Today, the insurance industry faces a various challenges, just like any other industry. For example, utilization of big data based on the digitization and mobilization of customer touchpoints, inter-company collaboration (expanding ecosystems) with platformers for the developing new channels, and development of products and services according to individual characteristics, etc.

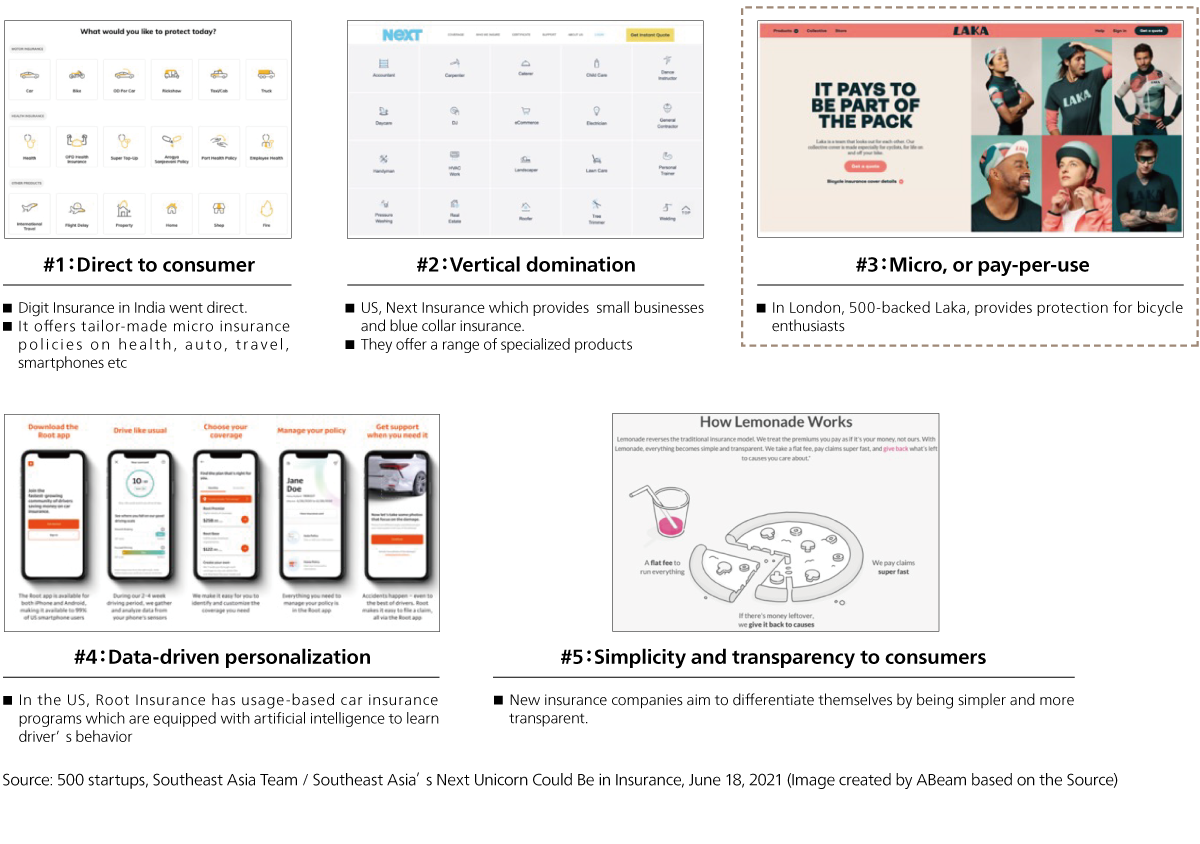

Given these challenges, there are five global trends in the insurance industry: (1) Direct to Consumer: a trend represented by Go Digit General Insurance Limited, a digital insurance company in India that provides insurance products directly to consumers without intermediaries. (2) Vertical Domination: seen in a case by NEXT (U.S.), which focuses on the SME business market and offers a wide range of products. (3) Microinsurance or Pay-per-use Insurance: represented by LAKA (UK) which focuses on coverage for the duration of a bicycle rider's ride. (4) Data-driven Personalization: the use of big data processing to identify personal characteristics through the spread of IoT devices, including smartphones. (5) Simplicity and Transparency to Customers: exemplified by Lemonade (U.S.).

