The Japanese manufacturing industry is being faced with the need to reform its demand chains (supplier-side processes originating in customer-side demand) as it seeks to secure stable profits while also addressing increasingly complex customer needs, and a dynamic business environment. Downward pressure on profits is coming from factors such as geopolitical risks, intensifying competition, fluctuations in demand and inflation of input costs. Siloed-off operations, in particular, are impeding prompt management decision-making. Companies thus need to set up processes for matters including improved coordination between manufacturing and sales or passing on costs, as well as establishing flexible systems for meeting customer needs. Meanwhile, transitioning towards decarbonization is also an important challenge.

Against this backdrop, this Insight will present some key points for initiatives the Japanese manufacturing industry can take to combine making value-based appeals to its customers while securing stable profits.

Realizing New Era Demand Chains in the Japanese Manufacturing Industry - Combining Value Appeal Based on Increasingly Complex Customer Needs While Securing Stable Profits -

- Process

- High Technology

- GX

- Marketing, Sales, and Customer Service

The Business Environment for Japanese Manufacturing

In this section, we will go over the business environment for Japanese manufacturing from a macro perspective.

How Japanese Manufacturing Fell into a Low-Profit Culture

The business environment for Japanese manufacturing today is growing ever more complicated. Leaders need to steer the management of their companies taking into account many factors, and keeping an eye on medium-to-long term trends such as increased supply chain risks stemming from geopolitical risks including the coronavirus, the Russia-Ukraine conflict, intensifying competition with emerging markets, decreased domestic and increased overseas demand, persistently high materials and energy costs, the transfer of skills and employment of foreign personnel corresponding to the medium-to-long term decline in the working age population, and considerations around operational automation through things like AI technology.

Leaders need to steer the management of their companies taking into account many risks including increased supply chain risks stemming from geopolitical risks including the coronavirus, the Russia-Ukraine conflict, intensifying competition with emerging markets. Additionally, they need to keep an eye on medium-to-long term trends such as decreased domestic and increased overseas demand, persistently high materials and energy costs, the transfer of skills and employment of foreign personnel corresponding to the medium-to-long term decline in the working age population, and considerations around operational automation through things like AI technology.

