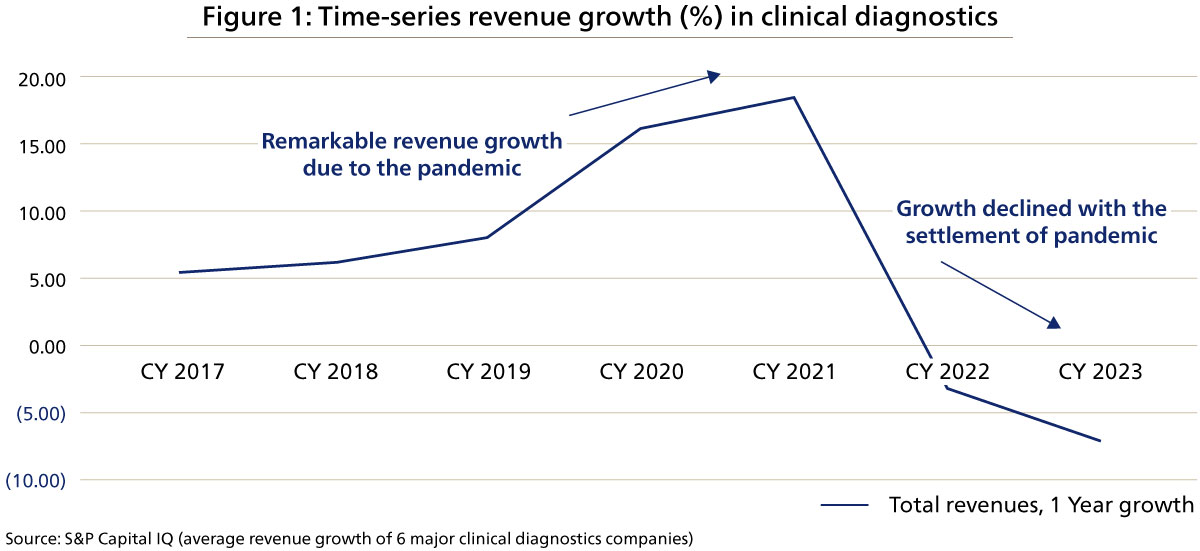

The clinical diagnostics market experienced significant growth due to the COVID-19 pandemic. However, post-pandemic growth is slowing as demand for COVID-19 testing has declined and the unit price of testing has dropped. It is now crucial for clinical diagnostics players to identify new areas for growth in the post-pandemic era. In this article, ABeam Consulting offers insights into key directions for future growth.

Beyond Pandemic: Find the Next Growth in Clinical Diagnostics Industry

- Health Care

- Management Strategy/Reformation

-

Naoto Mori

Principal -

Masashi Suzuki

Director -

Konami Aoyama

Senior Consultant

COVID-19 “Bubble” in testing service

The clinical diagnostics industry experienced rapid growth in lab testing services during the pandemic. Most clinical diagnostics players reported remarkable increases in both revenue and profit particularly in 2021. Major clinical diagnostics players ensured not only planned capital investments including upgrade of existing testing equipment. During the pandemic, governments worldwide supported hospitals and clinical laboratories in deploying instruments for genetic testing to meet urgent demand.

