Cashless payments have spread rapidly in Japan. PayPay, the main player in the market, has cleared 65 million registered users. Some among the credit card companies and electronic money providers that have established payments businesses already have raised concerns, however, that their revenues may deteriorate as transaction fees fall. The process of payments businesses going cashless, which from the point of view of general consumers has only just begun to spread, still has many payments markets where there is scope for further development.

In this insight, we will look at the latest trends in cashless payments and present three new payments markets where we can expect growth going forward.

The Three New Markets Where Cashless Payments Providers Should Advance: Looking Beyond Embedded Finance

- Retail/Distribution

- Banking/Capital Markets

- New Business Development

- Marketing, Sales, and Customer Service

The growth of code payments and an increased focus on in-house cashless payments

In recent times, consumers have been able to choose a variety of code payment options at checkouts in stores. Many of you are likely to have personally encountered the rapid progress of this technology. Code payments allow users to pay simply by verifying a QR code or barcode from the smartphone or other device. The convenience this affords and the attractiveness of the points these systems offer have led to growth in users.

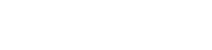

As of the end of December 2023, the number of cashless payments overall domestically in Japan is around 34.3 billion, of which some 9.4 billion are code payments (see figure 1). In 2022, code payments overtook the number of payments processed using electronic money. Code payments are on track to catch up to credit payments, around 17.9 billion payments, in a few more years.

Figure 1. Trends in Cashless Payment Transactions

Figure 1. Trends in Cashless Payment Transactions

The main player in this rapid spread of code payments has been PayPay. At present, the company has over 65 million registered users (as of August 10, 2024). Since launching its business in 2018, PayPay had continued to charge zero merchant fees, but from 2021 began collecting a 1.6% rate. This rate is around half of the rates prevalent among credit card companies or electronic money payment providers, which tend to be in the 2.5-3.0% range, so, combined with the government’s promotion of cashless payments, it has been one of the major driving forces of the downward competition in merchant fees in the domestic Japanese cashless payments market.

Meanwhile, this downward competition may lead to a deterioration in revenues for the credit card companies and electronic money providers that have already established themselves, leading these businesses to search for new business models. Amidst this context, there is an increased focus on new models such as “in-house cashless payments,” in which non-financial companies set up payment services under their own brands, and “embedded finance.”

Diverse platform registration in line with in-house cashless payments

In-house cashless payments refer to payment services set up by non-financial companies under their own brands functioning on their own apps, and which can only be used at group stores, such as, for example, “ANA Pay” from the airline ANA Group. In contrast to generic cashless payment services that can be used across stores from various industries such as PayPay, such services are confined within the group, which is why they are termed “in-house.” In-house cashless payments are limited in the scope of their usage to stores within a particular group, so they can have forms of interoperability such as being able to be charged from in-house points programs. This creates an enclosure effect, increasing value per customer and the frequency with which customers patronize group businesses.

