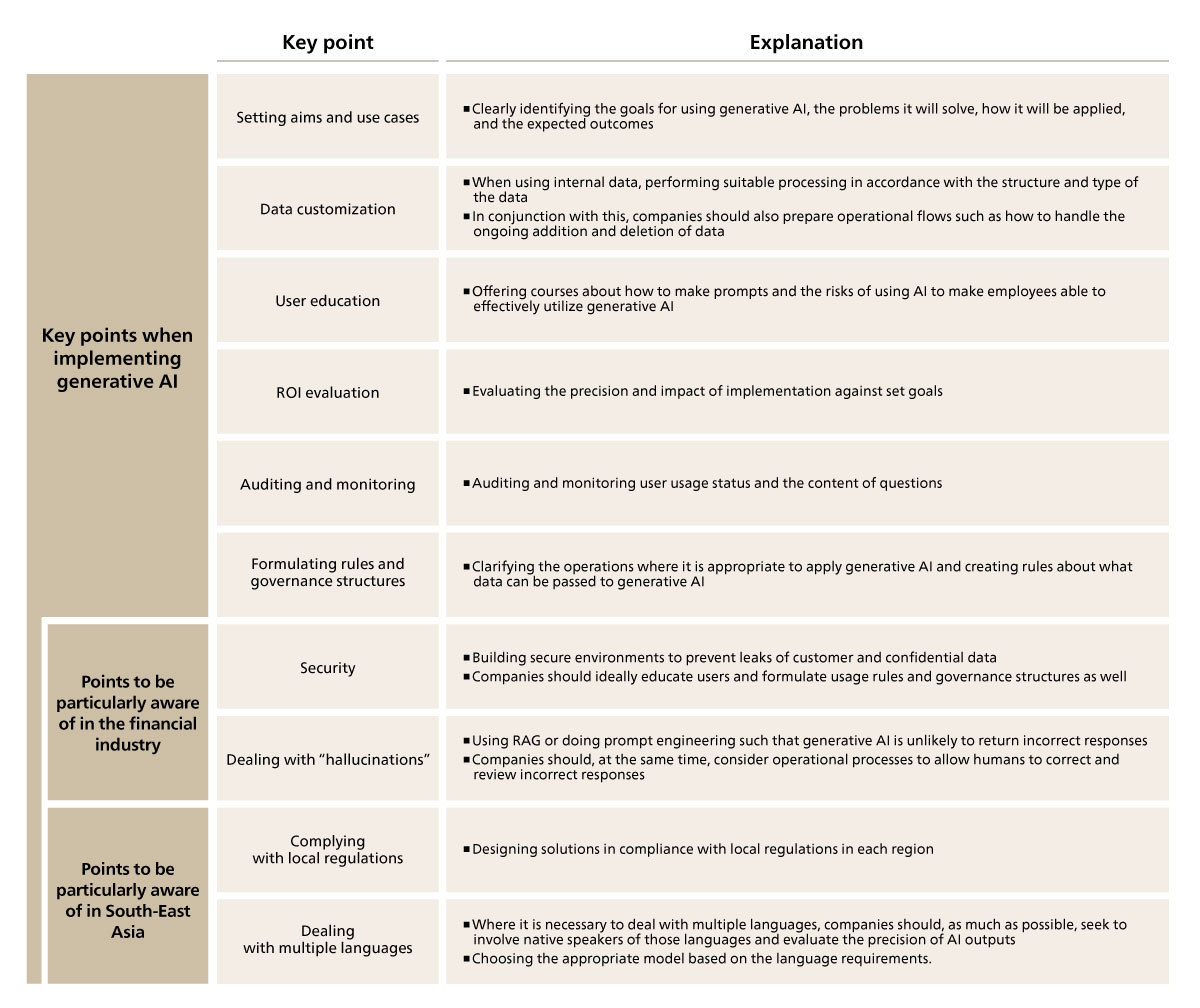

The following are four critical considerations for implementing generative AI in the financial sector within the Southeast Asian context:

1) Security

The financial industry deals with highly sensitive information, such as customer financial data, necessitating a strong focus on security and data protection. Financial institutions must establish robust security measures to prevent data leaks and develop clear governance structures that limit the type of information users can input during operations. ABeam Consulting has extensive experience in building secure environments across multiple cloud platforms, and we provide support in formulating user governance structures and operational rules to ensure compliance and safety.