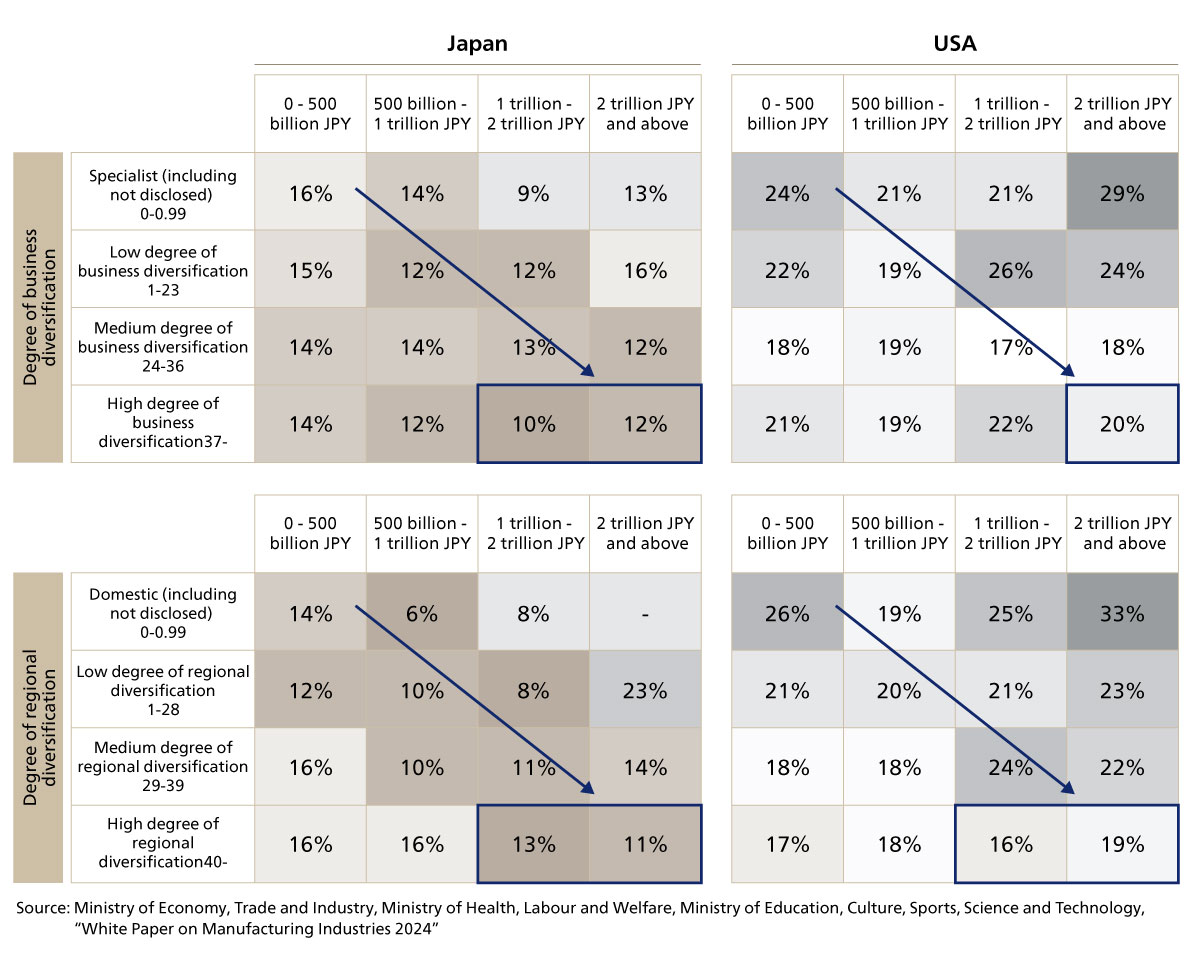

In addition, statistics from the Ministry of Economy, Trade and Industry show that, even as Japanese manufacturing is globalizing, and its consolidated sales yielded its highest ever profits, compared to other countries, its level of profitability remains lower compared to other countries (see Figure 1).

Figure 1. Japanese manufacturing profitability compared to overseas companies

Figure 1. Japanese manufacturing profitability compared to overseas companies

Siloed-off Business Operations Giving Rise to a Low-Profit Culture

Beyond the rise in materials costs mentioned earlier, one other factor behind this low profitability is the operation of businesses in a siloed-off manner, wherein optimizations are done in isolation centered around particular business units or products.

Naturally, companies need to properly convey the value of their products to customers and win them over in order to raise sustainable profits on an ongoing basis. In doing so, it is important for them to also pass on costs such as increased input and labor costs when such market conditions arise. One of the harms of siloed-off business management comes from the fact that the operational processes and systems involved become very finely specialized due to the massive scale of these organizations. This slows down the speed with which data can be aggregated and conveyed to decision makers. We believe that this interferes with operations, with the ability of companies to keep up with the present, rapidly changing business environment, and with their ability to make management decisions that anticipate the future.

For example, looking at the coordination of manufacturing and sales, many companies function with their organizations, operations and system environments siloed off along a manufacturing organization/factory axis, and a sales organization/office axis. The KPIs that each set of organizations focus on and the granularity of the information that they manage naturally differ. Additionally, operations often come to depend on individuals or on implicit knowledge, impeding timely coordination of information and management decision making. This trend tends to manifest particularly strongly in large companies that have scaled up through repeated mergers and acquisitions.

How Can Companies Push the Value of Their Products to Customers and Secure Profits?

Let us take a look at how Japanese manufacturing can make value-based appeals to customers and secure profits in an increasingly complex business environment.

Proactive Price Setting and Value-Based Appeals

So, what sorts of efforts can Japanese manufacturing make to secure stable profits? We believe that it is important for companies to foresee and anticipate customer needs and connect this to product development and marketing of the sorts of high-value-added products that the market demands. It is also important to design processes to quantitatively visualize the proper value of their products for customers and so be able to pass on costs, while getting buy-in for this from customers.

