ABeam Consulting: the car market in Thailand is ready for the adoption of a new sales model

ABeam Consulting: the car market in Thailand is ready for the adoption of a new sales model

ABeam Consulting conducted interviews with car dealers representing diverse brands across 24 nationwide locations. Thai car dealers seek new sales models like the Agency Model and Online Sales to counter a challenging market. The Agency Model involves dealers no longer buying cars to stock; instead, they receive a fixed profit margin from car companies for managing sales. Online Sales are direct selling by car companies, bypassing dealers. Both models streamline the sales process, making it more flexible to adapt to a challenging market. Car dealers grapple with intense competition, reduced profits, shifting consumer behavior, and diminishing demand, both from rival dealers and emerging brands. The overall automotive market decline is linked to weakened consumer purchasing power, exacerbated by changing online-driven consumer behavior.

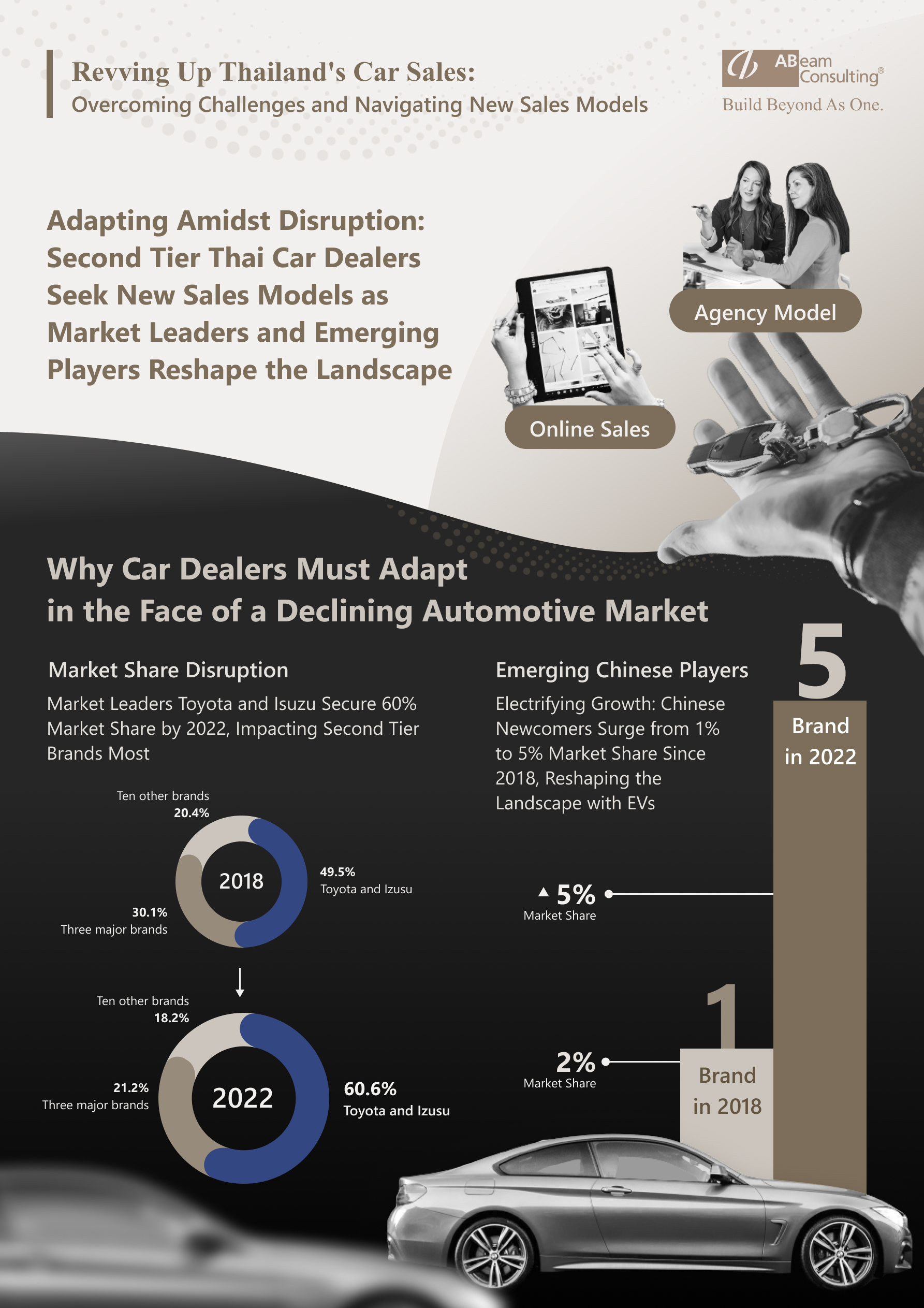

Intense competition within the automotive industry has significantly impacted car dealers, leading to a decline in their turnover. Industry leaders Toyota and Isuzu expanded their market presence, increasing their combined market share from 46% in 2018 to 60% in 2022, while the remaining three major brands saw their cumulative market share drop from 28% to 21% during the same period. Over ten other brands also faced challenges, collectively decreasing from 25% in 2018 to below 20% in 2022. The competition intensified with the entry of new Chinese electric car brands, which grew from one in 2018 to five in 2023, resulting in market share shifts from 2% to 5% in 2022. This heightened competition directly impacted dealerships' financial performance, particularly those associated with secondary brands, resulting in reduced monthly car sales per dealer and numerous dealers struggling to remain viable.

Reaching one million car sales in Thailand appears challenging as the industry faces a decline, with only 830,000 units sold in 2022, down from almost one million in 2019. Projections for 2023 predict a further drop to approximately 782,000 vehicles, reflecting a 22% decline in car sales. This situation is attributed to slowing consumer income growth, notably in regions like Bangkok, where household income decreased from 43,000 baht in 2017 to 39,047 baht in 2021. Mounting household debt, reaching 90% of total income, has impacted purchasing