As Japan’s population continues to decline, banks are embarking on a variety of corporate strategies seeking to capture customers and improve productivity to counter labor shortages. Among these, strategies that make use of digital technology are particularly essential. Amidst ongoing technological advances, trends in the use of digital technology are changing, rendering this a domain that requires constant updating for bank leadership and planning officers.

This Insight collects and analyzes trends in case studies into the use of digital technology at banks that make partial use of generative AI, thus putting together a series of prescriptions for the effective use of digital technology.

Trends in the Use of Digital Technology in Banks and Prescriptions for Promoting Its Use

- Banking/Capital Markets

- Technology Strategy and Management

- Management Strategy/Reformation

1. What is digital technology utilization in the context of banking?

The use of digital technology currently occupies an important place in corporate strategy at banks. This is because, in 2019, the Japanese Financial Services Agency (FSA) released its “Discussion Paper for Dialogues on Practices of IT Governance at Financial Institutions,” which described the FSA’s vision for the use of digital technology, and because the use of digital technology can provide solutions to a variety of business challenges facing banks.

History and Positioning of the Use of Digital Technology at Banks

Since WWII, Japanese banking systems developed largely in parallel. However, since the end of the government policies aimed at ensuring that equal financial services are available at any financial institution, each bank has faced the need to develop its own corporate strategy, meaning Japanese banks have long since entered an era in which they have needed to develop their own strategies for IT systems as well. Due to external factors such as the decline of the Japanese population, the number of financial institutions is forecast to fall in the future. Corporate strategy over the coming years can thus be said to be approaching a watershed, where the futures of all financial institutions will be determined. This makes strategy for the use of digital technology, which is tied to corporate strategy, even more important for banks, as they seek sustainable growth and improve competitive advantage in this context.

