With the advance of digital technology, accounting and finance departments too are facing calls to make greater use of digital tools, beginning with AI.

In this Insight, we examine the division of roles between people and AI needed for accounting and finance personnel to make effective use of AI, based on how AI technology is currently being used in such departments. In doing so, we reveal the accounting and finance department skills needed in the AI era.

Accounting and Finance Departments in the AI Era: “Judgment”, “Creativity” and “Foresight” Hold the Keys

- Financial Accounting and Business Management

- AI

-

Goh Yanagawa

Senior Manager -

Yosuke Iwata

Manager

Contents

1. AI utilization trends and future prospects in accounting and finance departments

AI and IT technologies have made stunning progress in recent years, bringing forth a wave of digital transformation on the ground in business as well. In particular, the rapid development of AI models and the emergence of large language models (LLMs) have enabled rapid and precise analysis and forecasting of massive amounts of data, creating expectations of further streamlining in business decision-making processes and operations. Such technological progress has made the ability to make effective use of AI the key factor in digital transformation in business activities. Against this backdrop, accounting and finance departments are also facing calls from a variety of stakeholders including management and investors to drive further digital transformation using AI technology.

As the decline of the working-age population from falling birthrates has become a serious social issue, particularly in Japan in recent years, efficiently advancing work with limited numbers of people has become an important challenge even in accounting and finance departments, amidst anticipated future shortages of personnel. To make effective use of limited personnel, we believe that a key point, taking into account the future survival strategies of companies, will be securing a competitive edge by using digital technology (in particular AI) to substitute operations traditionally performed by people (or thought to only be performable by people) and using the freed-up time for high value-added work such as data analysis, and providing suggestions and advice to other internal departments.

Amidst such social demands, AI technology for accounting and finance departments is continuing to advance. Even in our own consulting work, we receive many inquiries around things like the implementation of automatic FAQ response systems in which AI can handle questions from employees, automation of scanning and referencing proofs of transactions through AI-OCR, and the introduction of systems to detect fraud and falsification using AI, showing the growing interest in the technology from a variety of companies. There remain, however, limitations to the accuracy and scope of what AI can do at present. It is not always necessarily the case that the technology is generating enough freed-up time to allow employees to focus on high value-added work. We thus expect further advancements in AI technology going forward.

While there is demand for further development of AI technology, it seems doubtful that just freeing up more time using AI and other technologies will really be able to shift accounting and finance personnel into high value-added work on its own. While having begun the implementation of AI with the aim of streamlining existing accounting and finance work is a good thing, we also believe that companies can encounter phases where they do not make progress as anticipated. For example, without realizing it, companies can find that implementing AI has become an aim or goal in itself, or that there is a mismatch in skills between target personnel and what companies seek to apply them to once their time is freed up, or that implementing AI can eat up time and costs beyond what was anticipated. We believe that what lies behind the failure of such projects to proceed as expected is a failure to anticipate what work will look like after implementing AI technology, define the new division of roles for AI and people, define the skills accounting and finance personnel will need based on those definitions, and to move forward in a joined-up way with training and other programs based on those skill definitions.

