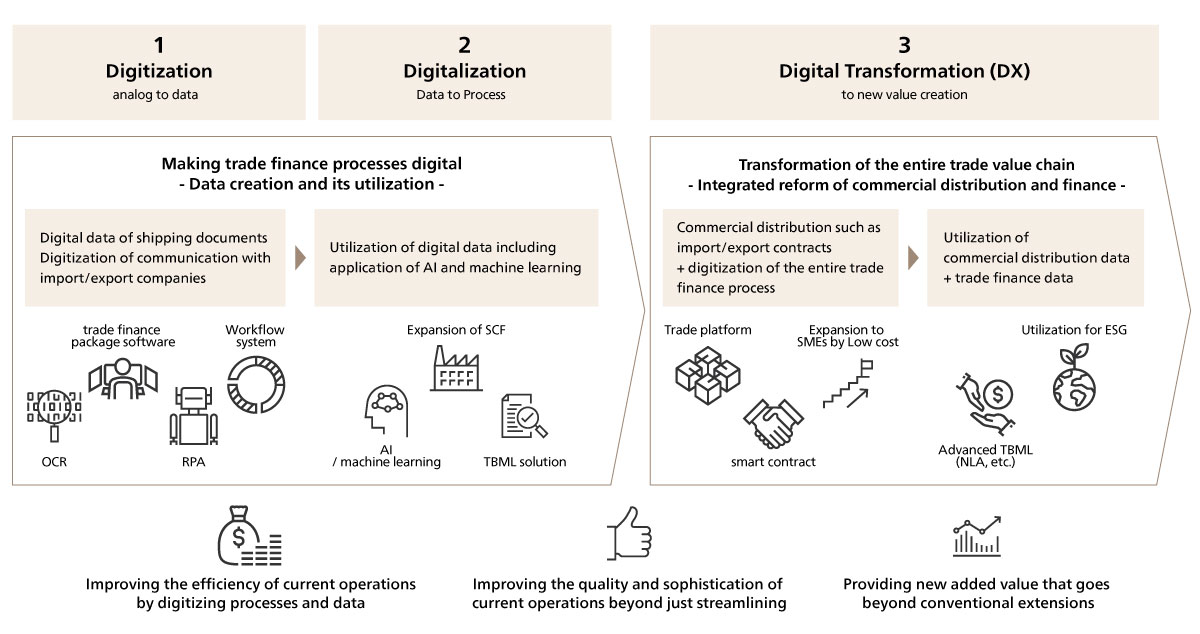

As mentioned above, trade finance is at the dawn of full-scale digitization, and we would like to consider the approach required of financial institutions based on the future image. First, when considering the future vision, if we reconfirm the evolution of the generally defined trends to digital, (1) “Digitization” to convert physical information into digital format, such as automating paper processes, will improve the efficiency of current operations. (2) "Digitalization" to improve service quality for clients and partners by using digital data to renew the entire business model. And then (3) “Digital Transformation (DX)” which changes business model using digital technology, and creates new value through changes in the industry structure.

In line with this, looking at the evolution of the trends to digital of trade finance from a bird's eye view, as shown in Figure 6, the trade finance process itself has become more efficient through the "Digitization" and the use of digital data has led to the improvement of service quality. It is thought that the entire value chain, which combines commercial flows such as import and export transactions and trade finance, will evolve into a “Digital Transformation” in which the entire value chain will be transformed in an integrated manner.

Fig. 6 Progress to digital

Fig. 6 Progress to digital

In other words, there has been an increase in cases of introducing packages and OCR/RPA for trade finance processes within banks, and using portals for customer contact points, mainly at major banks. And, Digitization will progress as well. As the digitization of paper information progresses as a result, from the perspective of data utilization, from the simple check of risk word automatic screening of shipping document data that has begun to be implemented in recent years, from the perspective of TBML using AI and also Digitalization with advanced data analysis by machine learning will spread. Furthermore, I think that the digitization of the entire value chain of the trade process will progress through the digitization of the commercial flow, that is, by connecting the digitized trade finance process to the blockchain-based trade platform.

In addition, although the current trading platforms differ in terms of regions and countries and the functions they implement, cooperation between trade platforms gradually progresses, and from the user's point of view, ultimately participating in a single platform will allow. It will be possible to access functions ranging from commercial distribution to finance across the network. Ultimately, a smart contract (automation of contract fulfillment management) will be implemented on the blockchain platform, and if the contract conditions are met, it will be possible to draw a future image in which settlement is automatically performed.

