In May 2024, the Monetary Authority of Singapore (MAS) issued an Information Paper on governance and management practices. This document outlines MAS’s expectations for financial institutions regarding governance, data management organizations, and quality control. Financial institutions are required to promptly enhance their data governance and management practices. However, many financial institutions face significant challenges in meeting these expectations. This insight examines the primary challenges and proposes strategies to overcome them.

Considerations for Strengthening Data Governance and Management Practices at Singapore Financial Institutions

- Banking/Capital Markets

- Technology Strategy and Management

- Talent & Organization Management

-

Eiji Matsumoto

Senior Manager -

Daisuke Kuge

Senior Manager -

Naoaki Saeki

Manager

1. Analysis of Challenges

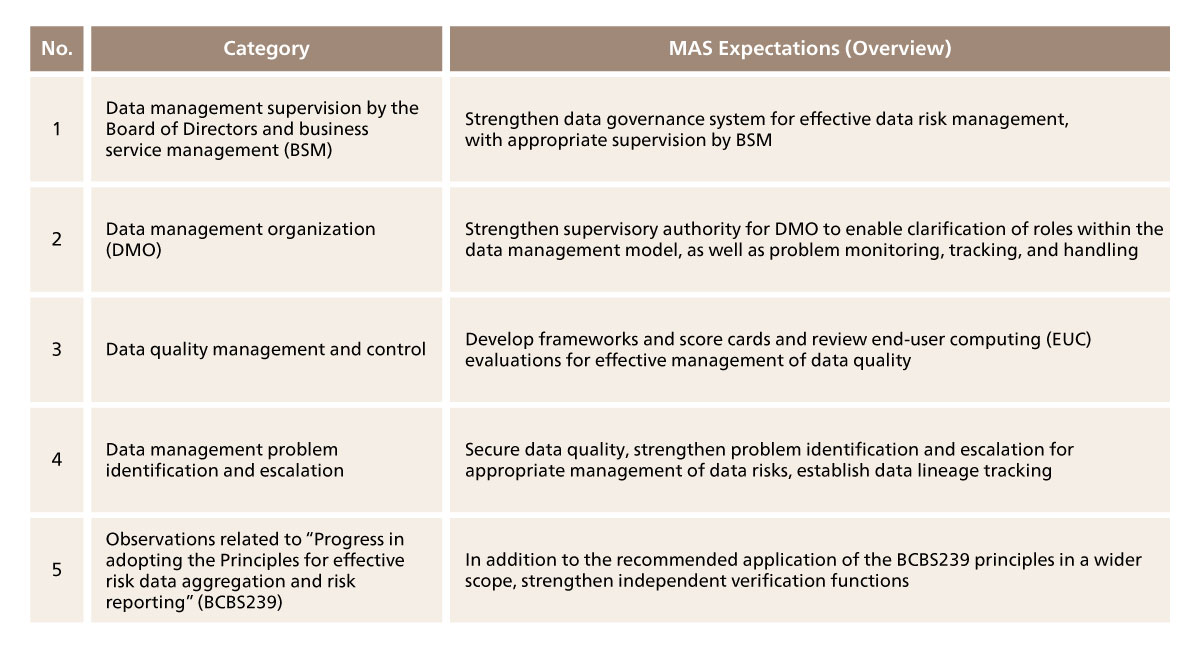

The table below outlines the expectations for data governance and management practices detailed in the Information Paper issued by the Monetary Authority of Singapore (MAS) in May 2024.

Created by ABeam based on the following:

Monetary Authority of Singapore: “Data Governance and Management Practices”

https://www.mas.gov.sg/publications/monographs-or-information-paper/2024/data-governance-and-management-practices

As previously mentioned, the Monetary Authority of Singapore (MAS) expects financial institutions to enhance their data governance and management. This includes establishing or strengthening processes & frameworks, improving data quality monitoring, and managing issues effectively. Achieving these goals can be challenging and varies depending on each company’s circumstances. This insight takes three key issues and proposes solution approaches to address them.

Challenge 1: Talent Shortage in Leading Data Governance/Management Transformation

The MAS Information Paper outlines the expected standards for data governance and management. However, financial institutions are experiencing a shortage of skilled professionals to plan and implement these transformations. To meet MAS’s expectations, leaders must possess a wide range of capabilities, including expertise in data governance and management theory, a thorough understanding of current operations, systems, and data, as well as domain skills in IT, business and risk management. It is challenging to find all these skills in a single individual.