Product Development and Marketing That Foresees and Anticipates Customer Needs

It is important for companies to not only shift to a more high-value-added model through their own efforts, but also to improve their competitive edge relative to their competitors by quickly gathering information such as the situations of customers and new business/product initiatives at client companies, their latest development roadmaps, and their needs.. They then need to promptly reflect this information in the roadmaps of their own products.

To that end, companies need to both convey the needs captured by sales and retail to related internal departments such as the engineering chain (R&D) and the demand chain (SCM), and to move forward based on government support measures, while bringing into view not only initiatives on the single company level, but partnerships across the whole value chain, including upstream and downstream business partners.

Quantifying the Proper Value of Company Products

Companies need to approach pricing by strategically displaying prices calculated backwards from market demand and by proactively making value-based appeals, rather than displaying prices by just adding up the cost of inputs. In process industries in particular, companies often perform transactions where they set prices after the fact. However, this leaves them vulnerable to increases in input costs or rapid fluctuations in exchange rates. They should therefore consider the issue taking into account approaches such as switching to a formula-based pricing method (i.e., a formula that decides the price tied to dynamic factors such as input costs or market prices) or using shorter contract cycles. The further downstream you go, the more the industry turns to high-variety, small-lot production. Undoubtedly, as the relative number of customers increases, price competition intensifies, leading to negotiations with customers becoming harder. However, it is important to strictly manage the prices offered to customers from the point of view of securing a proper market environment.

Designing Processes for Passing on Costs and Getting Customer Buy-In

Companies need to practice careful internal management of prices and drive improvements in governance, including across business partners such as trading companies and brokers. Many companies do not have adequate information management systems in place, as the quotation formats required by customers vary. However, storing, collating, and analyzing the prices companies offer, along with their negotiating histories with their customers helps improve transparency around price fluctuations stemming from fluctuations in input prices. This is an essential measure if companies are to explain pricing logically to customers. It is also important for companies to store price negotiation outcome data together with this information so they can analyze successes and failures to select which buyers to prioritize.

Demand Chain Optimization for Switching to a High-Profit Culture

Given the above, companies need to gather, collate, and analyze a broader range of more detailed data than they have before as they make value-based appeals and pass on costs to customers. It is also important for them to advance proactive measures in order to seek to take the initiative.

The Role of Sales and Retail Managers as the Front-End for Customers

Sales and retail managers, who are responsible for the front-end work with customers, must observe movements in demand and drive coordination with related departments at their companies such as R&D and SCM. Throughout this series of measures, promotion of more impactful and efficient operations is required. While it is a well-worn piece of advice, it is essential for companies to advance what is termed sales DX by making it so that proactive sales activities backed by data, rather than relying on intuition or experience, permeate the whole sales organization from the front lines to middle and top management, by unifying management indicators and standardizing operations.

How to Drive Proper Sales DX

Sales DX initiatives are widely attempted in the manufacturing industry, but, in many cases, these fail to produce adequate results. We often see cases where sales DX starts and ends with simply digitalizing immediate operations. Alternatively, because measures are too general and are not based on specific business environments, there is only perfunctory management of KPIs that should be focused on as part of operational processes specific to their businesses and products, leading the sales DX measures to end up just increasing the overall operational burden.

To ensure proper sales DX, companies need to consider the specific circumstances of their businesses and products, while also being conscious of standardization across businesses and organizations. In adopting technology too, companies need to be mindful of refining scope of use and of the goals of using said technology. It is also important to have a sense of urgency around ascertaining and making judgments on information, in addition to precisely managing information.

For example, supposing we could get 90 out of a possible 100 points of information after a month, or we could get 80 points in nearly real time, thus enabling immediate responses, which of these would be more profitable in business terms? In particular, we could ask the same thing about the use of generative AI, which has garnered significant attention recently. While it may be impractical to aim for 100% accurate summaries of internal sales meetings or negotiations with customers, getting reasonably accurate output immediately is possible. How this can be incorporated into and applied to existing operations is naturally down to the management skill and experience of a company’s leadership.

