Southeast Asia’s largest insurance-related event, InsureTech Connect Asia 2024, was held in Singapore from June 4-6, with ABeam Consulting once again taking part as an official sponsor.

This Insight presents a portion of the discussions held at this event, covering leading topics across the insurance industry, as well as the domains of support offered by ABeam Consulting across the major categories.

InsureTech Connect Asia 2024 Summary Report

- Insurance

- Global

- AI

1. Overview of InsureTech Connect Asia

ABeam Consulting Enters Its Second Year Running as an Official Sponsor of InsureTech Connect Asia

InsureTech Connect Asia is the largest insurance industry event in Southeast Asia, held annually in Singapore. 2024 saw a total of 350 companies and 1,300 individuals take part, representing insurance (including numerous Japanese insurers), reinsurance, insurance brokerage, InsureTech, VC (venture capital) and consulting firms. ABeam took part this year as an official sponsor, hosting a joint booth together with IT company SAP.

The event also saw some 80 sessions held covering leading topics across the insurance industry. ABeam Consulting took part in these together with insurers and InsureTech companies, acting as panel discussion moderator for sessions on digital strategy and insurers.

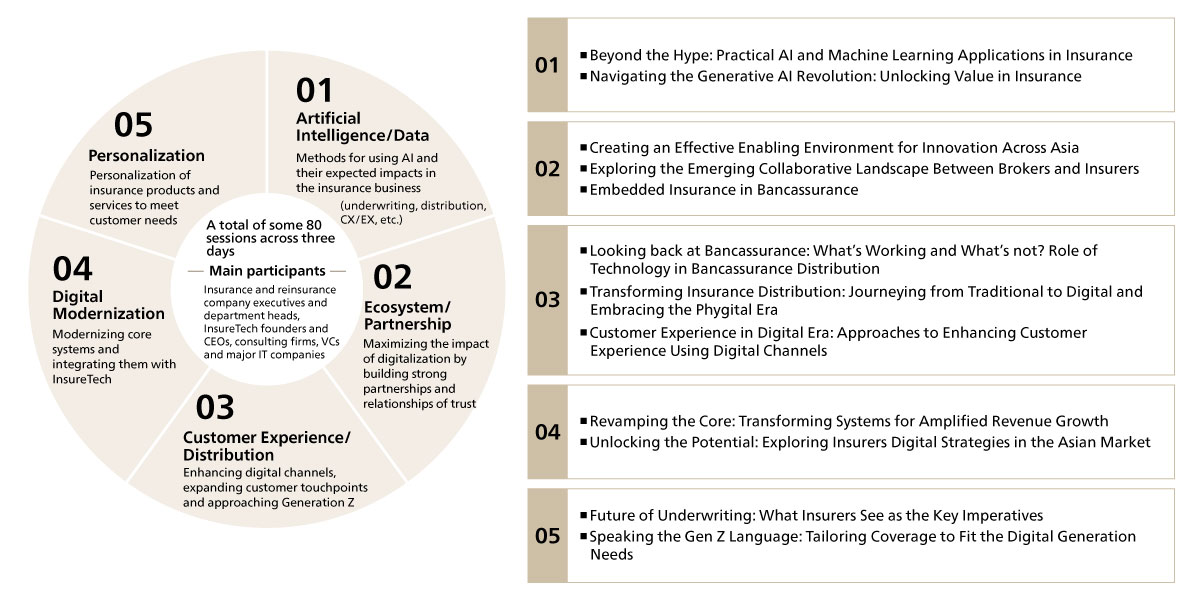

2. The Five Major Categories for 2024 and How These Have Changed Since Last Year

The five following topics dominated discussions at the event for 2024 (see Figure 1). The first of these was “artificial intelligence/data,” covering methods for using AI and its expected impacts in the insurance business (UW: underwriting, customer support, contract management etc.). The second was “ecosystems/partnerships,” going into how to maximize the impact of digitalization by building strong partnerships and relationships of trust. The third was “customer experience/distribution,” addressing questions of how to enhance digital channels, how to expand touchpoints with customers, and how the industry can approach Gen Z. The fourth was “digital modernization,” referring to the modernization of core systems and how to integrate these with InsureTech. The fifth topic was “personalization,” covering how companies can make insurance products and personalize their services to meet customer needs.