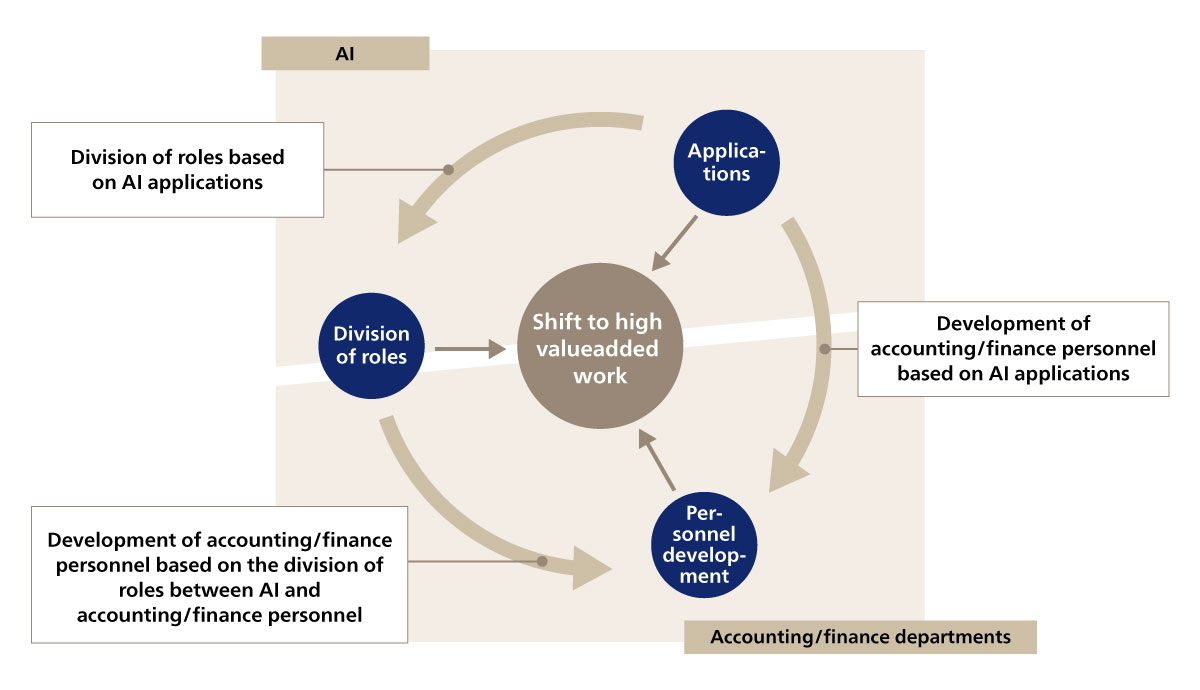

In other words, we believe that, in order to achieve the original goal of securing a competitive edge with limited personnel and to shift accounting and finance personnel to high value-added work, companies need to find ways to make AI and people work together through a triune approach combining “division of roles” and “personnel development” in addition to “applications of AI” (see Figure 1).

Figure 1. A model for how people and AI can work together

Figure 1. A model for how people and AI can work together

Given these conditions, this Insight will seek to use AI implementation as an opportunity to investigate the various divisions of roles between accounting/finance departments and AI, and to find directions for personnel development.

2. Applications of AI in accounting and finance departments

In Section 1, we introduced the background to calls for the use of AI technology in accounting and finance departments and clarified the challenges faced in practice in its implementation. In this section, we will build on that to organize the roles that AI can take on in future in accounting and finance departments, approaching the matter from its functional aspects.

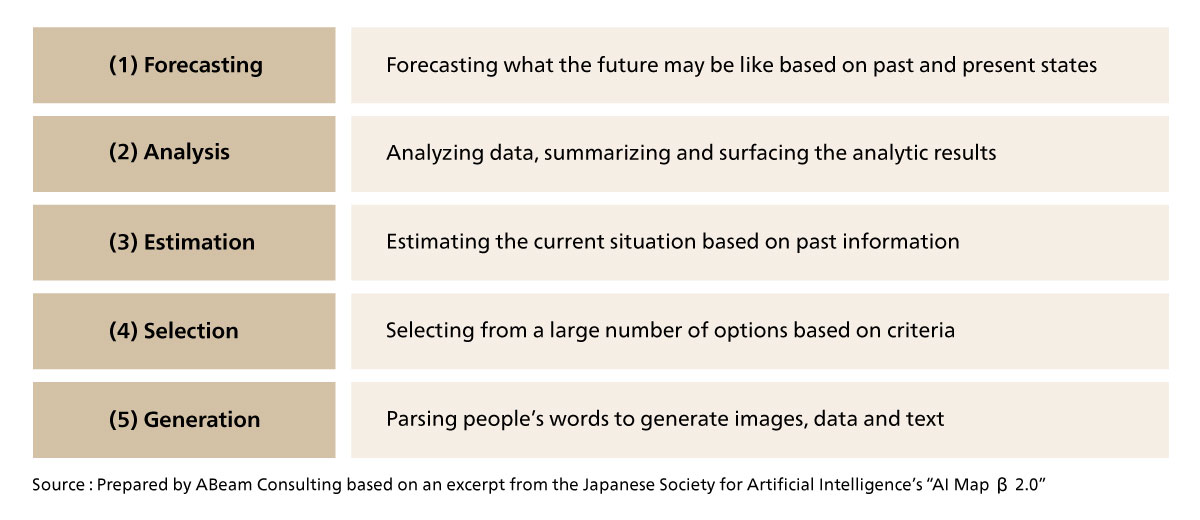

To begin with, we have organized the roles from the perspective of the “functions that AI performs in accounting and finance departments,” based on the document “Types of Problems Expected to be Solved by AI Systems,” published by the Japanese Society for Artificial Intelligence. We thus categorized the problems into five areas: “(1) Forecasting,” “(2) Analysis,” “(3) Estimation,” “(4) Selection,” “(5) Generation” (see Figure 2).