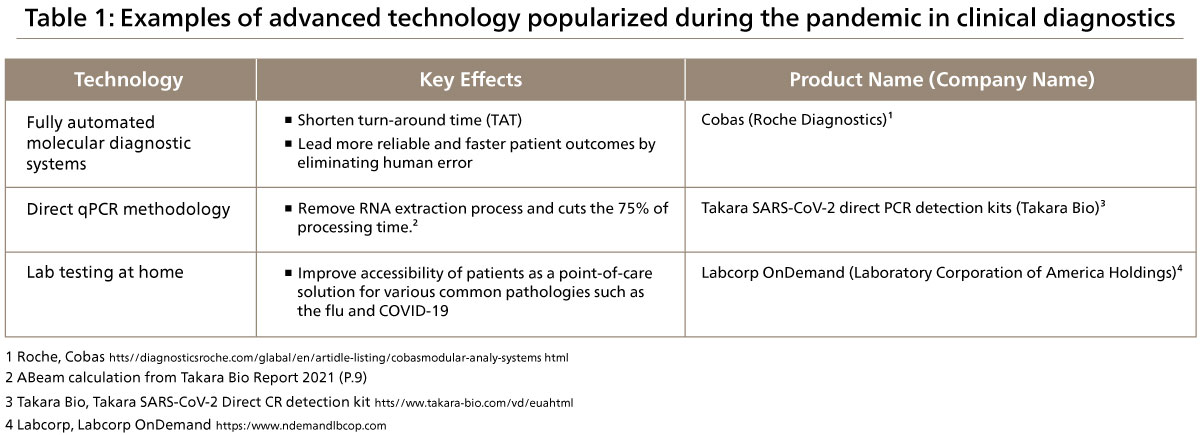

Moreover, the pandemic has brought positive impacts on scale, efficiency, and patient access across entire diagnostic workflows to meet increasing demands. For example, clinical diagnostics players have started adapting Direct qPCR methodology, which is one of the PCR methodologies that is not required RNA extraction process and cuts the processing time. Also, Covid-19 popularized the adoption of at-home testing as a point-of-care solution because PCR testing process is slow and high-cost, resulting in long wait times for patients.

However, the growth began to decline in 2022 as the realized price for PCR testing decreased and the volume for COVID-19 testing dropped. From 2023, some clinical diagnostics companies were compelled to downsize and return to an appropriate size after the expansion driven by COVID-19. The industry is now in urgent need of strategies to utilize the retained profits, assets, and surplus talent accumulated during the pandemic and to identify the next area for growth.

Where to focus for next growth

1. Accelerate integration of advanced technology into testing workflows

The sudden surge in testing demand caused by the pandemic, coupled with the imbalance in overall laboratory capacity, highlighted not only turn-around time (TAT) in PCR testing but also reevaluated the importance of improving the efficiency of other testing. In this context, significant global advancements have been observed, particularly in workflow optimization, and genetic testing methodology. These advancements have driven a trend toward automation, robotics, and digitalization in testing laboratories worldwide.