The Components for Realizing New Era Demand Chains

To realize such new era demand chains, we believe that companies will need internal components such as cross-business-unit organizational structures for executing customer-centered business, operational processes that strike a balance between standardization and individual optimization, cross-organizational data sharing platforms and highly extensible systems platforms.

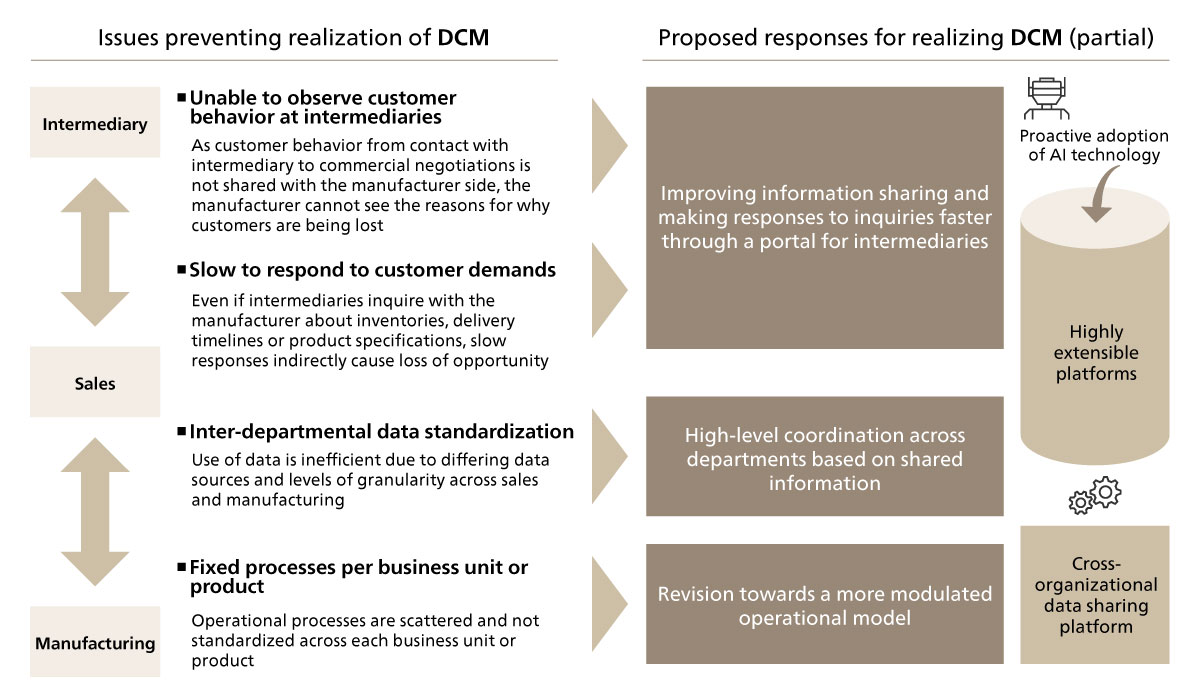

Particularly for businesses situated upstream in the value chain, because their transactions tend to take the form of being mediated through intermediaries such as trading companies and brokers, accurately ascertaining the needs of end customers, and quickly taking action in response to such needs is challenging, so establishing a clear scheme to facilitate effective communication with such business partners is a particularly key point (see Figure 2).

Figure 2. Issues preventing realization of demand chain management and some examples of how they can be addressed

Figure 2. Issues preventing realization of demand chain management and some examples of how they can be addressed

Passing Costs Through to Green Products Which Can Become Future Differentiators

In recent years, efforts to achieve carbon neutrality by 2050 have also become a challenge that cannot be overlooked in the manufacturing industry.

