Since the 2010 total lending limit regulations, the personal loan market has been recovering, but the competitive landscape that includes new entrants has intensified due to the diversification of players brought about by new participation from other industries such as retail companies and the introduction of new business models utilizing Fintech.

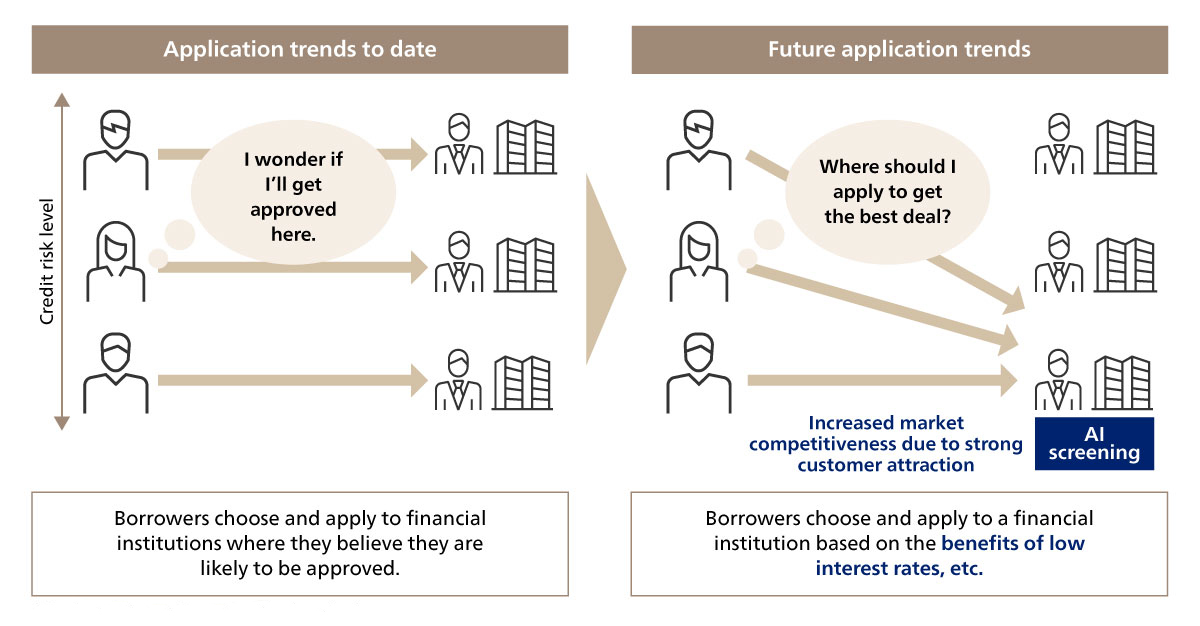

One additional factor intensifying competition is customer segmentation in the personal loan market. Traditional credit screening did not disclose the basis for approval decisions or loan amount limits to loan applicants. As a result, borrowers who urgently needed loans typically had to judge for themselves which financial institutions were likely to approve their applications and apply accordingly. This naturally led to the personal loan market being segmented according to the risk level of loan applicants. Recently, however, online pre-screening has become mainstream, allowing loan seekers to now check the screening results of financial institutions in advance. With such increased credit screening transparency, loan seekers have begun selecting financial institutions based on borrower benefits such as high loan limits and low interest rates, leading to a breakdown in the industry's traditional customer segmentation.

Enhancement of the credit screening through AI utilization

- Banking/Capital Markets

- AI

The new competitive environment and key to securing a business advantage

Figure 1: Changes in personal loan market

Figure 1: Changes in personal loan market

In this personal loan market where customer segmentation no longer exists, financial institutions should, rather than evaluating incoming applications, be the preferred choice for potential borrowers. The key is to appeal to borrowers with benefits such as high credit limits and low interest rates. Financial institutions capable of doing so will be able to attract many borrowers. This then allows the financial institutions to select and retain good borrowers from among those they have attracted, making them highly competitive even in the aforementioned intensified competitive environment.

To achieve and sustain a competitive edge, financial institutions must focus on minimizing credit costs through the implementation of precise credit screening procedures. How do you do this? Generally, there are two main ways. One is to diversify the screening process by increasing evaluation criteria, and the other is to technically enhance default prediction scoring models through the use of AI and other means.

In the diversification of the screening process, the more factors strongly related to defaults are considered, the higher the accuracy of the screening. Consequently, most financial institutions currently utilize a variety of data at the time of application, including attribute data, transaction history data, and information from external credit bureaus. Adding new criteria data facilitates a more multifaceted credit screening and, as a result, highly accurate credit screening is achieved. On the other hand, in the technical enhancement, credit screening accuracy can be fundamentally strengthened by utilizing AI, a cutting-edge analysis technology, in conventional credit screening operations.