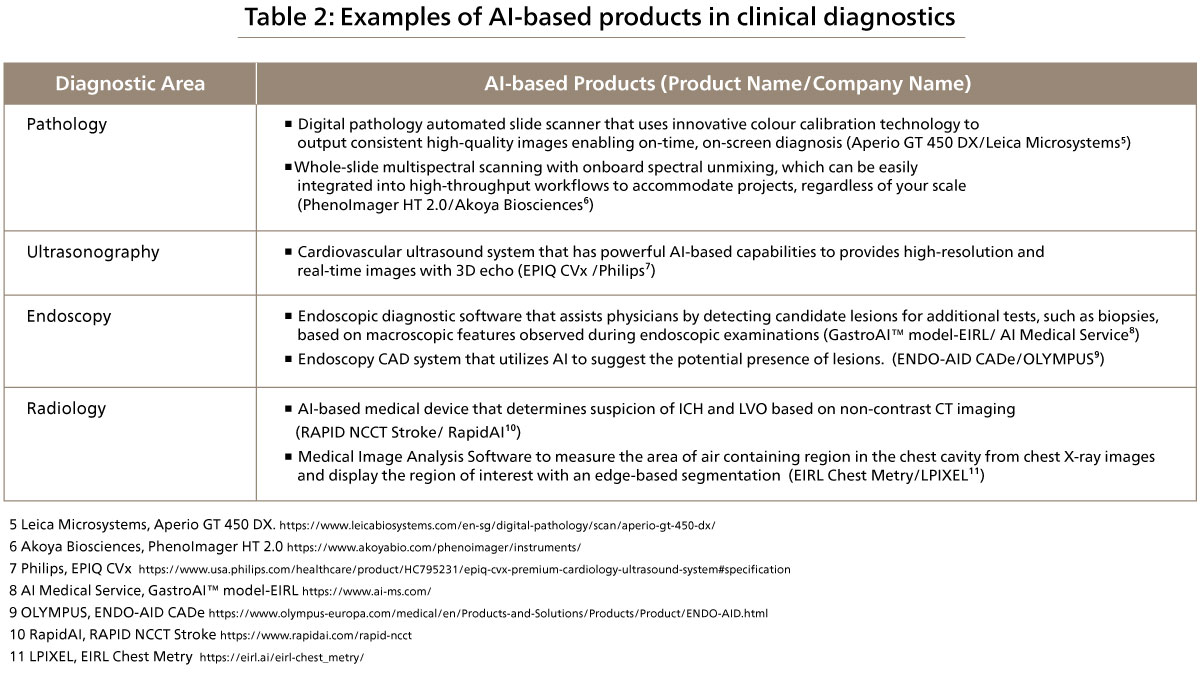

Drawing from experiences during the COVID era, Artificial Intelligence (AI) and Machine Learning (ML) are now becoming increasingly significant in enhancing the productivity of clinical workflows and the quality of diagnostic outcomes. This is one of the most critical areas where clinical diagnostics companies should invest the financial resources accumulated during the pandemic.

The research and implementation of AI and ML technologies are particularly advanced in the following diagnostic areas related to imaging diagnostics.

Digital pathology exemplifies the utilization of AI in clinical testing workflows. It is increasingly used in cancer diagnostics, providing faster, higher-quality, and more reliable diagnoses. By implementing a digital pathology workflow, misidentification errors were reduced by approximately 62%12 through the application of barcode tags for specimens, significantly increasing the efficiency of pathology laboratories.

12 Zarbo RJ, D’Angelo R. The Henry ford production system: effective reduction of process defects and waste in surgical pathology. Am J Clin Pathol. 2007 Dec;128(6):1015–22

Additionally, the use of whole slide imaging (WSI) scanners, which convert traditional glass slides into digital images, has improved diagnostic quality with high-resolution images of entire slides. This technology facilitates the storage of large histological datasets, enabling predictions and prognoses from pathology images and aiding in the generation of new disease biomarkers through deep learning. Multiplex immunofluorescence, an advanced method for labelling multiple biomarkers in a single pathological section, leverages deep learning to accelerate precision medicine.

AI and ML technologies would be continuously evolving, significantly impacting the clinical diagnostics industry. Clinical diagnostics players are required to stay updated with these advancements to maintain a competitive edge.

2. Expand business to growth market

The market growth of the clinical diagnostics is promising in emerging countries in Asia such as Southeast Asia and India. The following trends is driving a high demand in clinical diagnostics market.

- Ageing population with increasing risks of chronic diseases and ageing-related diseases

- The increasing number of patients driving demand for diagnostics testing

- Middle-class and affluent population accelerating need for enhanced diagnostics services

- Increasing demand for quality clinical diagnostic services with the greater accessibility and availability of diagnostic services

Especially, the genetic testing market is expected to grow in the long-term at a 11.90% of CAGR from 2024 to 2029 in Asia Pacific13. This is particularly true in segments such as Oncology, Immunology, Infectious diseases, Inherited cardiovascular diseases and New-born screening.

13 Mordor Intelligence “ASIA-PACIFIC GENETIC TESTING MARKET SIZE”

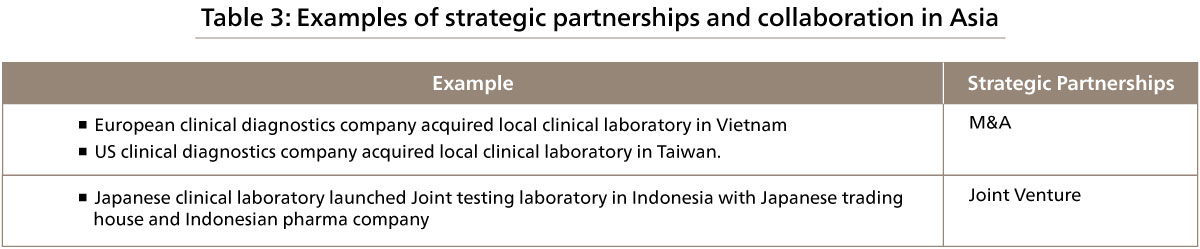

Here are the examples for strategic partnership and collaboration to expand into Asia market

3. Diversify business lines with assets from pandemic

The pandemic has provided significant physical, human, and financial assets to each clinical diagnostics player. These assets include high-end testing equipment, new automated workflows, surplus talent, and financial support from governments. After the pandemic, some clinical diagnostics laboratories leveraged these assets to expand into its peripheral areas for their next growth phase.