Efforts to Achieve Carbon Neutrality Subject to Growing Calls

In FY2026, the GX League (a framework wherein a group of successful international businesses seek to lead on GX, resolutely taking on the challenge of transitioning to carbon neutrality) entered its second phase, and a genuine emissions trading system began operations in Japan as well. From the second phase, mandatory participation for large companies will come into view, so particularly for businesses that deal with large manufacturing companies, it will be more necessary than ever to work with an awareness of whether the products they are offering are traditional products or green products.

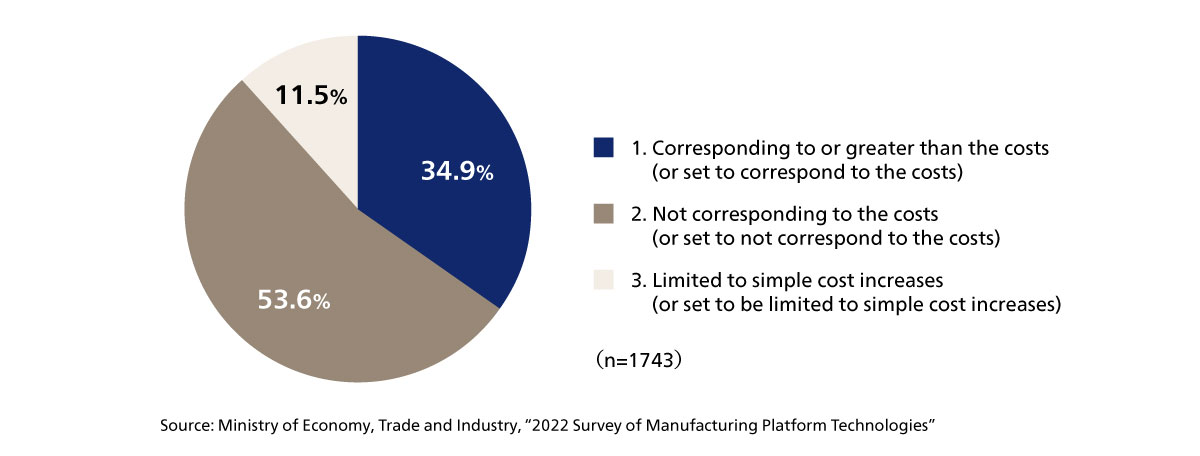

For example, according to the “2022 Survey of Manufacturing Platform Technologies” conducted by the Ministry for Economy, Trade and Industry, measures to visualize and cut greenhouse gas emission volumes have begun at most major companies, with over 95% of companies tackling Scope 1 emissions, and over 80% of companies tackling Scope 2 emissions. It also cannot be overlooked that such initiatives are being advanced due to demands from client and parent companies. With that said, only around 35% of companies surveyed responded that they have produced results that correspond to costs through this series of efforts, so this remains a state of affairs limited only to some companies (see Figure 3).

This is because realizing decarbonization implies large-scale capital investments such as the use of hydrogen reduction steelmaking and electric furnaces in the steel industry and the use of ammonia-fueled naphtha crackers in the chemicals industry, so such moves end up running counter to securing profits in the short term. Companies also need to proceed under domestic emissions trading regulatory and rules frameworks that remain ambiguous. In such an environment, putting in place operational processes for gathering data to surface emissions and introducing tools to calculate emissions is placing a significant burden on companies moving forward with such initiatives.

Japanese manufacturing is thus faced with the need to put in place carbon neutrality initiatives to meet demand from customers and their social responsibilities on top of their original mission of steadily supplying high-quality products.

