Banks worldwide are currently moving forward their payment services to ensure the smooth adoption and migration to ISO20022, the new global messaging standard for the payments. This transition period is expected to take some time, and the urgent issue is that it requires careful planning, system development, and seamless transition. Moreover, banks in the midst of ISO20022 migration must not only manage their own updates but also actively communicate these changes to customers and lead them towards the new remittance methods. This insight outlines the challenges and strategies for banks whether they have already started the transition to ISO20022 or are yet to begin.

What are the challenges for banks in the ISO 20022 migration and what are the solutions?

Introduction

This insight provides information for companies that use bank payment services to achieve a smooth migration to ISO 20022. It also provides some examples of the challenges in the ISO 20022 migration and a possible course of action that bank employees can take.

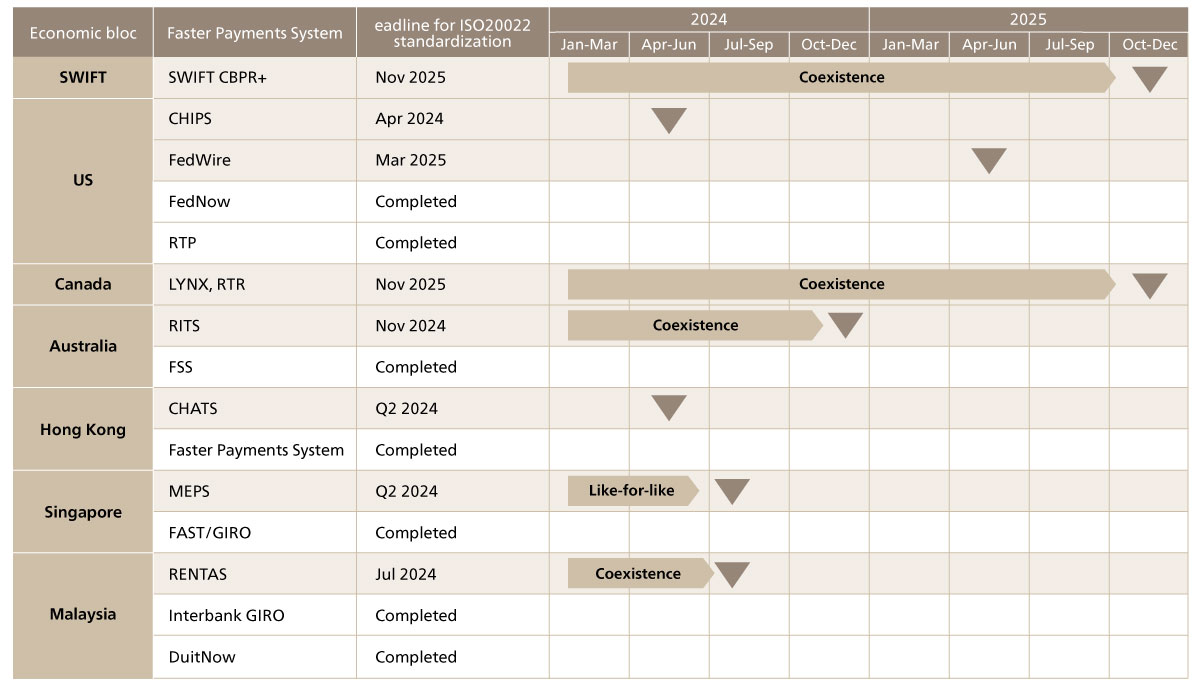

Although moving to SWIFT MX formats and ISO 20022-compliant local settlement in each country have yet to be fully begun in several economic blocs, the ISO 20022 timeline in Figure 1 is an important focus for the banking industry.

Figure 1. Part of the schedule for the ISO 20022 migration

Figure 1. Part of the schedule for the ISO 20022 migration

For globally operating banks, the migration to ISO 20022 is an inevitable challenge. The failure to complete it, they will not be able to settle interbank payments, and thereby potentially lose some of their capabilities.

The adoption of ISO 20022 requires close cooperation between banks and their customers who use their services. Compared to MT formats and others, ISO 20022 has more fields for customers to enter, and those fields are more itemized. However, we know that some companies may not be fully informed about ISO 20022 or may not even realize its importance. Therefore, banks need to be proactive in guiding their customers to migration to ISO 20022.

This insight describes the challenges banks face in moving to ISO 20022 and a course of action to take for the challenges.

What do banks need to do to help their customers migrate to ISO 20022?

Currently, many banks have already started to develop ISO 20022-compliant services. Once banks are on track to complete the development of ISO 20022-compliant services, they will need to explain the ISO 20022 migration to its own customers.

