The banking industry in the SEA region faces unparalleled changes. The rapid widespread adoption of mobile banking and financial technology and the existence of “unbanked” customers who do not have a bank account are flipping the status quo of traditional banking operations on its head. Establishing “digital-first” organizations to address these changes is a pressing and important matter. It requires, however, not only the acquisition of personnel with digital skills but also a transformation of the organization’s culture.

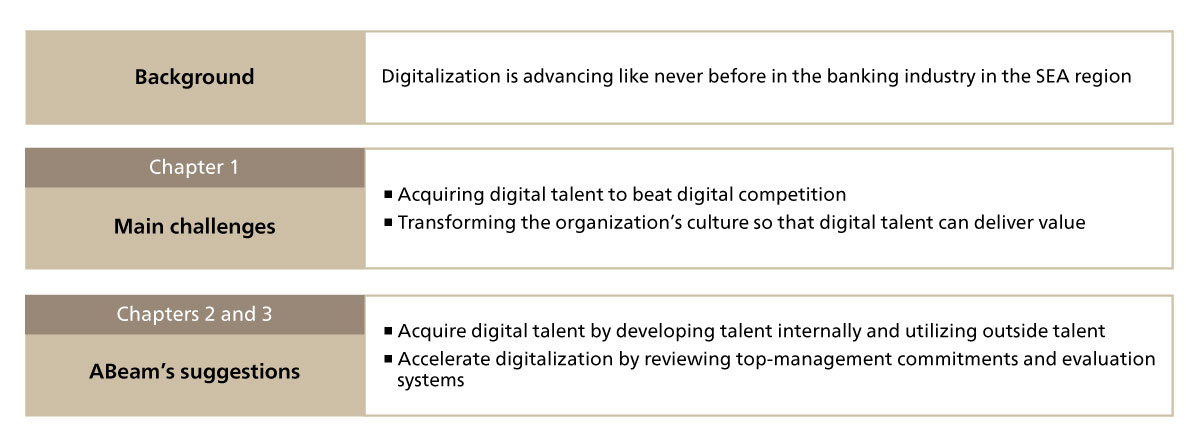

This report analyzes personnel challenges in the banking industry in SEA, introduces innovative success cases that leverage data and technology, and gives a roadmap to acquiring digital talent and transforming the organization’s culture (Figure 1).

Successful Digital Talent Management in the Banking Industry in Southeast Asia (SEA)

- Banking/Capital Markets

- Technology Strategy and Management

- Talent & Organization Management

Figure 1: Executive summary

-

Eiji Matsumoto

Senior Manager -

Daisuke Kuge

Senior Manager -

Naoaki Saeki

Manager

1. Personnel challenges in the banking industry in SEA

1.1 Intensifying digital competition across industries

The SEA region has seen digital advancements with the explosive rise in popularity of mobile banking and the emergence of personalized services using AI. The speed and scale of this advancement are greater than that of other regions. Digital competition in the banking industry is intensifying, with Singapore’s DBS Bank introducing an AI chatbot to improve the efficiency and service quality of dealing with inquiries. Furthermore, technology companies entering the financial services space are sparking greater competition. Ride-hailing service companies such as Grab and Gojek, for example, also roll out a mobile payment service, threatening the customer base of banks.

1.2 Analyzing personnel challenges unique to SEA

For banks to come out on top in this intensifying digital competition, they naturally require resources such as people, products/services, and money. That being said, the capturing of talent (people) is a particular challenge. While digital competition requires new areas of expertise such as data analysis, cybersecurity, and digital marketing, there is a lack of digital talent with the skills to meet this demand. For example, in Singapore, the government has implemented measures such as granting preferential treatment to foreign persons with digital skills when issuing a work visa. This indicates a situation where the supply of available digital talent here falls short of the demand*1.

*1 COMPASS C5. Skills bonus - Shortage Occupation List (SOL)

https://www.mom.gov.sg/passes-and-permits/employment-pass/eligibility/compass-c5-skills-bonus-shortage-occupation-list-sol

