The rapid development and spread of generative AI, of which ChatGPT is a prominent example, is having major effects, including on the management of Japanese financial institutions.

This Insight goes over the AI initiatives of Japanese financial institutions to present basic information to readers wanting to comprehensively learn about AI in the finance industry. In addition to generative AI, which has spread rapidly particularly in recent times, with many similar services appearing, we will also cover traditional AI initiatives and the backgrounds to them. This Insight will also indicate points that Japanese financial institutions must address in order to make use of AI based on initiatives thus far in the use of generative and traditional AI.

Understanding Japan’s AI Shift in Finance: Challenges and Priorities (Basic Version)

- Banking/Capital Markets

- Insurance

- DX

- AI

-

Motomi Tanaka

Director -

Naoya Matsui

Senior Manager

1. The rapid spread of generative AI in society

ChatGPT, which emerged in November 2022, is believed to have recorded a million users five days after its release, and to have reached 100 million users one month after its release, with user numbers still growing further. OpenAI, the company behind ChatGPT, announced the GPT artificial intelligence model, which has served as the foundation for ChatGPT since 2018. Initially, however, it had few learning data sets and parameters, and was thus limited in its abilities. OpenAI subsequently grew the model, leading to GPT3, which has 175 billion parameters, and ChatGPT. The GPT series leading up to ChatGPT had been available for use by developers via an API, but ChatGPT put the focus on dialogue with users. It also had the ability to to tune itself through dialogue, so the range of users expanded and the model showed rapid growth.

2. Where Japanese financial institutions are at in their use of generative AI

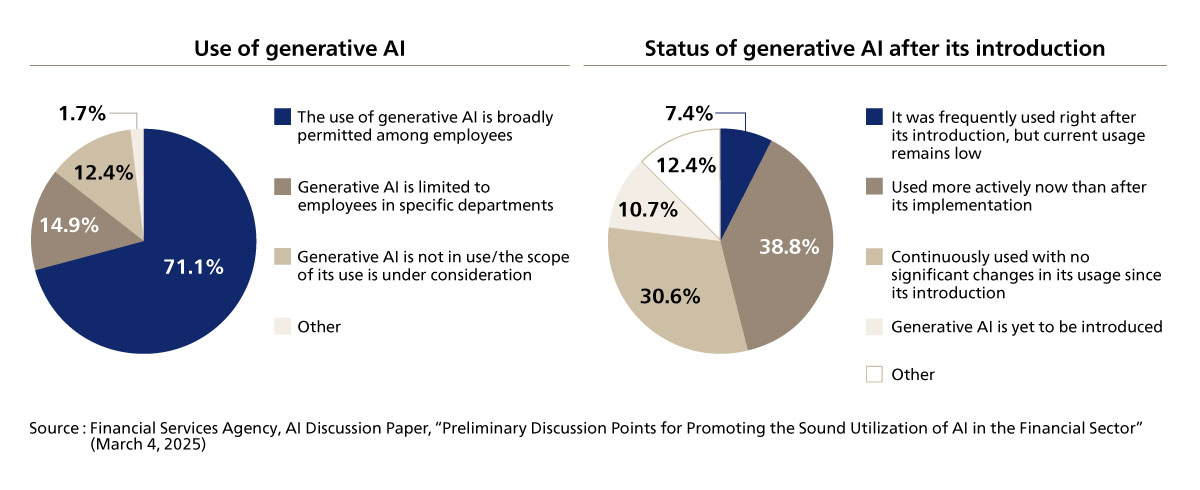

The application of generative AI to operations has proceeded rapidly even among Japanese financial institutions. According to an AI Discussion Paper released by the Financial Services Agency on March 4, 2025, entitled “Preliminary Discussion Points for Promoting the Sound Utilization of AI in the Financial Sector,” over 70% of the financial institutions surveyed said they permitted the use of generative AI broadly among employees (see Figure 1). The paper also found that over 69% of institutions reported that generative AI is “used more actively now than after its implementation” or “continuously used with no significant changes in its usage since its introduction.”

Figure 1. Implementation of generative AI among Japanese financial institutions

Figure 1. Implementation of generative AI among Japanese financial institutions

We believe that behind these developments lie concerns over the DX initiatives of Japanese financial institutions being behind the curve, and shortages of personnel. We can also guess that because generative AI, represented by ChatGPT, is easy to use and can be tried out without any investment, the technology was easy to adopt. The experience of operational streamlining through RPAs that has spread in the past ten years may also have had an effect. Looking at the issue by industry, the rate at which RPAs have spread throughout major Japanese financial institutions is believed to have been higher than in other industries, so there is likely to be a high degree of synergy between such technology and these operations.

3. The use of traditional AI

The AI Discussion Paper includes survey data on the use of not only generative AI but also traditional AI. The “somewhat using AI” response thus climbs to 93.1%, suggesting that AI was being utilized in the financial industry even before the emergence of generative AI. In October 2024, the Bank of Japan (BOJ) released “The Use and Risk Management of Generative AI by Japanese Financial Institutions” as part of its Financial System Report Annex series. Here, too, many financial institutions responded that they had either already implemented traditional AI or were in the process of considering trial. Traditional AI is mainly used for “converting documents into text (OCR),” “customer support operations,” “information retrieval,” “marketing,” “AML/CFT measures,” credit screening, credit risk management, and underwriting screening.”