Although circumstances vary from bank to bank, they are required to explain to their customers the following topics; "Overview of ISO 20022," "Benefits of migrating to ISO 20022," "Impact on bank customers" and "What banks can do for support" (see Table 1).

横にスクロールしてご確認ください

| # | Title | Overview |

|---|---|---|

| 1 | Overview of ISO 20022 | Make them informed of what ISO 20022 offers and a timeline as to how the standard will be introduced. |

| 2 | The benefits of migrating to ISO 20022 |

|

| 3 | Impact on bank customers | Customers sending files to the bank need to change the file format, fields, and code values to meet the bank's specifications. In most cases, customers will need to secure staff for system development and the cost of the development. |

| 4 | What banks can do for support | Although it varies from bank to bank, the following details are generally expected;

|

Figure 2. For explanation to customers

We believe that banks' customers would find it helpful to have support from their banks for migrating to ISO 20022.

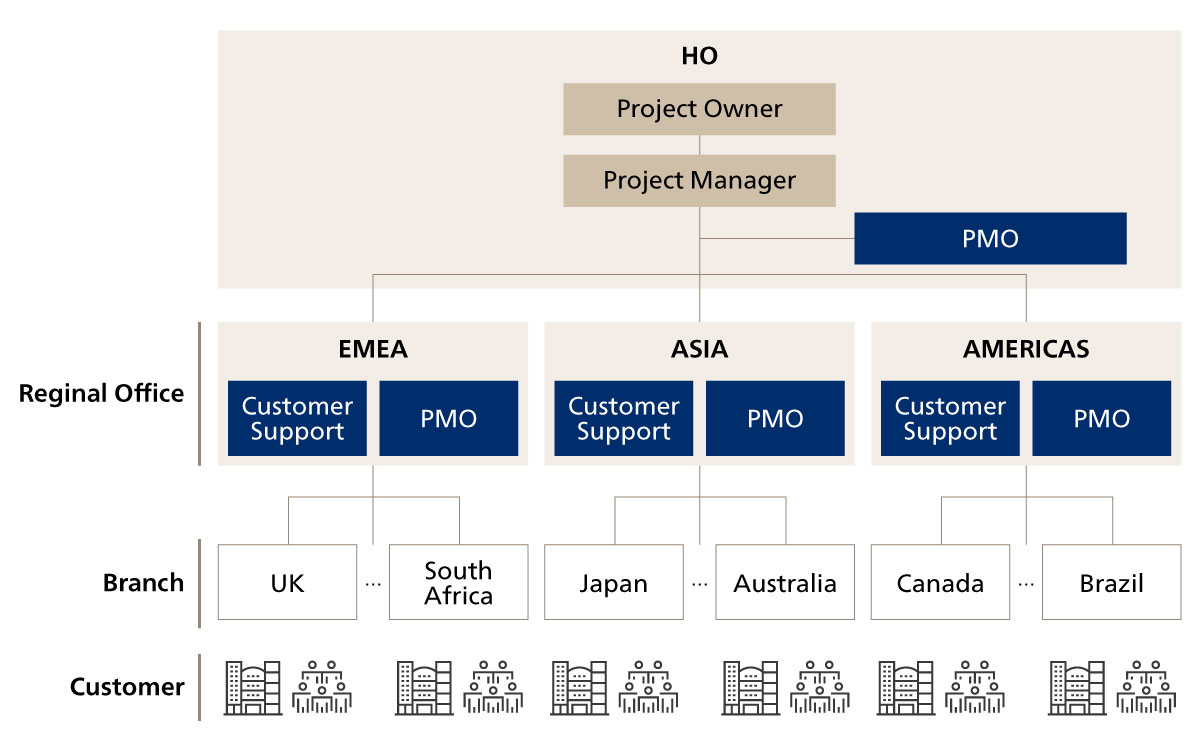

In preparing the explanation to customers in Table 1, banks in every country will need to act in concert to provide quality support, taking into account their customers' organizations. Therefore, they need to be prepared for developing an operational structure in which relationship managers/product officers at each branch, reginal management, and the head office (HO) work together, building policies for the migration project, tracking the migration status, and supporting the migration (Figure 3).

