Aug 2, 2021

ABeam Consulting observes the tipping point for ASEAN markets switching from motorcycles to cars

ABeam Consulting (Thailand) Ltd. - a Japanese-based leading consulting firm, revealed the results of their study into ASEAN motorcycle markets and their impacts on the car market. The finding shows that ASEAN countries with large numbers of motorcycles are in the different stages of transition to the car market. ABeam predicts every country will be finally moving towards a car market in the next few years. The key factors are the rising income of ASEAN countries, policy initiatives, and expansion of infrastructure. In order to stay relevant, OEMs need to look at the tools at their disposal already before the transition happens.

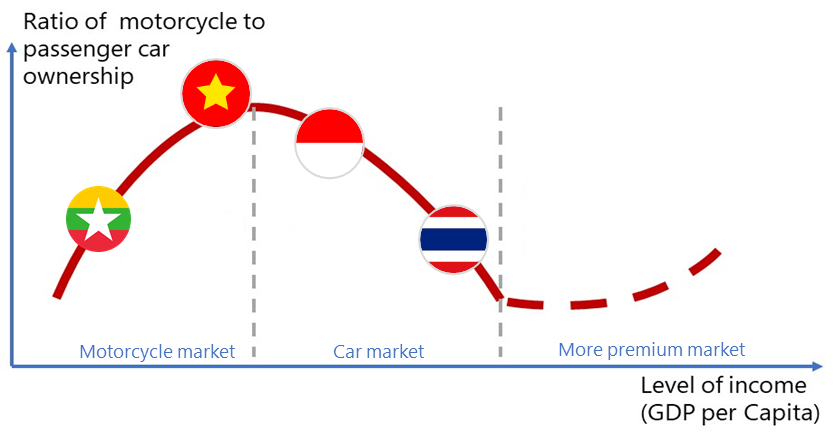

Mr. Ichiro Hara, Managing Director of ABeam Consulting (Thailand) Ltd., a subsidiary of ABeam Consulting Ltd., a global consulting company headquartered in Japan that specializes in digital transformation, disclosed ABeam’s analysis results of the different stages for motorcycle and car market economies for developing countries in ASEAN. The Analysis shows that Myanmar and Vietnam’s motorcycle market is still in an upward trend with growing motorcycle numbers for the better part of the next decade, while Indonesia is in the middle of its transition from a motorcycle to a car market. Thailand is the only developing market found in the study that has already transitioned and shows slow to stagnating motorcycle sales compared to the growth between the last decade, but a steadily growing car market. These findings also show that Thailand is in line with the history of more developed markets, with growth starting to manifest in the more premium motorcycle segment for large-engine sized motorcycles and electric motorcycles. The change is comparable to China, where the sales of motorcycles with engines of 250 cc and above recorded 177,000 units in 2019, a dramatic increase of 33% CAGR since 2010, when the yearly units sold were just 10,000.

The rising of GDP per capita explains this kind of transition. Consumers with higher purchasing power will ask for premium motorcycles as luxury & hobby goods, not as a necessity anymore, while basic transportation is satisfied by the purchase of cars rather than motorcycles.

The relationship between GDP per capita and the ratio between motorcycle and passenger car ownership in ASEAN shows a reverse U-shape graph, with the tipping point being the point where GDP per capita reaches a certain level, at which people earn enough to afford a passenger car: around the low 3,000 USD is considered to initiate that tipping point. The ratio between motorcycles and passenger cars increases again when GDP per capita reaches even higher levels – at around 5,000 USD and higher – having consumers seek for larger engine motorcycles or electric bikes as their luxury items.

The ASEAN region plays a key role in the global motorcycle market, being the third for decades in terms of production and sales units, after India and China. Indonesia, Thailand, and Vietnam are the top three markets in ASEAN with the highest numbers of motorcycles sold in 2019, representing 11 million units out of the total 13.7 million in the region. Myanmar is another interesting market with a stark increase in the numbers of motorcycles, exacerbated by legislation that forces owners to register previously unregistered motorcycles.

Main reasons for the popularity of motorcycles in the region is due to their ability to ride through small alleys, traffic congested roads and an overall cheaper cost, big factors in ASEAN.

“While most countries in ASEAN will soon go through the more advanced stages, causing a decline in the motorcycle market with the sales of cars increasing instead, countries like Vietnam and Myanmar are not expected to reach that point until a few more years down the road. Vietnam’s ratio for motorcycles to cars was still at 30.1 to 1 in 2019, even after a steady decline from almost twice that number in 2010. Thailand’s ratio on the other hand is 1.2 to 1 with just a slight drop over the same time frame. For markets in transition to a car market or about to start their transition, OEMs should consider adapting their business early. At ABeam we believe that a focus on the customer journey can become a crucial step towards a strong differentiation with other brands, which is something that has been actively pursued by car makers, has been less prominent in general within the motorcycle segment. Having tools in place even before the transitioning stage can help to segment and guide customers in the future as well as maintain customers in a shrinking market. At ABeam we have the expertise and tools to support dealers and OEMs to make that transition, as well as to guide them towards the market’s best practice,” concluded Mr. Jonathan Vargas Ruiz, Head for ASEAN Automotive Strategy of ABeam Consulting (Thailand) Ltd.

For more Information make sure to read our White Paper on this Topic which you can find by clicking here.

About ABeam Consulting (Thailand) Ltd.

ABeam Consulting (Thailand) Ltd. is a subsidiary of ABeam Consulting Ltd. –headquartered in Tokyo having 6,600 people serve more than 700 clients throughout Asia, the Americas and Europe providing consulting services in Thailand since 2005, ABeam Consulting (Thailand) has 400 professionals serving more than 180 clients in Thailand with expertise in digital transformation services that create strategic advantage, improve business processes, leverage technology innovation and enhance organizational performance with ERP and all other solutions including Management Consulting, Digital BPI, Data Analysis, IT project management and outsourcing for leading companies in Thailand. Moreover, ABeam has been in a strong partnership with SAP and provided services by SAP-certified consultants to achieve clients’ transformation. ABeam partners with clients to diagnose and solve their real challenges with solutions that combine industry and operational best practices with technical expertise. Pragmatic approaches ensure that clients gain measurable value more quickly. With the management philosophy to be "Real Partner", ABeam provides real people, real solutions, and real results to ensure clients' success.

For more information, please visit https://www.abeam.com/th/en.

Click here for inquiries and consultations