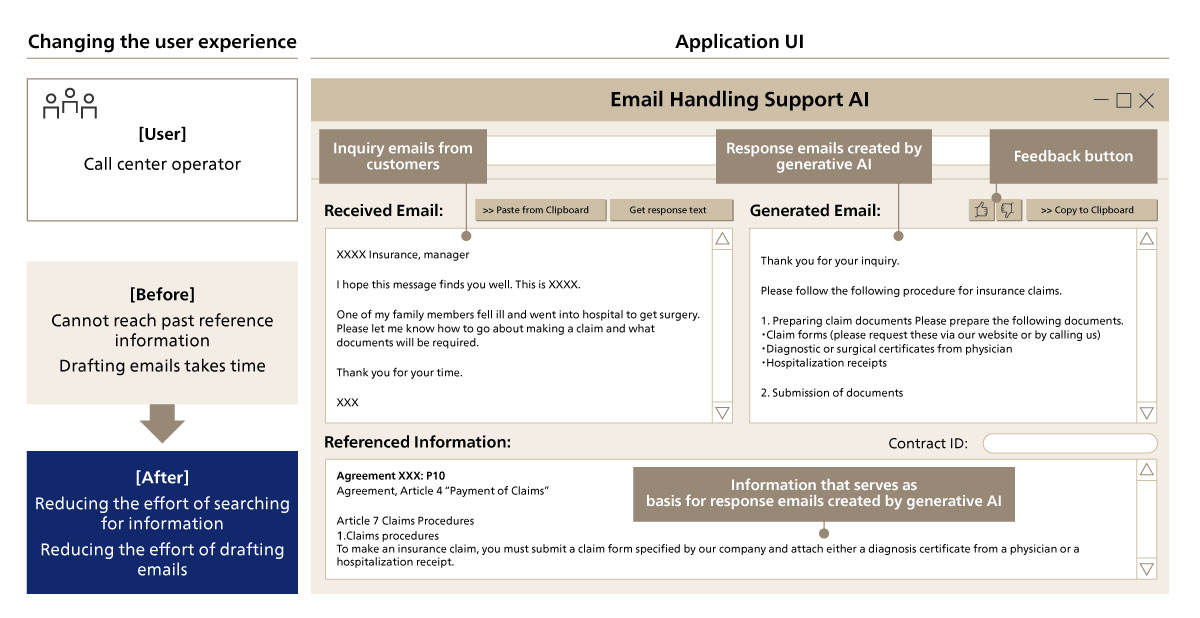

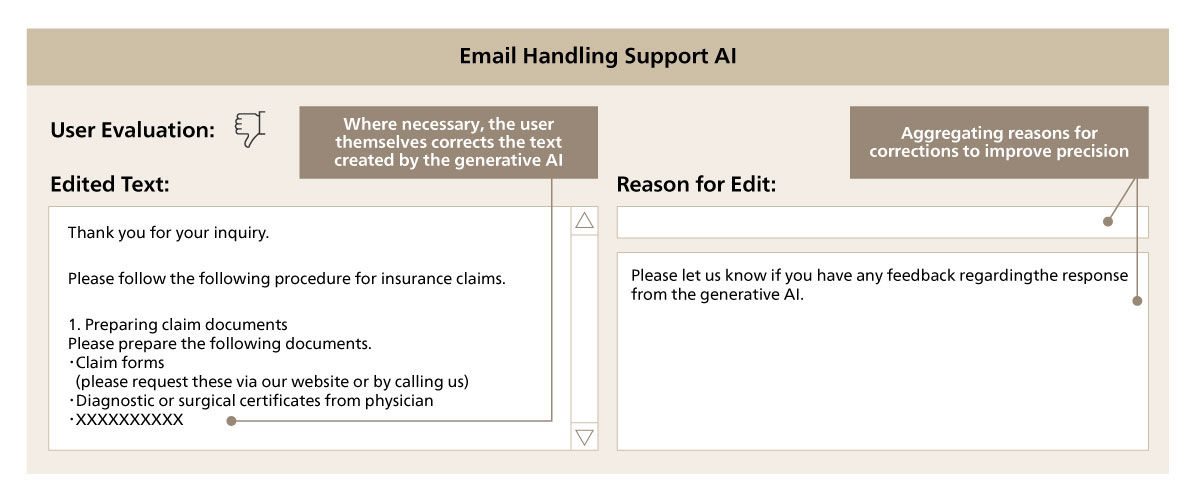

2) Addressing AI "Hallucinations"