Also, from the perspective of data utilization, if the processes of commercial distribution and trade finance are digitized in an integrated manner, it will be possible to utilize a wide range of commercial transaction data in the supply chain and create a new business model by grasping credit risks with high precision and comprehensiveness. It will be possible to analyze and check using a wider range of customer and related party data than now from the perspective of flexible finance and TBML. Furthermore, from an ESG perspective, the entire supply chain will be visualized, and it will be possible to comprehensively understand carbon emissions, including logistics, as well as products and parties with risks of human rights violations. In this way, integrated reform of the entire trade value chain, including commercial distribution and trade finance, is expected to bring abundant added values.

(2) Desired Approach - Toward the trade finance DX

On the other hand, as mentioned above, the digitization of trade finance is only at the stage of gradual start of digitization efforts to streamline the bank's own processes. In addition, although platforms with various functions using blockchains are popping up in various regions and countries around the world, they have not yet reach full-scale adoption. One of the factors is the return on investment in terms of efficiency (including increased revenue from increased customers due to the benefits of streamlined processes). At ABeam Consulting, we have heard from multiple financial institutions that it is difficult to invest in digitization in this field because the current efficiency effects of digitization are limited, resulting in insufficient return on investment. It is true that connecting all processes within a bank, from communication with importers and exporters to various checks and fund settlements, all at once would entail enormous costs, and in many cases, it is not worth the efficiency gains (Figure 7).

Figure 7 Trade finance process (example of negotiation with L/C)

Figure 7 Trade finance process (example of negotiation with L/C)

However, are the Digitization and the Digitalization of trade finance processes just for short-term efficiency?

ABeam Consulting believes that the Digitization and the Digitalization of trade finance processes has great significance for advanced data utilization as well. As mentioned above, TBML checks, such as discrepancies with fair market prices and transportation routes falling within high-risk areas, are generally performed manually and visually. However, if information on shipping documents is converted into data, various external data and AI/machine learning can be used to efficiently check hidden risks that are not noticed by the human eye. As the importance of economic security increases, TBML can be advanced.

Furthermore, as the digitization of society and economy as a whole progress, even if it takes time, it is inevitable that trade transaction issues such as the establishment of electronic BL legislation and cooperation between trade platforms will be gradually resolved and digitization will progress. In that case, if the trade finance process is digitized, it will be possible to create various added values through the visualization of the supply chain, etc., as described above, as an integrated digital transformation in conjunction with the commercial flow.

Based on the above, I believe that the most important approach is to draw a picture of the future with a broad perspective, backcast from the future picture, and work on it from a medium-to long-term perspective, without being bound by immediate efficiency improvements.

One of the points related to current efforts is to determine whether or not the investment will lead to value creation through digital transformation in the future, even if the current efficiency effects are insufficient to match the investment. In that sense, while various values can be expected from the use of digital data, the digitization of paper processes (points of contact with customers + internal processes) has the immediate effect of improving efficiency in the sense of converting information into digital data. It should be regarded as a foundation for the future.

Another point is to make agile decisions according to the situation while assessing the overall progress of digitization of trade transactions, including the speed of future development of platforms. Digitization of trade transactions has the characteristics mentioned above, it is difficult to make progress, but the movement toward trade platforms, including commercial distribution, is becoming active, and there is a possibility that the movement will accelerate gradually. It appears in examples like Komgo for commodities and TradeWalts funded by Japanese megabanks. Therefore, while taking an approach that backcasts from the future picture, it is also necessary to have the flexibility to revise the approach based on changes in the environment, including when and what to invest.

This concludes my overview of the current trends and issues surrounding trade finance, as well as future visions based on this. In other words, after backcasting from the future vision of the integrated transformation of the entire trade value chain, including the commercial flow, we will focus on improving the efficiency of the current process toward creating various values through the use of data, including the supply chain. It is important to make steady progress based on an approach that responds to environmental changes in an agile manner, without being bound by immediate effects.

In addition to collaborating with the trade platform TradeWalz, ABeam Consulting has been supporting the digitization of trade finance in a wide range of ways, such as improving profitability and efficiency by introducing trade finance packages including SCF and introducing TBML solutions such as Network Link Analysis. We would like to strengthen our support for new value creation by domestic and foreign financial institutions, based on the skills and experience we have cultivated globally in trade transactions, which is an unexplored area of digitization, and with the above approach in mind.

Click here for inquiries and consultations