横にスクロールしてご確認ください

| # | Title | Overview |

|---|---|---|

| 1 | Developing an organization/operational structure based on customer support | Create an organization and operational structures for the ISO 20022 migration taking into consideration your organizational structure constituted of the head office to the branches. |

| 2 | Policy development and planning for the migration project | Develop a timeline for a successful migration to ISO 20022, taking into consideration the priorities and the tasks postponed, as well as a timeline for ISO 20022 migration in each country |

| 3 | Tracking customer migration status and address issues | Track the number of customers in each country that have migrated to ISO 20022, resolving new challenges identified during the migration as well as sharing the details with other countries regarding how the challenges were resolved. |

| 4 | Migration support |

|

Figure 3. Banks' preparation

Solutions

Solutions to the challenges in customer support (Figure 5) and migration management (Figure 6) listed in typical challenges include "Enhancing PMO functions and consider/introduce efficient project promotion system" and "Incorporating a team of people with skill sets required for customer support into the organizational structure of a bank"

Figure 7.

Figure 7.

Enhancing PMO functions and consider/introduce efficient project promotion system

It is necessary to analyze the ISO 20022 related services in each country, the schedules of those services, the number of customers using them, etc., as well as to consider developing a system that can track the situation accurately. Then, it will be communicated to top management and stakeholders at an appropriate granular level.

PMO at the bank's head office plays a high-level role in coordinating requirements and issues in each country, while the local PMO provides support for the migration which includes identifying requirements for systems specific to each branch and coordinating the migration schedule with the head office to further ensure the success of the project.

Furthermore, we believe that setting a local PMO in each country instead of a centralized PMO in a single location will allow for early detection of issues in each country and seeing the entire world from a higher perspective. At the same time, separating the information collection functions of a local branch moving to ISO 20022 will enable the creation of an environment where they can concentrate on collecting information that does not miss anything.

