In recent times, the finance industry has been heavily impacted by political and economic impacts such as fiscal policies and legal changes, and by social impacts such as the aging and declining population. Since the lifting of zero interest rates, competition in existing interest spread and fee-based businesses has intensified, thus failing to show anticipated growth. It is no longer enough for companies to compete on interest rates and fees, or to just meet demands presented by customers if they are to stand out from the competition. These days, for companies to continue being the financial institution of choice among customers, they have to “sell products and experiences that exceed customer expectations.”

In this Insight, we go over some misconceptions and issues companies across the financial industry are apt to fall into as they take on CX transformation in this day and age. We also propose some key points to which they will need to pay heed in order to achieve success, and some approaches to realizing those transformations.

Misconceptions Around CX Transformation in the Finance Industry and Approaches to Realizing CX Transformation

- Leasing/Credit

- Banking/Capital Markets

- Marketing, Sales, and Customer Service

Contents

- The Past and Future of the Financial Industry

- Changing Demands Coming From Diversifying Businesses/Customers

- Key Points to Advance When Pursuing CX Transformation

- Common Misconceptions and Issues That Arise in CX Transformation Efforts

- ABeam Consulting’s Approach to Realizing CX Transformation

- Summary

The Past and Future of the Financial Industry

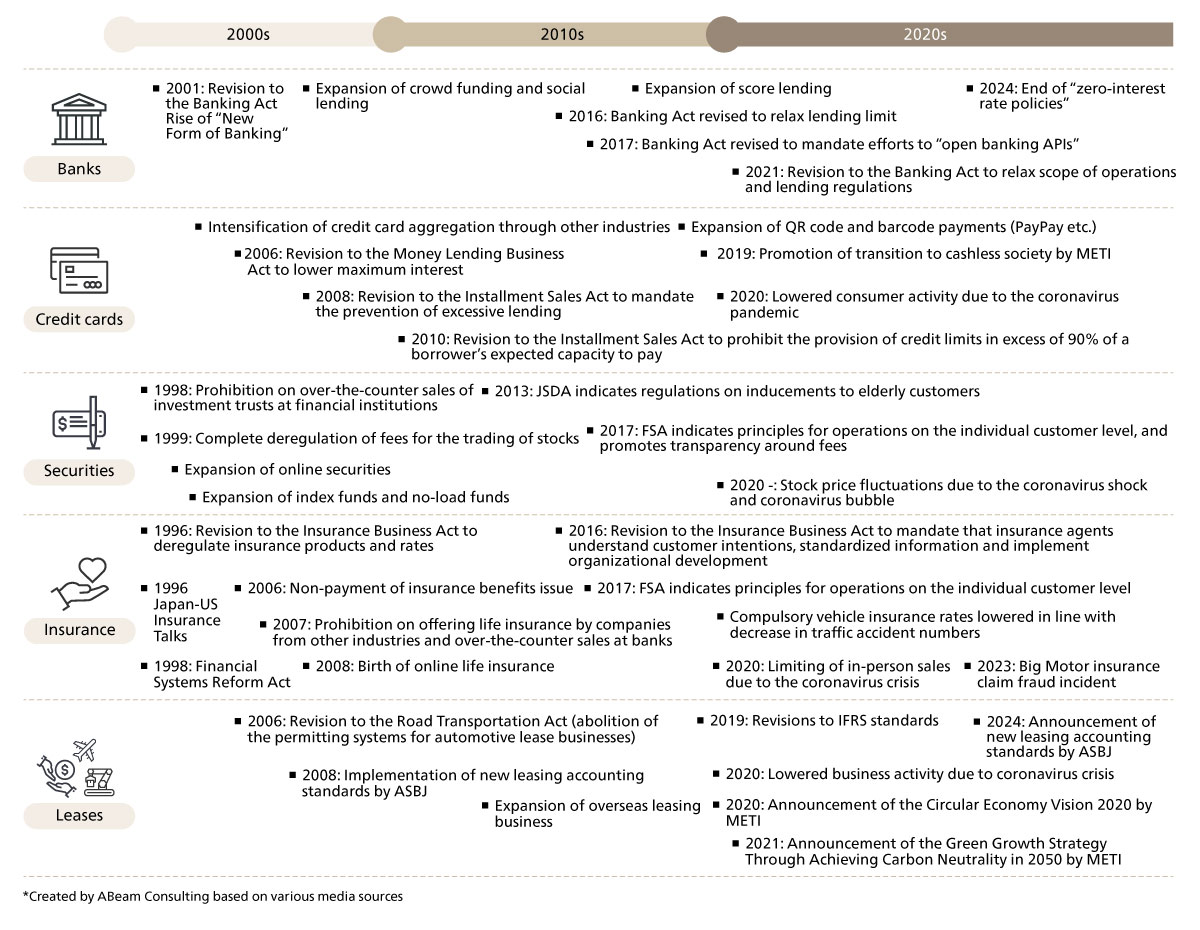

In recent years, since the lifting of zero interest rates, while the financial industry has seen interest spreads trending towards recovery, competition in existing interest spread and fee-based businesses has intensified, thus failing to show anticipated growth. Companies have been heavily impacted by political and economic impacts such as those fiscal policies and legal changes, and by social impacts such as the aging and declining population (see Figure 1). With the advance of entrants from other industries and the appearance of platformers, existing financial businesses have entered a red ocean environment. For example, we have seen an acceleration in trends such as automakers beginning to offer their own automotive