Figure 3. Cost balance of decarbonization efforts

Figure 3. Cost balance of decarbonization efforts

Passing on the Costs of Green Products

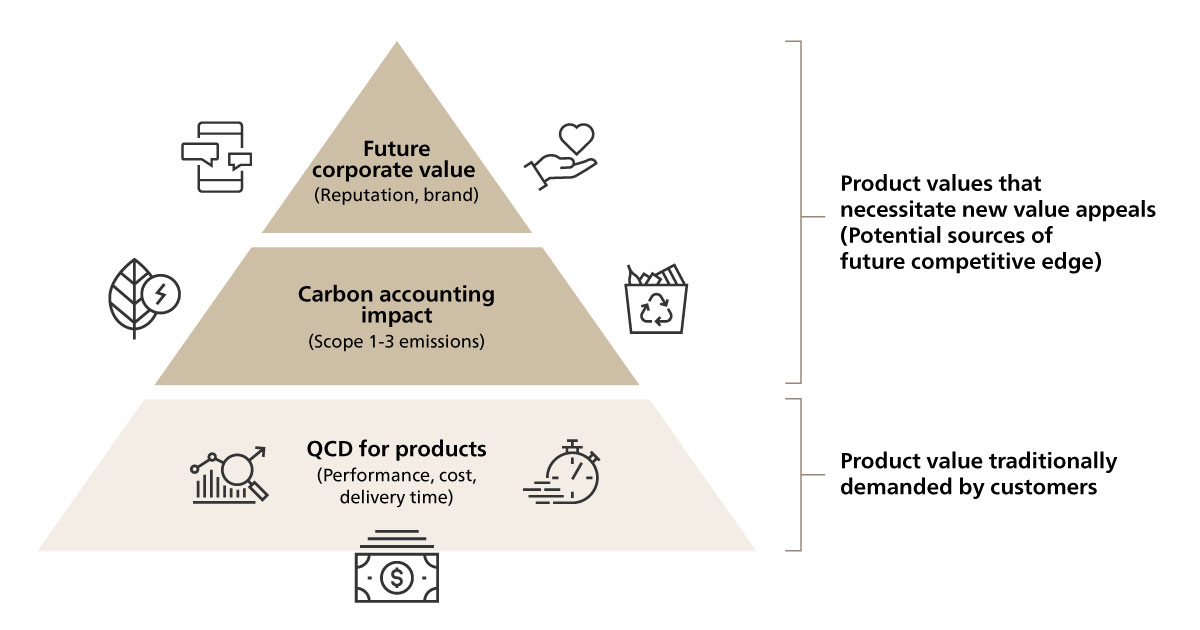

Investments in carbon neutrality will naturally add to the input costs of products, so, if companies are to secure stable profits, it is important for them to consider how they will present the validity of green product prices to customers.

Passing on the costs of green products requires properly conveying to customers the value of those products, as well as some ingenuity in sales techniques. Companies need to not only present the current costs of green product options, but also do things like providing quantitative data considering the impact of carbon accounting (this includes not only decarbonization of manufacturing processes, but also revisions to production locations and transportation methods, and collection of products for reuse) and presenting to shareholders the non-financial benefits of contributing to future corporate value, such as reputation. (see Figure 4). It goes without saying that this will require companies to have systems for aggregating, analyzing, and visualizing such information. Relevant laws and regulations differ across countries, introducing complexity to compliance, so companies need to advance such measures while aligning them with their global strategies.

Visualization of emissions is also set to include everything up to manufacture, sale, delivery, and reuse of a product, necessitating negotiations and information management at each customer contact point. This makes it difficult for sales and retail to address the issue in isolation and makes coordination with related internal departments such as R&D and SCM even more important than with non-green products.

Naturally, these efforts are exceptionally challenging. However, decarbonization efforts are an inevitable demand coming from client companies and society, so we believe that working to make value-based appeals in line with the diverse standards set by clients will be a source of competitive edge in future global markets for Japanese manufacturing.

Figure 4. Key points in making value-based appeals of green products that can be a source of future competitive edge

Figure 4. Key points in making value-based appeals of green products that can be a source of future competitive edge

Summary

Amidst a highly variable business environment for Japanese manufacturing, working to reform demand chains to secure stable profits is likely to be an exceptionally challenging and drawn-out endeavor. The more companies delay starting on this work, however, the more irreparable their situations could become.

While decarbonization is also no simple affair due to the many factors where the future is unclear, we also believe that by starting on it now, early movers stand to reap corresponding rewards. Whichever direction companies go, we believe they will need the resolve and perseverance to build consensus across departments and organizations such as R&D, CRM and SCM, organically coordinate and integrate all their operational processes and systems, perform stakeholder change management, and produce results.