power. Financial institutions are tightening automotive loan approval processes due to a high non-performing loan rate, resulting in an 18% increase in non-performing car loans in 2023 and a rise in loan rejections. Achieving one million car sales may take at least five years due to constrained consumer income, prolonged household debt reduction, tourism challenges, and demographic shifts diverting income away from car purchases.

Consumer expectations in the car buying process have shifted, with many beginning their journey on social media, leading to a flood of sales offers, which can be overwhelming. A survey by ABeam Consulting indicates a preference for straightforward pricing, as extensive price comparisons lead to subpar buying experiences, affecting satisfaction and brand perception. Consumers, particularly the younger generation, now prioritize "value for money" and "Infotainment technology" over brand loyalty, contributing to the rise of new car brands. Additionally, consumers are increasingly relying on online research before visiting a dealership, influenced by influencer reviews, and some are even making purchase decisions based on this research. While transactions still require a physical dealership visit, consumers are moving toward embracing fully online transactions for various products in the future.

Car dealers, especially those in the second-tier segment, consider embracing new sales models crucial to maintain their position in the highly competitive automotive industry. The market has seen increased competition due to consolidation of market leaders and the entry of numerous Chinese brands. Rising household debt has led consumers to prioritize debt repayment over buying cars, and they are becoming more price conscious.

About ABeam Consulting (Thailand) Ltd.

ABeam Consulting (Thailand) Ltd. is a subsidiary of ABeam Consulting Ltd. – headquartered in Tokyo, with roughly 7,000 richly professional, experienced consultants who have served clients throughout Asia, the Americas and Europe, providing consulting services in Thailand since 2005. ABeam Consulting (Thailand) has more than 400 professionals serving clients in Thailand with expertise in business and digital transformation services that create the future together with corporations and other organizations. As a creative partner leading the way reliably through change, we contribute to industrial and societal change.

Please contact us at contactthailand@abeam.com or visit https://www.abeam.com/th/en for more details.