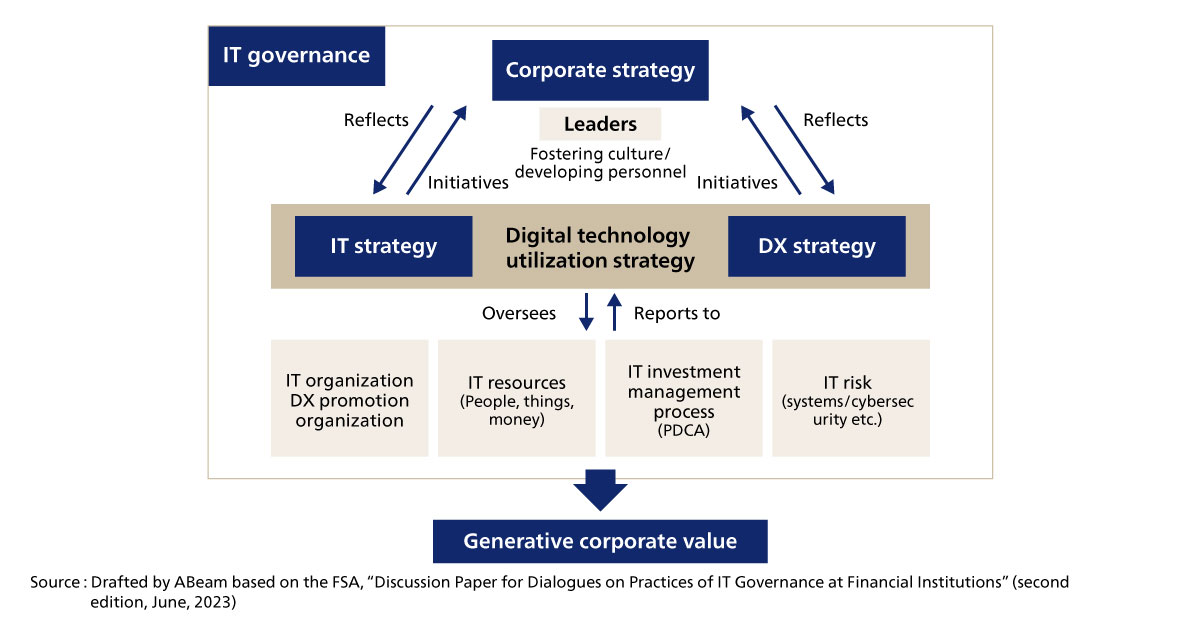

The FSA has also made clear the relationship between corporate strategy, IT strategy and DX strategy, having released its “Discussion Paper for Dialogues on Practices of IT Governance at Financial Institutions” in June of 2019 (see Figure 1). This paper defined corporate strategy as strategy seeking to establish sustainable business models for financial institutions, IT strategy as strategy seeking to decide policies for the upgrading of core systems and for next-generation system architecture, and DX strategy as strategy seeking transformation of channels and operations with a view to improving profitability and transforming the business models of financial institutions.*1This Insight refers to the overlap between IT strategy and DX strategy as digital technology utilization strategy.