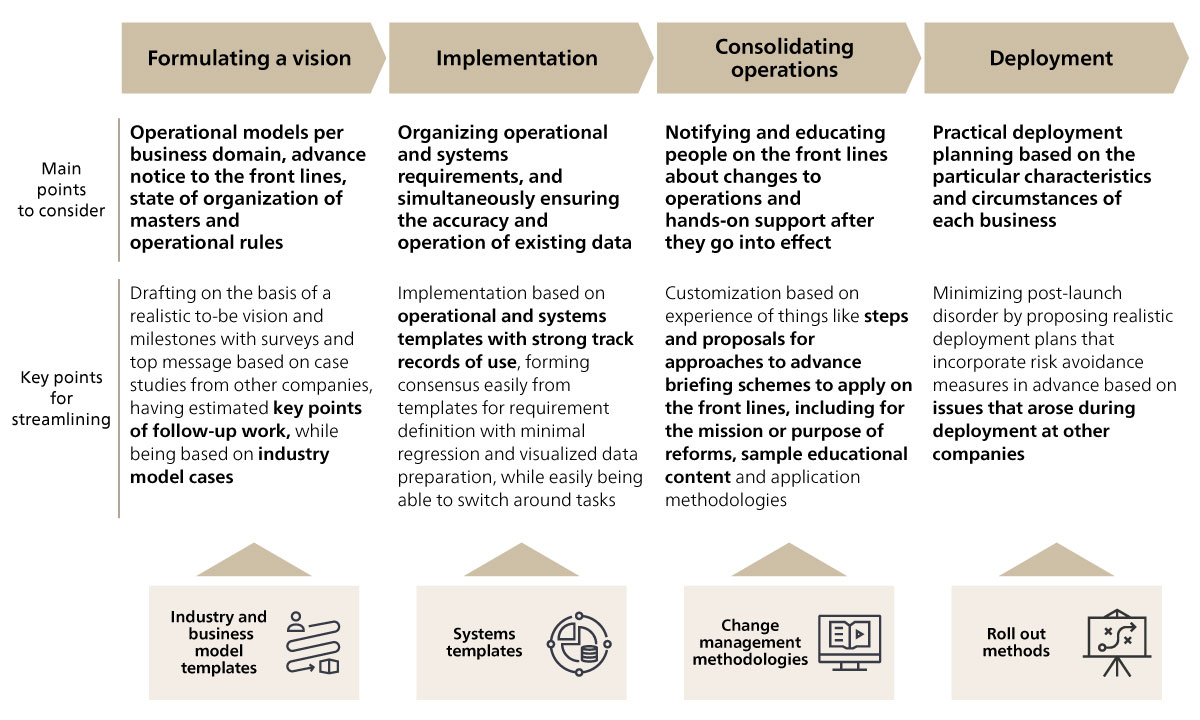

At ABeam Consulting, we can segment business environments per business or product based on various business strategies across the manufacturing sector, and line up all the relevant key points such as suitable information management indicators, key operational processes, and use of technology (see Figure 5). We also possess frameworks for looking into and capabilities in building optimal customer contact points and realizing customer experience (CX) through value-based appeals, while coordinating with internal and external stakeholders involved in not only the CRM domains of customer contact point marketing, sales, and customer service, but also the engineering chain (R&D) and the demand chain (SCM).

As key points surrounding the indicators that should be managed and technologies that should be used differ depending on the business characteristics and marketing environments of each business when advancing sales DX in particular, we also provide side-by-side support for not only assessing present operations/use of tools and deriving the challenges and points to reform, but also for consolidating data-oriented execution of operations all the way from management to the front lines.

If you or your company are considering demand chain reform, please don’t hesitate to reach out to us.

Figure 5. ABeam’s approach to looking at demand chain reform

Figure 5. ABeam’s approach to looking at demand chain reform

Click here for inquiries and consultations