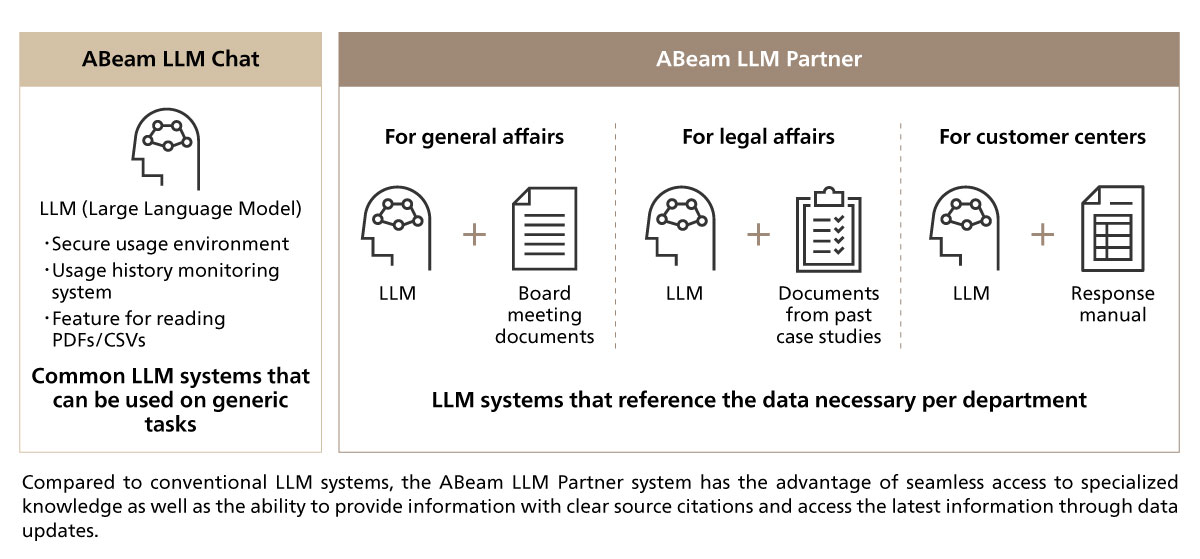

One significant risk when deploying generative AI is the potential for "hallucinations," where the AI generates inaccurate or misleading information. In operations requiring high levels of precision, it is essential to mitigate these risks. Companies should implement frameworks where human oversight can detect errors or use technologies such as Retrieval-Augmented Generation (RAG) to ensure AI responses are backed by external, reliable data sources. For example, in a project aimed at streamlining customer support for an insurance company, we incorporated a review process where human agents verify the accuracy of AI-generated email content (see 4(3) ABeam LLM Partner implementation case study).

3) Compliance with Local Regulations

Different countries impose varying legal restrictions that can affect AI deployment. For instance, in Indonesia, regulations prohibit storing personal data overseas, limiting the range of applicable AI models. At ABeam Consulting, we assess the best generative AI models, including open-source options, to ensure compliance with local laws while meeting operational requirements. This approach enables us to select models that align with both regulatory guidelines and business needs.

4) Handling Multiple Languages

In Southeast Asia, the ability to support multiple languages is often a critical system requirement. Ensuring the accuracy and relevance of AI responses across languages requires careful evaluation and continuous improvement. Companies must decide on the optimal language structure for their knowledge base*, whether it involves unifying input and output in a single language or creating a separate knowledge base for each language. In some cases, it may even be necessary to use specialized generative AI models tailored to specific languages. ABeam Consulting provides solutions to help clients navigate these complexities, ensuring their AI systems are suitable for multilingual operations.

*Knowledge Base: A database containing company-specific reference information to enable generative AI models to provide accurate responses.

