As a leading integrated trading company, meaning it deals in a wide variety of products and services globally, and to establish a comprehensive global development infrastructure, the client (“Buyer”) plans to acquire a promising Vietnamese Technology company (“Seller”). This acquisition will leverage the target company's established development environment, enabling the client to offer a full range of services – from consulting to digital transformation (DX) and IT development & operations.

People, Process, Power: Ensuring a Smooth Transition through IT Due Diligence (IT DD)

Challenge

- In order to acquire a new company, a comprehensive IT Due Diligence assessment is mandatory, however client hasn’t had expertise in the home country of their target.

- Cross-border acquisitions present unique challenges that can lead to overpaying or integration failures.

- The IT DD is requested to complete in a very short period of time, super tight deadline might put them in challenging decisions if no local experts involved.

ABeam Solution

- Targets to provide thorough appraisal which is aimed at gathering, assessing, and analyzing all IT systems and information associated with the target business.

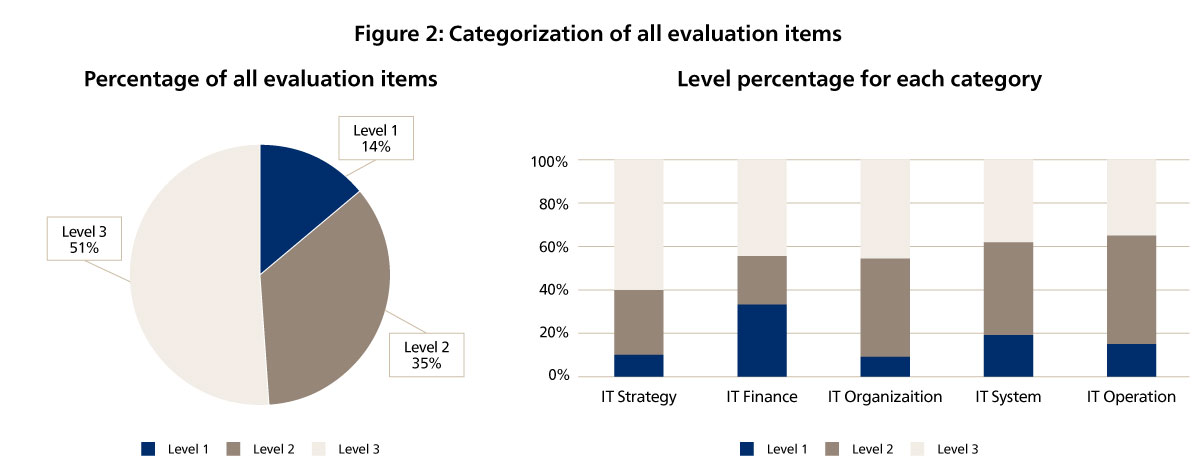

- Utilize the unique framework and support clients' actions for improving IT values, by clarifying and categorizing current IT status and tasks.

- Support to visualize the whole IT lifecycle and assess IT integration, based on business and operational impacts.

Success Factors

- Supporting client in highlighting critical risks for Day 1 and especially anticipated investment amount, together with list of operation which are required to be upgraded/improved.

- Forming the best practices in receiving analysis/forecasts and order to reduce the risks of over-payment.

- Making purchasing decisions on customer’s actual order derived from thorough analysis.

BUSINESS SUMMARY

PROBLEM OVERVIEW

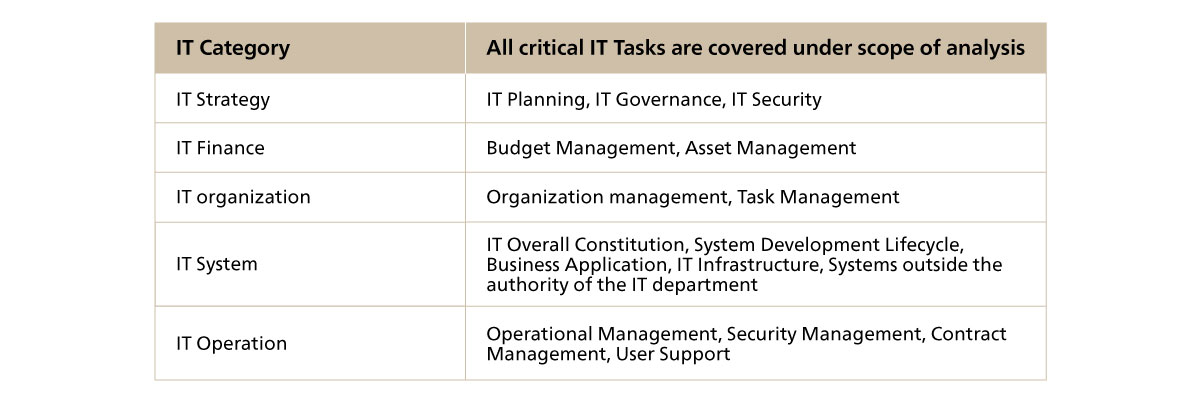

Before acquiring the new company, the client must conduct a comprehensive IT Due Diligence assessment, a thorough appraisal which is aimed at gathering, assessing, and analyzing all IT systems and information associated with the target business. This in-depth analysis will provide a thorough understanding of the target company's entire IT landscape and cover 05 key:

- IT Strategy

- IT Finance,

- IT Organization,

- IT Systems,

- IT Operations.

