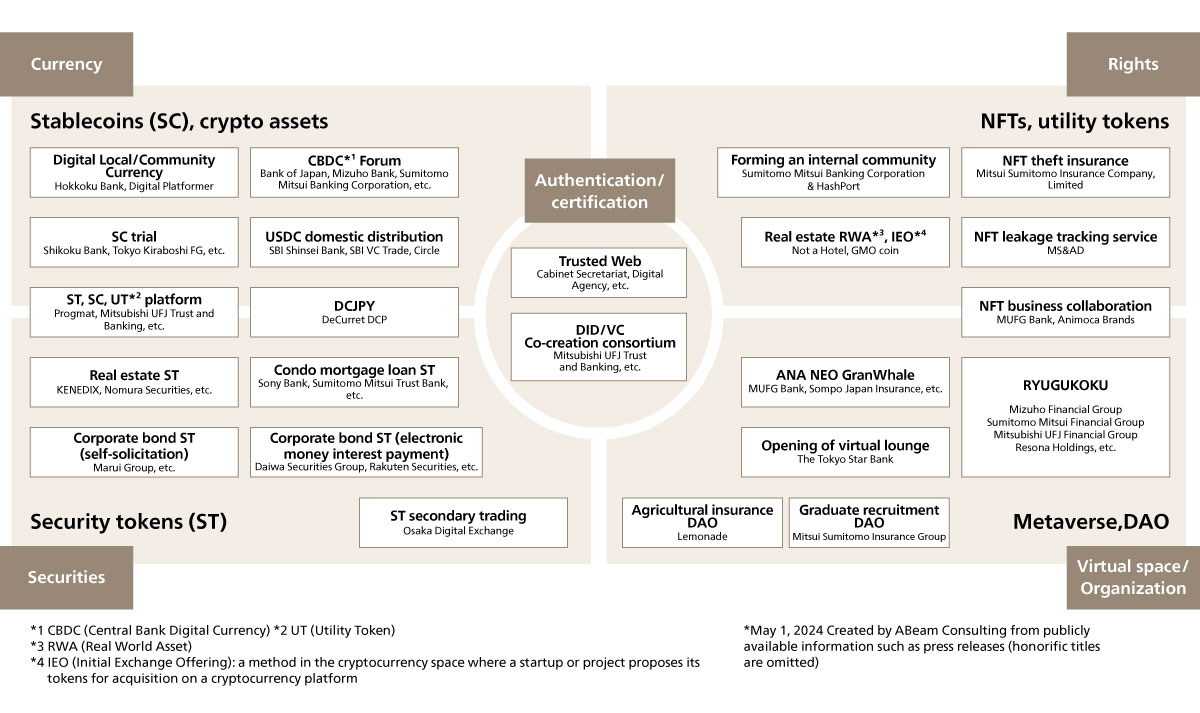

Although things like fluctuations in crypto assets are currently making headlines, in the medium- to long-term, it is said that Web3 will steadily embed itself within our society. For example, an increase in the following cases has been witnessed at financial institutions, too. To a certain degree, we can see a cycle where legal regulations are revised based on technical developments, sparking more and more business opportunities.

Web3 Planning and Implementation Support Service for Financial Institutions

Enhancing financial operations by incorporating stablecoins, security tokens, NFTs, decentralized identities, and more

Background

What should financial institutions do before Web3 becomes the norm?

Blockchain-based digital technologies, known as Web3, are also increasing at financial institutions. Web3 infrastructure is also advancing in terms of political policy. This is evident from a statement by the Web3 Project Team of the LDP Headquarters for the Promotion of a Digital Society, Policy Research Council, which declared to make Japan the center of Web3.

We receive many inquiries about Web3 service planning from financial institutions. Our client's concerns range from 'We don't know where to start' to 'We're having difficulty selecting use cases and aligning them with our existing business' and 'We're uncertain if our implementation method is optimal.'

ABeam Consulting offers Web3, a support service for financial institutions. We help plan services and facilitate projects focused on Web3 technologies, such as stablecoins, security tokens, decentralized Identifiers, and NFTs.

Case study of “Finance × Web3”

Challenges

Why “Finance × Web3” projects are difficult

Projects that utilize Web3 technologies at financial institutions will sometimes encounter challenges. While there are various reasons for this, here are some typical examples.

-

There are diverse perceptions of what Web3 is, making it difficult to get a shared understanding. For example, if Web3 is “a state of decentralization and the removal of central authority,” financial institutions, which often tend to act as central authorities, may find it difficult to interpret their role.

