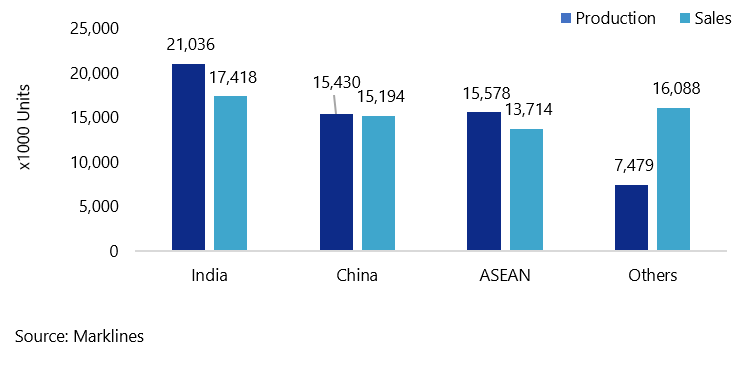

Globally, the ASEAN region plays a key role in the global motorcycle market. For decades now, it is considered the third in terms of production and sales units after India and China. The ASEAN market is led by Indonesia, Thailand, and Vietnam, representing total motorcycle sales of more than 11 million units in 2019 out of the total sales of 13.7 million in the region. As of 2019, before the COVID-19 pandemic, the total number of motorcycles registered was 106 million in Indonesia, 62 million in Vietnam and 21 million in Thailand.

Myanmar is another interesting market to compare as it has by far the highest growth rate of registered motorcycles in the region with a 14% CAGR over the last decade, resulting in a high jump from 1.8 million to 6.1 million between 2010 and 2019, while Malaysia and the Philippines have larger numbers of motorcycles in use in 2019 with 14 and 8 million units respectively.

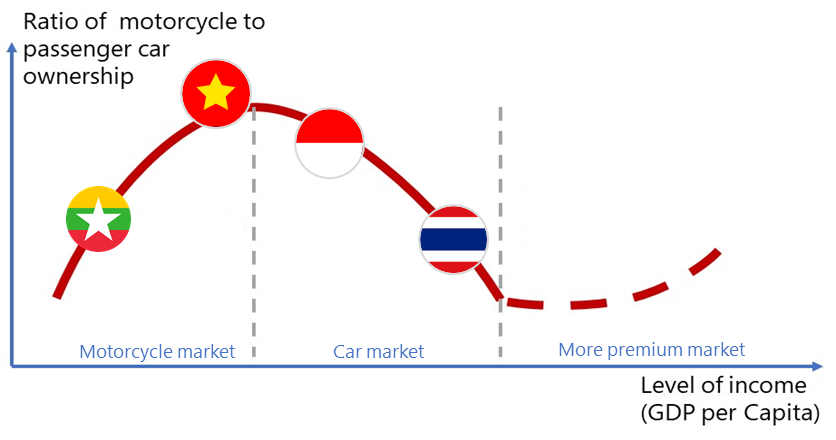

The impact to the car and motorcycle market is mainly linked to the national income or GDP per capita which shows the relative wealth of people in each country. In emerging countries like Vietnam and Myanmar, motorcycles are usually a key mode of transportation, not only, in urban areas but also in rural areas, due to their flexibility, and lower prices compared to cars. A recent study from Malaysia’s Road Safety Engineering and Environment Research Centre in 2020 indicates that in the early stage of a developing economy, due to lower income levels, a strong growth in motorcycle sales can be observed, going hand in hand with the increase in personal income. The tipping point is when income levels for the average population are high enough to afford a car, resulting in a decrease in motorcycle sales. The relationship between GDP per capita and the ratio between motorcycle and passenger car ownership shows a reversed U-shape.

On the other hand, people in more developed ASEAN countries like Thailand are slowing down their replacement of older motorcycles and moving towards the purchase of entry-level passenger cars with key reasons such as rising incomes, policy initiatives, and the expansion of infrastructure. It represents that the country is relying more on the car market and at the same time gently shifting to a more premium motorcycle markets with larger engines (sports vehicles) and electric vehicles.