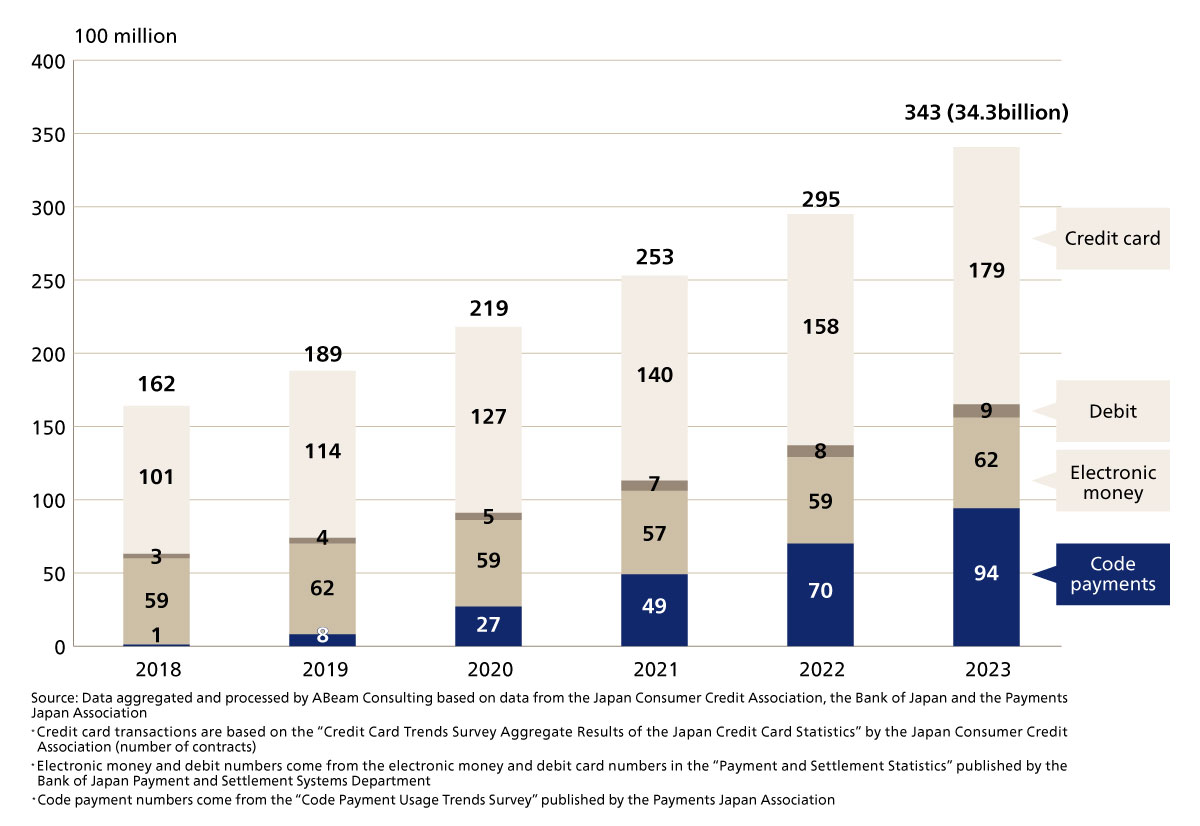

With such in-house cashless payments, companies typically use platforms built on the cloud by credit card or other companies rather than building and implementing systems themselves from scratch, allowing them to speedily stand up payments services. Compared to building systems themselves, this approach comes with less risk of system faults or fraud. While the non-financial company is deploying the payment service under their own brand on the surface, behind the scenes, a financial company, such as a credit card company, serves as the platform providing the payment functions. In such a scenario, there will be a framework in which the company pays part of the transaction fees it receives to the financial company. The business upside for the non-financial company is that it is able to enter the payments business without making a large-scale investment into its systems. Such a business model is referred to as “embedded finance,” and has garnered increasing attention as a new kind of business model.

Amidst this context, financial companies, such as credit card companies, have targeted an increase in partnerships with non-financial companies, developing and releasing platforms that leverage the specific characteristics of each kind of company (figure 2).

Figure 2. Overview of In-house Cashless Payments and Platforms

Figure 2. Overview of In-house Cashless Payments and Platforms

The in-house cashless payments and embedded finance models presented here are part of the domestic Japanese CtoB payments market, which is characterized by its jumble of different payment methods, and form one way for companies to insert themselves into a market already saturated with players. However, as transaction fees are predicted to fall further going forward, credit card and other companies are in no position to let up in their efforts to find and pioneer new payments markets oriented towards the future.

Three new payments markets expected to grow going forward

Through our experience partnering with various financial and non-financial clients, ABeam Consulting has identified the following three areas as new payments markets to explore and develop in a digitalizing society. We hope that this proves useful to companies looking into cashless payments-related business, such as companies considering adopting embedded finance, credit card companies, electronic money providers and code payments providers.

(1) Digitalization of corporate payments

As previously stated, the CtoB cashless payments market for domestic Japanese consumer payments is saturated. The BtoB domain, however, still has significant scope for going cashless. According to American Express International’s “BtoB Payments White Paper 2022,” the cashless payments ratio for BtoB payments remains just 12.5%, with many companies continuing to use bank transfers as a traditional business custom. Traditional bank transfers come with various burdens on business in terms of work associated with payments operations, such as credit checking operations on new transaction partners, and checking the effects on cash flow and financing when executing payments. For example, by embedding the credit functions of a credit card into a non-financial company’s services, new measures to improve financing can be expected.

