News

-

Press Release

ABeam Consulting, BearingPoint Establish New Company in the Americas Strengthening transformation services and support framework for global companies

-

Information

Announcing the Publication of CUSTOMER CENTRICITY 3.0

-

Information

ABeam Consulting Named One of the World’s Best Management Consulting Firms 2025 by Forbes

Insights

-

Taking on Low Productivity and Labor Shortages at Japanese Companies Through Capabilities-Based Human Resources Management Part 1: Why the Capability-Based Approach Now? A Background and an Overview of the Approach

Dec 15, 2025

-

What Are the Keys to BPR Success in Creative Industries? A Behavioral Economics-Informed Approach

Dec 4, 2025

-

Sustainable IT Operations and Maintenance -The Key to Business Stability and Growth

Nov 21, 2025

-

InsureTech Connect Asia 2025 Summary Report

Nov 6, 2025

Trends

- Smart Factory

- Holistic Enterprise Value Management

- Human Capital Management

- GX

- SX

- DX

-

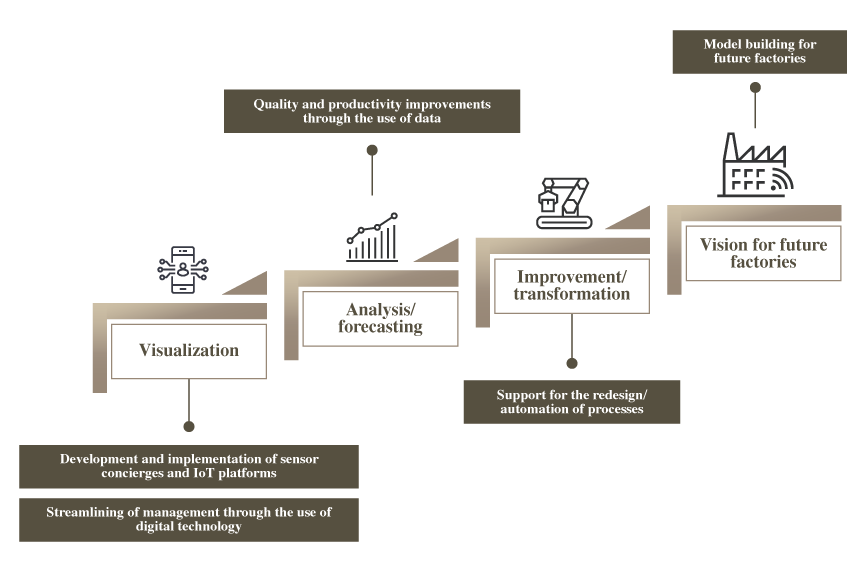

Realizing Smart Factories Through Cross-Organizational Support From On-The-Ground Business Improvement to Overall Design

ABeam Consulting supports end-to-end transformation from process design, automation and digitalization to address manufacturing challenges to indirect operations, personnel, design and procurement, helping clients realize smart factories.

Learn more

-

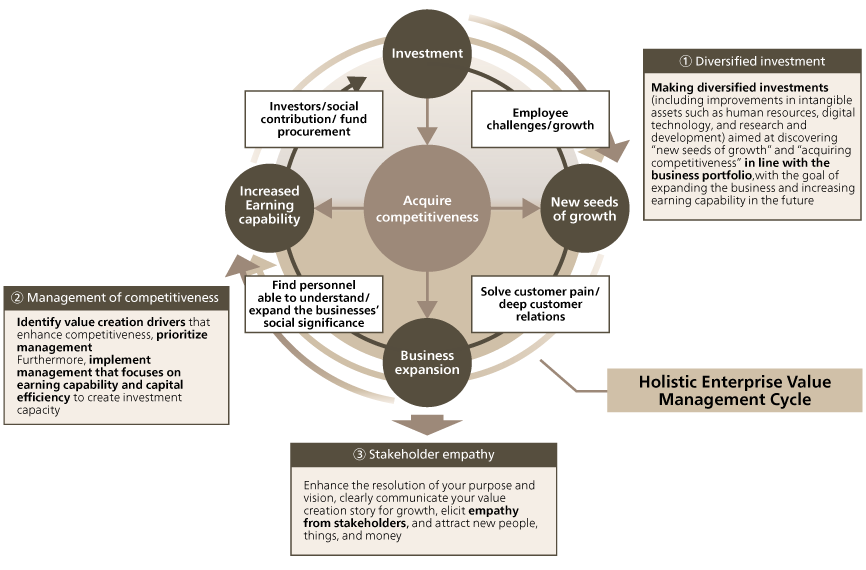

Supporting vision-driven corporate transformation through growth story design based on the mechanism for enhancing corporate value

ABeam Consulting supports the establishment of a management foundation and sustainable growth aimed at enhancing corporate value by leveraging the “Corporate Value Management Cycle.” This approach integrates three key elements: diversified investment, management of competitiveness and profitability, and stakeholder empathy.