Figure 1. Positioning of digital technology utilization strategy

Figure 1. Positioning of digital technology utilization strategy

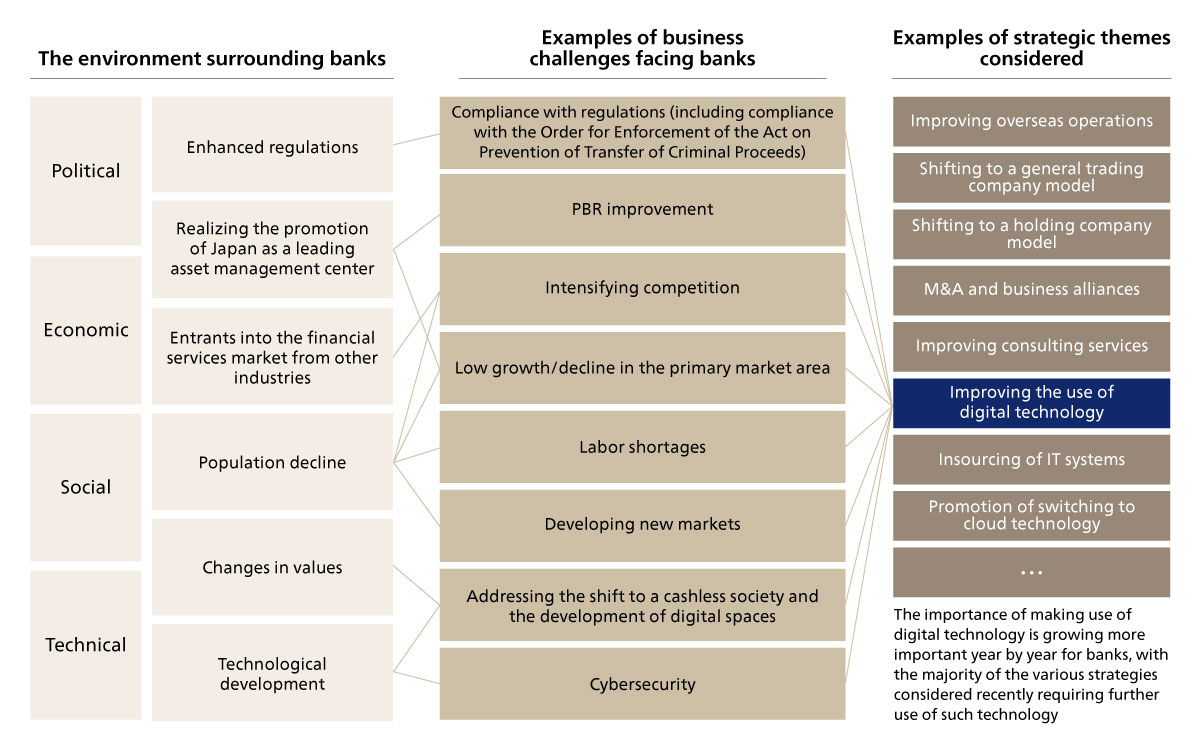

Major business challenges faced by banks and the use of digital technology

As banks face a great many business challenges including low growth and labor shortages across regions due to the declining population, addressing the shift to a cashless society in response to the development of technology and changing consumer preferences, and handling cybersecurity, in practice, they have adopted a wide variety of strategies, including improving their overseas operations, shifting to a general trading company model, shifting to a holding company model, M&A and corporate alliances, improving their consulting services, insourcing IT systems and improving their use of digital technologies. Even amidst all of these strategies, “utilizing digital technology” can be a strategy that offers some means of addressing many of the challenges enumerated (see Figure 2). While every bank is unique, it is important to note that there are virtually no banks not incorporating the use of digital technology into their strategies. This Insight puts the spotlight on the use of digital technology by banks and summarizes the results of a survey of the state of recent such efforts across banks.

Figure 2. Examples of business challenges addressed by improving the use of digital technology

Figure 2. Examples of business challenges addressed by improving the use of digital technology

*1 ABeam definitions based on the FSA, “Discussion Paper for Dialogues on Practices of IT Governance at Financial Institutions” (second edition, June, 2023)

2. Trends in the use of digital technology among banks

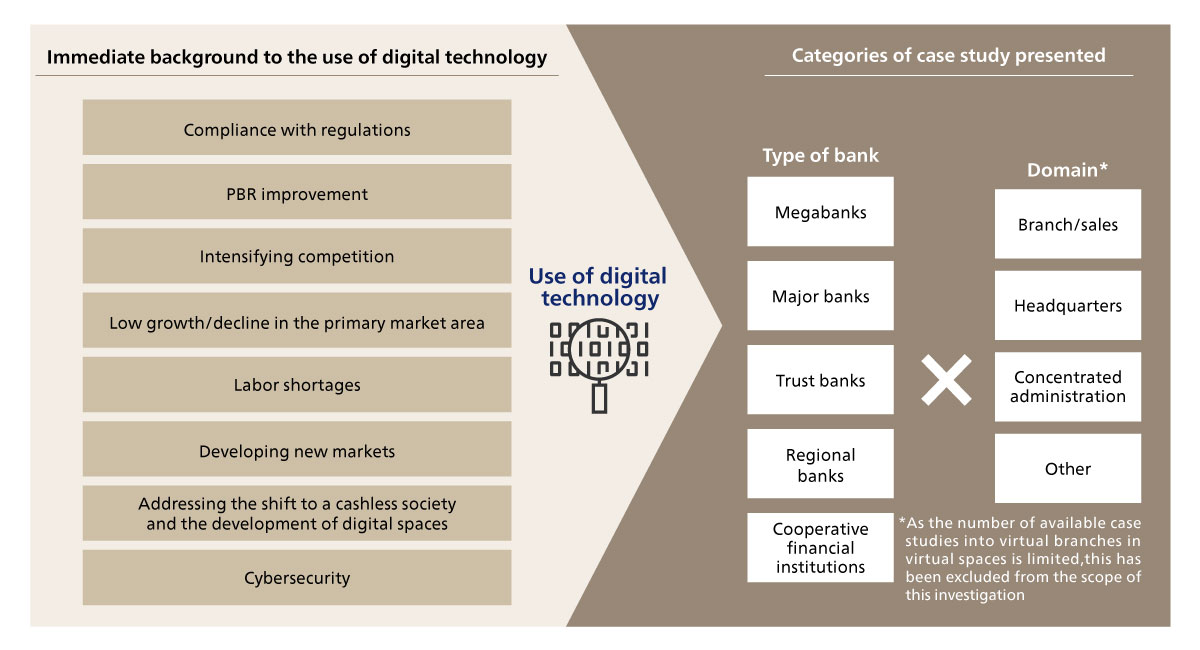

In surveying trends in the use digital technology at banks, we took into account the differences in the environments in which each bank operates. We collected case studies from roughly the past two years on the use of digital technology at banks with physical locations, organized by type of bank and domain, then looked for trends by type of bank and across the banking sector as a whole (see Figure 3).

