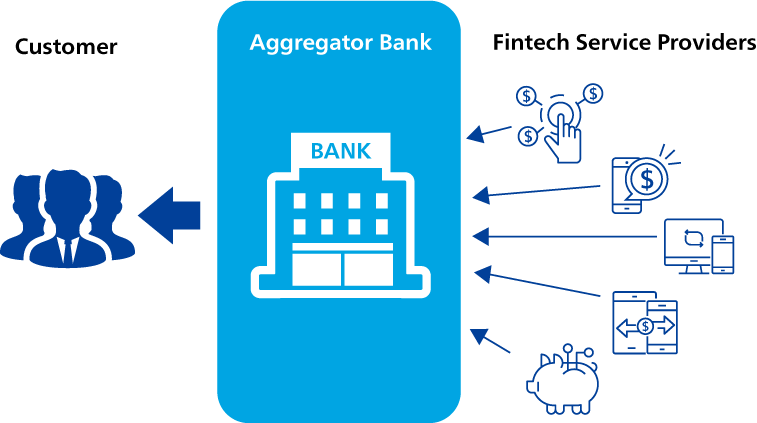

Financial institutions are facing more competitive pressure today than ever before. Fintech, blockchain, startups, non-bank financial institutions and other non-financial institutions are entering different industry verticals at an increasing rate.

A major driver for digital transformation is the need to adapt and evolve as competitors enter the market, or to stay ahead of peers who are also implementing digital strategies. In more developed markets, new entrants have been at the forefront of the industry and left traditional businesses behind. They are exerting real change on the industry by virtue of their digital-first approach, offering more sophisticated technology that increases the digital expectations of customers. Three quarters (75%) of insurers surveyed fear competition from data-driven digital competitors1.

Digital banks have emerged that exist only on the internet. Brokerages are using machine learning to pick stocks and package them into portfolios. Wealth management companies are using robo-advisors to bring their products to the mass market. These companies are developing new business models and leveraging technology to introduce products that today’s customers expect. Altogether, these developments have pushed the financial services industry forward and created an environment of innovation.

Some of the existing players in the financial services industry have shown they are prepared to compete. Banks, Insurers, Consumer finance companies and brokerages have all acknowledged the need to adapt to a changing landscape. Siam Commercial Bank embarked on a 40 Billion Baht, 5-year digital transformation project in 20152. UOB launched a digital bank – TMRW, that has no brick and mortar presence and offers innovative products for millennials such as budgeting services and spending analysis.

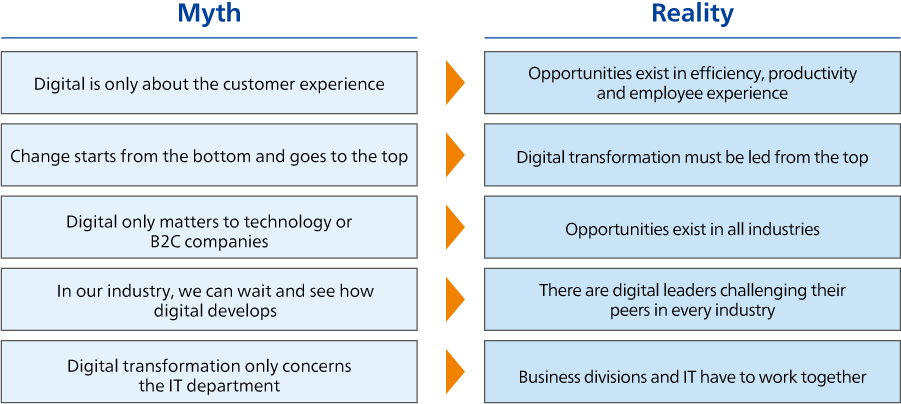

There are some myths believed by institutions that either paralyzes them into inaction or sets them on the wrong course of path. The reality is there are opportunities from digital transformation in every business line and in many elements within each business, not just in customer facing elements or B2C industries.