(2) Digitalization of global e-commerce payments

There has been an increase in services allowing for transactions across borders, termed “cross-border e-commerce.” Emerging companies such as Shopify (Canada) have appeared, while there has also been an increase in digital services that allow domestic sole proprietors and small to medium-sized companies to both sell products in overseas markets and import products from overseas to sell domestically. Going forward, we expect there to be demand for support for sole proprietors and small to medium-sized companies that want to engage in cross-border e-commerce. We also anticipate the emergence of unique cross-border e-commerce platforms across a variety of industries.

(3) Digitalization of loan, installment payment and warranty services

CtoB consumer-focused cashless payments is a narrow-margin, high-turnover fee business for cashless payments providers. With fees continuing to fall as described above, we anticipate greater focus being placed on interest businesses as a new stream of revenue. For example, embedding individual lending functions that credit card and other companies have into the core businesses of non-financial companies so that individuals to make high-cost payments, on things such as medical expenses, furniture and white goods, travel or real estate, in installments or for no upfront cost, can allow those non-financial companies to capture new customer demographics. Lending, installment payment and warranty services generally carry a negative image among many consumers as forms of “borrowing money,” so it is important to think carefully about UX/UI presentation in smartphone apps and on websites and the timing of promotion notifications to counter this image.

ABeam Consulting services for embedded finance

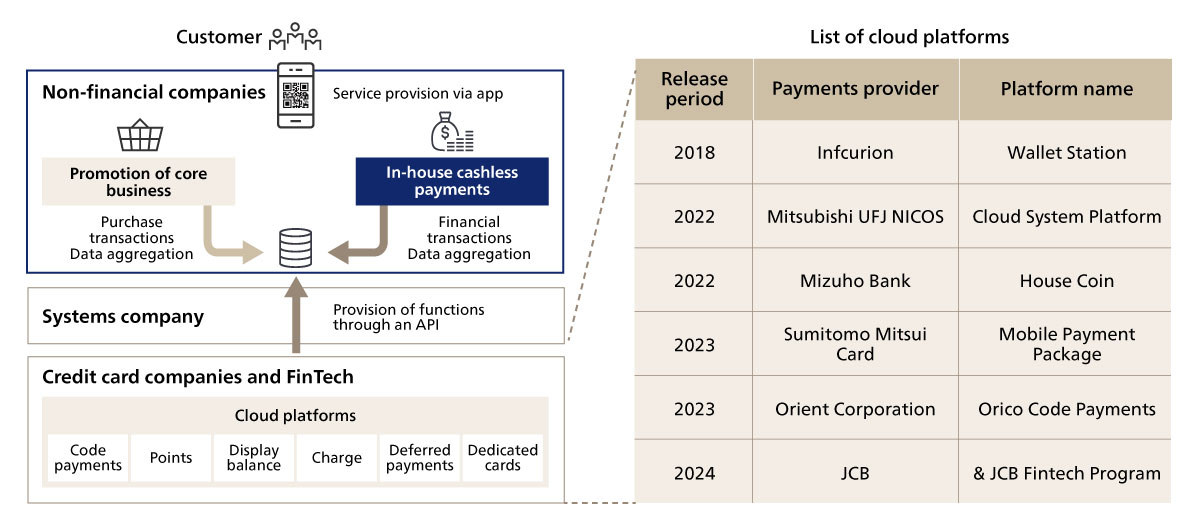

ABeam Consulting offers a range of consultation services, including planning, research and negotiation support services to facilitate the provision of financial functions and operational know-how from financial institutions to non-financial companies, with the aim of allowing companies to develop new cashless payments and embedded finance markets (figure 3). Leveraging our global network, we provide services not only in Japan but also globally, without compromising on the levels of quality expected domestically.

If you are in the finance industry and looking into developing new cashless payments or embedded finance markets, please feel free to reach out.

Figure 3. ABeam Consulting’s Service Provision Structure

Figure 3. ABeam Consulting’s Service Provision Structure

Click here for inquiries and consultations