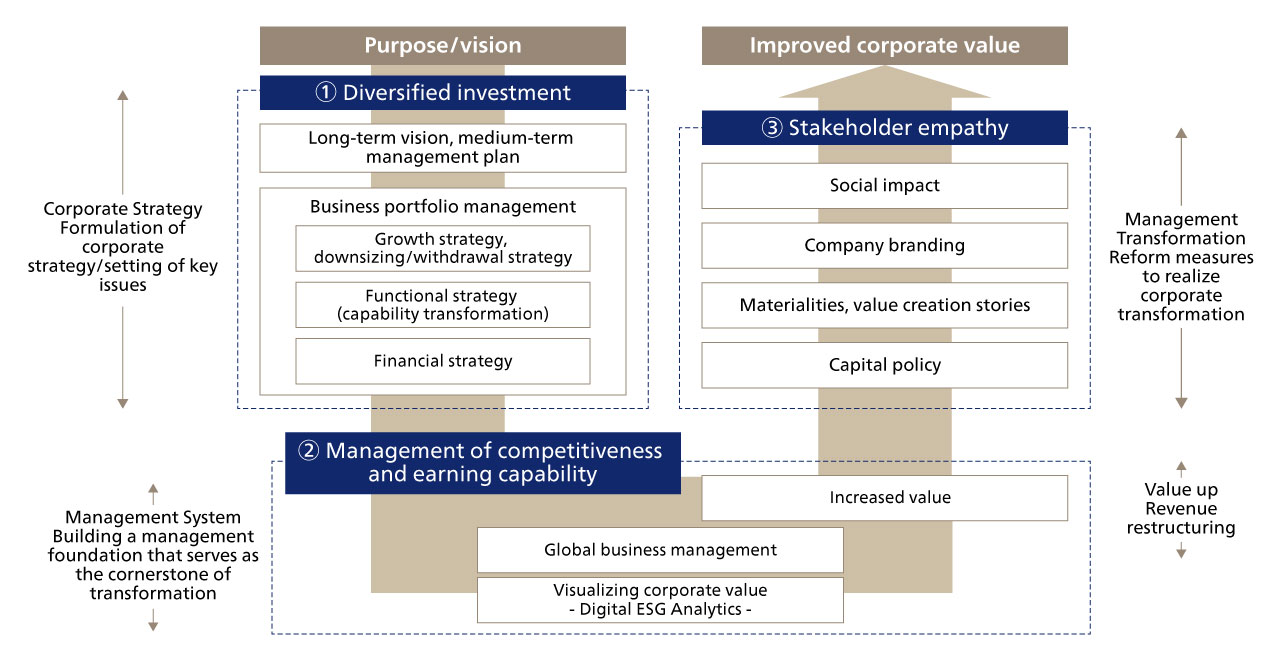

Rather than simply proclaiming its vision and management goals as slogans, companies must also share common goals with stakeholders, build empathy and resonance, and steer the company toward “co-creation” through mutual engagement.

This kind of co-creative management approach forms the foundation for companies to achieve sustainable growth and value creation. To that end, it is important for companies to develop their future “growth prospects” while delivering near-term results that raise their “earning power,” thereby increasing their overall value.

In order to realize such value creation, companies require management that views financial and non-financial capital as two sides of the same coin, repeatedly engages in strategic capital investments and outcome measurement.