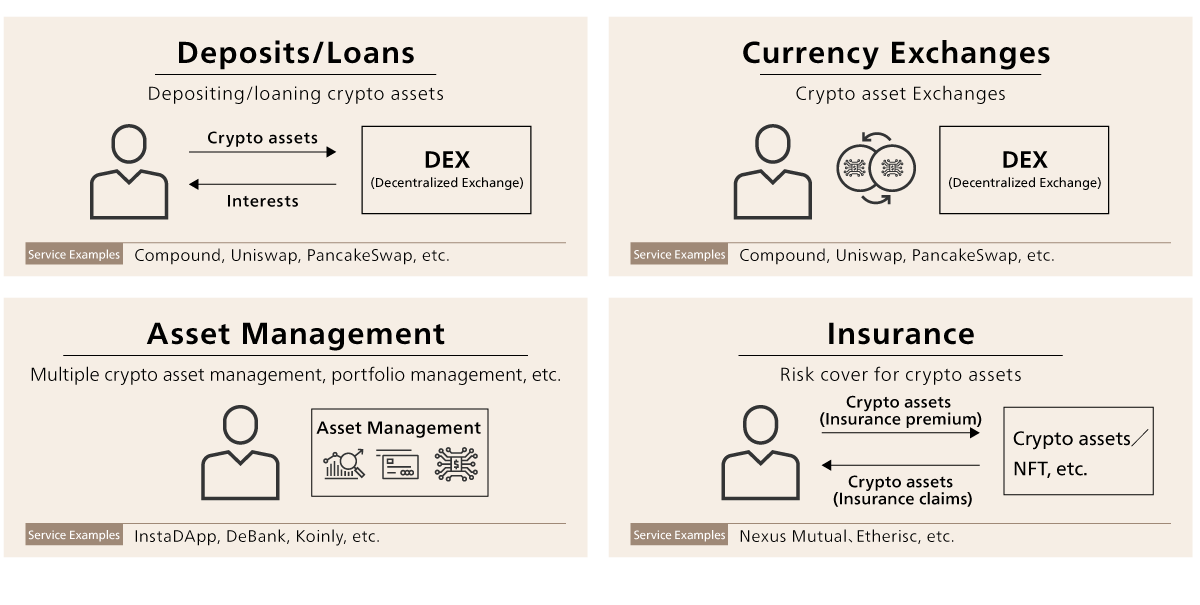

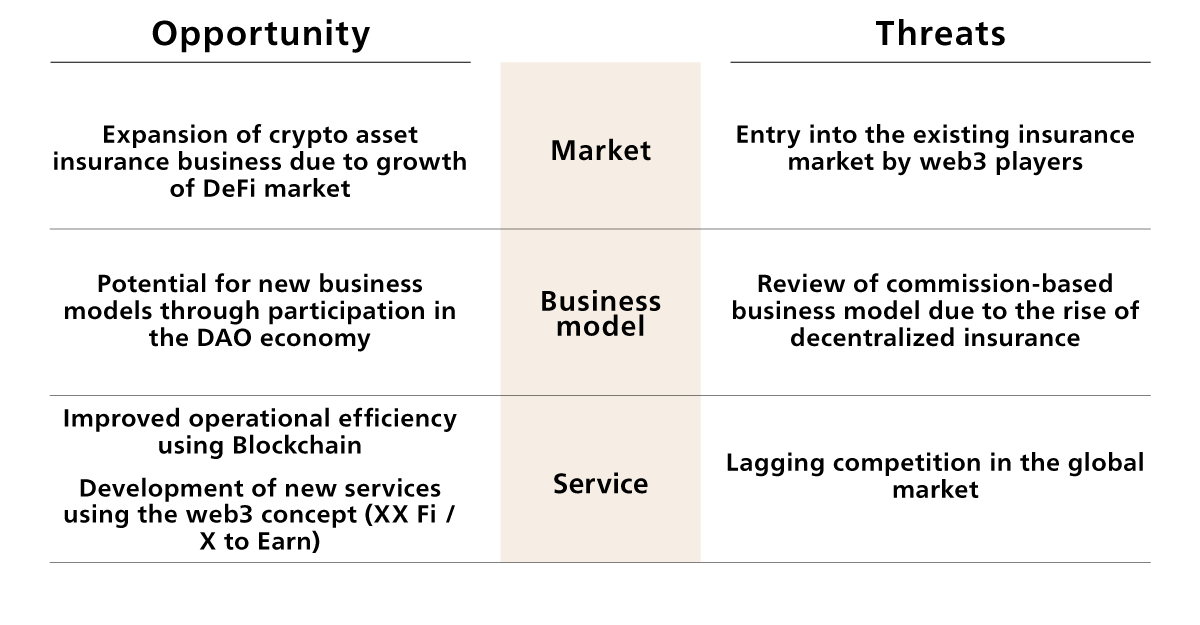

Attracting great public attention, web3 and DeFi present great opportunities and, at the same time, threats. Finally, we discuss what insurance companies should do to cope with web3 and DeFi movement.

Given the current state of various systems and laws, it is not easy for insurers to enter the "business to cover assets on DeFi." Therefore, we believe that insurance companies need to take the first step to "learn" about DeFi insurance from a medium-term perspective by researching advanced cases and protocols, as well as participating in DAOs.

In addition, we believe that from a short-term perspective, insurance companies can develop new services based on the web3 concept. For example, we refer to "STEPN*7" from the Move to Earn project, a GameFi, one of the web3 use cases, related to health and longevity risks.

STEPN is a blockchain game in which users can earn crypto assets by buying NFT sneakers, putting them on the app, and running or walking. Ten minutes of exercise daily can make the equivalent of several hundred yen in crypto assets. As a result, the game has changed behavior among home workers who rarely go out or users who had not been in the habit of exercising.

The incentives that cause these behavioral changes have two design aspects: economic value and social contribution value. The former is economic value design based on Tokenomics (token economy)*8with crypto assets. The latter is social value design by the game operator, which promises from the beginning of the service launch to allocate a portion of game revenues to purchase carbon credits for carbon neutrality.*9

Finally, by utilizing the web3 mechanism and technology, we can increase customer contacts, urge people to change their behavior in ways that could not be achieved with the traditional insurance, and develop services to solve social issues.

ABeam Consulting is working to create business for well-being and social good expected in web3 era by leveraging deep insights on insurance from strategy to operation, insights on emerging technologies and trends, and know-how and talents for new business development. Stay tuned for our coming web3 related publications. Feel free to contact us when you have interests in this Insight.