Figure 1. The five major categories at InsureTech Connect Asia 2024

Figure 1. The five major categories at InsureTech Connect Asia 2024

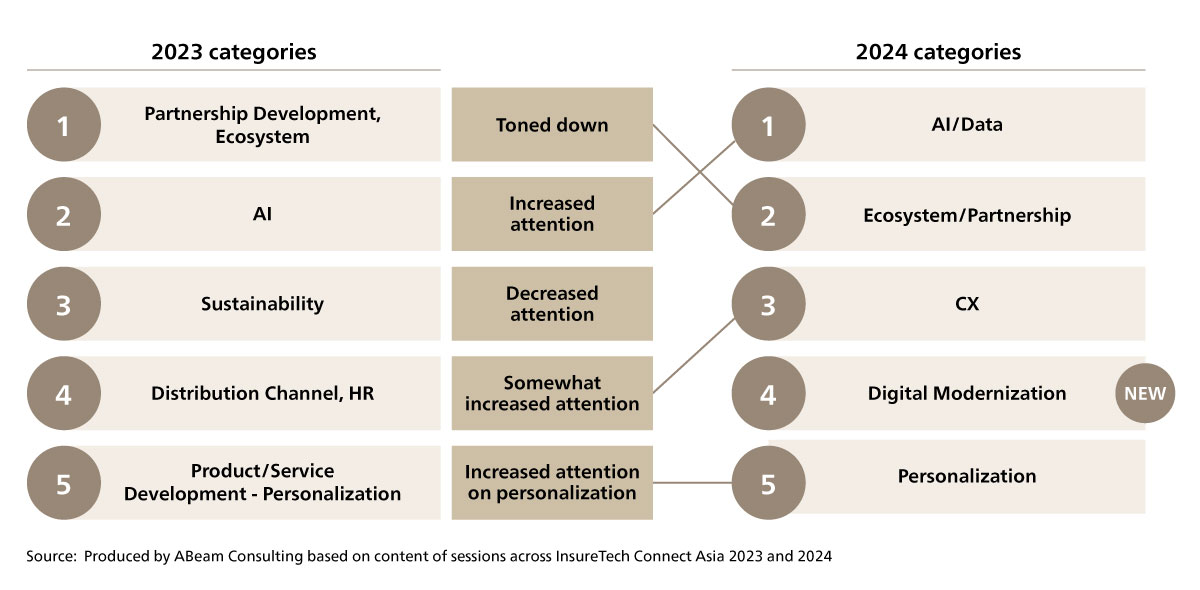

Figure 2 shows the changes in the major categories from last year. While AI, CX and personalization have seen greater attention this year, the focus on sustainability has declined. While insurers are continuously taking action on ESG/sustainability, we infer that the role that InsureTech can play in this area is relatively limited, so it has seen its importance as a theme decline. We have also seen trends in digital modernization such as changes in the roles that insurance core systems are expected to play and growing numbers of domains that InsureTech is taking on, leading to its rise as a key theme.

Figure 2. Comparison of the major categories between InsureTech Connect Asia 2023 and 2024

Figure 2. Comparison of the major categories between InsureTech Connect Asia 2023 and 2024

Next, we would like to go over a few of the sessions in detail per category.

(1) Artificial Intelligence/Data

Swiss Re and Bolttech took on the topic of AI/data in their presentation, “Beyond the Hype: Practical AI and Machine Learning Applications in Insurance.” In the insurance industry, AI is already showing practical impacts in streamlining processes, fraud detection, automation of claims processing and improving customer service, thus helping drive productivity and reduce costs. The presenters mentioned that it is important to consider data privacy and long-term impacts going forward. Based on these impacts, we can expect that companies will be able to address challenges such as labor shortages and budget restrictions through the strategic introduction of AI.