insurance by incorporating new insurance sales methods wherein companies provide “insurance” that is bundled in with the products or services they already offer (“embedded insurance”). Automotive insurance is insurance in which car-mounted systems measure driver safety scores and calculate insurance premiums based on those values. This is how insurance companies come to be competing with manufacturers entering their existing businesses.

Figure 1. The changing face of the financial industry

Figure 1. The changing face of the financial industry

On the other hand, changes in the external environment are not purely a cause for despair. Thanks to digitalization currents such as the increasing numbers of digital natives, the advances of the cashless society, the advance of paperless business and the use of AI, even the financial industry is seeing the thorough advance of “streamlining” and “selection and focus” in existing financial businesses. Amidst this market competition, we are seeing more and more cases of companies reassigning the human resources freed up through streamlining away from their existing finance businesses to create new businesses, and, by taking on such challenges, diversifying their businesses.

With that said, as business diversifies and the positioning of customers changes, keeping the customers in view and getting a proper understanding of them becomes ever harder, so the challenges associated with gaining customer insight increase.

To continue being the business of choice for customers, it is important for companies to pursue “customer experience transformation” (“CX transformation”) that hones in on customer needs and offers them new experiences, based on comprehensive customer insights. In other words, it has become necessary for companies to move from a “product-first model” wherein they act on the market from internal causes to a “customer-first model” wherein the focus on customer expectations and the true needs that lay behind those to offer value.

In this Insight, we will begin by covering the points that companies across the finance industry need to address in response to the growing diversification across their industry. We will also present some approaches to realizing CX transformation, after covering some key points in driving CX transformation and some misconceptions companies tend to have around CX transformation.