Figure 2. Five functions that AI fulfills in accounting and finance departments

Figure 2. Five functions that AI fulfills in accounting and finance departments

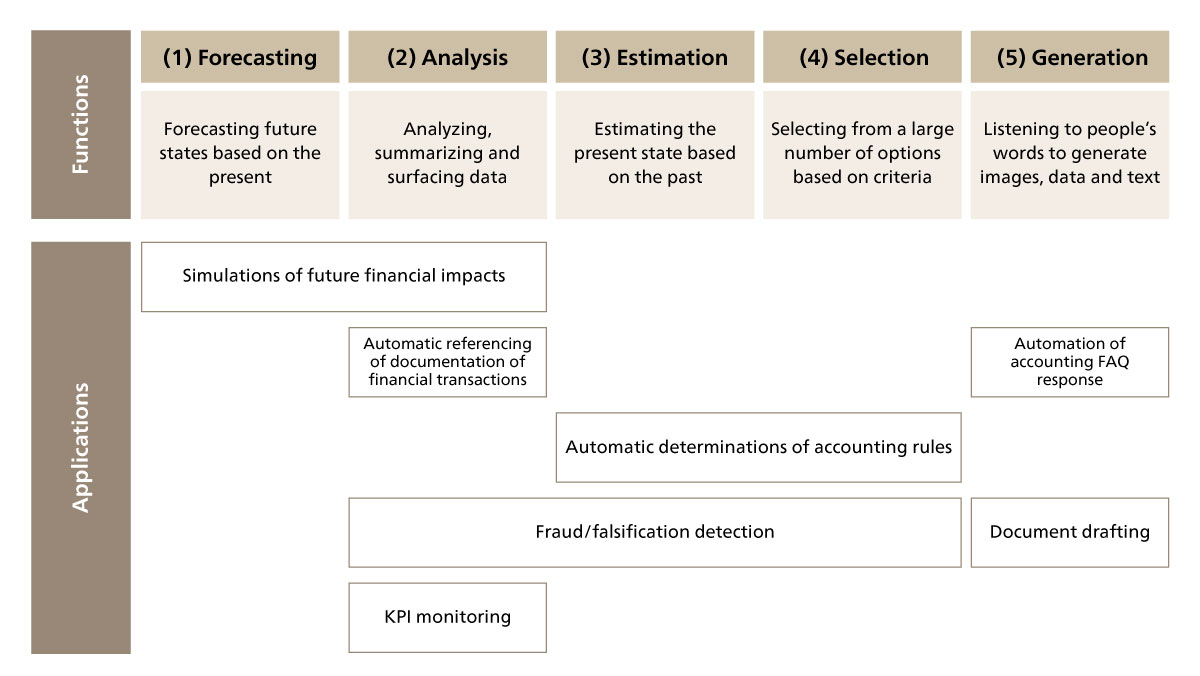

Thinking about how to apply these five categories of “functions that AI performs” to accounting and finance departments, we believe that the following applications can be anticipated going forward (see Figure 3).

(1) Forecasting

- Simulations of future financial impacts: Forecasting how business activities will affect future financial figures and how future performance will change with what sorts of policies. We expect such simulations could be provided to hands-on departments as materials for considering measures and used as drafting materials for projecting where results will land. This could streamline the work of making forecasts of where results will land and improve the accuracy of such forecasts.

(2) Analysis

- KPI monitoring: Summarizing and surfacing analytic results taken from automatic aggregation and variable adjustment of various KPIs. We believe this could be used for offering reporting, suggestions and advice to hands-on departments and leadership.

- Automatic referencing of documentation of financial transactions: Analyzing documentation of financial transactions and transaction data to check for inconsistencies. This will streamline collation work.

- Fraud/falsification detection: Identifying irregular data patterns tending towards fraud or falsification. This is expected to improve the accuracy of detection based on objective data and streamline the work involved in finding patterns.

