With the rise of the COVID-19 pandemic, the automotive market experienced a global slump that has been slowly recovering over the end of 2020 and early 2021. Now is the time for distributors and dealers to identify the best way of how to maintain flexibility in the future. As the recovery begins, insights into how customer purchasing behaviors have changed are more valuable than ever to support business making decisions and to steer company strategies in the right direction.

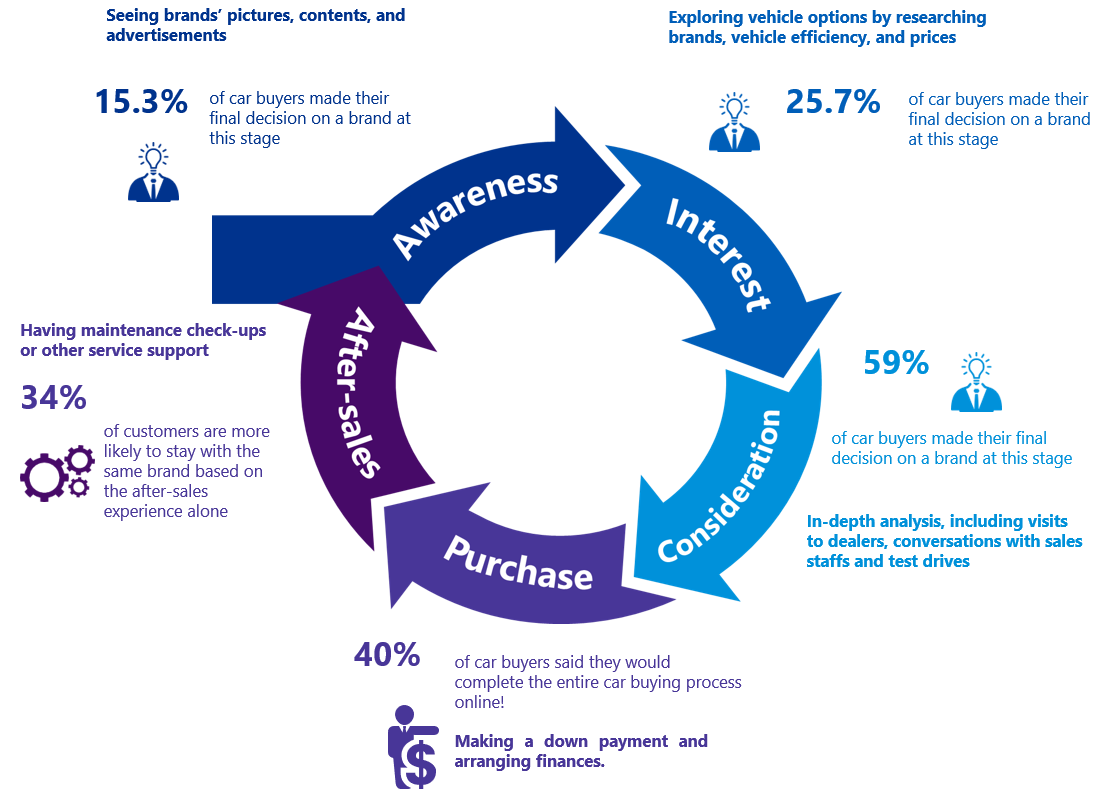

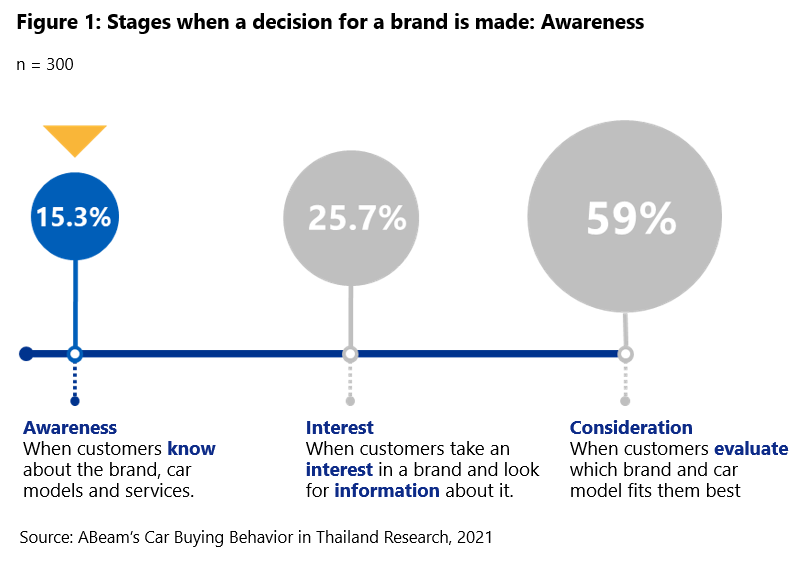

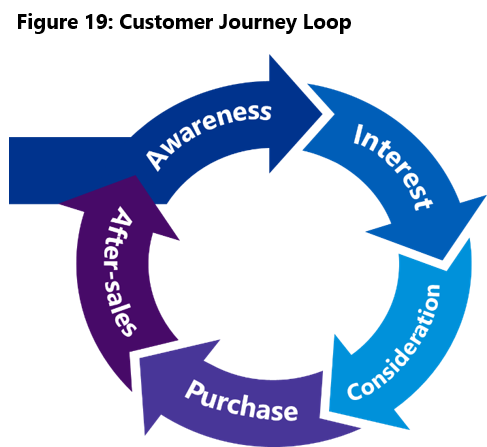

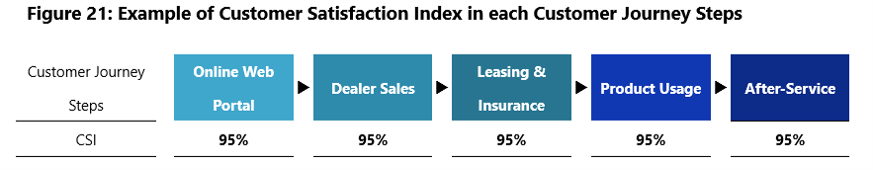

ABeam Consulting has conducted Car Buying Behavior surveys in 2019 and 2021 for the Thai market, designed specifically to focus on understanding the overall end-to-end customer journey from the awareness to the retention stage for both sides of the pandemic; the before and after COVID-19 behavior of consumers.