Figure 3. Background to the use of digital technology at banks and categories of case studies presented

Figure 3. Background to the use of digital technology at banks and categories of case studies presented

Tendencies and trends across types of bank

All megabanks have had dedicated digital technology organizations for some ten years, and are seeing efforts in the area progress and expand in terms of the fields they are addressing. Key characteristics of such efforts at megabanks are both that all of these trends are being tackled across a broad spectrum, and that the megabanks are engaged in many initiatives that go beyond the bounds of individual banks, such as proposing and leading cross-industry measures, and advancing digital technology itself through investment, collaboration and research and development. They are also proactively employing cloud and AI (including generative AI) services, pursuing a digital shift in clerical work, and working to streamline and enhance analog operations.

Many of the major banks are focusing on the provision of financial services through open platforms, in addition to making proactive use of AI (including generative AI) services and cloud technology, shifting paper operations to digital channels, and streamlining and enhancing analog operations, in order to address management’s agenda.

Among trust banks, we have noted trends for the automation of AI-enabled operations, progress in the enhancement of solutions and the utilization of digital channels, the differentiation of products and services and the improvement of customer experience through the use of digital technology, and for cost-cutting through streamlining. Even amongst these efforts, standout applications of digital technology among trust banks have included such things as the use of security token offering and smart voting apps.

Regional banks are using digital technology to free up new investment capacity (creating investment opportunities) and to develop and secure personnel. We have seen not only many cases of regional banks improving the productivity of their banking operations by expanding their use of AI and digital channels, but also a trend for such banks to move their core banking systems to the cloud.

Among co-operative financial institutions, the use of digital technology advanced by a core group consisting of Shinkin Central Bank and Norinchukin Bank, which are central agencies, has largely sought to contribute to improving productivity, forming a wider trend for such financial institutions. We have seen trends for many initiatives from individual financial institutions to place their focus on productivity improvements.