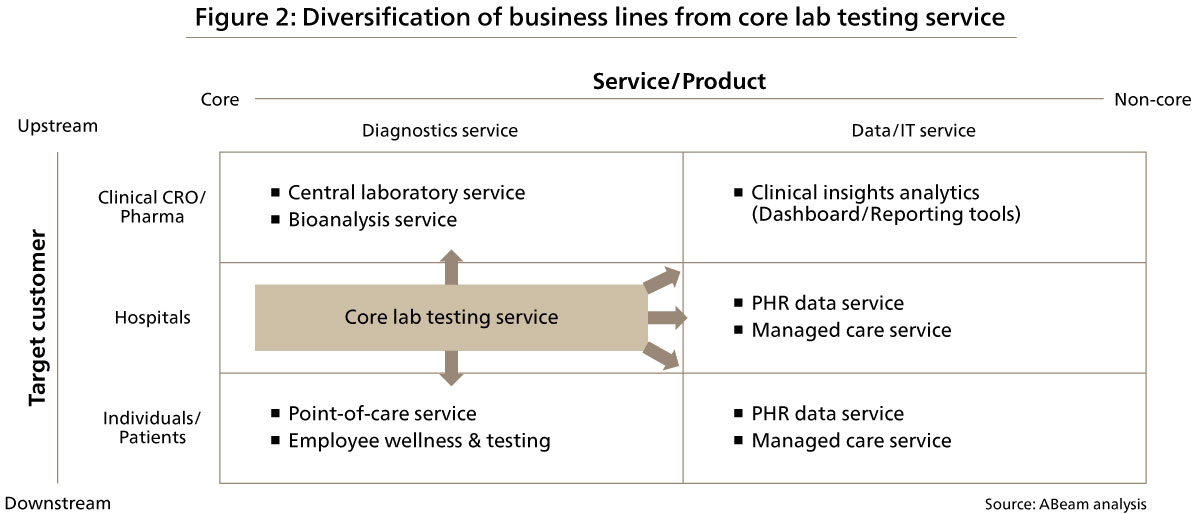

There are two main directions for diversifying business lines. One approach is to expand target customers from hospitals to individuals, patients, clinical CROs, and pharmaceutical companies. The other approach is to expand services/products from traditional lab testing services to related services, such as data and IT related products and services.

Bioanalysis services represent one of the trends in expanding target customers to clinical CROs and pharmaceutical companies. Leveraging resources developed during the pandemic, some clinical diagnostics players have begun investing in single-cell analysis and spatial biology to identify novel biomarkers and facilitate drug discovery.

Data services could potentially become a crucial area of growth for clinical diagnostics players, as the importance of utilizing testing result data has increased during the pandemic. Some clinical diagnostics players have provided data services such as PHR data services to individuals/patients and data analytics services with laboratory patient data to identify high-risk patients and implement more effective clinical practices.