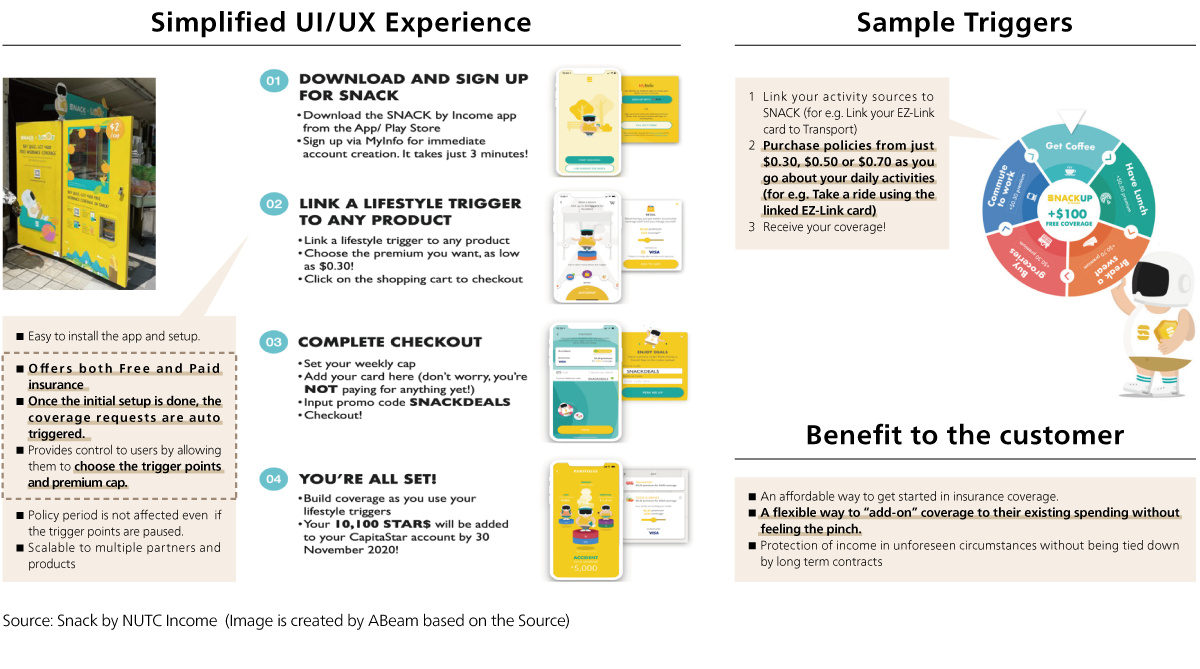

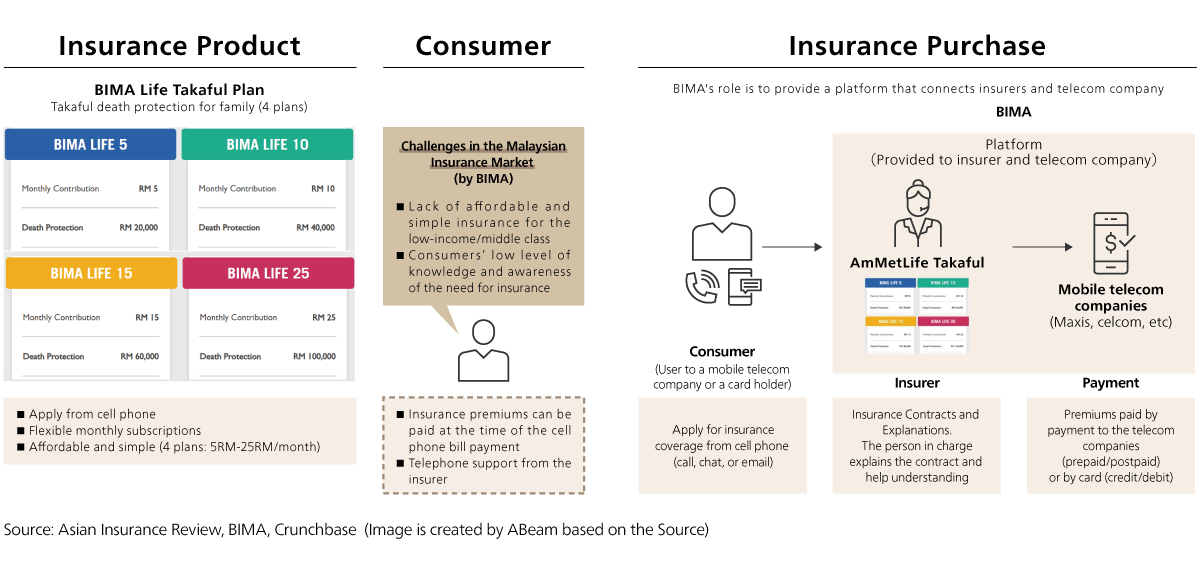

These trends can be seen not only in Europe and the U.S. but also in Southeast Asia. In this paper, we will explain microinsurance trends in Southeast Asia. We believe that the traditional microinsurance model is transforming through our project support for the insurance industry in Southeast Asia.