Companies including Bolttech and General Reinsurance AG talked about generative AI in their presentation, “Navigating the Generative AI Revolution: Unlocking Value in Insurance.” Generative AI is AI that approaches a form wherein in imitates the thinking and awareness of real humans. This technology has significant potential to drive growth and innovation in the insurance industry. Combining elements of machine learning and deep learning, generative AI has the ability to comprehend massive data distributions and generate new content, differentiating it from other AI approaches.

Generative AI also takes on the roles of improving day-to-day risk prevention and customer engagement in embedded insurance. For example, use cases such as enhancing customer support are being developed. Introducing generative AI requires companies to have the right technology stack, data platform and organizational culture, so companies need to prepare themselves through training and experimentation. It is also important for companies to have ethical frameworks and regulations in place to adapt to rapidly advancing technology, with companies expected to address risks such as deep fakes. While the technology presents challenges, generative AI has the potential to drive growth and innovation in the insurance industry through a process of trial and error.

Summary: AI, machine learning and generative AI are being applied in the insurance industry to challenges such as streamlining processes, fraud detection, automation of claims processing and improving customer service. The technology has the potential to drive growth and innovation while realizing productivity gains and cost reductions. On the other hand, the introduction of these technologies means technologies need to address challenges such as having the right technology stack, organizational culture, ethical frameworks and regulations for AI.

(2) Ecosystems/Partnerships

The Monetary Authority of Singapore (MAS) and the Financial Services Agency of Japan (FSA) took on the challenge of “Creating an Effective Enabling Environment for Innovation Across Asia.” Even as growth in InsureTech and innovation are proceeding across Asian countries including Japan, these countries are also coming face to face with challenges such as aging societies, data security and dealing with regulations. Regulators across countries are building regulatory frameworks that support the testing of revolutionary insurance products and services, maintaining data security and supporting social inclusion, using sandboxes and self-regulatory institutions. The session presented the importance of initiatives that pursue a balance between consumer protection and innovation through regional cooperation and dialogue between regulators.

Companies including Tokio Marine Asia and QBE Asia covered relationships between insurance brokers and insurers in a section entitled “Exploring the Emerging Collaborative Landscape Between Brokers and Insurers.” In the insurance industry, the relationship between brokers and insurers is moving from a transactional one to a cooperative one. This has made it more important to streamline processes and offer personalized services through data sharing and the use of AI. Increasing flexibility in insurance products and pricing strategy, combined with the development of new solutions enabled by generative AI are expected to play an important role in the partnership between both parties, as they seek to address new risks and meet the diverse needs of customers.

Zurich and One Connect covered the topic of embedded insurance sold via bank contact points in their presentation, “Embedded Insurance in Bancassurance.” Through strategic partnerships between insurers and banks, companies are driving the adoption of embedded insurance at both traditional and digital banks, developing micro-insurance that meets the changing preferences of consumers and the provision of insurance products using digital channels. For future embedded insurance at banks, the key will be to target specific customers based on data analysis, and providing products to individual customers seeking a seamless digital experience, small and medium-sized companies with complex insurance needs and wealth management clients who focus on added value.

Summary: The development of InsureTech and embedded insurance in Asia is being deployed to address challenges such as aging societies and changing consumer preferences through support from regulators, cooperative relationships between insurers and brokers, and the provision of revolutionary products and services using generative AI and data analysis.

(3) Customer Experience/Distribution

DBS Bank and Standard Chartered Bank talked about customer-first approaches and the challenges that arise in that as part of bancassurance in their presentation, “Looking back at Bancassurance: What’s Working and What’s not? Role of Technology in Bancassurance Distribution.” The keys to the success of bancassurance are the integration of technology, working with fintech companies and customer-centered solutions. While challenges remain such as the balance between using data and privacy as well as integrating digital and a human touch point, sustained growth and progress are possible if companies focus on trust and transparency, and address these challenges using technology.