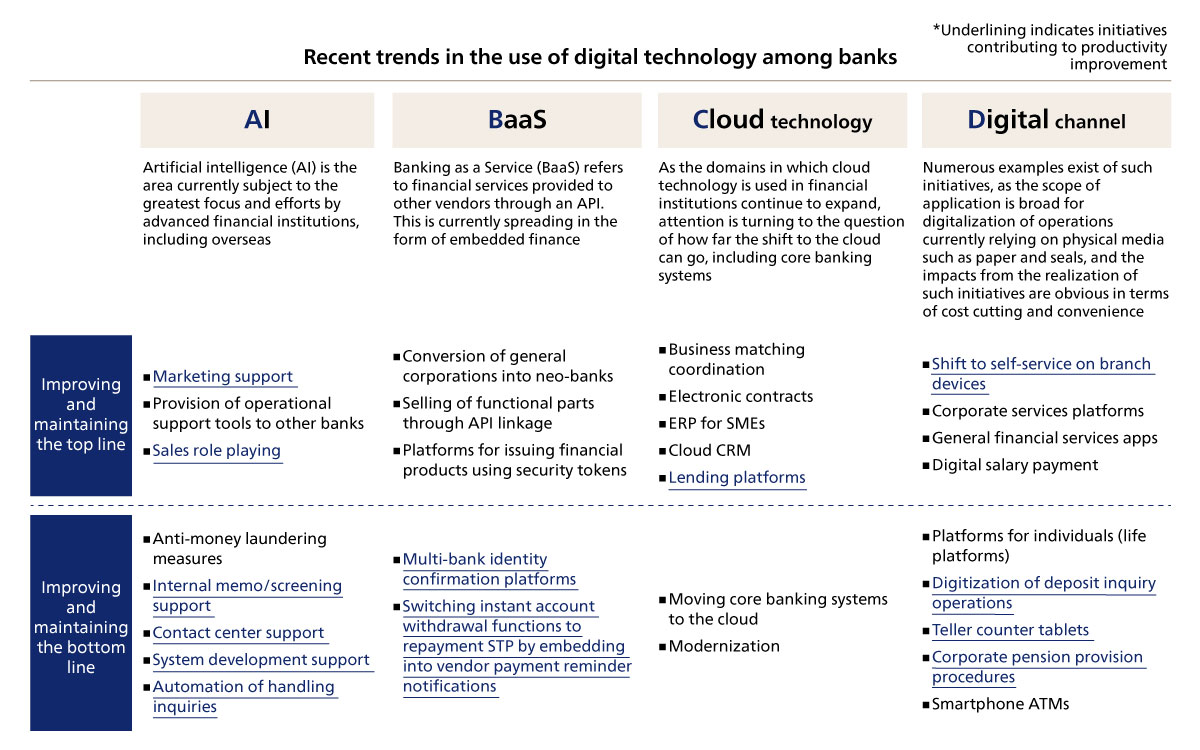

Industry trends

While a variety of digital technology utilization projects have been announced across banking as a whole, in recent years, a focus on the four domains of AI, BaaS (banking as a service), cloud technology and digital channels has become a trend for the banking sector as a whole, spanning different types of banks. This has resulted in efforts aimed at improving productivity across both sales and operations standing out (see Figure 4)

Figure 4. Recent trends in the use of digital technology among banks

Figure 4. Recent trends in the use of digital technology among banks

3. Challenges in utilizing digital technology at banks and prescriptions for the future

We believe that banks should be aiming to use digital technology in a way where, rather than having digital technology personnel pursue specialized careers in specific departments, digital-enabled transformation is incorporated into all possible layers of their organizations, and where a cycle of accelerating the use of digital technology is produced from the ground up. Achieving this calls for the formulation of a medium to long-term plan including HR strategy and the creation of a digital technology utilization promotion cycle, rather than the mere accumulation of individual digital technology measures that happen to be easy to tackle.

A vision for the future of banking that accelerates the use of digital technology (our hypothesis)