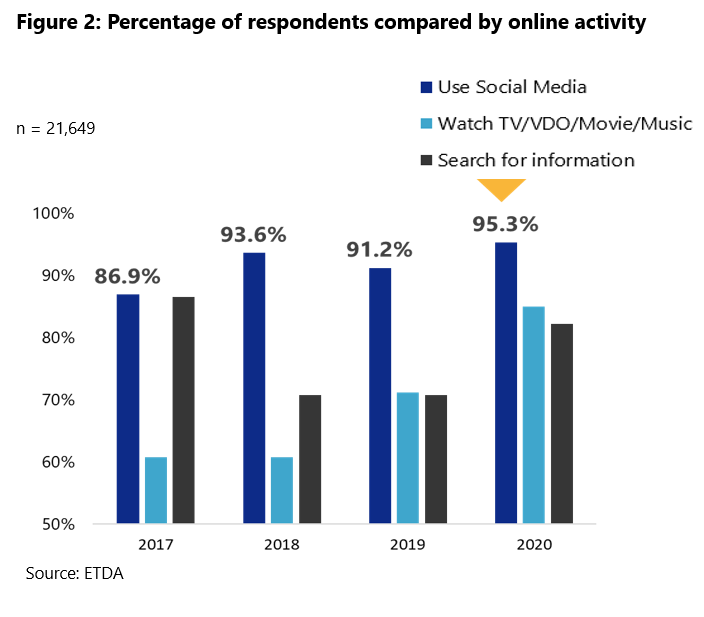

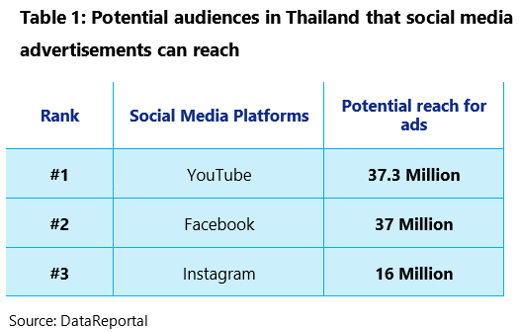

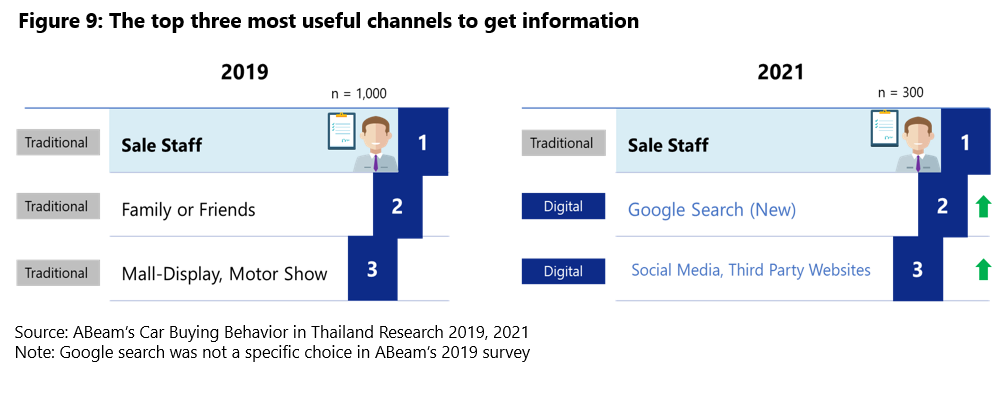

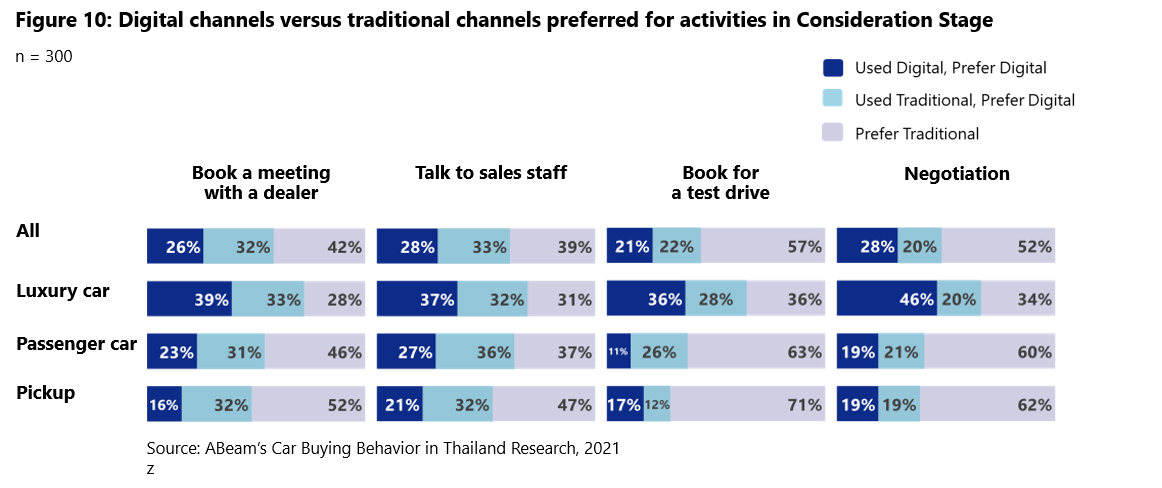

Thailand's average daily internet usage has increased over the last five years, increasing to 11.25 hours in 2020, up by 1.03 hours from the previous year, highlighting COVID-19's effect on people. Since customers' touchpoints have shifted more and more from face-to-face to online, OEMs need to make sure they are ready to be competitive when