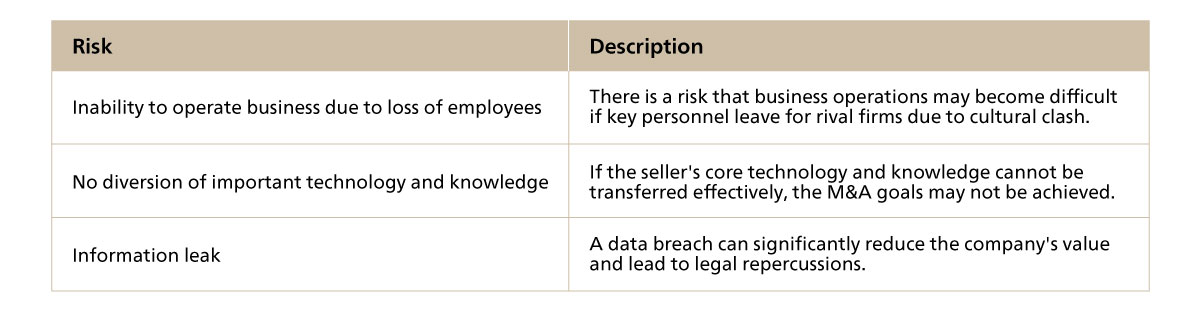

There are many types of potential risks that Buyer to consider: unconfirmed major IT information, large IT expenditure, legal risks, social reputation loss, business suspension, non-compliance, unable to achieve business goals, significant asset loss.

While ITDD is to be performed outside the Buyer’s country, hence requirements of experts from the seller’s location are crucial, to support them in exploring and resolve those risks

ITDD Conducting: Challenges and Solutions

There are different risks of assessing information that can influence the buying decisions of the M&A: the price which is determined by the health situation of the target in distinct aspects: and the target company's financial, legal, and operational status.

The challenge:

Cross-border acquisitions present unique challenges that can lead to overpaying or integration failures. These challenges include:

- Navigating unfamiliar regulatory and legal environments.

- Involved complex stakeholder coordination across locations and time zone

- Unclear goals or objectives with a tight schedule for a large-scale of more than a thousand employees

- Overcoming cultural and technological integration challenges

Failing to thoroughly assess these risks can be a costly and time-consuming mistake.

The solution:

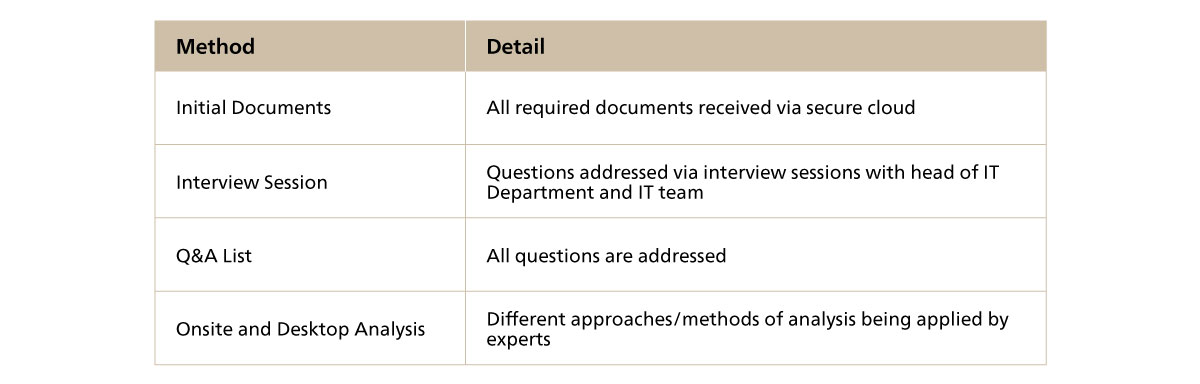

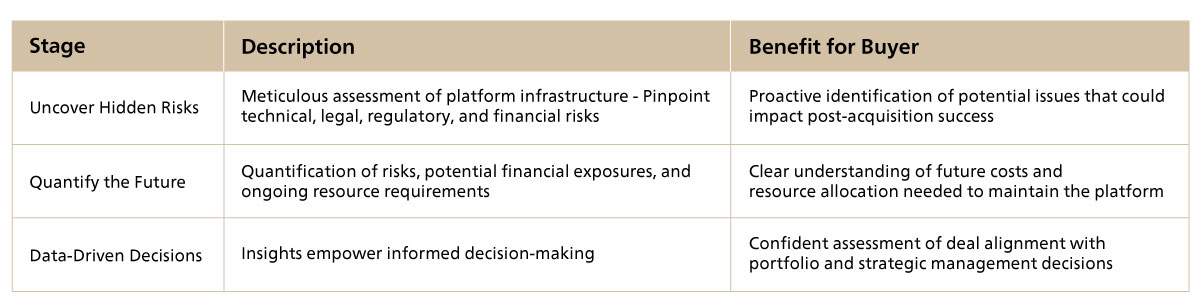

For the buyer, technology due diligence is a key step on the road to an M&A deal. A thorough understanding of the target's IT capabilities, technology products, data protection, and internet security is essential in today’s digitally driven business world.

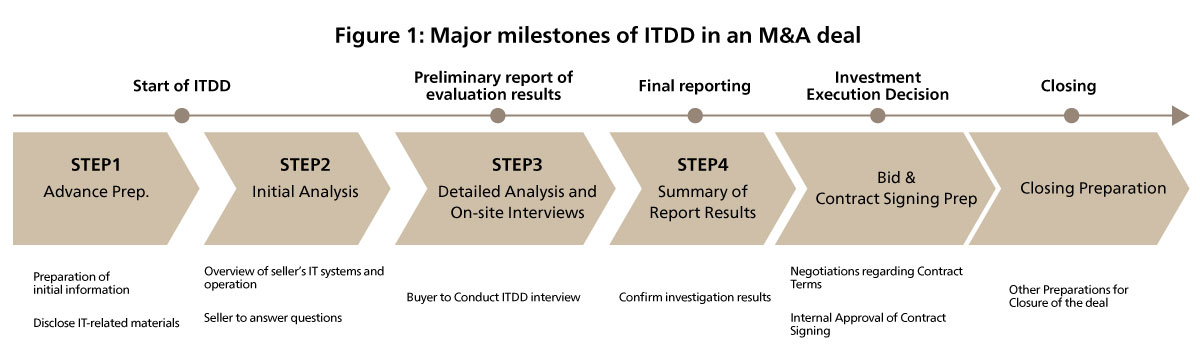

ITDD experts in ABeam Consulting utilize their unique framework and support clients' actions for improving IT values, by clarifying and categorizing current IT status and tasks. They visualize the whole IT lifecycle and assess IT integration, based on business and operational impacts.

Corporate ITDD is designed to identify potential IT issues of a target company and to reflect them in valuations or to minimize risk:

- Check the probability of the subject company's business value and present the factors reflected in the Stand-Alone Value

- Minimize risk by clarifying responses to IT issues

Items which are included in the scope of the survey and interview:

- IT Strategy, IT Governance, IT Security

- IT budget, IT assets

- IT organization and business allocation

- Overall IT configuration, system implementation process, Business applications, IT infrastructure, Systems outside the authority of the IT department

- Operation management, user support, Security measures, IT Contract Management

In this case study, we focused on how process approach in M&A project, and the keys of ITDD / formulating an IT integration plan

Deal Summary

Investment by client (“Buyer”) in a Vietnamese Technology company (“Seller”). Buyer plans to acquire parts of Seller through third-party allotment of seller and purchase from existing shareholders.

- Source of Investment: Buyer.

- Investment pattern: Equity method investments.

- IT environment of the seller will be continuously utilized post-merger.

- Objective is to diversify the value chain.

Results

The IT Due Diligence (ITDD) project, completed within the planned time, thoroughly examined the target company's IT landscape in both Vietnam headquarter and their foreign subsidiaries.

After ITDD, ABeam has supported client in highlighting critical risks for Day 1, and anticipated investment amount, together with list of operation which are required to be upgraded/improved.

Despite a tight deadline, a comprehensive review was conducted, analyzing all required documents, and covering the whole list of required checkpoints. Notably, half of identified issues were classified as signifying potential IT challenges. The final report was delivered on schedule to support the client's informed decision-making on pricing and M&A terms.

ABeam Vietnam Takes Deep Dive: Unleashing Strategic Insights Through Intensive IT Due Diligence

Beyond technical specifications, successful acquisitions hinge on understanding the target's underlying IT infrastructure, ABeam Vietnam delivers unparalleled expertise in navigating complex IT Due Diligence (ITDD) projects.

In this case study, we supported a leading integrated trading company (buyer) acquiring a promising Vietnamese software company (seller). Our comprehensive ITDD went beyond simply evaluating the seller's property management platform.

ABeam Vietnam's IT Due Diligence Expertise

The ABeam Advantage: Our ITDD goes beyond the technical. We combine years of IT expertise with a business-minded approach to uncover the critical factors that shape successful acquisitions.

Customer Profile

- Industry

- Integrated trading company

- Product

- A wide variety of products and services globally

Jun 26, 2024

- Corporate data and titles are those in use at the time of writing.

Click here for inquiries and consultations