4. Integrate into healthcare ecosystem

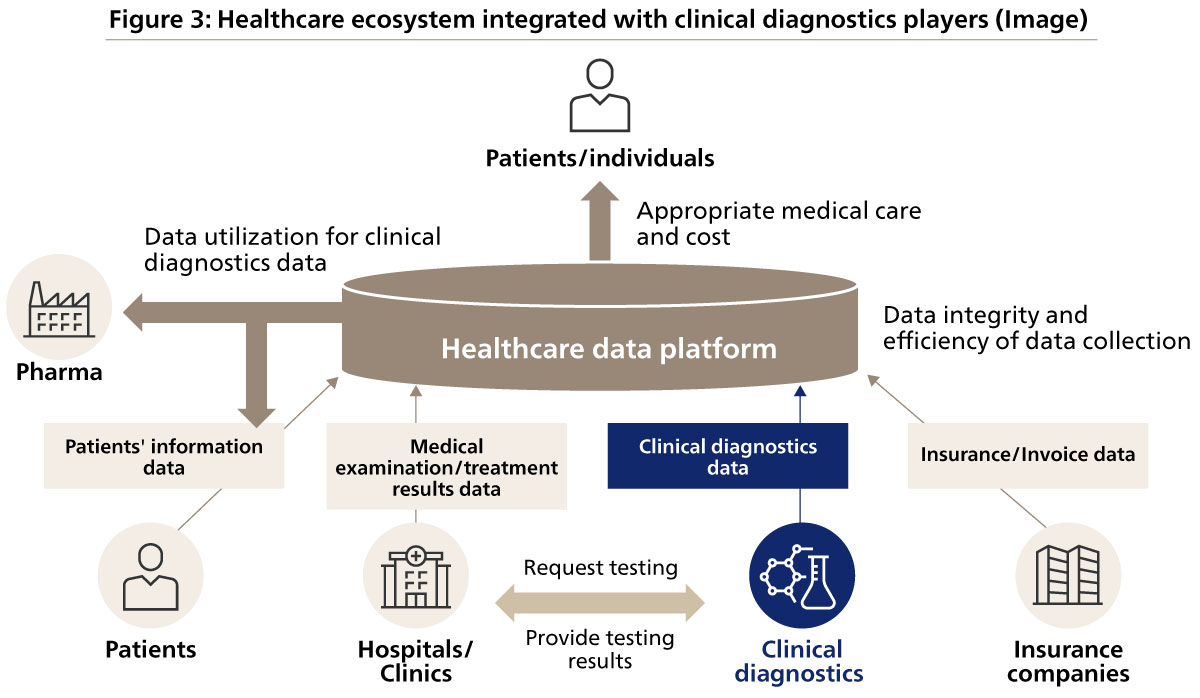

Healthcare ecosystem, which comprises a network of patients, hospitals, and other stakeholders involved in healthcare, is a critical trend in the healthcare industry today. It aims to improve health outcomes and affordability by providing patients with a personalized, intuitive, and integrated experience.

Healthcare ecosystem benefits clinical diagnostics players as a new investment opportunity as well as they play a key role to drive more significant values to the entire ecosystem especially patients, as clinical testing is essential for assessing a patient's condition, determining the appropriate treatment methods, understanding prognosis, and preventing patient deterioration by early detection.

<Key added values provided by clinical diagnostics players>

- Clinical diagnostics data – Clinical diagnostics data are crucial for patient health and drug development. These data can enhance medical services and create new services for medical institutions, insurance companies, and pharmaceutical companies. For instance, pharmaceutical companies can utilize the data for clinical research, while medical institutions can use them to improve diagnostic accuracy.

- Efficiency and neutrality in data collection – Data collection can become more efficient in the entire ecosystem by collecting clinical diagnostics data, and it enables to ensure data integrity of patient’s data by obtaining clinical diagnostics data independently from hospitals and clinics.

- Appropriate medical care and cost to patients – The healthcare ecosystem enables the centralized management of patient treatment processes, including clinical diagnostics players, which contributes to sustainable profit generation. It ensures the provision of appropriate medical care by controlling medical costs, preventing unnecessary tests for patients, and eliminating kickbacks between medical institutions and clinical diagnostics players.

<Key benefits for clinical diagnostics players>

- Loyal customers – Clinical diagnostics players can establish tight connectivity to the hospitals and clinics within the ecosystem network

- Easiness of capacity planning – It is easy to plan and control testing capacity of clinical diagnostics as the customers are within the network.

- Early assess to novel biomarkers – The close network with pharmaceutical companies and medical institutions helps clinical diagnostics players developing novel biomarkers.

- Opportunities in Data-Driven business – Clinical diagnostics data would benefit pharmaceutical companies and medical institutions for their new research and business efficiency.

Conclusion

Clinical diagnostics industry has significant growth opportunities following the pandemic. At the same time, the evolution of clinical diagnostics industry would benefit the entire healthcare industry as well as patients.

At ABeam, healthcare specialists support clients with a strong network of experts globally by not only engaging in typical consulting and system development/implementation but also running their own practical businesses. ABeam supports clinical diagnostics players in the following areas:

-

–

Coordination of integration into healthcare ecosystems.

-

–

Implementation of laboratory operation systems

-

–

M&A

In case of questions, feel free to contact us.

Click here for inquiries and consultations