-

The necessity of financial institutions will be lost if Web3 solutions progress. Web3 is only a means and not an end, and therefore, pursuing an objective to be achieved is important. Thus, it is vital, for example, to examine things from the perspective of whether it is a use case that can be applied in one’s economic zone.

-

It is necessary to ensure feasibility from various perspectives. Various skills and resources are required, such as technical knowledge about Web3, legal knowledge about financial regulations, knowledge about one’s business and systems, and the ability to push forward to their launch.

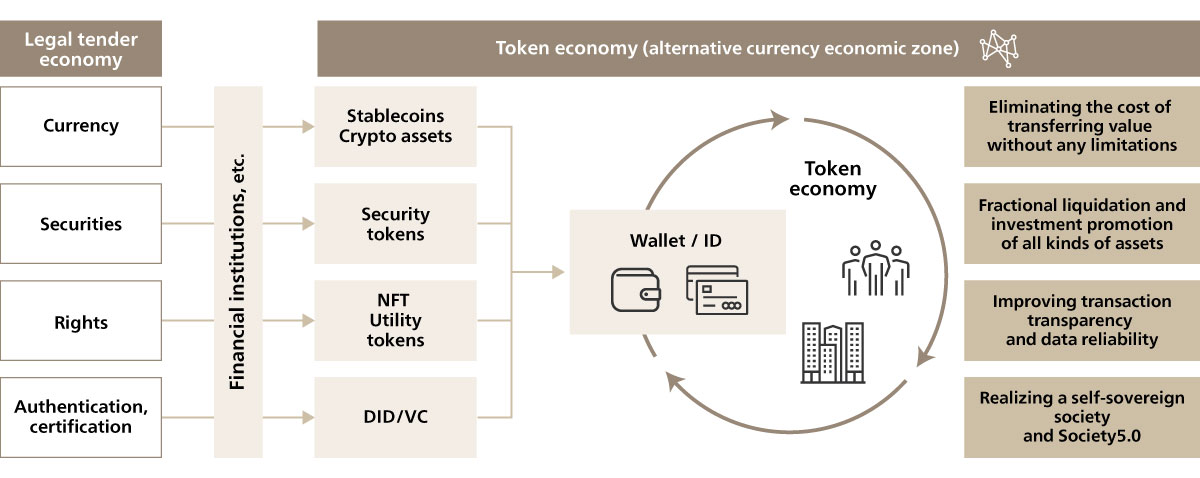

A future created with “Finance × Web3”

Web3 is described as the “internet of value.” It is an ideal-type platform that is innovative in that it allows value to be exchanged reliably with anyone at almost zero cost. That is why creating a token economy with Web3 technologies has become a subject of consideration.

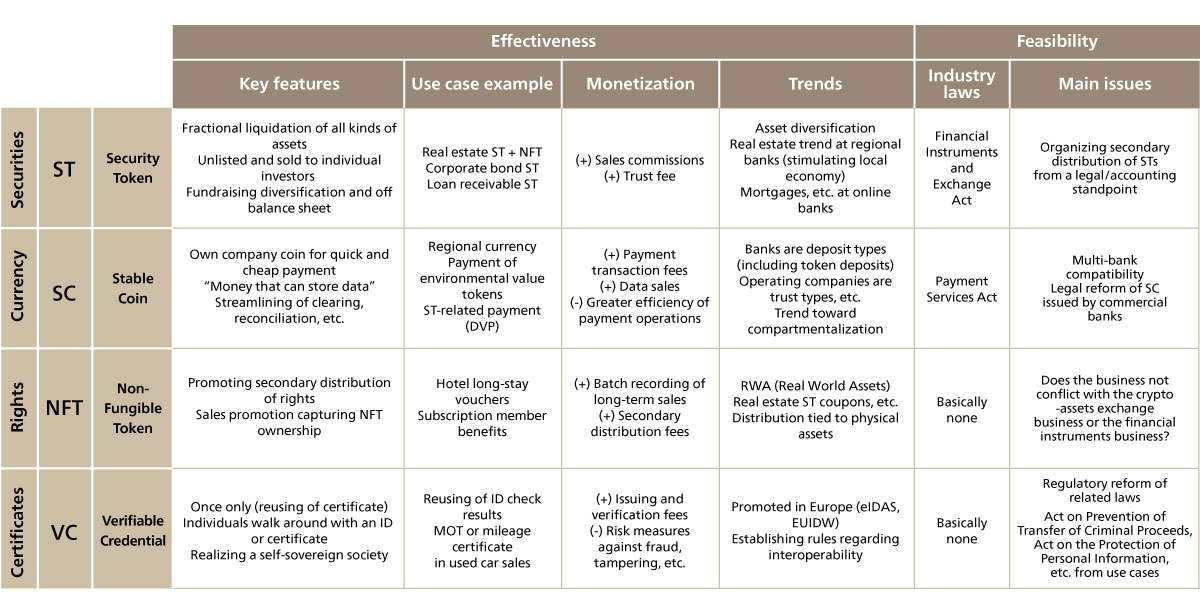

Technologies such as stablecoins (payment tokens) as a currency/payment method, security tokens as securitization/liquidation of assets, or decentralized identifiers (DID) and verifiable credentials (VC) as an authentication/certification means are highly compatible and have a strong affinity with existing financial services.