SingLife and InsureMO introduced the idea of “the phygital” (i.e., the blending of the real and the digital) in their presentation, “Transforming Insurance Distribution: Journeying from Traditional to Digital and Embracing the Phygital Era.” By blending the real and the digital, companies can improve their customer engagement and operational efficiency, while AI-enabled data analysis contributes to streamlining underwriting operations and improving customer experience. While regulations and product complexities are challenges in digital transformation, companies can expect sustained growth and the ability to meet diverse market needs through employing the idea of the phygital and through global innovation.

Photo: Transforming Insurance Distribution: Journeying from Traditional to Digital and Embracing the Phygital Era

Photo: Transforming Insurance Distribution: Journeying from Traditional to Digital and Embracing the Phygital Era

Summary: In the discussion around bancassurance and the integration of the phygital, emphasis was placed on contributing to improving customer experience and streamlining operations through the integration of technology and the use of AI-enabled data analysis, centered around a customer-first approach. In bancassurance, striking a balance between using data and maintaining privacy, and integrating digital and a human touch, while focusing on trust and transparency, were held up as challenges. At the same time, companies can expect to be able to meet diverse market needs and promote sustained growth through the idea of the phygital, integrating the real and digital worlds.

(4) Digital Modernization

Dai-ichi Life, Chubb Life and AIA Group discussed the importance of balancing the digital with a human touch in their presentation, “Customer Experience in Digital Era: Approaches to Enhancing Customer Experience Using Digital Channels.” The companies stressed the importance of simple and speedy handling of customers and the integration of the digital and a human touch (the “phygital”) through four domains that go into creating the customer experience in the digital age: (1) customer expectations, (2) integration of the digital and the human touch, (3) digital ecosystems, and (4) AI-enabled opportunity creation. Insurers are being faced with simultaneous demands to both improve customer engagement, thus realizing improvements to customer experience, and to streamline operations through individualized handling by making use of digital ecosystems and personalization of customer service using AI.

Sapiens and Zurich Insurance talked about the importance of modernizing core systems and the challenges that come with that in their presentation, “Revamping the Core: Transforming Systems for Amplified Revenue Growth.” Modernization of core systems is a key imperative for insurers if they are to maintain their competitiveness and realize improvements in operational efficiency and customer experience. To deal with risk and complexity, it is essential for companies to take strategic approaches including phased approaches, flexible integrations using APIs, and involving end users in the early stages. This makes partnering with system providers and selecting vendors that have a strong track record key to success.

Cyrus Cruz, Corporate Innovation Lead at ABeam Consulting Singapore, moderated a panel entitled “Unlocking the Potential: Exploring Insurers Digital Strategies in the Asian Market,” focusing on insurer digitalization strategy, which has been recognized as an important topic in recent years in the industry, with participants from insurers Tune Protect and SunLife, and InsureTech companies Igloo and Swiss Re Corporate Solutions.

Photo: Unlocking the Potential: Exploring Insurers Digital Strategies in the Asian Market

Photo: Unlocking the Potential: Exploring Insurers Digital Strategies in the Asian Market

Among insurers in Asia, digitalization that gets “back to basics” has gathered pace with the aim of improving profitability. This has made modernization of contract management systems and core systems an important platform. This approach focuses on improving human touch points and streamlining back-office operations to realize the prompt and accurate customer support, which is the essence of the insurance business, including the market for high-net-worth clients. Going forward, companies will be required to apply technology that improves the speed with which they can enter markets while faithfully executing the basics, and to enhance their customer contact points.

Tune Protect differentiates itself in the market by offering digital-first and user-friendly insurance products targeted at Millennials and small and medium-sized companies. Tune Protect handles embedded insurance and makes use of its own digital technology. The company achieves a seamless customer experience and maintains industry top-class NPS scores using advanced tools such as chat bots and APIs, and its 3-3-3 commitment (letting customer purchase insurance in three minutes, giving a response within three hours and paying claims within three days of approval).