Changing Demands Coming From Diversifying Businesses/Customers

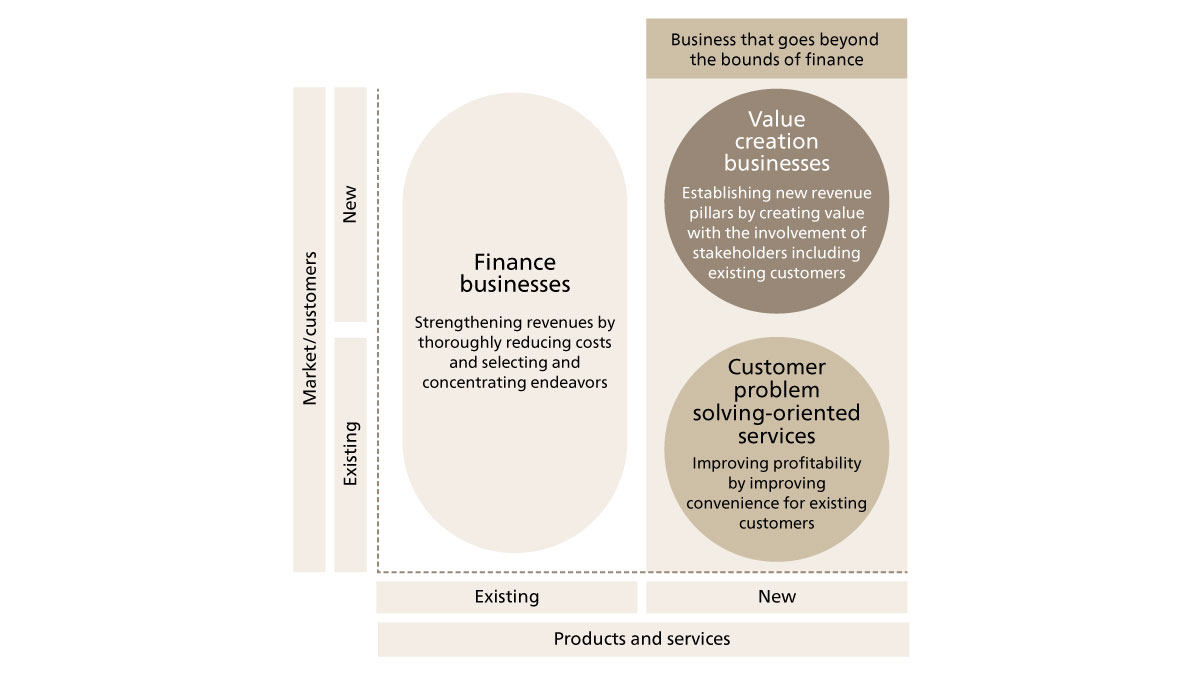

While traditional financial businesses such as lending operations, securities operations and insurance operations will continue to be important foundations, the scope of business in the financial industry is expanding to encompass customer problem solving and value creation-oriented services (see Figure 2).

Figure 2. Directions of diversification in the financial industry

Figure 2. Directions of diversification in the financial industry

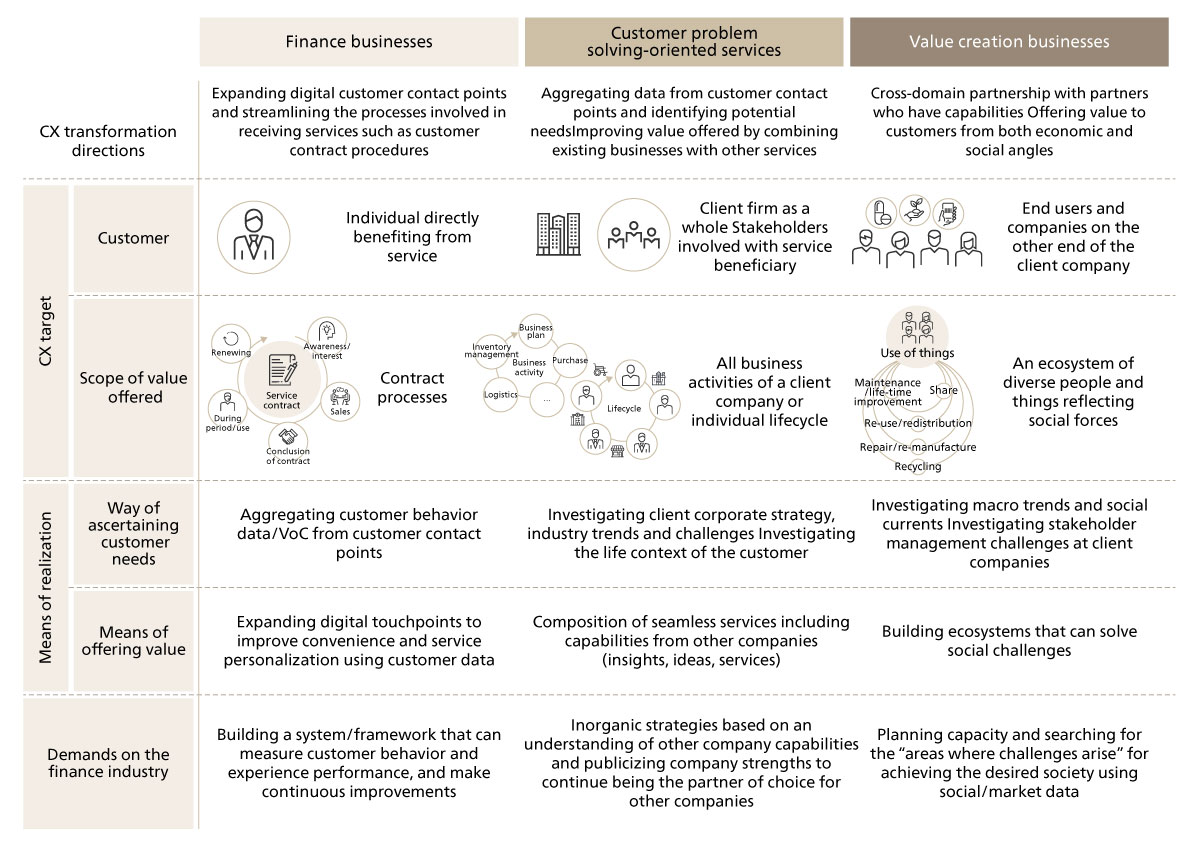

To advance optimization and diversification of each business, companies need to build up new relationships not only with new customers, but also with existing customers. To meet changes in relationships with customers, companies across the financial industry will also inevitably change in terms of the items demanded by customers. We will go over, in detail, the roles that the financial industry is expected to fulfil and the direction of transformation in the industry across the three domains of the finance business, customer problem solving-oriented services and value creation businesses (see Figure 3).

