Changing Gen Z Preferences Reshaping Car Sales

Changing Gen Z Preferences Reshaping Car Sales

The future of car retail in Southeast Asia will need to adapt to better serve younger demographics.

(Bangkok, Thailand) Generation Z is rapidly growing its share of the adult population in Southeast Asia and is projected to represent 165 million people, or 30% of the total demographic, by 2030. Consequently, understanding the preferences of this generational cohort becomes crucial for car manufacturers, distributors, and dealers to prepare the right products and services.

For the second consecutive year, ABeam Consulting proudly served as the knowledge partner at the Future Mobility Asia Exhibition & Summit, held in Bangkok from 17-19 May 2023. On this occasion, Jonathan Vargas Ruiz, Director of Mobility at ABeam Consulting (Thailand), took the stage and gave the presentation on “The Future of Car Buying: How the Preferences of Gen Z will Impact Car Retail in Southeast Asia”

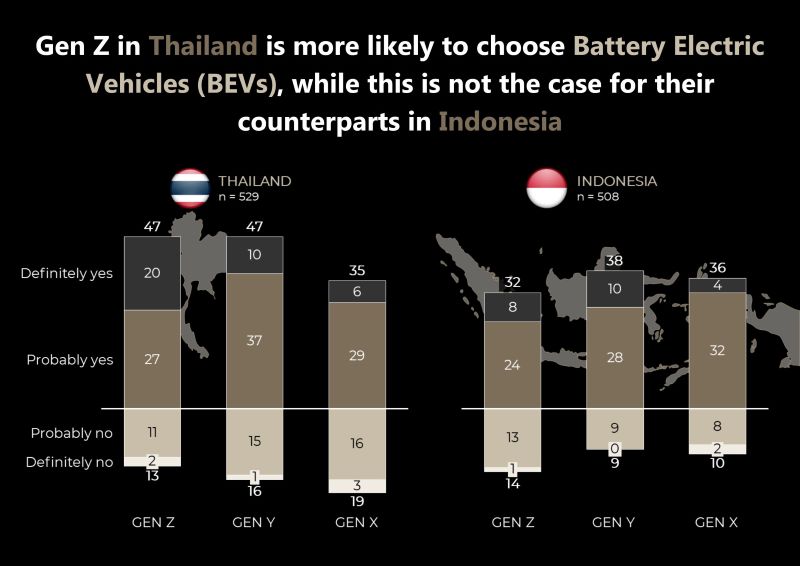

“In April 2023, ABeam Consulting surveyed over 2,200 respondents across Indonesia and Thailand, the two largest automotive markets in Southeast Asia,” he said, “The findings reveal that Gen Z shares many similarities with other generational cohorts, while also exhibiting few noticeable differences. As a result, we anticipate that the future of car retail will need to adapt to better serve younger demographics. However, we expect this change to be an evolutionary process, not a revolutionary one, as many Gen Z buyers expressed satisfaction with the way they purchased their last vehicle.”

By definition, Generation Z, or Gen Z, are people that are presently aged between 14 and 26 years old and grew up in the Internet explosion as well as the proliferation of smartphones and social media. Gen Z is

rapidly growing its share of the adult population in Southeast Asia and is expected to represent 30% of the total demographic by 2030. Gen Z has a different mindset and values, especially when compared with Gen X (people aged between 43 and 58 years old). Contrary to the conventional belief that car ownership signifies social status, only 31% of Thai Gen Z respondents attribute importance to owning a car, compared to 45% of Gen X (aged 43-58). Instead, Gen Z prioritizes familial responsibility and lifestyle compatibility over flaunting wealth.

Moreover, environmental consciousness plays a pivotal role in Gen Z's car purchasing considerations. While the vehicle price is the most important factor (for 57% of Gen Z respondents, it is an important factor), environment friendliness is the second most important factor, on par with fuel economy (24% of respondents). In contrast, other generations rank environmental factors only as the ninth most important factor. Furthermore, Gen Z showcases a greater inclination towards fully electric vehicles, driven by the potential savings on fuel costs (68% of respondents) and the desire to limit their environmental impact (43% of respondents). The presence of government incentives also influences their decision-making (30% of respondents).

Surprisingly, despite their affinity for digital channels, a significant proportion of Gen Z car buyers, as high as 78%, still prefer to conduct the purchasing process offline. Thus, car dealerships will continue to play a substantial role in the foreseeable future. Nevertheless, there is room for improvement in future car retail practices, such as emphasizing omnichannel experiences, delivering personalized marketing messages, and enhancing overall customer engagement.

Jonathan Vargas Ruiz, Director of MFG/Automotive & Mobility, ABeam Consulting (Thailand) Ltd., reflecting on the study's findings, asserts, "The growth of online traffic on major car manufacturers’ websites notwithstanding, most car buyers, including Gen Z, value the involvement of car dealerships. But the role of dealers will need to evolve, also because the importance of shared mobility players such as ride-hailing or car rental companies will increase."

To navigate this shifting landscape, dealerships must adapt, incorporating 360-degree customer views and omnichannel experiences to tailor marketing strategies. Third-party retailers will continue to play a vital role in the distribution process, although OEMs' increased engagement with customers may gradually diminish the relative importance of these intermediaries.

ABeam Consulting's comprehensive survey illuminates the changing dynamics of car ownership in Southeast Asia, driven explicitly by Generation Z's preferences. With these insights, OEMs, distributors, and dealerships can proactively realign their strategies to cater to this influential demographic, laying the foundation for a thriving automotive future.

For further information and detailed findings from the survey, please contact ABeam Consulting at https://www.abeam.com/th/en.

About ABeam Consulting (Thailand) Ltd.

ABeam Consulting (Thailand) Ltd. is a subsidiary of ABeam Consulting Ltd. – headquartered in Tokyo, with roughly 7,000 richly professional, experienced consultants who have served clients throughout Asia, the Americas and Europe, providing consulting services in Thailand since 2005. ABeam Consulting (Thailand) has more than 400 professionals serving clients in Thailand with expertise in business and digital transformation services that create the future together with corporations and other organizations. As a creative partner leading the way reliably through change, we contribute to industrial and societal change.

Please contact us at contactthailand@abeam.com or visit https://www.abeam.com/th/en for more details.