Summary: The Asian insurance industry is seeking to improve its competitiveness and maximize the speed with which it can enter markets by simultaneously improving the customer experience through the integration of the digital and a human touch (the “phygital”), and by advancing core system modernization that “gets back to basics,” thus building a platform that supports prompt and accurate customer support.

(5) Personalization

UnderwriteMe covered the transformation of the process of underwriting using AI in their presentation, “Future of Underwriting: What Insurers See as the Key Imperatives.” UnderwriteMe’s Head of Asia Pacific, Paul Hughes, said that while, currently, less than half of insurers are managing to personalize the underwriting process based on AI-identified customer-specific risks, the majority of companies are aiming to do this in the coming years, and that achieving this will require the building of structured data models.

Insurance comparison site PolicyStreet, insurer Dai-ichi Life Insurance (Cambodia) and online insurance broker Klook Insurance presented “Speaking the Gen Z Language: Tailoring Coverage to Fit the Digital Generation Needs,” covering key features of Generation Z that companies need to take into account as insurers in developing services targeted at that generation. Generation Z is the generation born after 1995. As they are mainly in their 20s, they include people enrolling in insurance as part of their first jobs, meaning they come with a variety of risks. At the same time, Generation Z has particular values and behavioral features, so they expect to have their individual values taken into account. Insurers thus need to have a deep understanding of Generation Z’s diverse risks and needs, and to design products based on targeted marketing and segmentation. By making use of cutting-edge technologies like generative AI and building a framework for providing a personalized experience, companies can handle Generation Z such that they make a future core customer demographic.

Klook Insurance talked about its customization of products and services related to travel using insights into its customer demographics in their presentation, “From FOMO to Fearless: Empowering Gen-Z's Travel Dreams” Millennials and Generation Z place a unique focus on immersive experiences in their travel planning, so they expect travel insurance to also be flexible, customizable and to conform to experience-oriented travel trends. Social media has a big influence on the decision making of these generations, so insurers need to meet the advancing expectations of these generations by making use of influencers and platforms such as TikTok, setting competitive prices and offering coverage that supports adventurous activities.

Summary: The insurance industry has seen increasing attention being paid to the personalization of the underwriting process and to product customization for Millennials and Generation Z, based on individual risks identified through AI. Insurers are thus being required to meet developing customer needs by constructing structured data models, offering personalized experiences using generative AI, and by marketing themselves using social media.

3. Summaries of the Five Categories and domains of support offered by ABeam Consulting

Finally, with these five categories representing the major recent trends in the insurance industry, we would like to present the domains of support offered by ABeam Consulting across these themes.

- In relation to artificial intelligence/data, ABeam has a strong track record in supporting business transformation at insurers using Chat GPT, and can support the setting up of PoCs or the introduction of such tools.

- In relation to ecosystems/partnerships, ABeam can support companies in looking for the right partnerships, performing business due diligence and examining new business models, taking into account industry insights and the scale at which business operates in Asia.

- In relation to customer experience/distribution, ABeam boasts a strong track record in supporting the introduction of digital technology in sales and brokerage channels, implementing NPS evaluations at customer contact points, researching platforms with customer bases in Southeast Asia, and in CRM marketing measures in the same region, with the aim of increasing customer satisfaction and improving operations.

- In relation to digital modernization, ABeam has extensive experience in supporting the formulation of IT and core systems strategies in Southeast Asia.

- In relation to personalization, ABeam can offer support from specialists in embedded insurance, and has a strong track record of performing market research into digital distribution in Southeast Asia and providing insights into trends in microinsurance.

ABeam Consulting provides various types of support for enhancing insurance business models based on our extensive experience working with the insurance industry across Japan and Asia grounded in these five categories. We encourage interested companies to get in touch with us to have discussions and exchanges of views.

*This Insight distributes information with the approval of the InsureTech Connect Asia organizers

Click here for inquiries and consultations