1. Finance businesses

Traditional financial businesses need to strengthen revenues by thoroughly reducing costs and selecting and concentrating their endeavors. As a specific example of a direction for CX transformation, one method could be to personalize the services offered and increase customer satisfaction scores by both streamlining internal operations involved in dealing with customer requests and procedures through establishment of workflows (automation), and using MA (marketing automation) tools to gather customer behavior data and VoC (voice of customer), while expanding digital touchpoints such as portal sites to improve customer convenience. In BtoC (BtoBtoC) businesses, companies can take this a step further into “hyper-personalization,” offering even more relevant customer experiences by leveling up from “personalization” in terms of offering recommendations from basic information such as customer age and past purchasing data, incorporating real-time data such as customer location and local time, then performing advanced analysis using AI. At the same time, in terms of operational streamlining, moves towards introducing “AI agents” that execute specific tasks without human intervention are advancing across companies even beyond BtoC. Thus, to continuously streamline and enhance the already optimized provision of customer experience and operations, companies need to not only introduce digital platforms, but also systems and frameworks for measuring and continuously improving customer experience and employee performance.

2. Customer problem solving-oriented services

Customer problem solving-oriented services, in the context of BtoB businesses, are services that seek to solve problems for customers by identifying not only the needs of managers at client businesses within operational processes, but also potential customer needs across business processes from across the whole client company, and thus offering solutions from even beyond existing products and services. In other words, they are services that seek to catch challenges and trends in client corporate strategy/industries, and use this information to develop and propose new solutions. Likewise, in BtoC businesses, such services pay attention not just to direct customer needs, but also to challenges in the background from across the individual’s lifecycle, proposing solutions to those challenges. While one option for companies is to wait for ideas for solutions to emerge organically from within the company, service development and provision that flexibly incorporates capabilities from other companies (insights, ideas and services) can be effective in solving complex challenges, as is represented by the technological changes seen in the rise of fintech. Going further, to scale up a business, it is also important for companies to be selected as a partner by other companies, which requires them to broadcast their strengths. For example, a bank creating a framework for providing its functions and services as a cloud service via an API (BaaS: Banking as a Service), thus increasing its number of partner companies and so helping it reach customers that would be difficult to access through just its own contact points could be seen as an example of this.

3. Value creation businesses

Customers in value creation businesses encompass not only client companies but also the end users and society on the other end of the client company. To develop businesses to reach those potential customers, companies need to expand their services that provide economic and social value, while partnering across domains with companies that have broader research capabilities and execution approach methodologies to understand macro trends and social currents. In other words, companies need to locate the “areas where challenges arise” together with co-creation partners including client companies and governmental and academic parties, then plan and create frameworks for the society they want to realize, amidst an ecosystem of diverse people and things that reflect social forces. For example, let us suppose that a company aims to help realize a sustainable society, so works with its partners to build an ecosystem and issue green bonds or invest in renewable energy projects, advancing this as a means of generating new commercial opportunities. On top of its existing strengths as a financial institution, such an initiative would require the company to be an organization that can exhibit leadership and planning ability.

Figure 3. Changing demands coming from diversifying businesses and customers

Figure 3. Changing demands coming from diversifying businesses and customers

As we have shown thus far, in the finance industry, just competing on interest rates and fees, and just understanding and meeting the demands of managers at client companies will not be enough for companies to differentiate themselves from their competitors. This will lead to companies needing more and more to enhance and streamline their businesses using digital technology. At the same time, in order for companies to continue to the go-to choice as they deploy new businesses that go beyond the bounds of traditional finance (offering new products and services) to new markets and customers on top of their existing markets and customers, they will need to continuously engage in “CX transformation” in the form of “transforming to a customer-first model” and “selling things and experiences that go beyond the expected value of the customer,” while also making full use of company assets such as data stored up through stakeholders and digital policies.