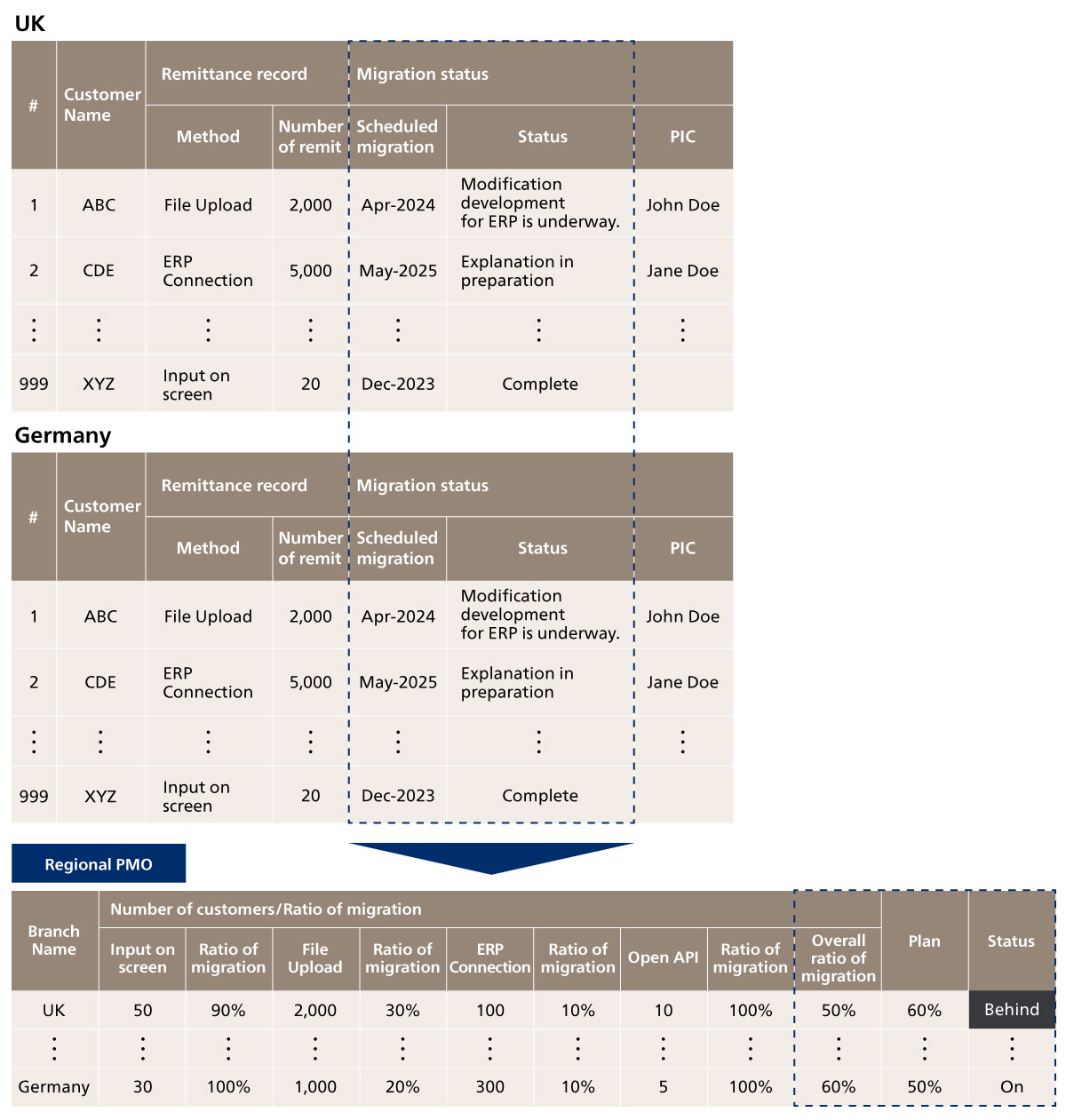

Figure 8 shows an illustration of how the reginal PMO will take the lead in managing the progress of the European migration. It is important to design materials that convey information to the head office and top management in a straightforward manner based on progress in each country. However, we need to customize our services for the requirements of each bank because the services and indicators vary from bank to bank.

Figure 8. Sample of tracking of migration status

Figure 8. Sample of tracking of migration status

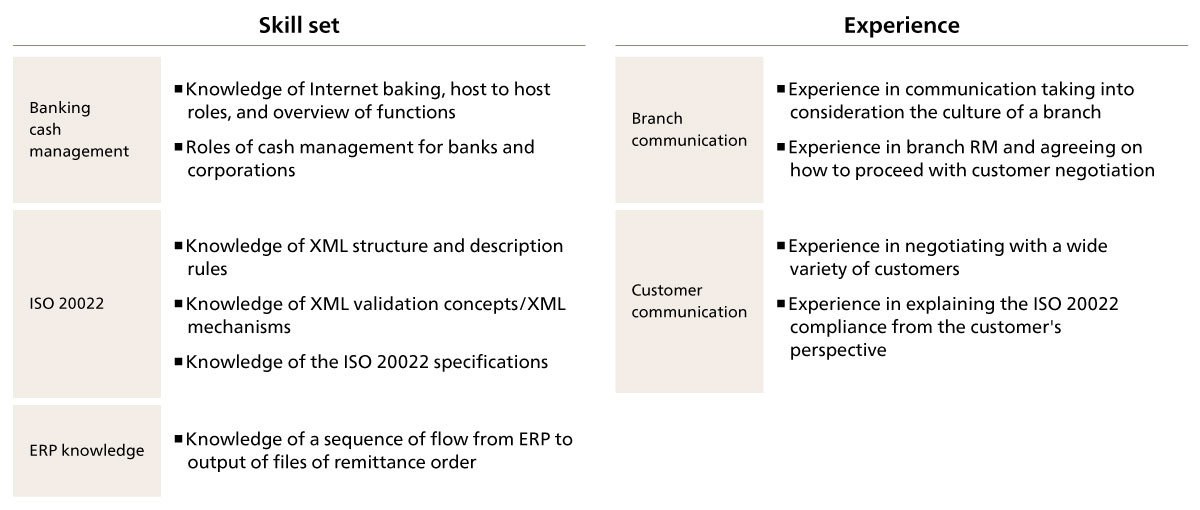

Incorporating a team of people with skill sets required for customer support into the organizational structure of a bank

We believe that it is necessary to develop a team of people with the necessary skills for customer support. In such case, one possible solution would be to bring in an outside team of experts to ensure that the necessary skill sets and resources are in place for the migration to ISO 20022.

Figure 9. Example of necessary skill sets for customer support for migration to ISO 20022

Figure 9. Example of necessary skill sets for customer support for migration to ISO 20022

Conclusion

The “ISO20022 migration” is not just about complying with new regulations for a bank’s internal processes. There are many challenges even within the simple operation such as receiving the remittance request from the customer and to sending the information without any defects in the new standard message format. The immediate challenge is to address “what kind of support can be offered to our customers as a bank”. Furthermore, it is crucial to align the transition with the authorities of each country and with other banks. To achieve this, it is important to have a project framework which can monitor each country’s authorities and other bank’s latest timelines and information for the migration.

As for migrating to ISO20022, you may have other challenges that are not described in this insight.

At ABeam Consulting, we have skilled and experienced consultants who have assisted major banks in visualizing the progress of multiple global projects and migrating to ISO 20022 in many countries.

We would be pleased to discuss the assistance required for migrating to ISO20022 tailored to your bank's needs.

For any inquiries, please contact us.

Click here for inquiries and consultations