(3) Estimation (4) Selection

- Fraud/falsification detection: Based on transaction data and settlement information, selecting regular and fraudulent transactions, then estimating the chances of fraud or falsification. We expect this will improve the speed with which countermeasures are implemented and streamline traditional fraud monitoring work.

- Automatic determinations of accounting rules: Based on past transaction details and financial data, estimating and selecting accounting rules that should be applied. This is expected to streamline the work involved in making such judgments.

(5) Generation

- Document drafting: Drafting documents for internal and external disclosure, proofing documents and automatically generating graphs and tables. This is expected to improve the efficiency with which various documents are drafted.

- Automation of accounting FAQ response: Automatically responding to internal queries to the accounting department about how matters are treated in accounting terms and about inputs to internal regulations. This is expected to save time on traditional inquiry response work.

Figure 3. The functions of AI and their applications to accounting and finance work

Figure 3. The functions of AI and their applications to accounting and finance work

In terms of generation, recent years have seen the rise of LLMs and generative AI, leading to a growing focus on “automatic response” and “natural language generation.” This means that “generative” functions such as automatically responding to accounting FAQs or drafting documents can go beyond mere form responses and simple report drafting to offer more complex, enhanced responses and to generate content that better suits the business.

For example, automatically responding to the accounting FAQs would now be able to go beyond handling simple questions to address more complex case-by-case questions, allowing it to effectively address even questions that would have been difficult to deal with using a traditional rule base. Even when drafting documents, we can now draft content that is more accurate and better suited to operations, by, for example, using AI to automatically generate enhanced reports or financial analyses based on accounting standards.

In either case, we can expect new applications of the technology to grow as the technology advances. However, for companies to be able to incorporate the features of AI into their accounting and finance work, they will need to clarify the division of roles between AI and people, and properly design their operations.

3. The division of roles between AI and accounting/finance personnel

Through Section 2, we have looked at the trends in and some actual case studies of the use of AI in the accounting and finance domain, as well as the prospects of the technology in the future. In this section, we will look to consider the division of roles between accounting/finance personnel and AI, assuming that the application of AI will take a further step up going forward.

Firstly, we want to think about what the fundamental differences between AI and people are. We believe the differences between AI and people lie in whether they are able to “make judgments” and “be creative.” AI is a so-called “tool,” with its standout feature being that, through repeated learning, its accuracy can be improved. For example, take the case of improving the accuracy with which AI reads documents, or the case responses drafted by a generative AI. In either case, the machine is doing no more than just responding based on results learned from past information. Consequently, “judgment” and “decision making” about the validity of AI responses and the validity of outputs generated by AI can only be done by people, no matter how far the technology goes.

“Creativity” works the same way. AI, which excels at learning past information and outputting the right answer based on what it has learned, cannot express “creativity” in the true sense of the word, producing wholly new ideas that have not previously existed.

Given the above, the big differences between AI and people are “judgment” and “creativity.” We believe this is the key to thinking about the division of roles between AI and people.

Now let’s look to apply this to actual accounting and finance work. For example, applying this to the process of receiving an invoice and issuing payment delivery voucher, the invoice sent by the customer is read with AI-OCR, then AI determines the transaction category and automatically issues a voucher for the journal entry. Up to this point is AI’s role. Subsequently, an effective division of roles would involve people determining the reliability of the voucher that was read in and directing it to be recorded in the accounts.

The process of detecting fraud would work similarly, with AI detecting that a voucher that differs from the norm had been recorded. A person would need to ultimately determine if the details of the transaction were really fraudulent, and then take appropriate action. It would also be possible for AI to make sales forecasts and projections of final results, and display multiple patterns for these based on past trends, with it being up to people to determine the reliability of this work.

So far, we have spoken about “judgment,” but the same extends to “creativity.” Say a CEO orders cost reductions. When working on considering what specific cost reduction measures to take, an AI could perform various assistant operations, but it would be up to people to do the thinking. The “creativity” portion of coming up with what measures to take is something we believe it would be up to people to determine.

Given the above case studies, the division of roles between accounting/finance personnel and AI in the era of AI is likely to grow ever more significant, with AI likely to take on rote work such as issuing vouchers, aggregating and processing data to output reports, and collecting necessary data, while people will have an even greater role in determining the validity of vouchers issued, of determining whether the information gathered by AI is true, and deciding the reliability of content of information output by AI.