Key Points to Advance When Pursuing CX Transformation

As the saying “tactics without strategy is the noise before defeat” suggests, for a financial institution to pursue sustained growth requires it to have a strategy as part of its CX transformation.

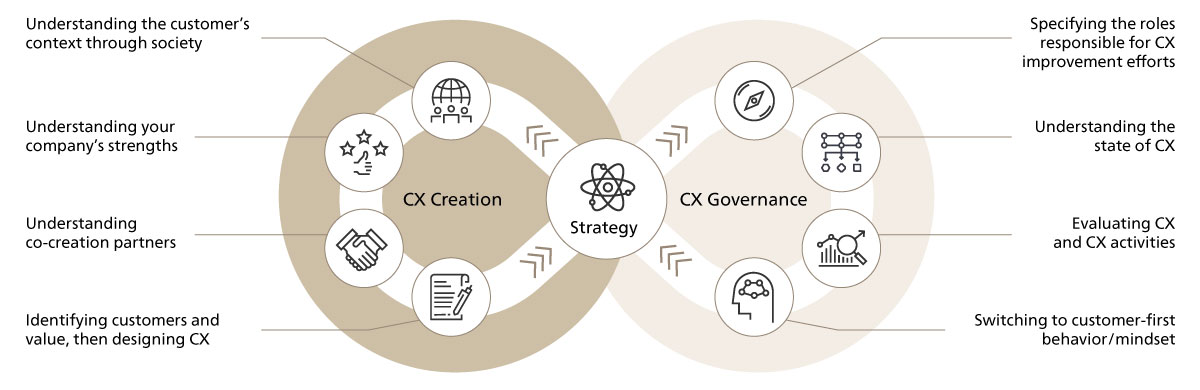

One key point companies need to bear in mind in order to “transform to a customer-first model” and sustain a process of “selling things and experiences that go beyond the expected value of the customer” is that they will need to formulate a CX strategy (the strategy involved in CX transformation efforts), and then make CX creation (designing customer experiences based on continuous insights into customers gained through provision of customer experiences) and CX governance (constant self-transformation through the execution and testing of business activities based on customer insights) function effectively (see Figure 4).

CX Strategy: Clarifies the relationship between improving customer experience value and corporate growth, pointing to customer-first policies

CX Creation: Designing customer experiences based on continuous insights into the customer gained through provision of customer experiences

-

①

Understanding the customer’s context through society

Understanding the situation the customer finds themselves in, and the mission or values they want to realize -

②

Understanding your company’s strengths

Understanding the strengths or capabilities of your company that can play a role in the customer’s context -

③

Understanding co-creation partners

Understanding co-creation partner capabilities and the business’s value chain -

④

Identifying customers and value, and designing CX

What value can your business provide to which customers through the insights gained through understanding the customer, and through your company’s services

Formulating a hypothesis

CX Governance (CX Management): Consistently self-transforming by executing and testing business activities based on customer insights

-

①

Specifying the roles responsible for CX improvement efforts

Indicating achievement targets for CX improvement and where responsibility for those lies in the same way was for business strategy -

②

Understanding the state of CX

Aggregating information coming from CX processes to understand the effectiveness of CX improvements -

③

Evaluating CX and CX activities

Considering catch-up measures for where there is distance to targets and evaluating CX improvement activities themselves -

④

Switching to customer-first behavior/mindset

Building up behavior patterns/culture to transform business activities based on customer voices, and establishing customer-first roots

In general, when discussing CX transformation, the focus tends to go on CX creation. There is also often a tendency to equate CX solely with just digitalizing customer contact points. However, CX transformation is a key mission tied into the action policies of companies across the financial industry. If those activities are not constantly operated, evaluated and improved in a suitable manner based on a clear company strategy, companies will not be able to keep up with the constantly changing needs of customers. The finance industry also needs to follow strict regulations and compliance/security requirements. This means that companies need to design CX policies based on said regulations, making the hurdles needed to clear here high. If companies just execute individual policies per individual department, such as a sales department, or per individual financial product, in a siloed-off manner, they will not be able to keep up with the true needs of customers. And while digitalization itself is an effective tool, it is ultimately just a tool. It is thus essential for companies to keep engaging in both CX creation activities and building up CX governance.