Challenge 2: Conflicts in Roles & Responsibilities for Data Management Organizations

When establishing a data management organization, defining its roles and responsibilities can sometimes lead to conflicts with existing structures. For instance, there are several ways to set up a new data management organization, such as placing it within the IT department, the business department or establishing it as an independent entity. Each approach comes with its own set of trade-offs, including the ease of cross-department coordination and distribution of workload.

- Within the IT Department: While this setup allows for the aggregation of technical knowledge, it may lack sufficient business insights, making close collaboration with business department crucial.

- Within the Business Department: This can ensure better alignment with business needs but might struggle with technical integration.

- Independent Organization: This approach can balance both technical and business perspectives but requires careful coordination to avoid overlaps and conflicts.

Adjusting roles and responsibilities among multiple stakeholders can be challenging and may create additional obstacles.

Challenge 3: Burden of Quality Control Including End-User Computing (EUC)

Many financial institutions utilize End-User Computing (EUC) for various purposes such as work optimization and flexible improvement. This increases the complexity of quality control. Each EUC has its own documentation and operational procedures, making governance challenging and raising the risk of quality control oversights. Additionally, maintaining EUCs can become difficult for various reasons, such as the retirement of the original developer, outdated design documents and manuals, and the critical role current functions play in supporting important business operations).

2. Solution Approaches to the Challenges

Approach 1: Compensating for Talent Gaps within the Organization

While it may be challenging to find a single leader who meets all the requirements for data governance and management, organizations can address these gaps collectively. For instance, in a previous project, an IT department employee was appointed as the leader for data governance and management initiatives. The organization supported this leader by helping them acquire business and regulatory knowledge.

Key steps included:

- Educating Management: Emphasizing the importance of data governance and management to senior management to secure necessary resources.

- Resource Allocation: Ensuring the leader had access to the required resources.

- Knowledge Sharing: Conducting workshops and sharing regulatory requirements with staff.

- Collaborative Support: Encouraging collaboration among departments to bridge knowledge gaps.

By taking these steps, the organization was able to compensate for the leader’s initial lack of experience and knowledge, ultimately enhancing their data governance and management capabilities.

Approach 2: Defining the Roles and Responsibilities of the Data Management Organization

When establishing a data management organization, it is crucial to start by defining its position within the company. There are two main options:

- Within an Existing Department: This approach is suitable for smaller institutions where data management is already handled by departments such as IT or business. It leverages existing structures and resources, making it easier to integrate data management practices.

- As an Independent Organization: This option is more effective for larger institutions that require a top-down and rapid enhancement of data management. An independent organization can focus solely on data governance, ensuring a more streamlined and dedicated approach.

By comparing these options, institutions can choose the most appropriate structure for their data management organization. This clarity helps address the data management issues effectively and facilitates support and understanding from existing stakeholders.

Approach 3: Implement Effective End-User Computing (EUC) Management

While quality control for End-User Computing (EUC) requires significant effort, it can be streamlined through strategic approaches.

-

Low-Code/No-Code and RPA Platforms:

-

Initial Effort: Developing and maintaining EUCs on low-code/no-code or Robotic Process Automation (RPA) platforms may require an initial redevelopment effort.

-

Long-Term Benefits: These platforms simplify EUC management, making functionalities easy to understand immediately, ensuring clear specifications, and securing data quality. In one real-world case, we use a low-code/no-code platform to consolidate multiple EUCs at a financial institution which led to improved data quality

-

-

Generative AI Coding:

-

Efficiency: Generative AI can enhance EUC management by automatically generating design specifications and test cases. This simplifies the visualization of data input, processing, and output, making EUC management more efficient

-

By adopting these approaches, financial institutions can streamline EUC quality control, reduce development efforts, and enhance data quality.

3. Conclusion

At ABeam Consulting, we go beyond presenting idealized concepts of data governance and management. We bring practical experience and deep knowledge to support your institution in overcoming its challenges. If you require assistance with data governance and management, please do not hesitate to contact us at Singapore Contact.

Click here for inquiries and consultations