2. Acquiring talent: training and hiring

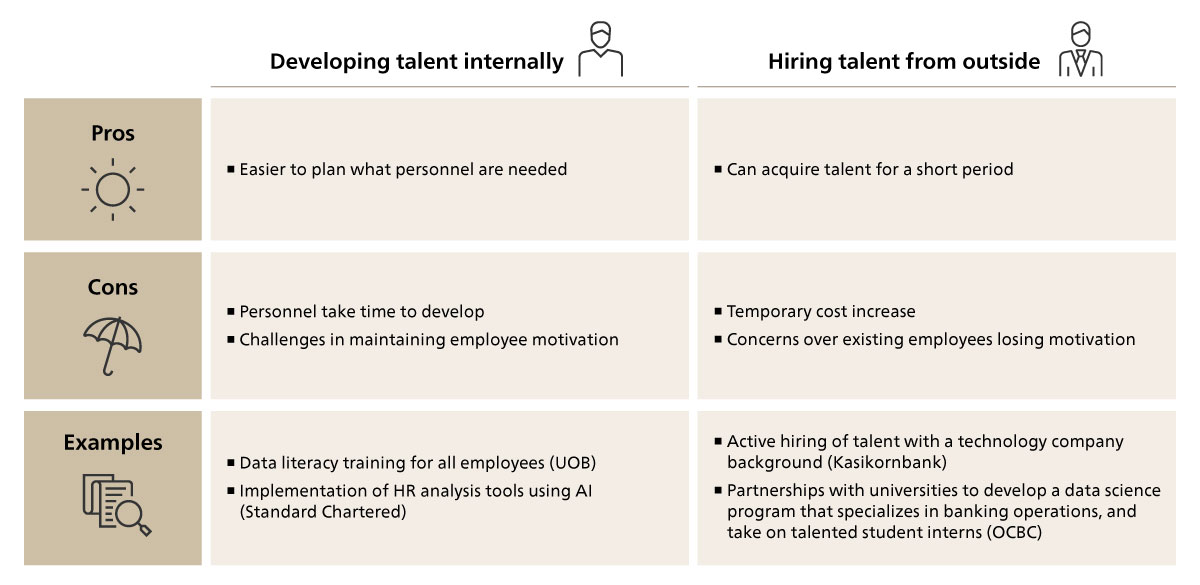

In order for banks to acquire talent with skills that they lack, there are two main approaches: (1) to develop talent internally or (2) to hire talent from outside. Based on the time it takes to acquire talent in each approach as well as the different pros and cons on employee motivation, it is vital to plan a talent-acquisition strategy that combines both of these approaches (Figure 2).

2.1 Developing talent internally

As this approach enables the use of current resources, it makes it easier to plan what personnel are needed. On the other hand, this approach may face hurdles in the form of the time it takes to develop talent and maintaining the motivation of employees toward their studies. Innovative banks are attempting efforts that utilize technology to overcome these hurdles. For example, by planning reskilling efforts according to the skill sets of employees with initiatives such as customized digital skill training and digital literacy improvement programs, it is possible to advance the talent development while eliminating the bottlenecks. Singapore’s United Overseas Bank (UOB) has raised the skills of its employees to the minimum level required by implementing data literacy training. From here, it considers factors such as the aptitude, skills, and roles of its employees while implementing practical training programs from basic data analysis skills to their application to solve business challenges. Singapore’s Standard Chartered Bank, meanwhile, matches its employees’ skills with internal operations and provides them with opportunities to improve their skills. It is also possible to offer personalized learning support and career development with the use of generative AI, which has grown phenomenally in recent years.

2.2 Hiring talent from outside

If there are no internal talent development initiatives, hiring talent from outside the company will increase costs temporarily and impact the motivation of existing employees. Nonetheless, it is an effective approach. In the SEA region, utilizing the human resources of nearby countries with differing salary standards is relatively easy. Being able to hire skilled digital talent cheaply without significant obstacles such as differing time zones and culture is a hiring technique unique to SEA.

To hire sought-after talent from outside, strategies could include declaring a digital vision, promoting the appeal of one’s innovative workplace environment and growth opportunities, and recruiting persons with an employment background in technology companies who possess a high level of expertise or those from “unbanked” demographics. For example, Kasikornbank in Thailand recruits new digital talent from outside and sets itself targets such as to become a comprehensive regional technology company. Meanwhile, Oversea-Chinese Banking Corporation (OCBC) Bank in Singapore provides grants to the likes of the National University of Singapore as a strategy to hire talented young personnel who have acquired digital skills. In terms of hiring talent from outside, aside from recruiting, leveraging outsourcing to obtain support from specialized talent for a fixed term can also give greater flexibility in the options available to you.

Figure 2: Talent development and hiring strategy

Figure 2: Talent development and hiring strategy

3. Transforming an organization’s culture

Even if you develop talent or acquire promising talent, without transforming the entire organization into one that is digital-first to enable said talent to deliver value, the results will be temporary. There are many support cases from yesteryear in which transformations did not go as expected due to strong resistance to change. To overcome such a hurdle, a transformation of the organization’s culture should be implemented at the same time as the talent strategy. It is important to change the culture in a top-down approach quickly by outlining a vision for the organization’s culture and the bank’s top management demonstrating exemplary words and actions that embody this culture. It is also vital to properly embed this new culture within the entire organization by reflecting the desired culture in goal setting and employee evaluations.