Figure 4. Key points to advance when pursuing CX transformation

Figure 4. Key points to advance when pursuing CX transformation

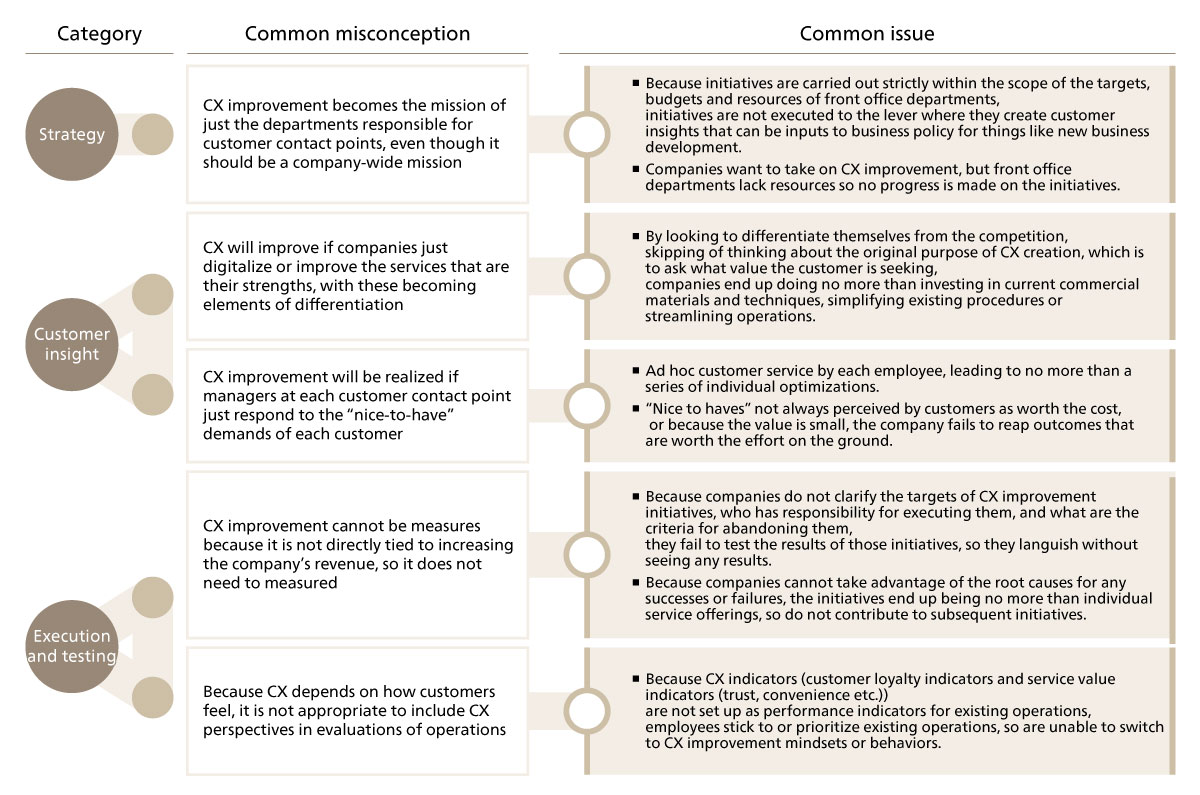

Common Misconceptions and Issues That Arise in CX Transformation Efforts

The finance industry is faced with the need to deal with a situation wherein “customers” and “value offered” are diverse and fluid. Thus, even though companies across the industry are advancing such initiatives, misconceptions over who should take the lead on CX transformation and what means should be used to achieve it can lead to companies losing sight of the true purpose of CX transformation and failing to convert it into a driving force for corporate growth. Here we can see some of the misconceptions and issues that companies are apt to fall into in pursuing CX transformation initiatives (see Figure 5).

-

CX Strategy: Misconceptions and Issues in Strategy

-

Even though CX transformation and CX improvement should be a “mission considered on the company-wide level,” companies often fall into the trap of thinking of these as “missions just for the front office departments (sales and customer service),” leading to frequent misconceptions about the scope for which strategy should be formed. Initiatives being carried out within the scope of the goals, budgets and resources of front office departments will, for this reason, make these initiatives too localized, rendering the company unable to offer customers a joined-up experience. This can also lead to companies struggling to arrive at the customer insights needed as inputs to business policy when looking at things like new business development.

-

-

CX Creation: Misconceptions and Issues in Customer Insights

-

Companies often fall into the trap of thinking that if they seek to differentiate themselves by digitalizing their customer contact points and improving their services, their CX will improve. By looking to differentiate themselves from the competition ahead of thinking about the original purpose of CX creation, which is to ask what value the customer is seeking, companies end up doing no more than investing in current commercial materials and techniques or streamlining operations.