4. What institutions need to address based on trends in generative and traditional AI

Taking all of the above into consideration, while it is clear that generative AI has come on leaps and bounds in what it can do as a solution to business challenges, it is critical for companies to properly build up a store of knowledge around such technologies, as, in a sense, it is an extension of past technologies. To build up such a store of knowledge and make more effective use of AI, we believe companies need to do the following things.

(1) Catch on to rapidly growing technological trends

While there are cases where even overseas financial institutions have actively made use of AI, due to the speed with which the technology is progressing and spreading, companies have not really gotten results commensurate with their investments, so it is fair to say there are no clear winners yet. Under such conditions of uncertainty, it is important for institutions to try out actual products and services and to get a feel for them through a process of trial and error. Compared to traditional large-scale package products, projects related to AI are amenable to small starts. Generative AI, in particular, compared to traditional AI, is often something that can be used in a way that is user-led, without putting in place any large-scale framework.

Reports published by public institutions and case studies into companies proactively engaged in DX initiatives also serve as useful reference points (see Figure 2). Case studies from other companies often do not match the conditions of your company or are out of date almost as soon as information about them can be acquired. Thus, rather than simply copying such cases, it is critical for companies to understand the aims, background and key points in those case studies, and to think up their own measures in light of their own management environments and business characteristics.

| Issuer | Report name | Overview |

|---|---|---|

| Cabinet (March 2019) |

Social Principles of Human-Centric AI | Summarizes social principles and principles for the development and use of AI, taking into account the benefits, influence and risks of AI from a social perspective. |

| BOJ (October 2024) |

The Use and Risk Management of Generative AI by Japanese Financial Institutions -Based on the results of questionnaire survey- |

Describes the current status, challenges, and issues related to risk management in the use of generative AI based on the BOJ’s “Survey on the Use of AI” targeting 155 financial institutions that the BOJ does business with. Also presents use cases and other information. |

| Financial Services Agency (March 2025) |

AI Discussion Paper “Preliminary Discussion Points for Promoting the Sound Utilization of AI in the Financial Sector” |

Presents use cases of AI in the finance sector, challenges in the use of AI and case studies of initiatives aimed at overcoming those challenges. |

(2) Preparing data to enable the effective use of AI

The main approach in traditional system development is to define and migrate data during system development or during large-scale system upgrades, or, alternatively, to newly store data from scratch. However, during AI-enabled system development, the approach becomes one of leveraging existing data. As a result, it is difficult to make effective use of AI if you do not have the data itself. In preparing data, setting specific goals is not something that can be done overnight, but, as there are cases where Japanese financial institutions have many legacy systems making it difficult to use data with flexibility, it is important for companies to begin by rendering data into a form that is easy to use. There are several methods available for making data easy to use including preparing integrated infrastructure such as data warehouses and data lakes, or making data easy to link through an internal API. When preparing data, as the amount of data held by financial institutions is massive, it is not practical to organize all data using various different apertures. For this reason, companies need to work on preparing data by considering several use cases and defining the data needed to realize those. Companies will also need data governance structures to protect the quality and security of their data.

(3) Building organizations that can develop and make use of people skilled in operations, IT and data

The Waterfall model of development, in which IT departments design and develop systems based on requirements defined by users, is still widely prevalent in the development of large-scale systems such as core systems. If we put the focus on making use of AI and data, however, defining requirements as in the Waterfall model is impractical due to the need to progress with an awareness of the characteristics and limits of the technology. It is thus important for companies to increase the number of people they have who are skilled in operations, IT and data, and who can thus think of the design and implementation of operations as a unified whole. It has long been pointed out that the knowledge barrier between operations and IT has become lower, and there are often cases of people moving between operations and IT departments. But in making use of AI, personnel should also be skilled in data on top of those domains. Such personnel also need to understand the characteristics of AI, due to the need for humans to be present to improve the accuracy of AI and to ensure the ethical side of its operation, as part of the “Human-in-the-Loop (HITL)” idea in AI development. As developing such personnel takes time, companies will also consider recruiting experienced personnel externally as an option. People skilled in IT and data are, however, in demand across all companies, so recruiting them is no mean feat. Companies thus need to take the medium- to long-term view and work on developing people internally in parallel to external recruitment.

Companies will also need to change the nature of their organizations to make effective use of these personnel. Broadly speaking, there are centralized approaches and autonomous, distributed approaches to this, but hybrid forms may also be possible. Where businesses are small or business models are simple, tacking the issue speedily through a centralized approach is ideal. However, where that is not the case, autonomous and distributed models or hybrid models will be the core approaches. Each approach has its pros and cons, so companies should revise their organizations in forms that are in line with the nature of their businesses and their cultures.

5. Summary

Generative AI has spread rapidly throughout society, and is beginning to have major impacts on Japanese financial institutions. Many Japanese financial institutions have, however, made use of traditional AI even before the spread of generative AI, and so should make use of the experiences they have gained in that process. For companies to leverage their experiences and make better use of AI, it is key for them to “(1) Catch on to rapidly growing technological trends,” “(2) Preparing data to enable the effective use of AI” and “(3) Building organizations that can develop and make use of people skilled in operations, IT and data.”

ABeam Consulting offers comprehensive support to financial institutions at every stage from planning and strategizing the use of AI and data, to implementation and operational consolidation, in order to improve the management of financial institutions, upgrade customer service and refine on-site operations. We look forward to continuing to contribute to the sustainable growth of financial institutions.

Click here for inquiries and consultations