[Main cultures that should be adopted by digital-first organizations]

- Pursuing innovation and customer-orientated service creation

- Strict data governance and data quality control

- Independent learning of all employees

- Prompt addressing of market changes and customer needs

To embed the culture within the organization, you must remember to consider the cultures unique to each country. Singapore, for example, which is one of the main SEA countries where the banking industry is a key industry, has an established culture where, rather than making detailed plans, there is a general tendency to keep rules to a minimum and take on new challenges. Perhaps partly due to this cultural backdrop, there are many new initiatives within the banking industry. This is highlighted by the fact that DBS Bank in Singapore was chosen as World’s Best Digital Bank*2.

It is highly likely that talent in Singapore with these cultural attributes is unfamiliar with a transformation approach that controls actions through top-down rules and processes. In undertaking a transformation of the organization’s culture, we believe it is important to identify the cultural characteristics of the respective SEA country before tailoring the transformation approach to the specific company to facilitate the transformation with the backing and cooperation of the local talent.

*2 DBS named World’s Best Digital Bank

https://www.dbs.com/newsroom/DBS_named_worlds_best_digital_bank

4. ABeam’s areas of support in SEA

This report has used examples of the talent and organizational measures required for the banking industry in SEA to overcome its digital competition.

Lastly, we would like to introduce areas in which ABeam Consulting supports talent management.

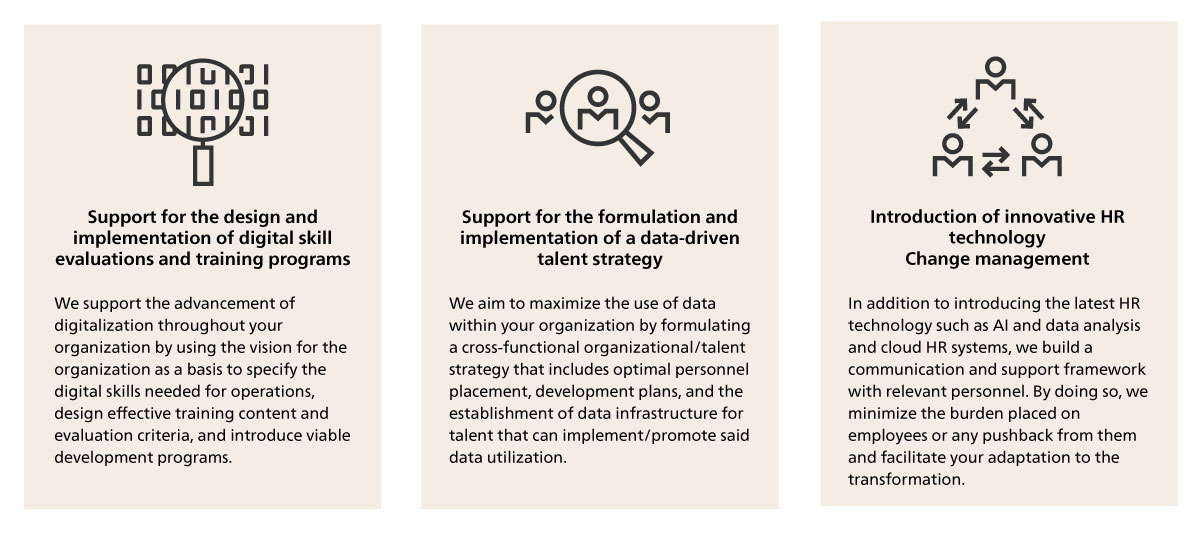

ABeam Consulting has a broad track record of support not only in SEA but in multiple regions, including Japan, and multiple industries to transform talent acquisition and the organization’s cultures. ABeam Consulting offers both theoretical and practical support (Figure 3).

Figure 3: Examples of ABeam’s support

Figure 3: Examples of ABeam’s support

4.1 Support for the design and implementation of digital skill evaluations and training programs in consideration of cultures and customs

ABeam Consulting has a track record of supporting DX at banks in SEA countries. We build the optimal support framework by leveraging our local consultants, who are experts in the local culture and customs, together with our Japanese consultants who have global know-how. In addition to evaluating the digital skills of employees and designing and implementing training programs tailored to the individual’s needs, we help your employees learn basic digital skills through practical training based on case studies.

4.2 Support for the formulation and implementation of a data-driven talent strategy

Based on a standard talent model such as IPA, we define a practical DX talent model customized to the DX strategy of each client. We help each client acquire and train the personnel necessary to advance its DX strategy, such as by clarifying the skills and mindset needed for its DX talent model, estimating the number of talent needed, formulating a development policy/plan, and reviewing its HR system.

4.3 Innovative HR technology implementation and change management

In addition to introducing the latest HR technology such as AI and data analysis and cloud HR systems, we build a communication and support framework with relevant personnel. By doing so, we help to minimize the burden placed on employees or any pushback from them and facilitate your adaptation to the transformation.

We encourage interested companies to get in touch with us to have discussions and exchange views.

Click here for inquiries and consultations