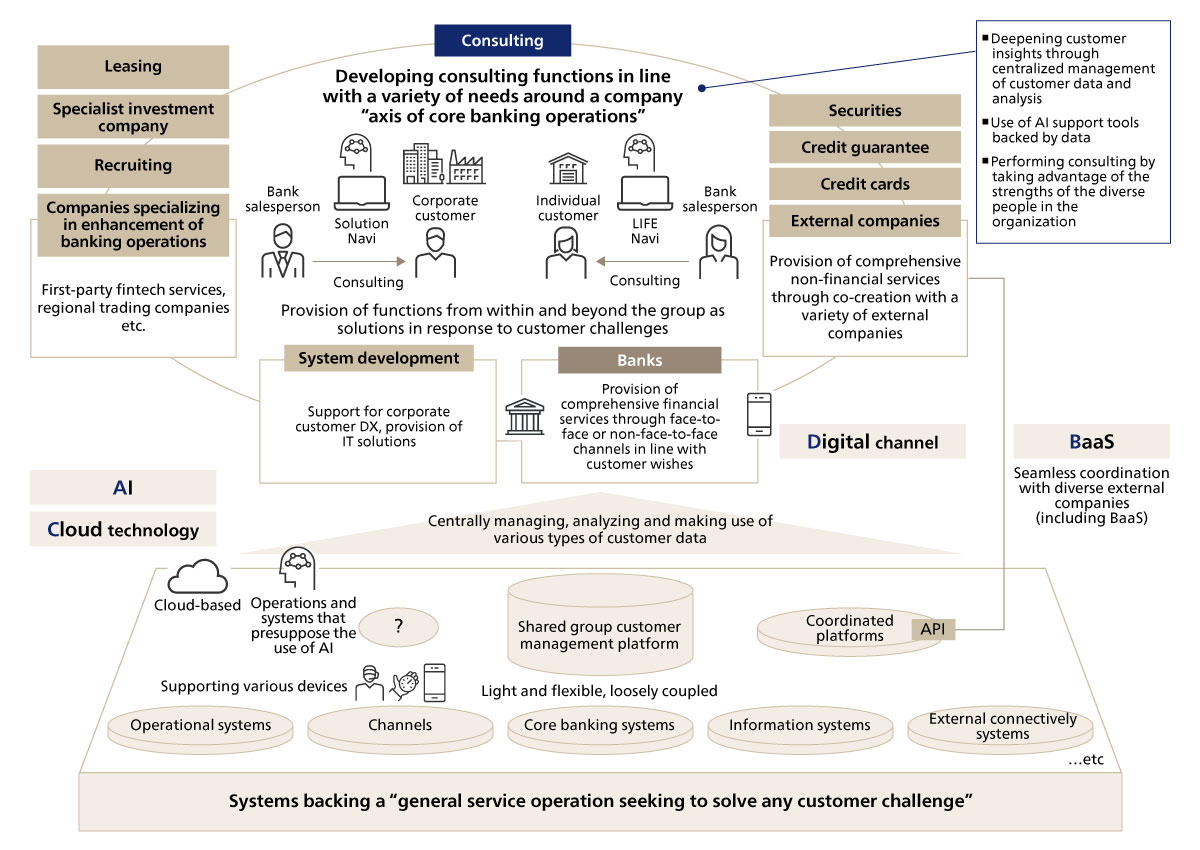

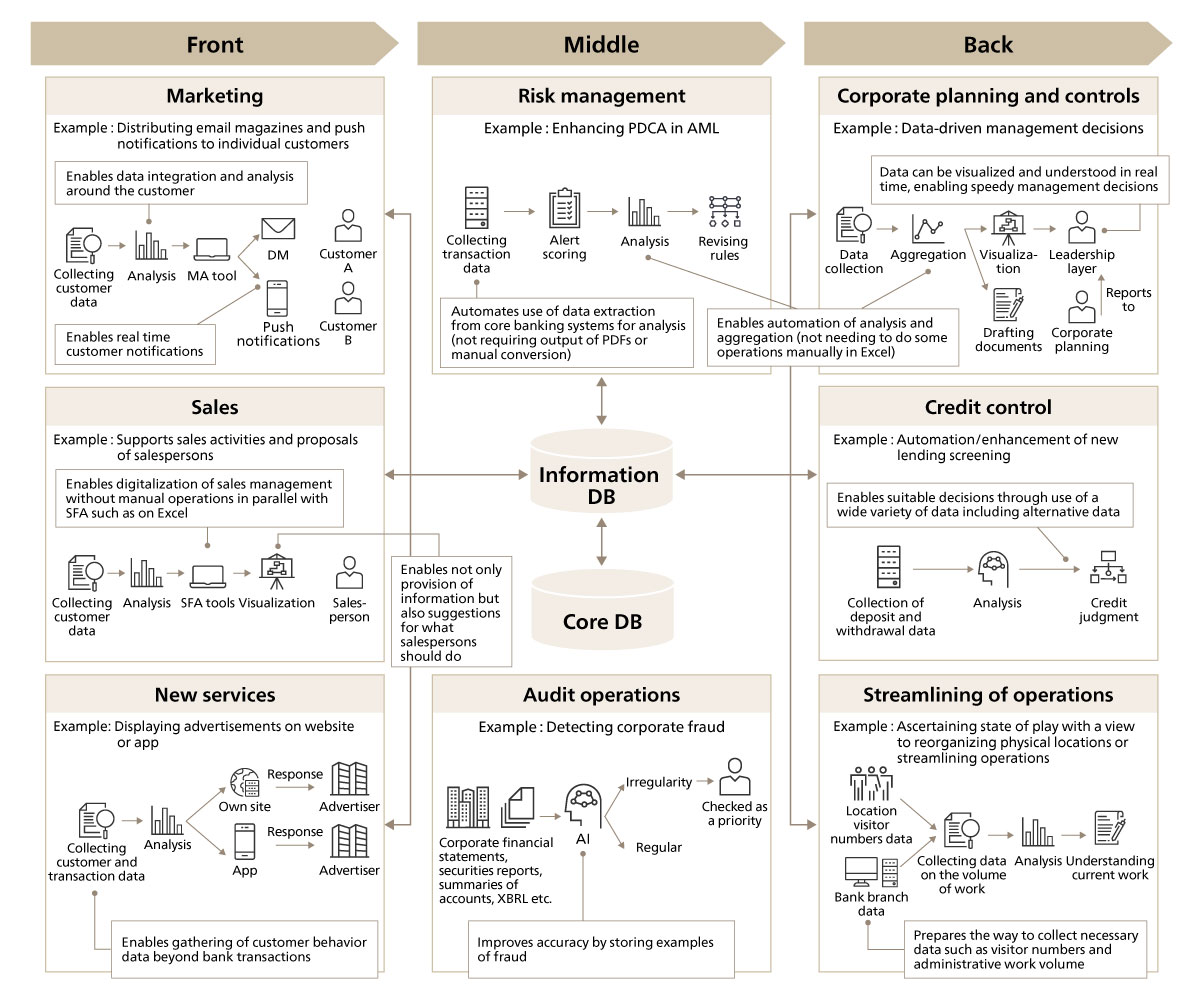

One possible vision for the future of sales at banks with face-to-face channels is as a general service operation going as far as to develop consulting services seeking to solve any customer challenge, centering on the original core banking functions. Specifically, banks could use their existing banking systems and customer bases as platforms to develop, for example, financial services including trust banking, securities, leasing and credit card services, recruiting and trading company functions, and services to support DX transformation (see Figure 5). In doing so, we believe that banks would need to seek to operate such that they can make the most of digital technology in operational terms and make the greatest possible use of the data they obtain, in order to develop a competitive general service for their individual services. Banks can operate in a way that combines productivity and improving customer satisfaction by understanding trends revealed by the storage and analysis of the massive amounts of customer data that they possess, and by thus improving automation and accuracy (see Figure 6).

Figure 5. A vision of the future of banking sales as a general service operation seeking to solve any customer challenge

Figure 5. A vision of the future of banking sales as a general service operation seeking to solve any customer challenge

Figure 6. A vision for the future of banking operations

Figure 6. A vision for the future of banking operations

How banks should aim to make use of digital technology and prescriptions for making progress in that direction

In seeking to operate in ways that make the most of digital technology and take fullest advantage of the data banks can obtain, banks will need digital technology personnel to be present broadly throughout their organizations, rather than pursuing specialized careers in specific departments. It is important for financial institutions to have their employees gain broad experience across departments such as corporate planning, operations and IT systems, and for those employees to develop the capacity to discover problems, the knowledge, planning and proposing capabilities to solve those problems, taking the ability to use digital technology to those ends as a given, as well as a leadership perspective.