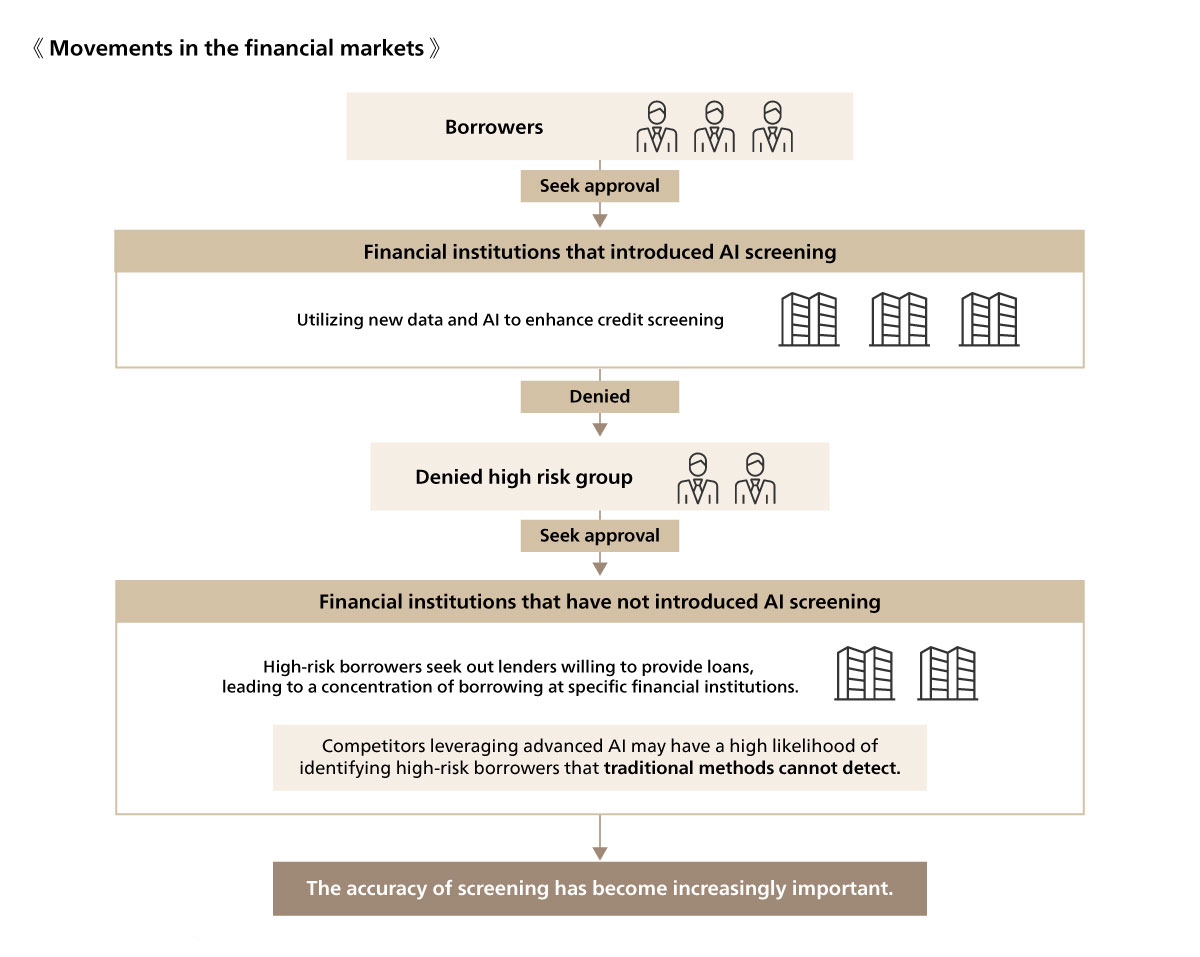

Such enhancement of the screening model through screening criteria diversification and AI utilization makes it possible to reduce credit costs and showcase benefits to customers, which in turn improves the ability to attract customers and strengthens market competitiveness. However, as more and more financial institutions are taking on this kind of advanced credit screening, financial institutions that are slow to take action will be unable to showcase benefits to borrowers, and their ability to attract customers will relatively decline. Furthermore, for such an institution, there is a risk of falling into a negative spiral in which high-risk borrowers who fail to pass the screening of advanced financial institutions flock to that institution and then, with a the concentration of applications that cannot be denied using existing methods of credit screening, credit costs increase due to the implementation of suboptimal loans, making it even more difficult to showcase benefits.

This major market change of the disappearance of customer segmentation urgently demands new approaches to credit screening.

Figure 2 The need to improve credit accuracy

Figure 2 The need to improve credit accuracy

Points to keep in mind when using AI for screening diversification and enhancement

In the diversification of screening criteria, social data from platforms like social media is gaining attention overseas, but its usage rate in Japan is low. Additionally, identifying individuals through such data is challenging, making it difficult to consider such data as effective. Important things to consider for diversification in the case of the personal loan market is to not indiscriminately add data, but rather examine and utilize data related to loan repayment ability. More specifically, household finance application data that can be used to understand the cash flow of borrowers, which is directly related to repayment capacity, and vital data that expresses health conditions, which are indirectly related to repayment capacity, can be widely and generally used. In addition, personality data, which can be used to focus on the repayment intention that underlies repayment capacity and is highly likely to be identifiable also has a high potential to be effective data in the future.

In the enhancement of the screening model, thousands of algorithms exist for AI. First, selection of the optimal algorithm for your company's environment is key. The critical methodologies for selecting the optimal algorithm include theoretical algorithm evaluation as well as selection through repeated trial and error through PoC testing in your company's environment.

Additionally, there are important considerations that must be kept in mind when utilizing AI for credit screening. While AI can identify default characteristics that human analysts may have missed, AI performs extremely complex analyses mechanically, resulting in cases where humans are often unable to interpret the analysis results. In credit screening operations, ensuring "interpretability of results" is a crucial requirement from a regulatory perspective. To meet this requirement, limiting the scope of AI utilization to areas where "interpretability of results" is not necessary and avoiding reduced interpretability (black-boxing) through partial implementation are important. To this end, the key to AI utilization lies in structuring the screening model not as a single simple configuration, but as multiple configurations divided from an interpretability perspective, or as an ensemble model structure.

The credit screening concepts and key points for personal loans described above can also be applied to corporate lending, and the screening technology itself can be applied to lease evaluations as well. ABeam Consulting hopes to contribute to maximizing benefits for fund seekers and the growth of lending companies by expanding our credit screening expertise accumulated in the consumer loan industry to other industries in the future.

Click here for inquiries and consultations