4. The skills expected of accounting and finance personnel in the AI era

As we saw in Section 3, the skills expected of accounting and finance personnel in the AI era are those of personnel who can show “judgment” and “creativity” from an accounting point of view. While in some cases this will overlap with the skills of existing team members, we believe it will be rare to have personnel who combine both sets of skills, so, to some extent, companies will need to separate them and take measures to improve their skills.

The first skill expected of accounting and finance personnel is “judgment.” This skill specifically requires the ability to tell whether proper journalizing has been performed, the ability to read financial statements, the ability to understand and judge company budgets and projections, and the ability to decide if the outputs of accounting work performed by AI were done correctly.

Put briefly, we believe these skills are extensions of traditional accounting and finance work, as they are skills developed in the course of performing accounting and finance work, namely bookkeeping ability, theoretical understanding of financial accounting, theoretical understanding of management accounting, and a grasp of the trends of one’s own company’s accounting figures.

When we consider that accountants traditionally got a sense of their own company’s trends through the process of issuing vouchers and drafting various reports themselves, it will be a challenge for the future to figure out how to foster accounting skills specialized in “judgment” and understanding of company accounts without direct experience of the actual work of accounting.

At the same time, “creative” skills, while still called for in traditional accounting and finance work, were not skills that were subject to great focus traditionally, so we expect there will be gaps in the know-how for developing them. We believe the “creativity” called for in accounting and finance work specifically includes the ability to streamline processes when surveying the company as a whole from the perspective of accounting operations, the ability to imagine and execute on ways of effectively using new technology such as AI, the ability to coordinate with other departments and push through work, and the ability to solve problems, as well as the ability to support the launching of new businesses from a financial perspective in the medium to long term.

If we think of the above as the skills of foundational accounting and finance personnel, the question arises of what would be the skills expected when developing section and department heads, or those expected of leads who decide overall departmental policy and drive forward work. We believe that accounting and finance departments should be expected to contribute to the overall development of a company’s “business” from a background of accounting expertise. In other words, it is up to accounting and finance team members to drive operations using their accounting knowledge and insight (particular insight into the company), using AI and other tools. Managers who lead such departments should understand the environment in which their company’s businesses operate, “create” by, for example, incorporating accounting insights into measures to develop their company’s businesses, “judge” the feasibility of such measures, and lead their accounting and finance departments as a whole to contribute to the organization. If we take such a perspective, the skills needed by accounting and finance department leads include “foresight” vis-a-vis their company’s businesses on top of “judgment” and “creativity.”

Such “creativity” and “foresight” are not things that can be developed overnight. We believe that to master such skills, a person would need to experience countless efforts in which they seek to find answers to problems that do not yet have solutions in the world. This would be difficult to achieve in the course of a company’s normal operations. Such personnel could thus, for example, take part in gatherings of entrepreneurs and find colleagues to frankly debate their ideas with, or use consultants from consulting firms like ABeam as sounding boards.

From a team member development perspective, there is also the option of working with a consulting firm like ABeam to re-skill (in terms of creative skills) accounting personnel. At ABeam Consulting, we have worked on countless projects to support the development of personnel to have standout problem solving skills through personnel development programs based on the development schemes and methodologies we use for our own consultants. We thus believe that, with that know-how, we are well placed to contribute to personnel development in accounting and finance departments in the AI era.

5. Summary

In the AI era, companies cannot continue to apply traditional values. Instead, with AI expected to substitute for people across many tasks, traditional accounting and finance department personnel (particularly lower-level employees) will need to newly master “judgment” and “creativity” as skills. It will also be essential for the leads overseeing them to possess “foresight,” analyzing their company’s businesses with that foresight and contributing to business development from an accounting perspective. With many companies falling into the trap of implementing AI become an aim in itself, we believe that combining AI with personnel development to advance both in unison will be key to success in the AI era.

ABeam Consulting is ready to contribute to the sustainable growth of companies through the promotion of the development of accounting and finance personnel who have the “judgment,” “creativity” and “foresight” needed to succeed in the AI era, by driving operational transformation and personnel development suited to the advancement of AI technology.

Click here for inquiries and consultations