-

Companies often fall into the trap of thinking that if each sales manager meets the demands of each customer, then CX improvement will be achieved. This leads to ad hoc customer service, which will be no more than a series of individual optimizations.

-

-

CX Governance: Misconceptions and Issues in Execution and Testing

-

Companies often have the misconception that because CX improvement is not directly tied to improving the company’s bottom line, it does not need to be evaluated. For this reason, we often see companies proceed without clearly establishing the goals of initiatives, who has responsibility for executing them, and the criteria for abandoning them. As a result, the results of initiatives are never tested, leading companies to continue seeing no outcomes from the process. This also makes them unable to take advantage of the root causes of any successes or failures, so do not contribute to subsequent initiatives.

-

Companies often mistakenly believe that because CX depends on the feelings of customers, it is not appropriate to include CX perspectives in evaluations of operations. Because CX indicators are not set performance indicators for current operations, employees prioritize existing operations and are unable to switch over to CX improvement mindsets or behaviors.

-

Figure 5. Common misconceptions and issues in CX transformation initiatives

Figure 5. Common misconceptions and issues in CX transformation initiatives

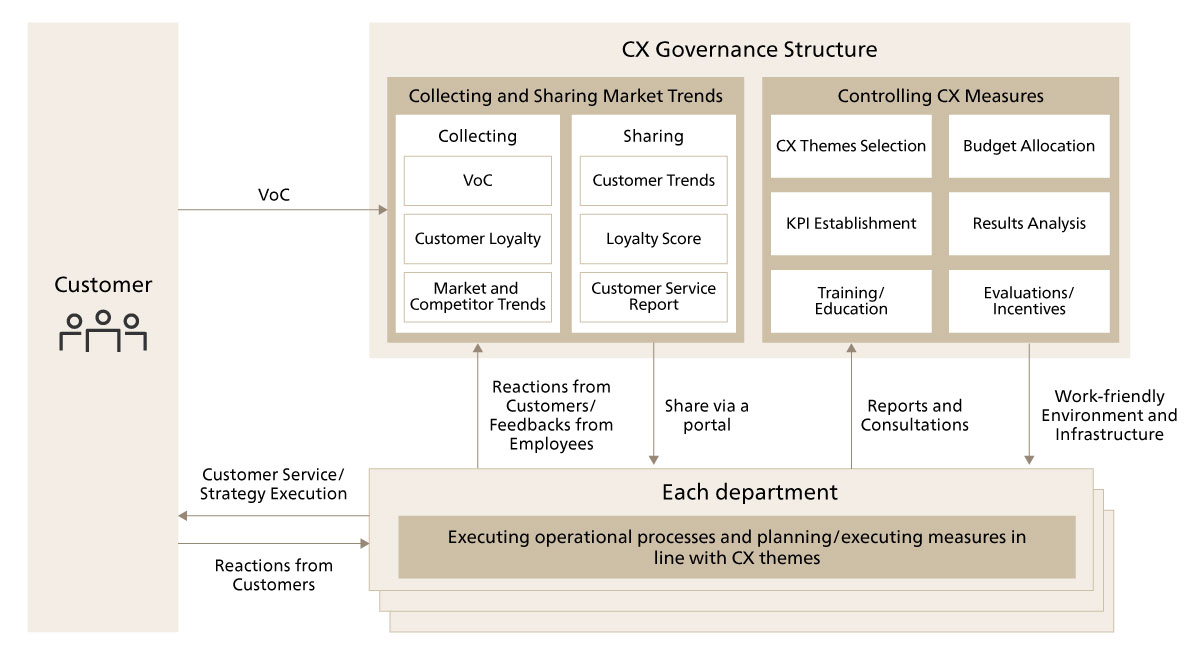

ABeam Consulting’s Approach to Realizing CX Transformation

In this Insight, we have stated that it is important for strategy, creation and governance to function by forming a trinity in driving CX transformation. Among these, it would be fair to say that CX governance is an especially important element in continuously carrying out CX transformation. The specific functions of CX governance are: (1) deciding CX themes, (2) supporting measures planned and executed by each department, (3) making an easy-to-work-in environment on the ground and (4) overseeing the PDCA cycle for evaluating and testing company-wide CX strategy. It is necessary for companies to establish this as a company-wide organization, and not something that is siloed off in each department (see Figure 6).