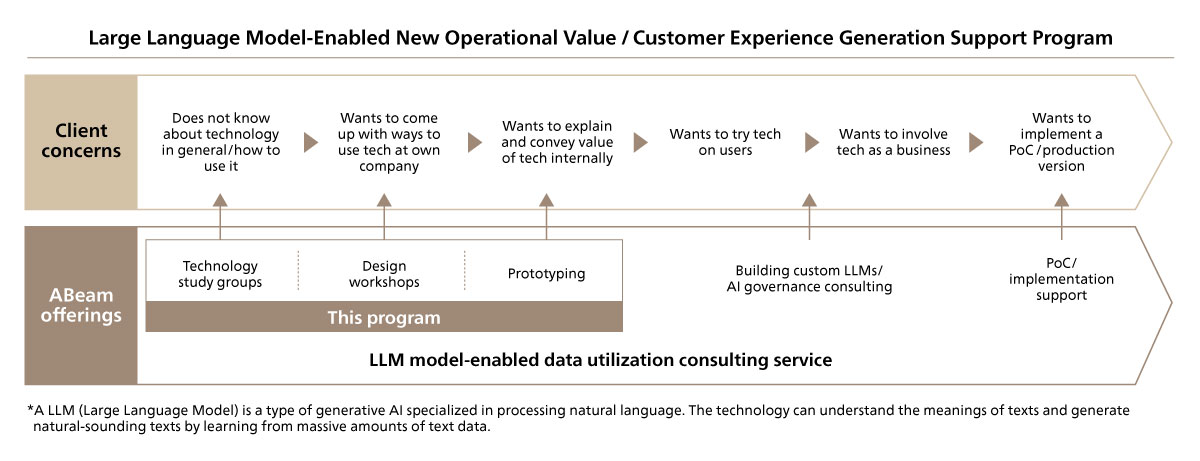

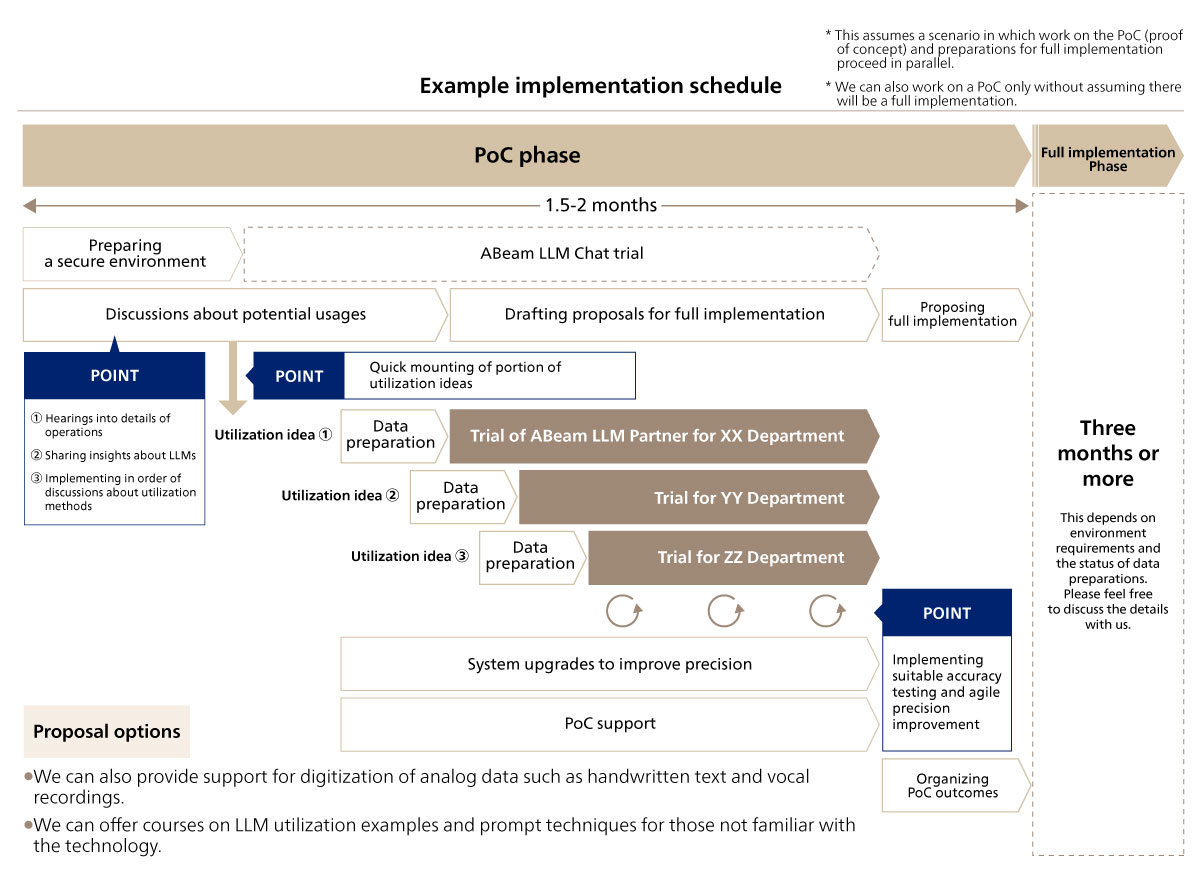

Generative AI offers immense potential for automating operations that were once considered too complex for machine-based solutions. However, successful implementation requires a combination of deep operational knowledge, AI expertise, and technological infrastructure. Many companies that have attempted to adopt generative AI without the right strategic approach have not seen the expected efficiency gains. ABeam Consulting combines its extensive financial industry insights with technical proficiency in AI and cloud technologies to deliver tailored solutions that address core business challenges.