What’s more, Web3 technologies have the potential to transform into a more cost-effective, faster, and highly reliable service. There is great expectation of enhancing finance in anticipation of creating a token economy as a “new economic zone.”

The technical elements of Web3 each have characteristics, such as monetization points and related legislation. For example, while Web3 technologies can be organized as follows, it is essential to scrutinize them from the perspectives of effectiveness and feasibility.

Approach

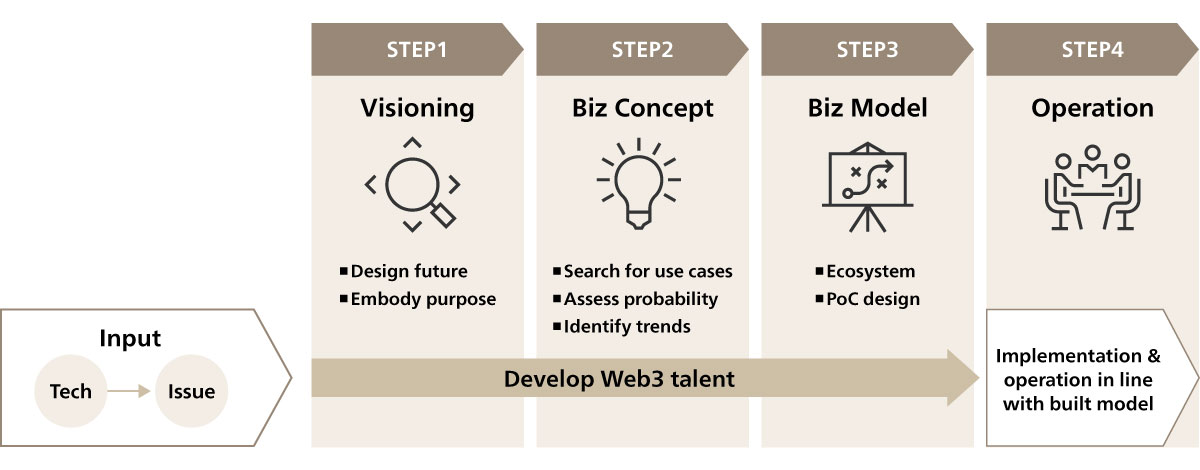

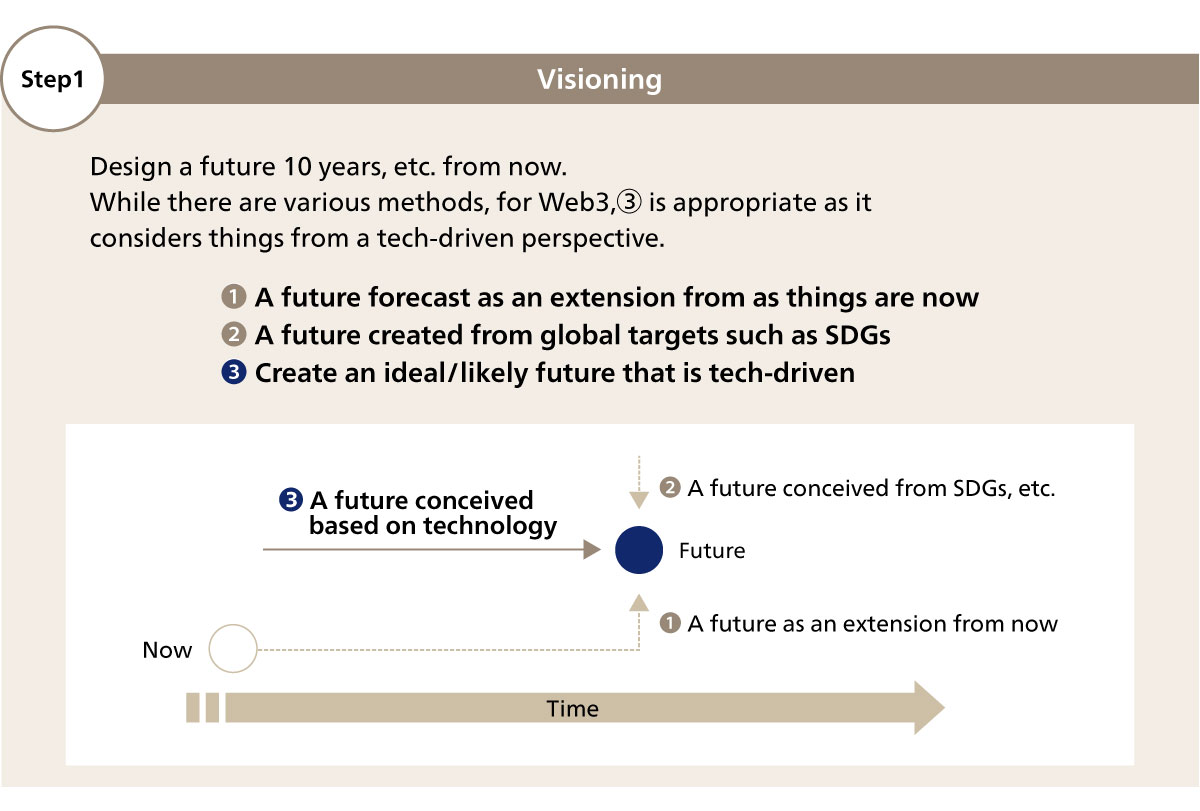

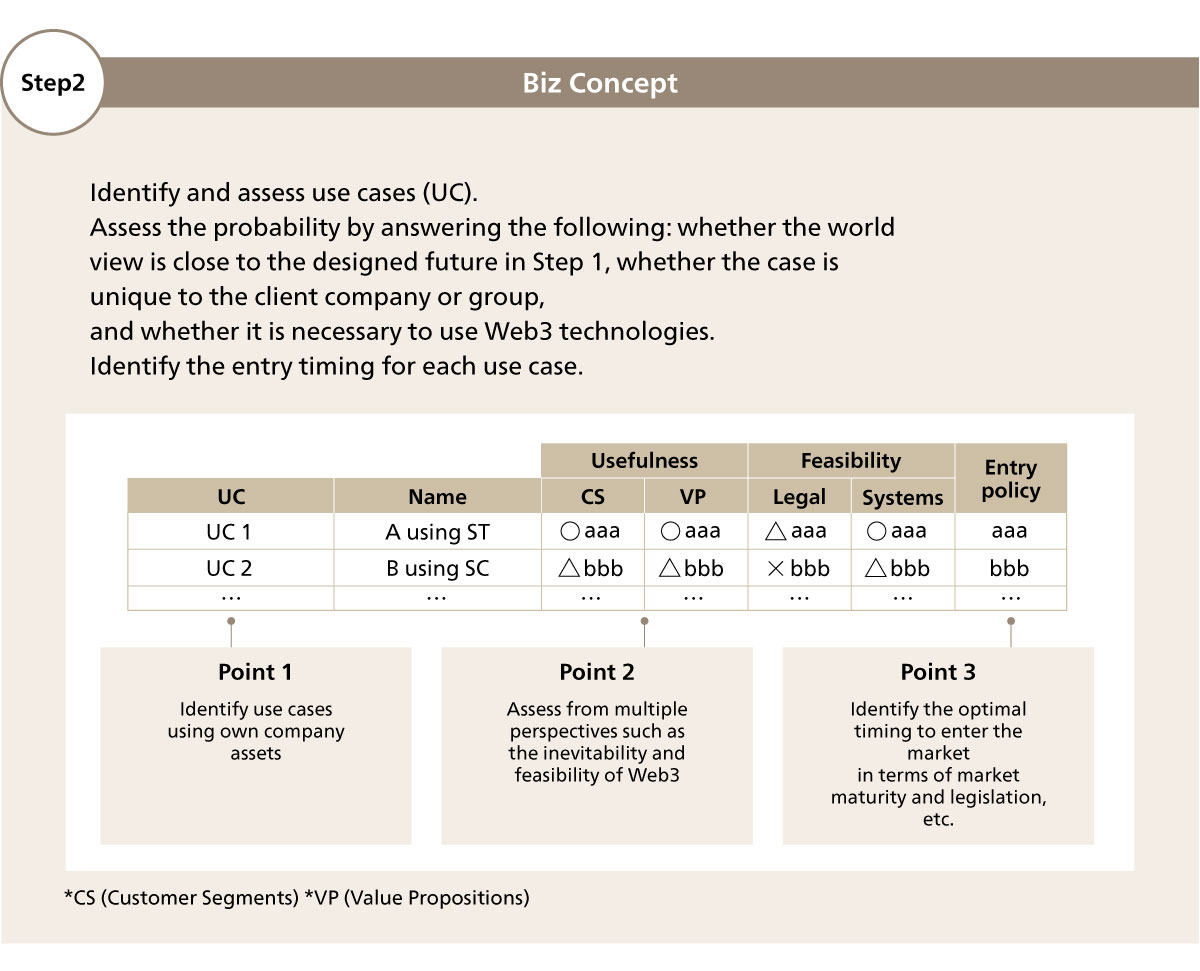

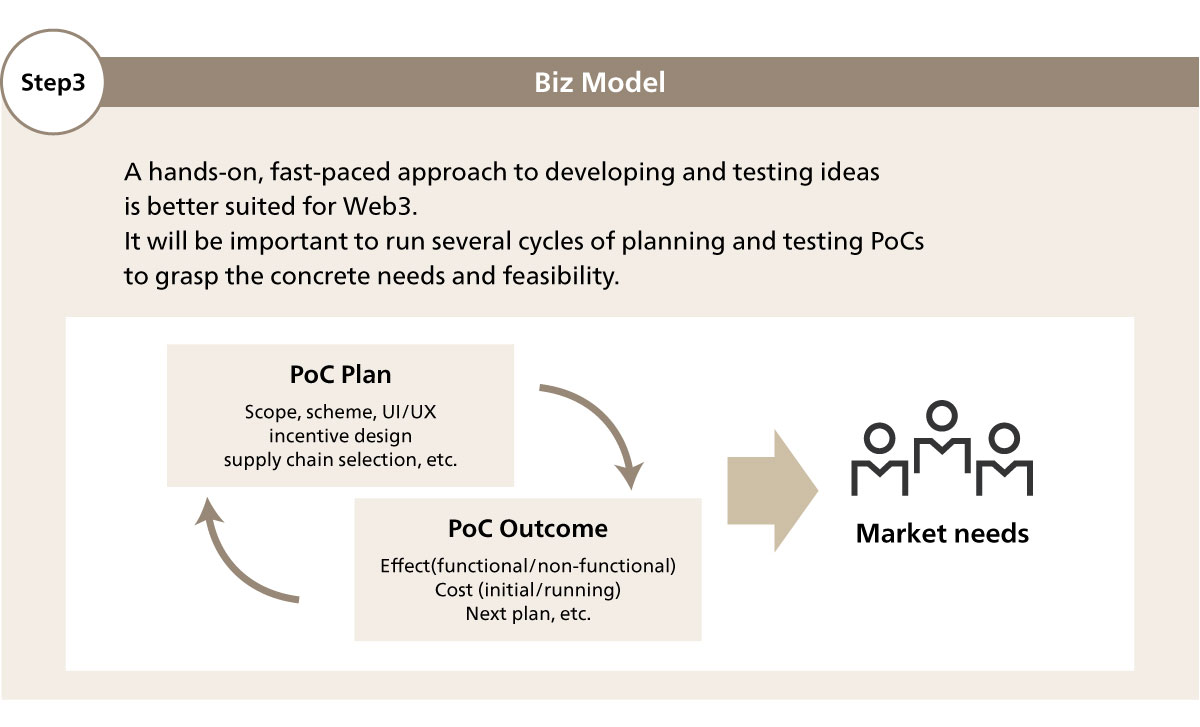

ABeam Consulting offers a Web3 Planning and Implementation Support Service for financial institutions. ABeam Consulting provides comprehensive assistance throughout the following processes: envisioning a future created by the token economy, the business concept process for identifying use cases, the business model process for developing schemes and validation, and the operational process for implementation and management.

Features of ABeam Consulting

ABeam Consulting’s Web3 Planning and Implementation Support Service for financial institutions has three main features.

-

Leveraging our wealth of knowledge and experience in Web3 finance, we can quickly examine a business plan by developing highly effective use cases tailored to the client’s business environment and estimating possible revenue

-

Appropriately utilizing our alliance partners with Web3 solutions, we can build the optimal framework from a business/legal/technology perspective

-

Based on the current admin and system properties at financial institutions, we can help bring to life services by working side-by-side with our clients

-

Key feature (1)

Quick initial examination utilizing Web3 knowledge and track record---------------------------------------------

-

Key feature (2)

Alliance management to build the optimal framework---------------------------------------------

-

Key feature (3)

Side-by-side implementation support based on the business operations/systems of financial institutions---------------------------------------------

Click here for inquiries and consultations