Figure 6. The role of the CX governance promotion organization

Figure 6. The role of the CX governance promotion organization

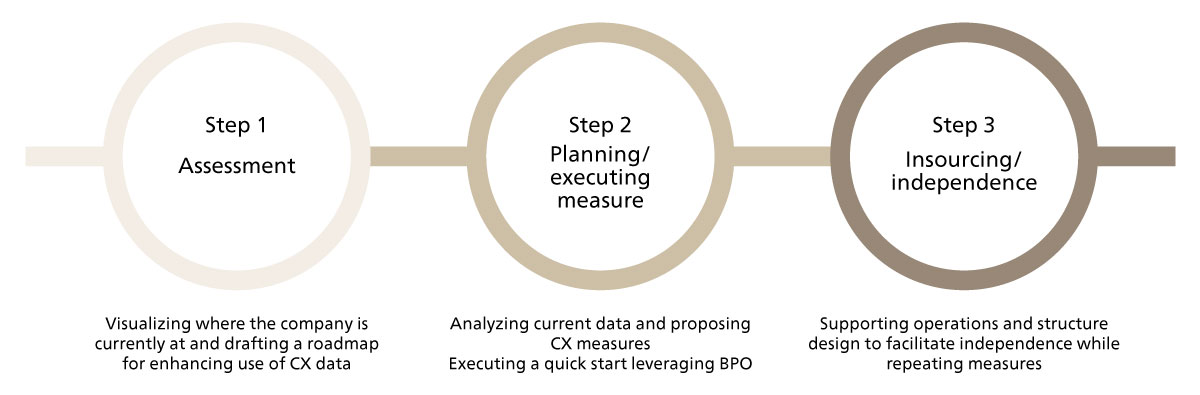

On the other hand, securing the necessary human resources, putting in place infrastructure such as a data utilization platform and developing (the skills of) personnel who can use the latest digital technology forms a bottleneck. As building a CX governance framework will foreseeably take time, companies may miss out on commercial opportunities in launching various CX measures as they build these organizations, personnel and environments, amidst a business environment defined by rapid changes to the status quo.

In this context, ABeam Consulting recommends an approach in which companies execute on measures by making use of outsourcing for the personnel (in terms of resources and skills) and digital platforms that form a bottleneck, then build internal organizations as operations regularize. We are able to offer companies consulting services and BPO services, supporting execution of CX measures in line with client conditions through a combination of those approaches. Companies can rapidly trial the process of considering, executing, testing the outcomes of and improving CX measures using our BPO services, which take advantage of ABeam human and systems resources to supplement or substitute client capabilities, in line with where client capabilities are currently at (in terms of resources, skills and digital platforms). By trialing creation (design) and governance (execution and testing), companies can establish their operations model for CX measures. ABeam then supports clients in building their own organizations in relation to the measures that produce results. The key feature of this approach is that allows clients to move forward while quickly carrying out tests and enjoying results, while keeping the building of independent organizations in view and avoiding wasting client resources. ABeam helps clients build organizations by both returning the insights gained through the BPO process to clients, and by supporting the transition to independence through operations and organizational structure design that takes into account corporate challenges such as making use of older generations of workers (see Figure 7).

Figure 7: ABeam Consulting’s approach to realizing CX

Figure 7: ABeam Consulting’s approach to realizing CX

Summary

For companies across the finance industry to optimize and diversify their businesses to meet the challenges of a dynamic external environment, they need to carry out continuous CX transformation to reform the value and processes they offer into even better offerings, by keeping up with the diverse and fluid customer needs that their businesses are faced with.

However, at many organizations, CX transformation is mistakenly viewed in terms of initiatives carried out on the level of individuals or single departments, limiting the impacts to merely localized outcomes. Companies therefore need to position CX transformation as a mission considered on the company-wide level, building frameworks for measuring customer behavior and tying this to employee operational performance so that all employees can act with a focus on the customer.

At ABeam Consulting, we believe that CX transformation is more than just a single policy. Instead, it is important to advance it in a comprehensive and end-to-end manner from the three phases of CX strategy, CX creation and CX governance. We offer comprehensive services all the way from formulating CX strategy, through side-by-side support for CX creation, through to building structures, systems and processes for realizing CX governance. Going forward, we will continue to support our clients in realizing rapid CX transformation by offering holistic services that combine the personnel, knowledge and systems environments that our clients demand.

Click here for inquiries and consultations