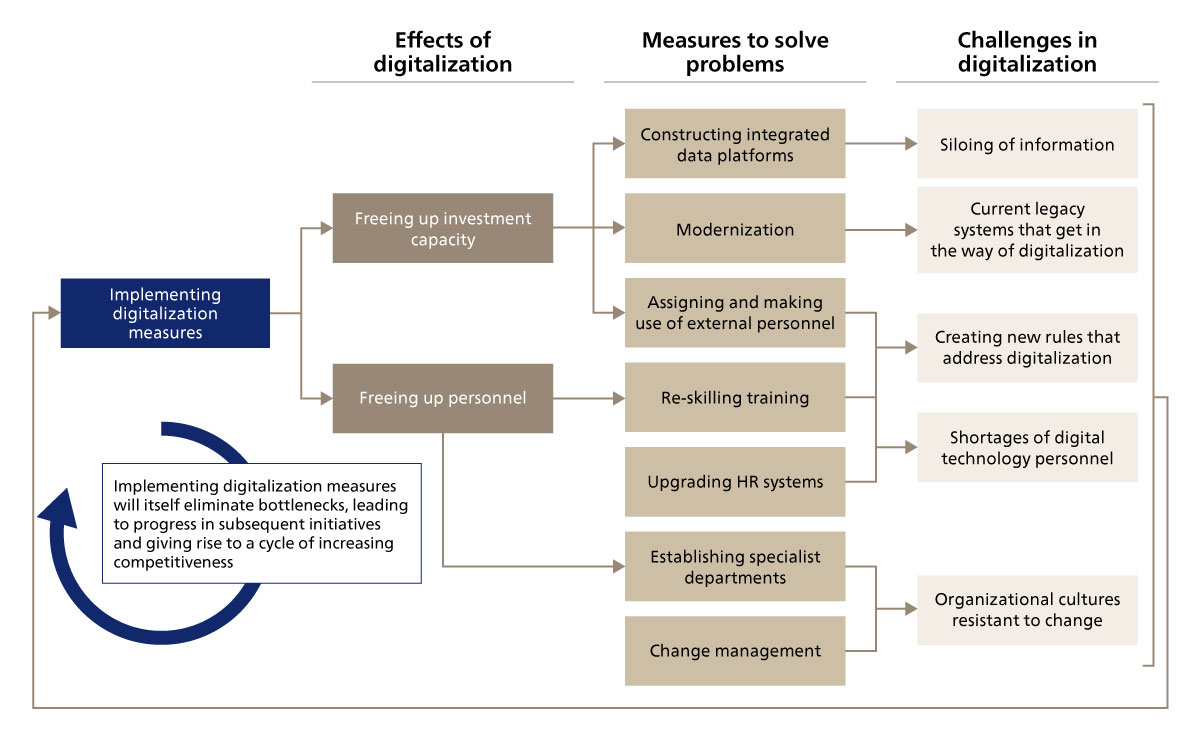

To do this, banks must first implement digital technology measures that help free up investment capacity and personnel, then leverage those outcomes for the next stage of digitalization. Then, in due course, banks should run as many cycles as resources allow in parallel in which they leverage the implementation of digitalization measures to facilitate the realization of subsequent initiatives, advancing the use of digital technology in stages and realizing a vision of accelerating digitalization (see Figure 7). It is of critical importance for banks to not simply consider individual measures that happen to be easy to do. Instead, they should advance digitalization initiatives with a medium to long-term plan. This plan should be based on an ordering of digitalization measures composed of the anticipated outcomes of each initiative, as well as the new measures that become achievable by leveraging those outcomes. By viewing digitalization initiatives in batches, coming from the vision for the future and the digital technology utilization promotion cycle, banks can effectively integrate these efforts with their wider corporate strategy.

Figure 7. How the use of digital technology should ideally be advanced

Figure 7. How the use of digital technology should ideally be advanced

4. Summary

In this Insight, we collected case studies from roughly the past two years on measures to make use of digital technology at banks, which are critical for realizing the corporate strategies of those institutions, and extracted trends from them. The results show that, while there are differences in trends depending on the type of bank, overall, efforts centering on AI, BaaS, cloud technology and digital channels stand out. In summarizing these findings and discussing them with multiple financial institutions and vendors, we have frequently come up against the difficulty of charting a path forward towards realizing the strategic visions of institutions, even where they are able to implement individual digital technology utilization measures. For this reason, we have also presented our prescriptions for what to do in this area, and not just the industry trends. We encourage managers at financial institutions who wish to learn in greater detail about the results of our research or our prescriptions to reach out to us.

ABeam Consulting offers support for formulating and realizing high feasibility digital technology utilization strategies, rooted in our years of experience in IT and DX strategy formulation support, and in our strong track record of working with institutions to realize their medium to long-term plans. Trends in the use of digital technology are constantly changing in response to changes in the external environment and technological advances. ABeam is ready to continue offering strong support for banks to keep up with trends in the use of such technology, and to formulate and implement strategies.

Click here for inquiries and consultations