Learn more

-

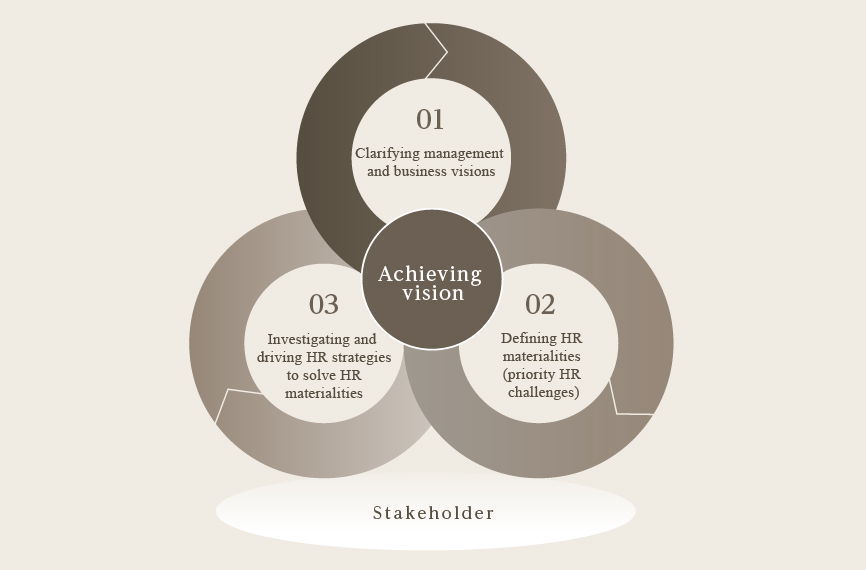

Supporting human capital management that drives business portfolio transformation

ABeam Consulting provides side-by-side support to clients seeking a human capital management approach. Our support ranges from identifying the most important HR challenges and achieving a business portfolio transformation, to formulating a transformation vision, proposing and executing specific measures.

Learn more

-

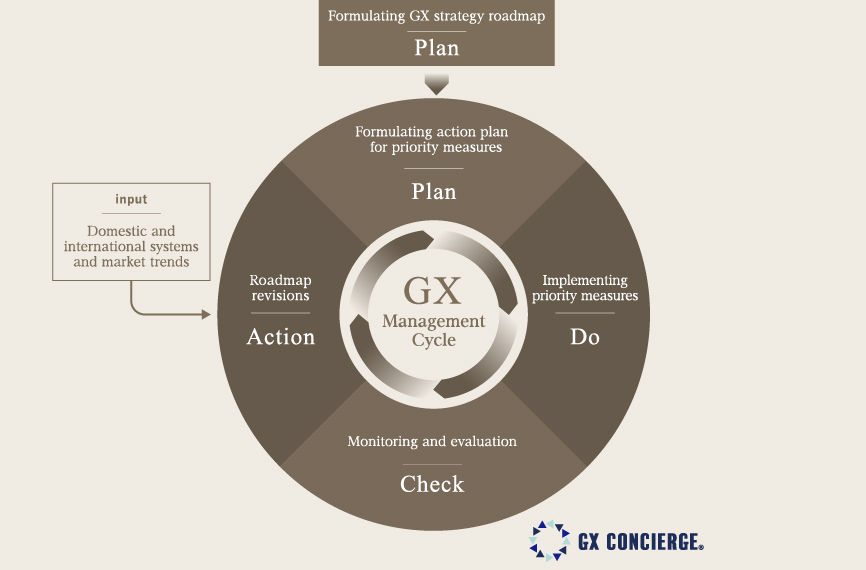

Supporting GX (Green Transformation) through business risk reduction and new business generation for carbon neutrality

ABeam Consulting supports clients in building the GX management cycle, which covering long-term strategy and roadmap formulation, evaluation, and strategy revisions. We are also ready to support clients in constructing business models adapted to the new opportunities of a post-carbon society.