it comes to digital platforms and channels without neglecting major parts of their core business.

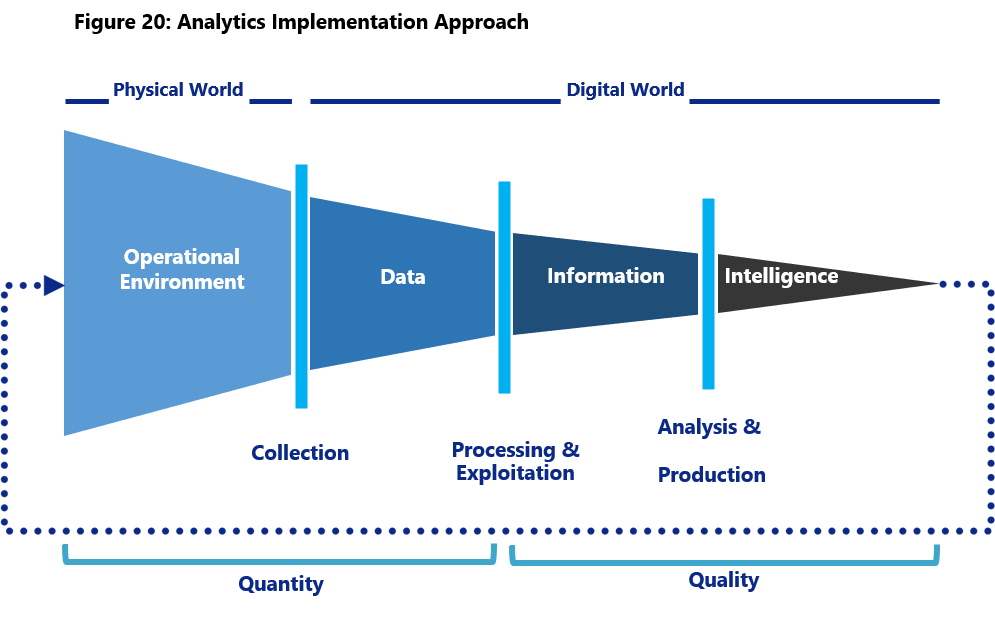

ABeam can support OEMs and dealers to improve their various touchpoints along the customer journey, with the goal to provide increased productivity, simplified & richer data collection, additional data analytical insights, and an enhanced customer experience based on the current sentiment in the market, as well as finding the right fit out of the latest CX technologies.