Learn more

-

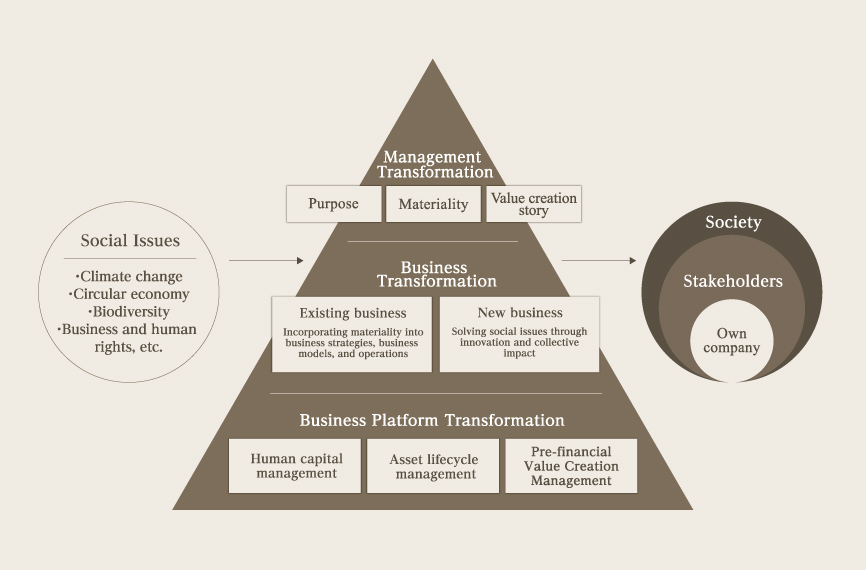

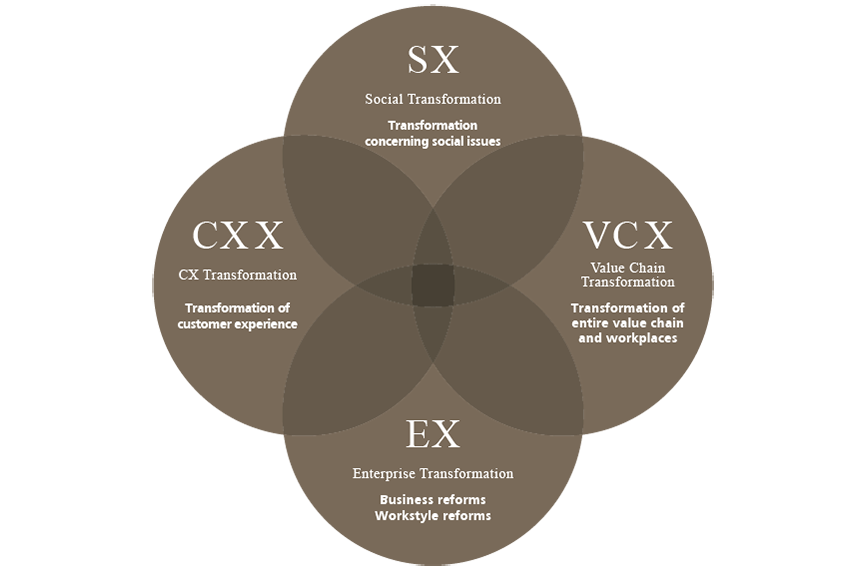

Supporting sustainability management for sustained financial and non-financial growth

ABeam Consulting provides comprehensive support for your company’s management agenda. We contribute to sustainability management on financial and non-financial axes and society-wide transformations.

Learn more

-

Creating the future together with DX

ABeam Consulting helps clients create a vision for what they want to achieve through DX. We work with them to establish scenarios for reaching their goal and engines that drive these scenarios forward.

Learn more

Case Studies

-

NEC Facilities, Ltd.

Improving productivity in facilities management to meet growing market demand Comprehensive support for developing a new business concept aligned with management’s vision

ConsultantTakeshi KiriiPrincipal

-

TDK Corporation

Realizing next-generation audits using digital technology Improving audit quality and business processes through data analysis and automated judgment

ConsultantIchiro HaraHead of Operational Excellence Business UnitPrincipal

Transforming the structure of companies and organizations, and building connections between them.

This is how we help create new value and bring about social change.

We unlock the power of vision and imagination to create the future, applying highly diverse and specialized capabilities and experience.

Together with clients, we realize unrivaled value at key stages of their transformation.

To the professionals and business partners united in these efforts, we provide meaningful opportunities powered by our creativity and diversity.

Growing together with our clients and society, progressing as One Team.

Remaining a Real Partner through it all.

We strive to be a creative partner.